Key Points

-

IndiaPulse is a part of country report series in MUFG Asia Global Markets Research. We provide a monthly assessment of India from the perspectives of the economy, latest policies, and market developments with a focus on the currency. Key points in this month’s assessment include:

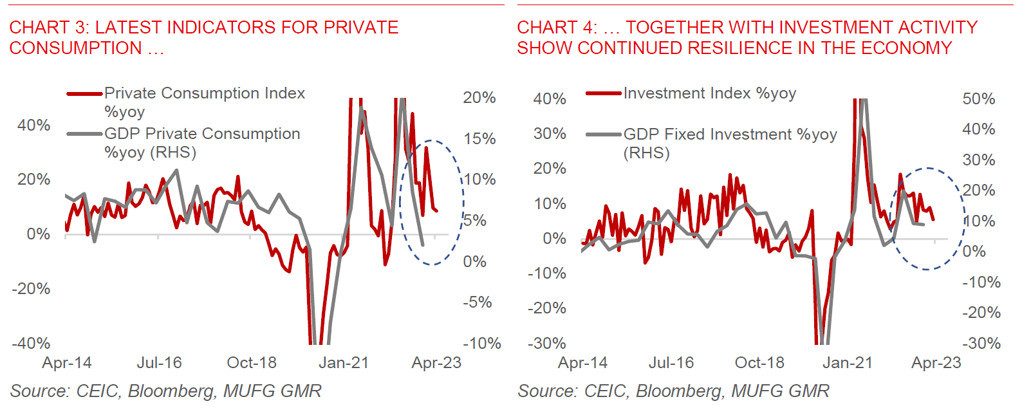

- India’s growth remains resilient, with robust domestic demand offsetting weak goods exports. Our tracking of the most pertinent indicators suggests private consumption and investment continue to grow at a healthy clip, with strength in infrastructure, domestic tourism, and green shoots in rural demand.

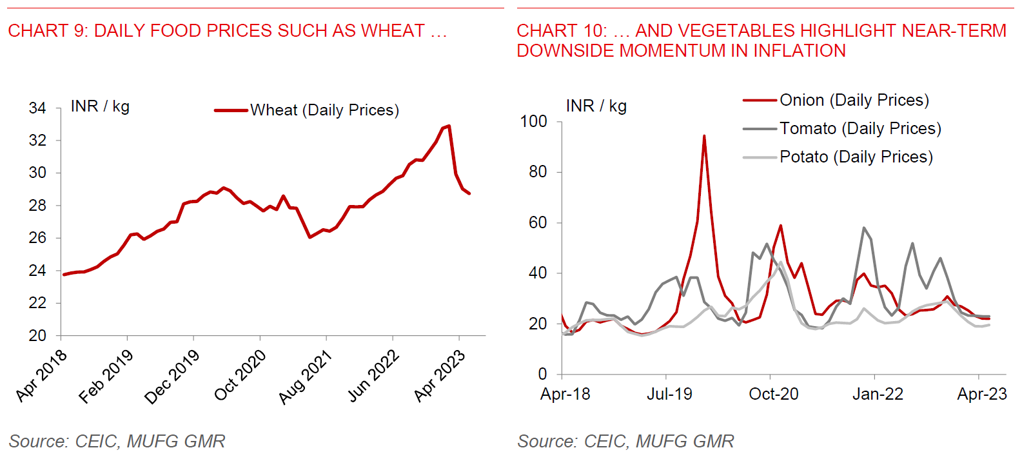

- More importantly, inflation is also showing signs of softening: Both food and fuel inflation are coming off, while goods-related items are also moderating. Daily data shows cereal and vegetable prices declining further.

