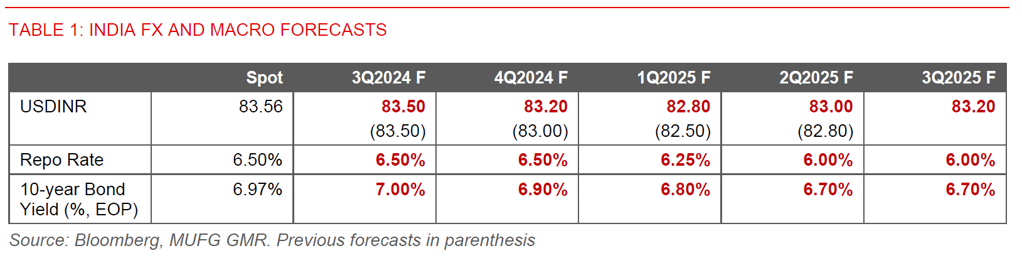

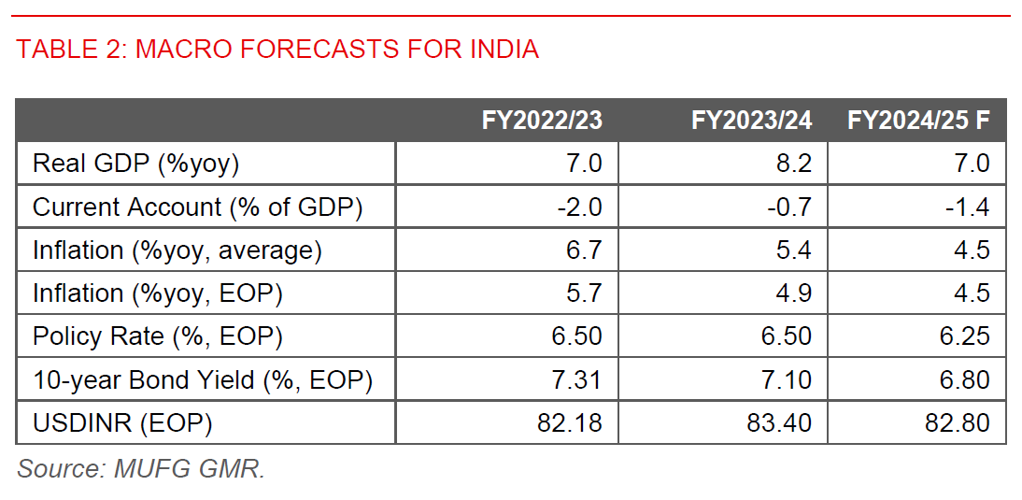

We forecast USDINR at 82.80 and IGB 10-year bond yields at 6.80% by the end of the fiscal year, together with a shallow RBI rate cut cycle of 50bps starting 1Q2025 (calendar year).

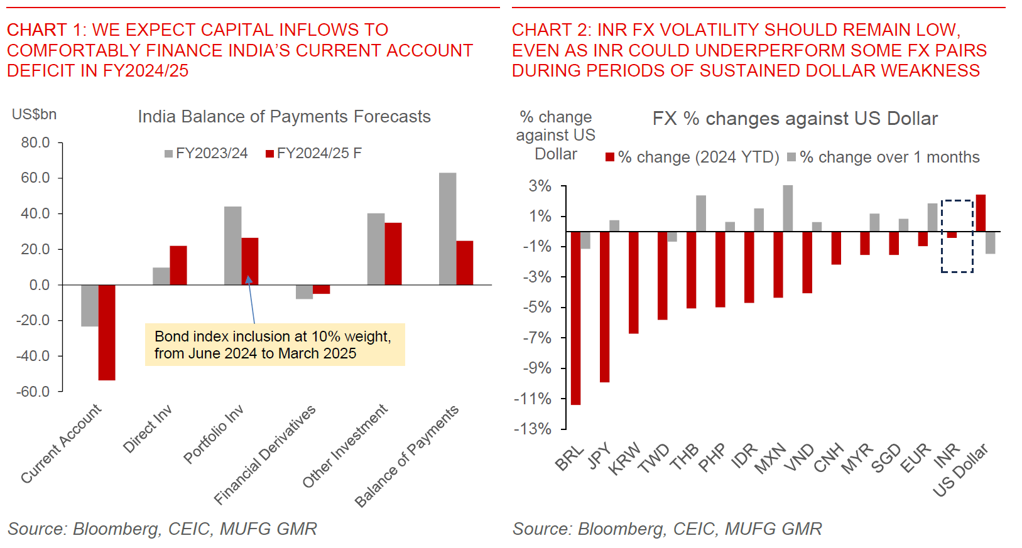

We maintain a constructive outlook on INR FX and rates, but temper the pace of our forecasted FX appreciation on the back of a slightly wider current account deficit forecast. More importantly, capital inflows including from bond index inclusion should still comfortably finance the deficit, while we expect RBI to remain steadfast in the market to accumulate more FX reserves.