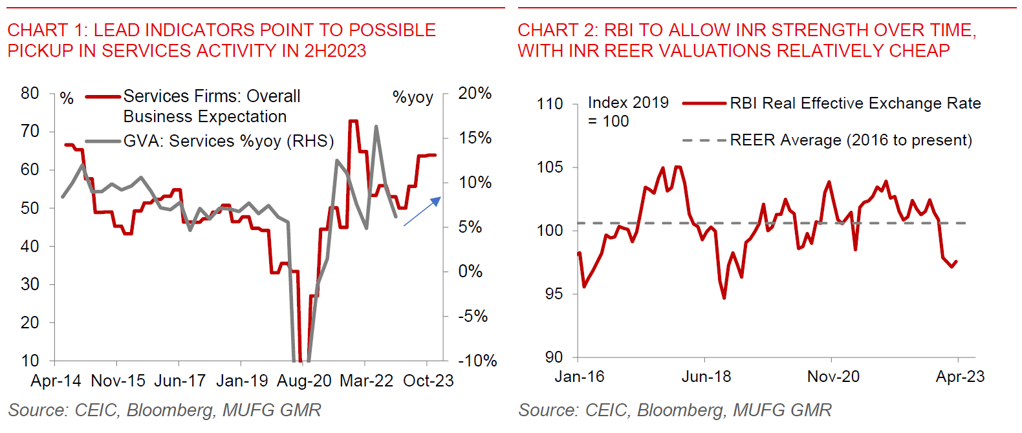

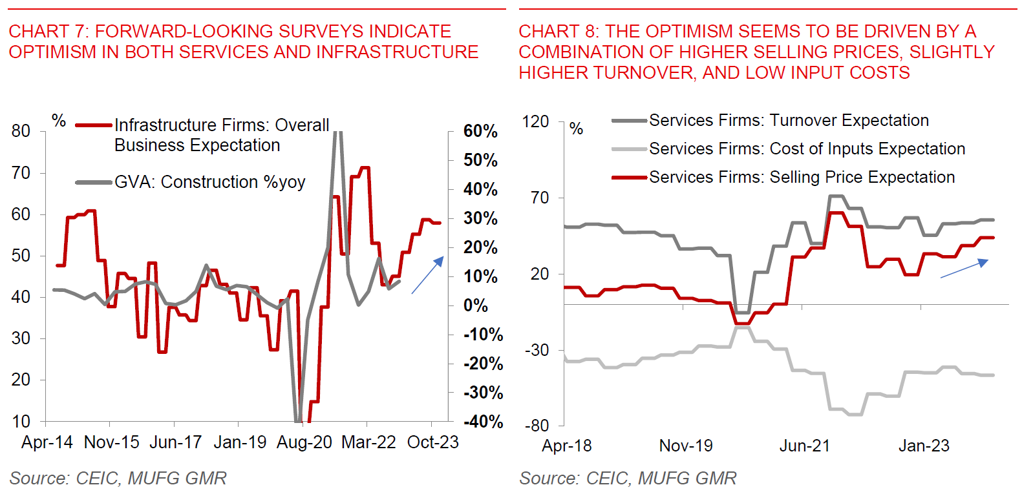

- We forecast India’s growth to improve in 2H as the lagged impact of lower costs, stronger infrastructure spending, and rate pause help. Lead indicators corroborate this, highlighting a bounce in services and infrastructure activity, especially as we move past difficult base effects. The flipside is that services inflation should remain sticky, even as goods inflation moderates.