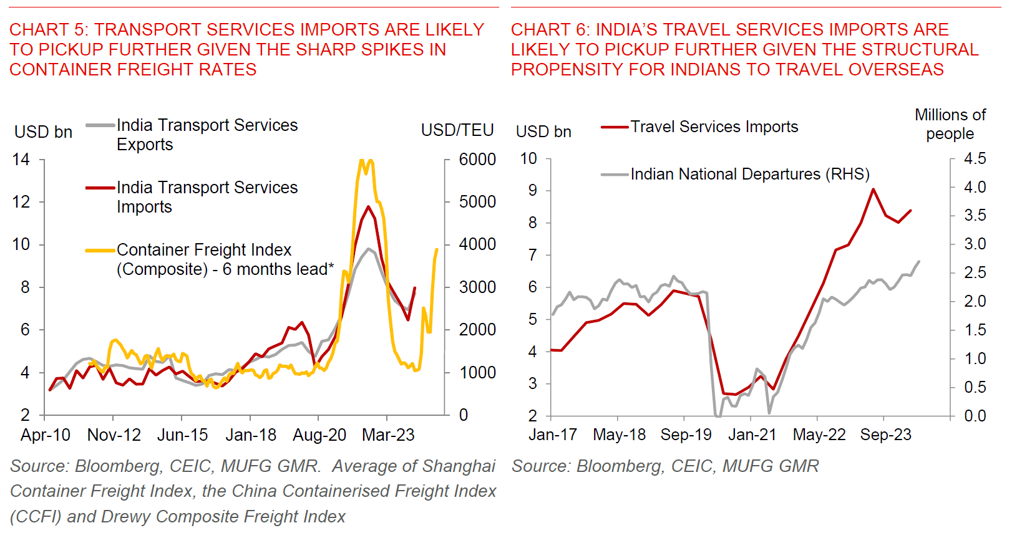

All this should combine to keep USDINR FX volatility at decadal lows, even as INR may shift from its outperformance year-to-date to now underperforming some FX pairs if the recent US Dollar weakness trend is sustained, due in part to the central bank’s activist hand in the FX market.