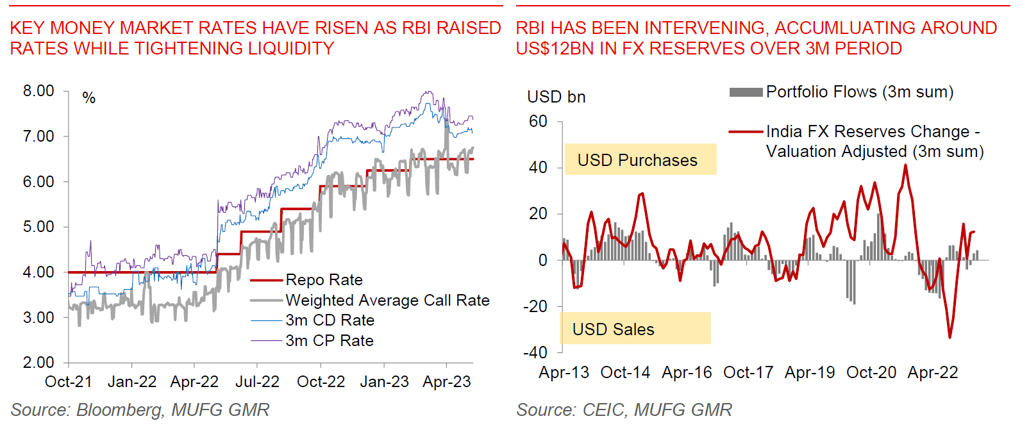

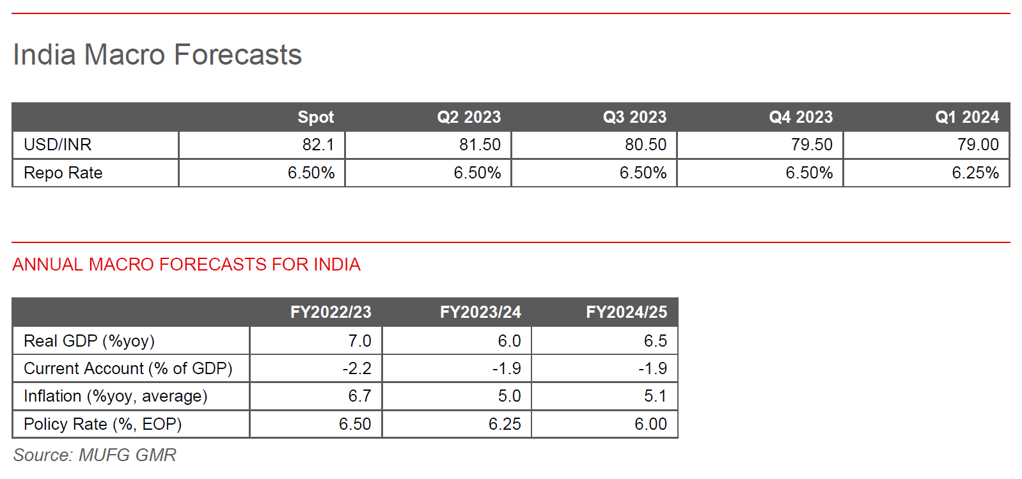

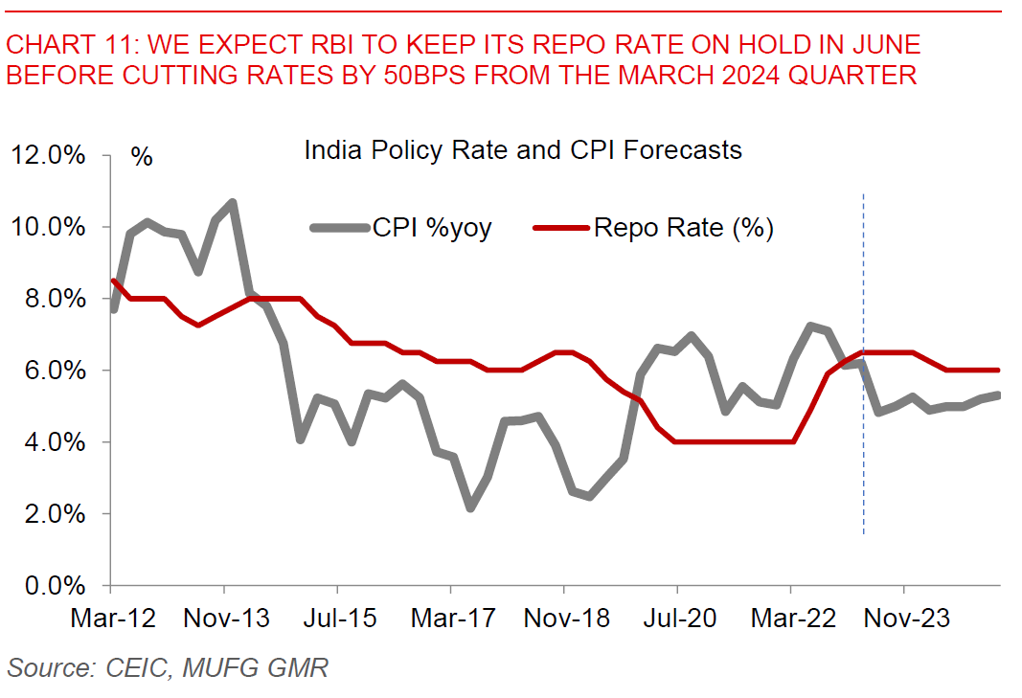

- RBI to hold repo rate at 6.5% in June. We pencil 50bps of rate cuts starting the March 2024 quarter, and see risks as balanced around our view.