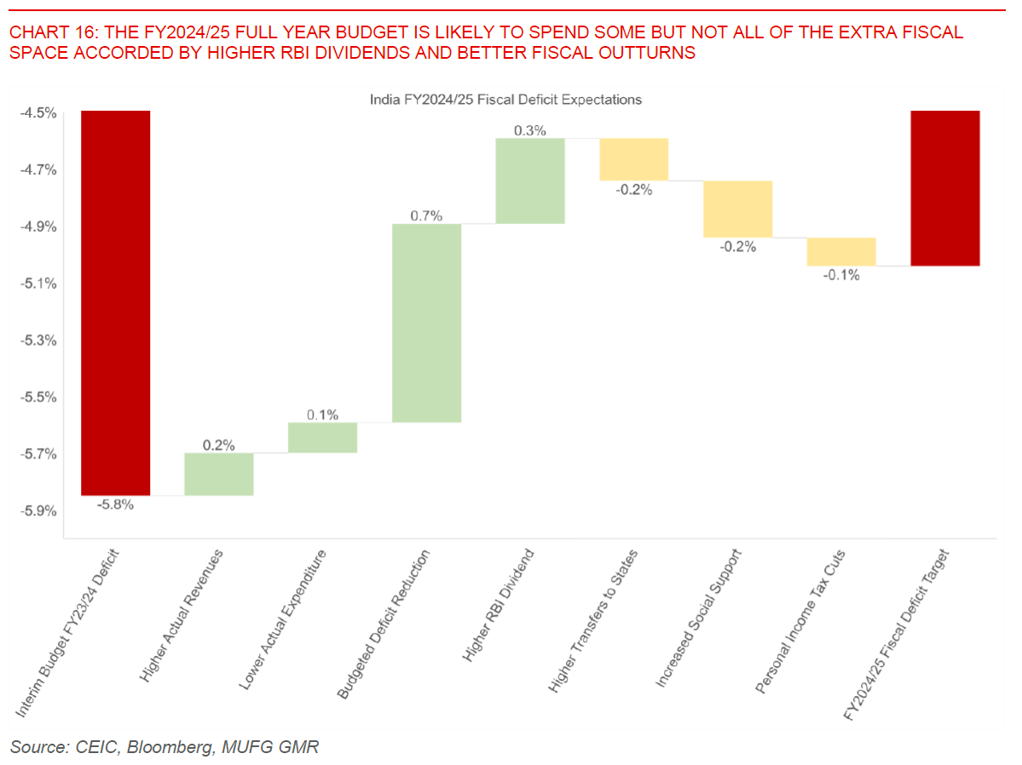

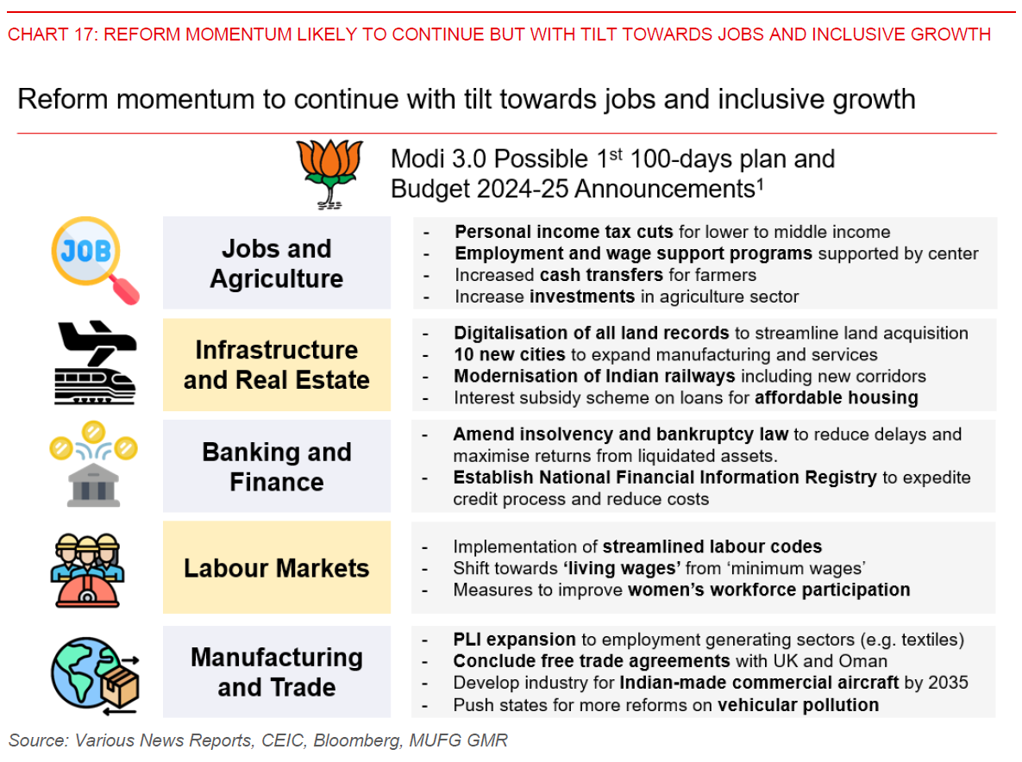

We think the new government is likely to keep the structural reform and fiscal consolidation momentum intact, while tilting the policy focus towards making growth more inclusive. Budget FY24/25 should use some of the extra fiscal space afforded by higher RBI dividends and better fiscal outturns to make an overarching push to support consumption, invest in the rural economy, raise employment generation including in manufacturing, and also improve Centre-State relations.

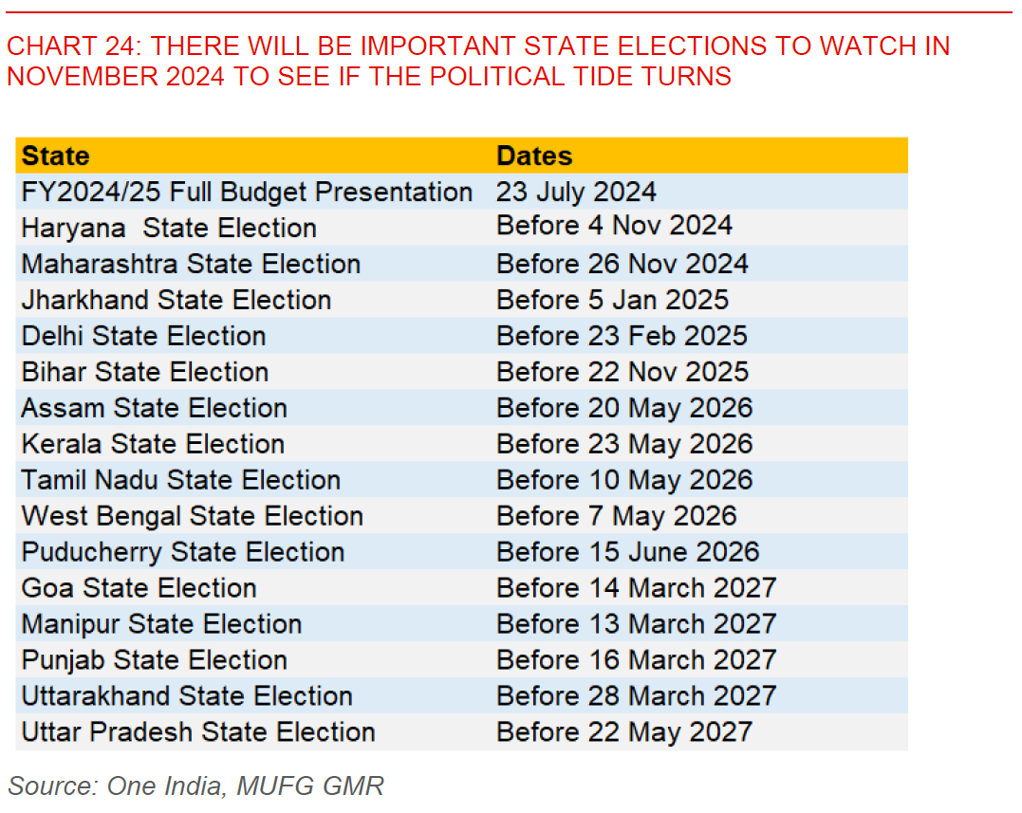

Political developments are a key risk to our views. Upcoming State Elections in India are important to see if the political tide signals any meaningful turn against the government, and perhaps raises pressure on the government to implement substantial populist policies moving forward to shore up support.