- Resilient growth with macro stability support our positive view on INR. We forecast USDINR at 81.5 in 3m and 79.0 in 12m. The key for INR is that growth resilience is occurring together with macro stability, with a narrower current account deficit, softer inflation and stable credit growth. A weaker Dollar and stable oil prices are also very helpful, with portfolio flows also stabilising. RBI’s aggressive FX intervention cuts both ways, but even here, we think the central bank should over time allow USDINR to fall given the cheapness in the REER.

- Risks include a meaningful El Nino event: Watch out for a deficient Monsoon, sharp spike in oil prices, decline in IT services exports, and a stronger US Dollar.

India's growth resilient and to improve in 2H-FY24

India’s economy remains resilient based on our tracking of the economy: Our tracking of India’s economy shows that the domestic economy remains robust so far, with both private consumption and investment activity picking up on a quarter-on-quarter basis and remaining resilient year-on-year. We have summarised these indicators into a private consumption and investment index where possible, and we are also tracking associated relevant indicators closely (see Charts 1 and 2 below, together with details in Appendix). We highlight a few interesting takeaways from a sectoral basis:

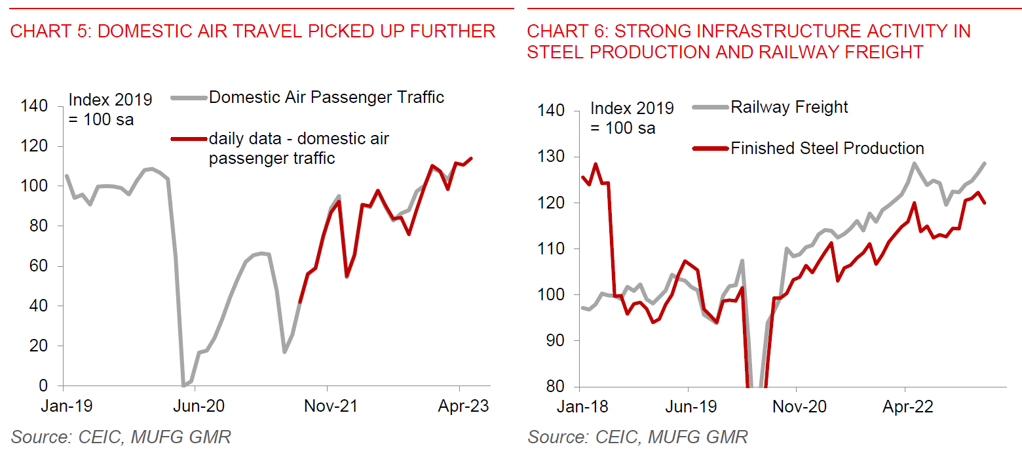

- Booming domestic air travel and tourism: Passenger trips data, for which a proxy is available on a daily basis, shows a further recovery in mobility and domestic tourism in April and into May (see Chart 5 below). On the same note, hotel occupancy rate crossed 70% for the first time since the pandemic, while average room rates also increasing substantially.

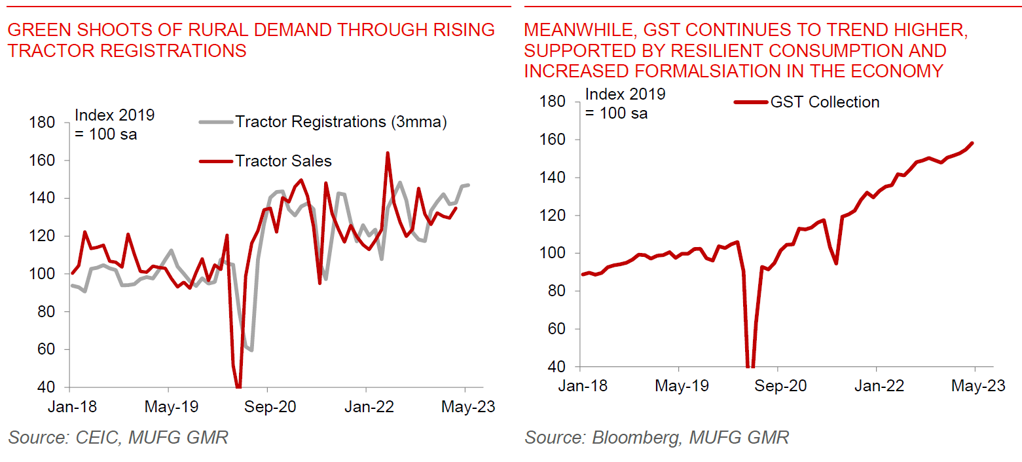

- Initial signs of rural demand and consumption recovery: While many commentators have touted the so-called “K-shaped recovery” in India, we see green shoots in rural demand with hopes for a more inclusive economic recovery. For example, tractor registrations rose by more than 18%yoy in 1Q, while agriculture exports also picked up to 11%yoy in the same period. Rural wages have been rising since 2H last year. Expectations of a bumper rabi harvest (winter season) could be driving this resilience, although it’s important to watch for the risk of a bad monsoon.

- Infrastructure spending continues to be a significant bright spot: Finished steel production rose by 6.5%yoy in March, while steel consumption increased by 22%yoy, albeit slowing down on a year-on-year basis in April. Meanwhile, railway freight grew steadily at close to 4% from January till April (see Chart 6 below).

- Manufacturing remains resilient, although partly weighed down by weak exports: India’s Manufacturing PMI remains firmly in expansionary territory at 57.2 in April, and the official industrial production index rose by 5.6%yoy in February (latest available), up from 5.5%yoy previously. We think resilient domestic demand helped to offset still weak goods exports.

We forecast India’s GDP to improve to 7% yoy in 2H-FY2024, supported by lower costs, rates pause and infrastructure spending

We expect India’s growth to rise to 7% in 2HFY24 from 5% in 1HFY24: Beyond just the near-term resilience we described above, we see several factors supporting India’s economy over course of the fiscal year. Several of the headwinds that the economy is facing right now, such as elevated inflation, the impact of higher rates and weak global demand should fade moving forward, or at the very least, not deteriorate at the same pace. For one, input costs and goods inflation are starting to come off, including through lower wholesale prices (see next section below on inflation). Secondly, with RBI very likely to keep its policy rate on hold for now, the negative impact through higher rates will increasingly fade through the rest of this year (see section below). Thirdly, the bumper rabi harvest will support rural demand and wages, with positive spillovers to private consumption, notwithstanding the uncertainty surrounding the monsoon. The green shoots in the rural sector we have seen through higher tractor registrations is one evidence in that regard. Fourth, the government’s focus on its capex plan should increasingly crowd in private investment over the rest of the year. Lastly, the most difficult base effects for year-on-year comparisons should increasingly fade as we move into the latter part of the year.

Forward-looking business expectations surveys are optimistic: The most reliable business expectations surveys that we track corroborate our sanguine view on India. If the sentiment of firms surveyed by the RBI are anything to go by, services and infrastructure activity could pick-up in the 2nd half of the year, albeit with somewhat less positive outlook amongst manufacturing firms. This optimism seems to be driven by a combination of both slightly higher turnover forecasts, together with improvements in expected selling prices and margins (see Chart 7 and 8 below).

Downside risks to positive growth view – meaningful El Nino event and a deficient monsoon: All this is not to say that our positive view is free from risks. One of the most pertinent and immediate risk to growth is that of a meaningful El Nino event leading to a deficient monsoon. If this happens and depending on the magnitude, this may have negative macro impact through lower agriculture output, weaker consumption, and potentially also higher food prices in India.