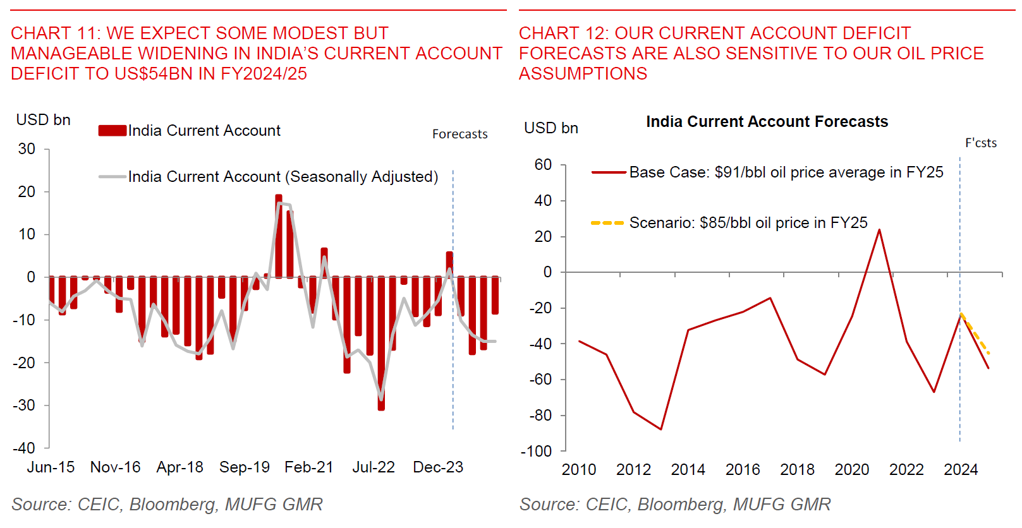

Current account deficit slightly wider than expected at 1.4% of GDP in FY2024/25

We have been holding onto a constructive view on INR fixed income markets since the start of the calendar year (see IndiaPulse – The Tide Has Shifted). This is notwithstanding the market volatility driven by the surprise Lok Sabha Election results, a topic which we have written about quite extensively (see India 2024 General Elections – Can the strong reform momentum continue, chartpack and India 2024 Elections – A major shockwave – wait for the dust to settle). We note that INR has outperformed many FX pairs year-to-date (since Jan 2024), although it has started to underperform over the past month as higher beta Asian currencies strengthened on the back of Dollar weakness (see Chart 2 above). More broadly, USDINR FX volatility has remained very low (see Chart 4 below).

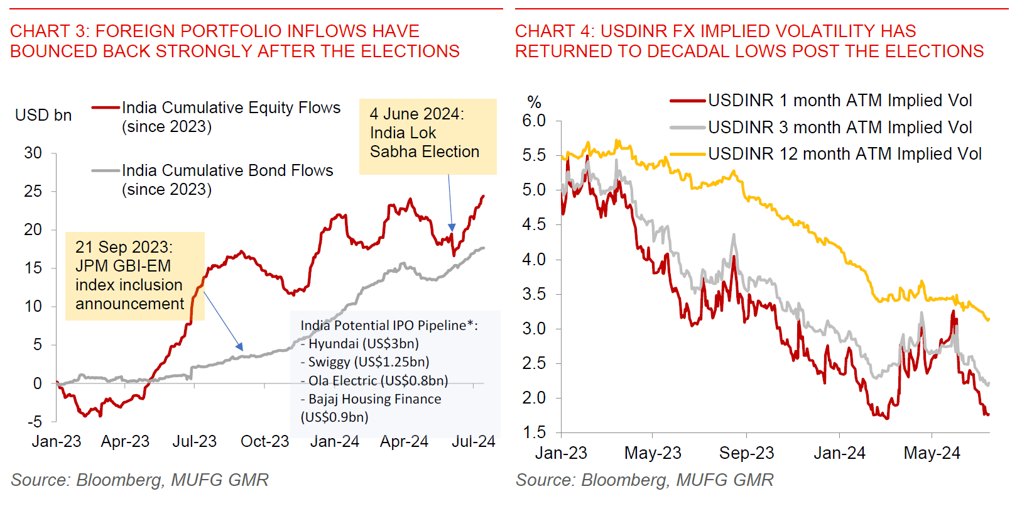

The good news post the Elections is that the new National Democratic Alliance (NDA) government is perceived to be a strong coalition and as such stable, even as there have been compromises on areas such as Ministerial positions and financial support for key allies. As such, our positive view which we have been highlighting on India’s macro outlook continues to stand, while foreign portfolio inflows both in the equity and bond markets have already bounced back quite strongly (see Chart 3 below).