Inflation is showing signs of moderating, providing space for RBI to pause in June, before lowering rates from March 2024 quarter

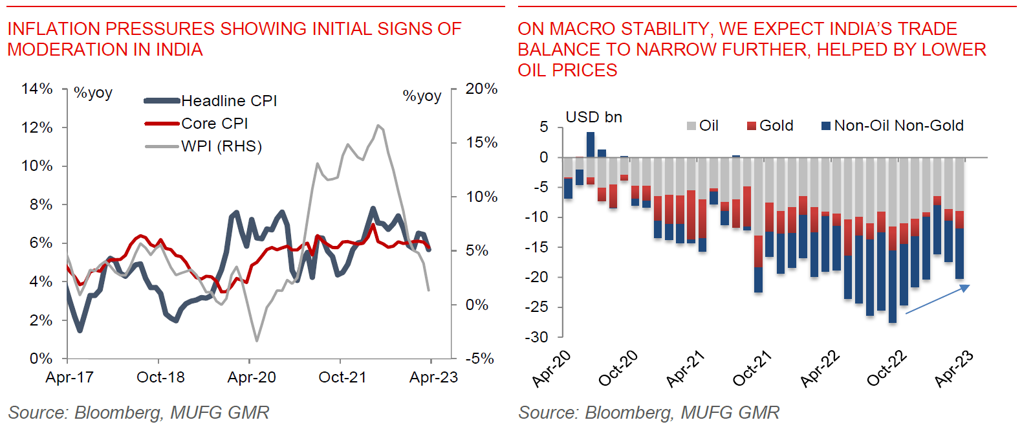

The other positive from a macro perspective is that India’s inflation is showing initial signs of moderating. Headline CPI moderated to 5.7% in March, down from 6.4%yoy the previous month. Core inflation was still quite sticky at 5.8%yoy but still down from 6.1% in February. More importantly, inflationary pressures are coming off not just due to base effects, but also on a sequential month-on-month basis. We’re seeing signs that goods inflation components such as in clothing, footwear, tobacco are coming off, although services inflation for instance in the healthcare sector is still relatively sticky. The stability in global oil prices has also been helpful to reduce domestic price pressures and reduce INR outflows (given India’s status as a significant oil importer), coupled with the government’s policy to fix domestic retail petroleum prices to shield consumers from price volatility.

High frequency food prices continue to show declines: In addition, daily food price data on wheat, onion, and tomato continue to decline on a month-on-month basis into May and remain low (see Charts 9 and 10 below), although partly offset by some upside risks to commodity products such as sugar and milk prices. This should be positive in the near-term for domestic food prices to moderate further. The government’s move to ban exports of wheat may have contributed somewhat to the decline in wheat prices, as have the global decline in food prices such as wheat (see Policy Tracker Table in Appendix). We will get more details from the April inflation print (to be released on 12 May), but suffice to say the direction of travel so far is quite positive on the inflation front.

We expect the RBI to hold its key repo rate at 6.50% in its June meeting, and pencil in 50bps of rate cuts starting the March 2024 quarter. With growth remaining relatively resilient even as inflation moderates, we think RBI will keep rates on hold for the time-being. We expect the RBI to deliver two 25bps cuts to its key repo rate starting the March 2024 quarter, and bringing the nominal rate to 6% and the real rate (based on forward-looking inflation) to around 1%. The risks around our policy rate forecasts are balanced. For instance, inflation could come in higher than expected due to a deficient monsoon or a spike in oil prices, but on the flipside, this has to be balanced with the potential negative impact on growth as well.

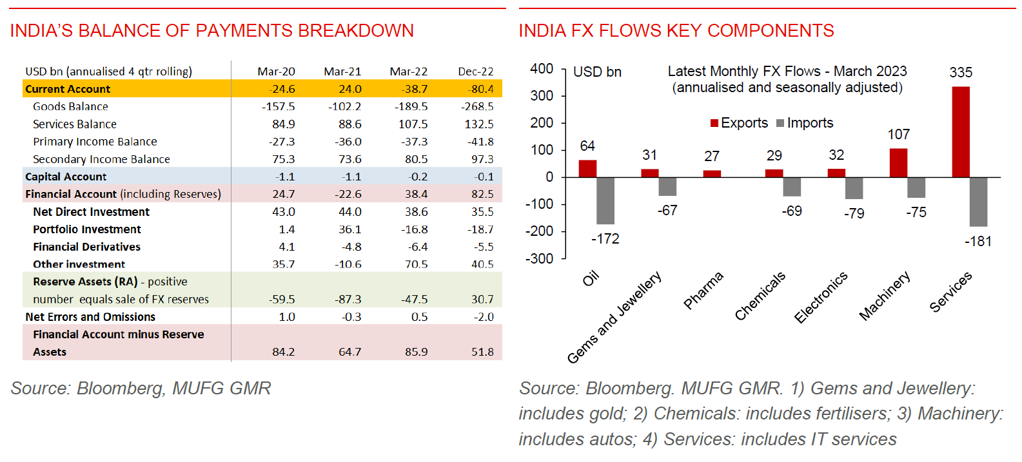

Positive on INR: Growth with stability – narrower current account deficit and stable credit growth

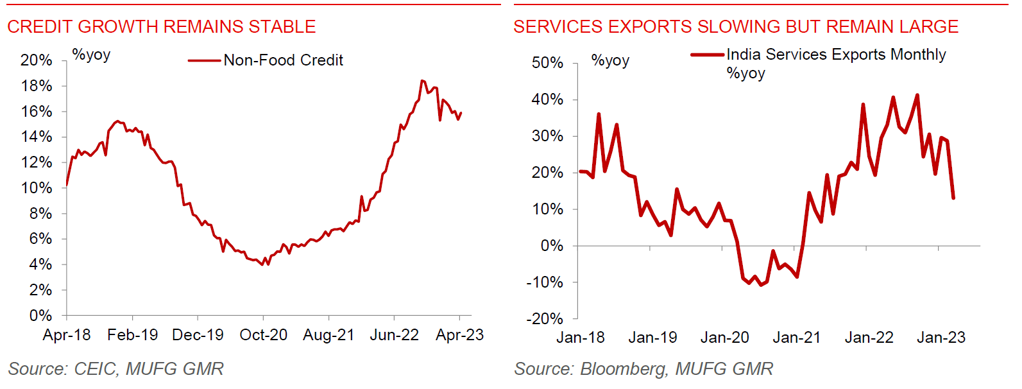

We remain positive on INR. We see USDINR at 81.5 in 3 months and 79.0 in 12 months in a broader backdrop of a weaker US Dollar. Bringing the latest macro developments closer to the markets, the key for our INR view is not just that growth is resilient, but that this is also occurring together with macro stability. This includes softer inflation (as highlighted above), a narrower current account deficit, stable credit growth, and a somewhat narrower fiscal deficit. Looking at current account flows, the stability that we have seen in oil prices thus far should be helpful in tempering the oil trade deficit over the rest of this year, and helped by India’s status as one of the largest buyers of discounted Russian crude. IT services exports have slowed down to 13%yoy, but we expect this to remain large in absolute terms, annualising closer to US$140-150bn in net terms. Meanwhile, remittances flows continue to be resilient, annualising close to US$100bn. We forecast the current account deficit to decline in 1.9% of GDP in FY24 down from 2.2% of GDP in FY23.