While we maintain a constructive outlook on INR FX and rates, we now temper the pace of our forecasted FX appreciation on the back of a slightly wider current account deficit forecast. We now forecast USDINR at 83.20, 82.80 and 83.00 by calendar 4Q2024, 1Q2025, and 2Q2025 respectively (from 83.00, 82.50 and 82.80 previously).

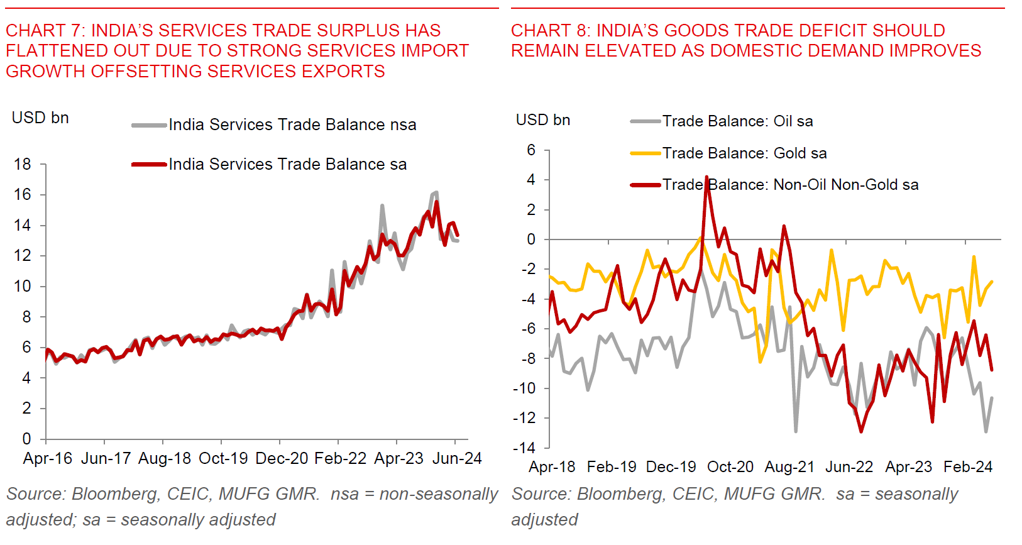

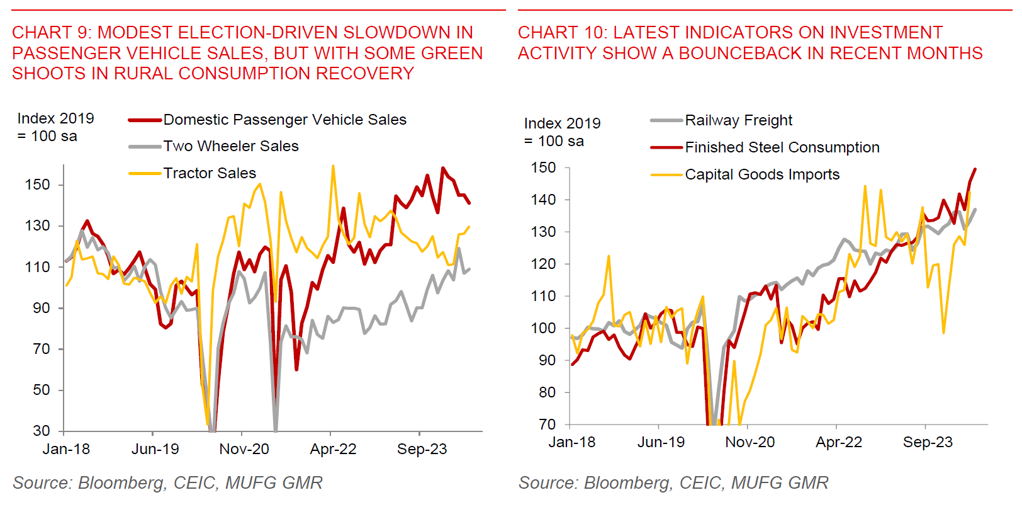

We now raise our current account deficit forecast for India up slightly to 1.4% of GDP (or US$54bn annualised), from 1.3% of GDP previously. Key to our view is that services imports are likely to pick up more than we anticipated driven by higher container freight rates and rising outbound tourism. The sharp pickup in spot container freight rates we have already seen should start to feed into India’s transport services trade balance with a 3 to 6 months lag, and as such there should be somewhat more Dollar demand in the months to come (see Chart 5). This is a risk we have mentioned in past reports (see IndiaPulse – The Tide Has Shifted). More generally, services imports have been growing steadily due to structural factors such as rising outbound tourism, and have thus far offset steady growth in services exports (Chart 6 and 7).

Beyond the services trade balance, we continue to expect India’s merchandise goods deficit to widen slightly over the rest of this fiscal year, with stronger domestic demand likely to offset some normalisation in the oil trade deficit. We are expecting the non-oil trade deficit to rise somewhat further, with an acceleration in domestic demand likely to increase import needs. This is also reflected in our robust growth forecast of 7% for FY2024/25. The latest demand indicators are showing a bounce back in investment activity with improvements in steel consumption and capital goods imports, although consumption is showing mixed trends thus far with a slowdown in domestic passenger vehicle sales due to election and heatwave related effects. There are some green shoots in rural activity with a pickup in tractor and two-wheeler sales, and over here the progress of the monsoon will also be key.

Putting everything together, we are forecasting India’s current account deficit to annualise US$54bn in FY2024/25 or 1.4% of GDP. The risks to our forecasts are balanced, and could come in lower if oil prices remain stable to lower in the quarters ahead. On the flipside, it could also be higher if container freight rates spike further.

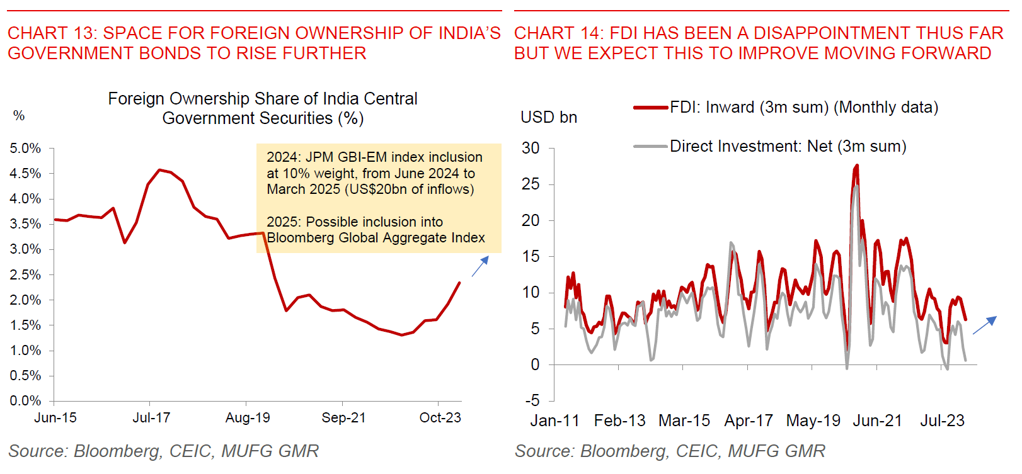

Capital inflows should comfortably finance current account deficit, including through bond index inclusion, strong equity IPO pipeline and rising FDI

We expect steady capital inflows given bond index inclusion inflows and strong equity IPO pipeline. Beyond just the current account deficit trends, what’s also important for INR is whether India’s current account deficit can be financed. We are quite sanguine on this front and have some visibility on portfolio inflows. With India being included in the JPM GBI-EM bond index from 28 June, this means that India should have steady bond inflows of roughly US$2bn per month from now till March next year. Beyond the JPM index inclusion, India’s government bonds could also be included in the Bloomberg Global Aggregate Index next year, which could add an additional US$10-15bn of inflows depending on various assumptions. It’s important to note that we have not built in possible inflows from the Bloomberg Global Agg inclusion into our base case assumptions. Beyond the bond market, there is also a strong equity market IPO pipeline, with companies such as Hyundai and Swiggy reportedly seeking to tap the market for funds of US$1-US$3bn each in their offerings, which could add further to foreign capital inflows into the country.

Beyond portfolio inflows, Foreign Direct Investment (FDI) inflows have disappointed, but our base case assumes some improvement. While there are some bright spots in some areas such as the electronics and renewable energy sectors, FDI flows have been weighed down by other sectors such as IT services and also the tech and VC sector (see Chart 14). Our base case expectation is that this should improve moving forward, given the strong pipeline of announced commitments by companies such as those in the Apple supply chain, and could also reflect some near-term slowdown induced by uncertainties from the Lok Sabha Elections.