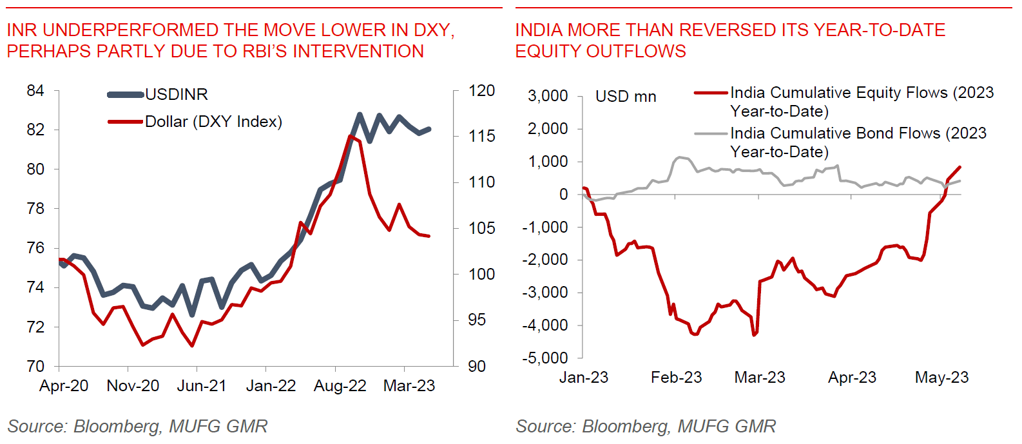

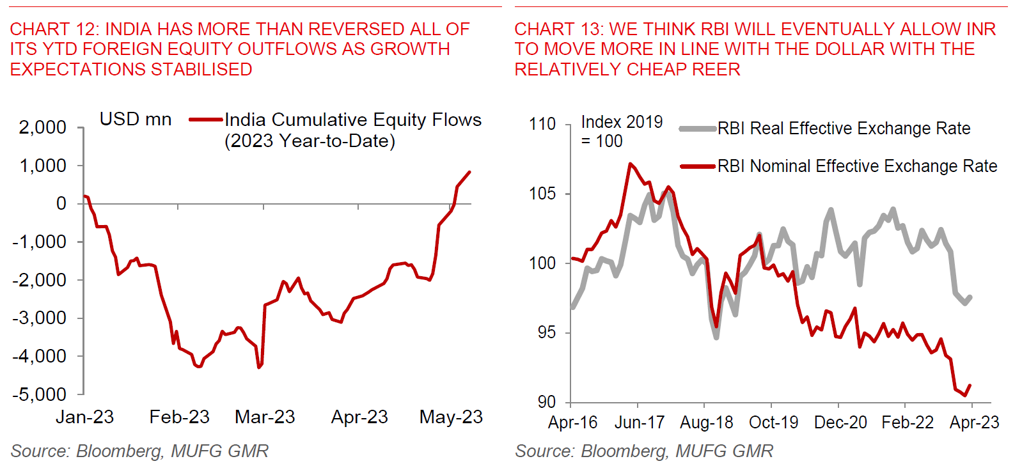

Portfolio flow sentiment has stabilised: In addition, the weaker US Dollar we forecast, driven by a Fed pause together with better European and Chinese growth will also be helpful to INR. It’s interesting to note that foreign equity flows into India have resumed meaningfully, and India has already more than reversed all of its year-to-date foreign equity outflows perhaps as growth expectations stabilised (see Chart 13 below). The recent stellar performance by Mankind Pharma’s IPO could also be positive in this regard in catalysing further IPOs (see Policy Tracker Table). Nonetheless, when placed in a historical context, India has seen annualised swings of US$20bn in equity flows, and so the recent pick-up is not huge by any means.

Exchange rate valuations not exorbitant, and as such RBI should allow greater INR appreciation over FY2024 as the Dollar weakens: Beyond macro and flows, a big part of the story for INR in 2023 has certainly been RBI’s FX intervention strategy. While it’s impossible to know what level USDINR would have been absent intervention, it’s clear that INR has underperformed the move lower in the US Dollar thus far, with both the Nominal and Real Effective Exchange Rates also declining correspondingly (see Chart 13 below). With the REER already quite cheap, and FX reserves relatively ample, we think that there is space for RBI to allow the currency to appreciate more in line with the US Dollar over the course of 2023, assuming we are right with our forecasts for the weaker USD through the year.

India Policy Tracker

Appendix: India Private Consumption and Investment Trackers

We introduce 2 growth trackers for India in this report, one for private consumption and another for investment activity. These indices incorporate the latest monthly real sector indicators such as passenger vehicle sales, petroleum and diesel consumption, steel production, and capital goods imports, coupled with key economic indices such as the industrial production and infrastructure industries index. We also track other monthly numbers such as GST revenue collection, rural wages and unemployment rates which give us a sense of the direction of travel, but are not as suitable to be included in an index.

Tracking these high frequency datapoints above is important for at least two reasons. First, the central bank tracks many of these data closely (for instance, see links here and here). Understanding their evolution will allow us to better forecast the central bank’s policy considerations, with a view to getting ahead of the curve. Secondly, having an updated view of India’s macro can allow us to better anticipate turning points in the economy and the associated market implications, given the significant uncertainty surrounding the global economy now.

India In Charts