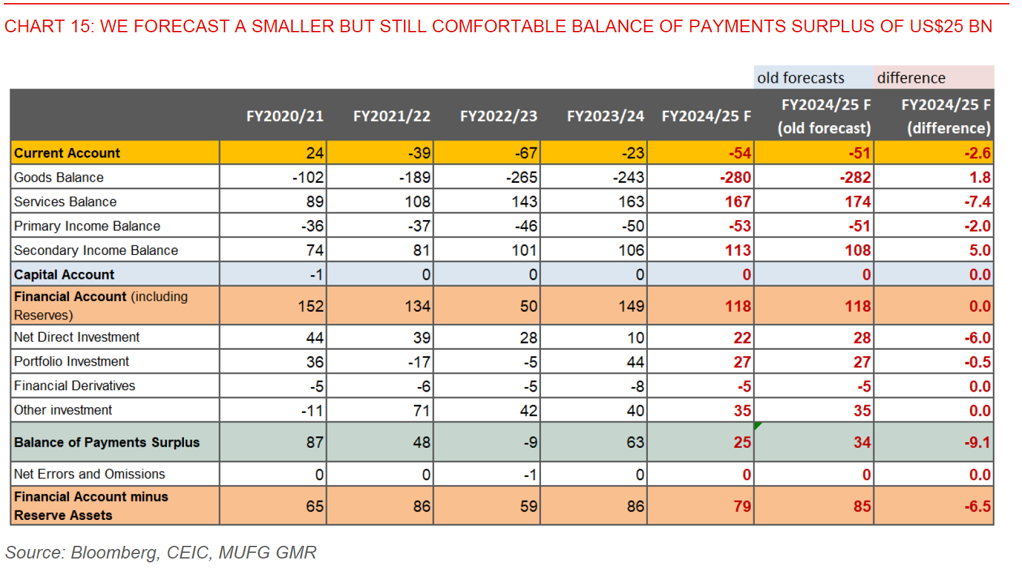

Putting everything together, we forecast a smaller but still comfortable balance of payments surplus of US$25bn for FY2024/25, down from our earlier forecast for a US$34bn surplus (see Chart 15). This is also lower than the US$63bn balance of payments surplus seen in the previous fiscal year. We feel comfortable with the balance of risks surrounding our forecasts. First, we are quite conservative in our equity inflow assumptions and see some potential for this to surprise on the upside. Second, External Commercial Borrowing (ECB) inflows could improve given expectations of Fed rate cuts, and we have assumed that this remains flat in FY2024/25.

Government to maintain commitment to structural reform and fiscal consolidation momentum

The new government is likely to maintain its commitment towards long-term fiscal prudence, while tilting the reform momentum towards consumption and inclusive growth. On that front, we expect Budget 2024/25 announced on 23 July to lower the fiscal deficit target slightly to 5.0% of GDP for FY2024/25 from the 5.1% target announced in the Interim Budget. As such, we expect the government to spend some but not all of the extra fiscal space afforded by higher RBI dividends and a better fiscal outturn (see Chart 16 below). We think the policy priorities will include an overarching push for more inclusive growth - through boosting consumption, supporting jobs, investing in the rural economy, and raising employment generation including in the manufacturing sector. Key changes and policy announcements in the Full Budget could include:

- Increased transfers to states, especially to key allies in the NDA alliance

- Employment-linked incentives to boost job generation

- Personal income tax cuts

- Increased allocation to healthcare, agriculture and the rural economy

- Continued commitment to boost manufacturing

RBI to start shallow rate cut cycle of 50bps from 1Q2025. Bond yields to grind lower

If we are right that the government will likely keep the structural reform and fiscal consolidation trajectory intact, we expect the RBI to have the policy space to embark on a shallow rate cut cycle of 50bps starting 1Q2025 (calendar year). This will be helped in part by external macro stability, with INR likely strengthening gradually against the Dollar with low volatility.

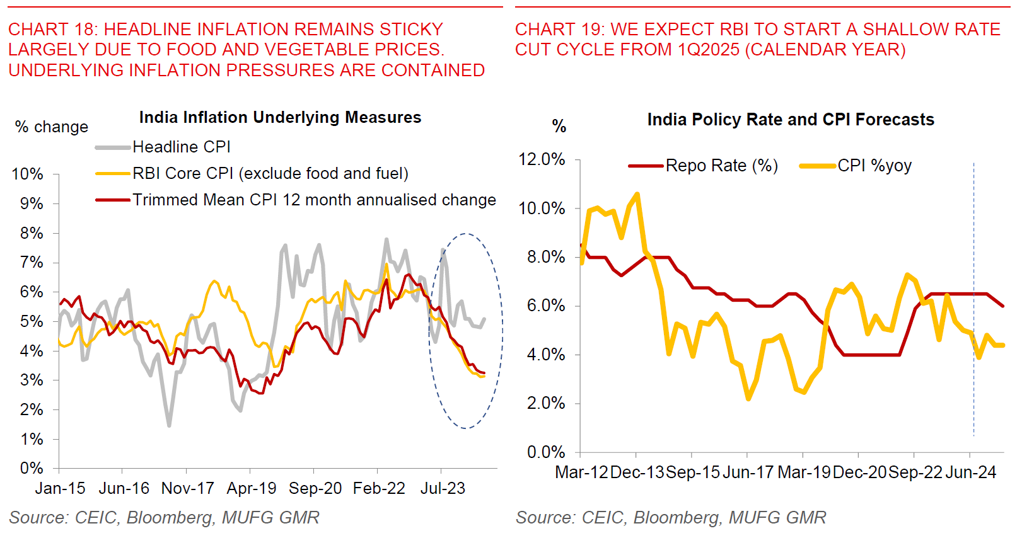

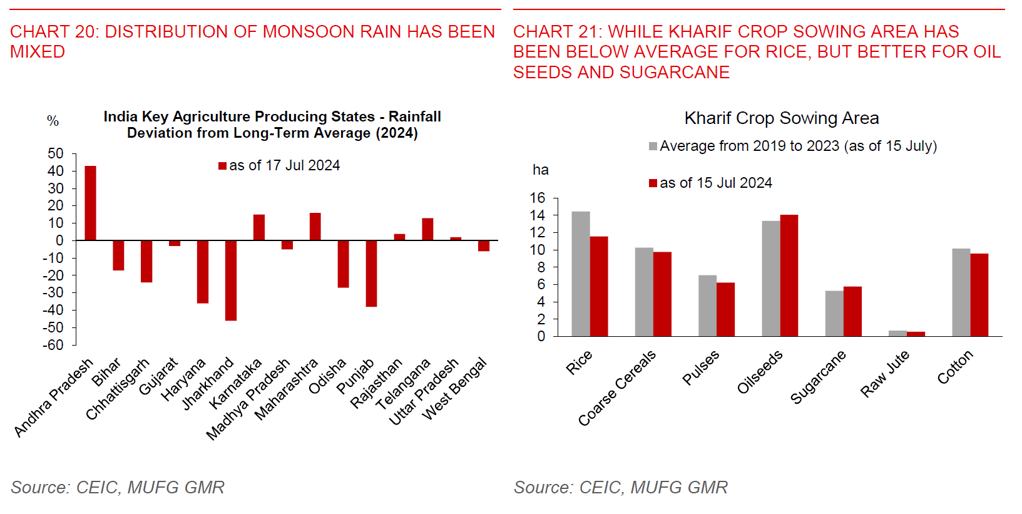

In terms of internal macro stability, we forecast inflation to average 4.5% for this fiscal year, with inflation likely to remain sticky in the near-term but head below 4.5% by 1Q2025: Sticky food and vegetable prices have been one of the binding constraints to the RBI easing and on this front, recent weather patterns including heatwaves have resulted in some spikes in volatile components such as potatoes, onions, and tomatoes. The continued good news is that underlying inflation trends including in core inflation and trimmed mean remain manageable, and we expect this show up more in the headline inflation rates once weather-related disruptions fade (see Chart 18 below). Nonetheless, with the Southwest monsoon showing mixed trends in terms of distribution of rainfall across agricultural producing states (see Chart 20 below), and with Kharif crop sowing still also unclear in terms of latest trajectory (see Chart 21 below), we think the RBI will want to wait for better data before committing to any rate cut and changes in communication.

RBI to continue to build up FX reserves, capping FX volatility

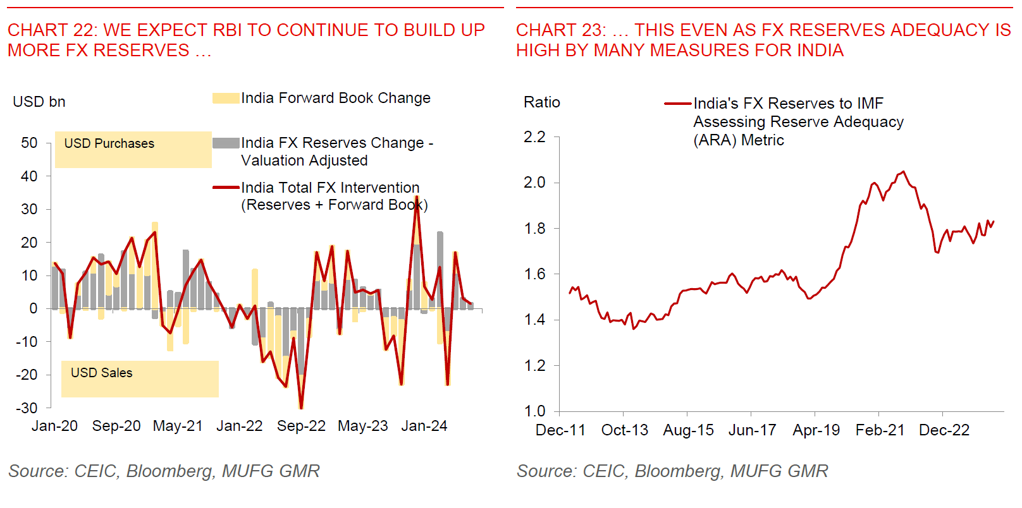

We expect RBI to continue to intervene to build up FX reserves, in part because it views inflows from bond index inclusion as “borrowed” funding that may reverse easily. As such, the penchant by the central bank to build up its umbrella remains high, even as most measures of FX reserves adequacy signal that they are more than sufficient (see Chart 22 and 23 below). While this means that USDINR FX volatility should remain low, it could also imply some underperformance in INR compared with other higher beta currencies moving forward if Dollar weakness is sustained.

Domestic political risks and upcoming state elections are also key to watch

Overall, we expect IGB 10-year bond yields to grind lower to 6.80% by 1Q2025 and 6.70% by 2Q2025 (calendar year), with the yield curve likely steepening as RBI cuts. A key risk to our views is on political developments, and upcoming state elections will be important to watch to see if the political tide against the government turns meaningfully in any way. This may raise pressures for government to turn more populist and at the very least slow the structural reform momentum, although it is important to stress this is not our base case (see Chart 24 below).