Key Points

Please click on download PDF above for full report

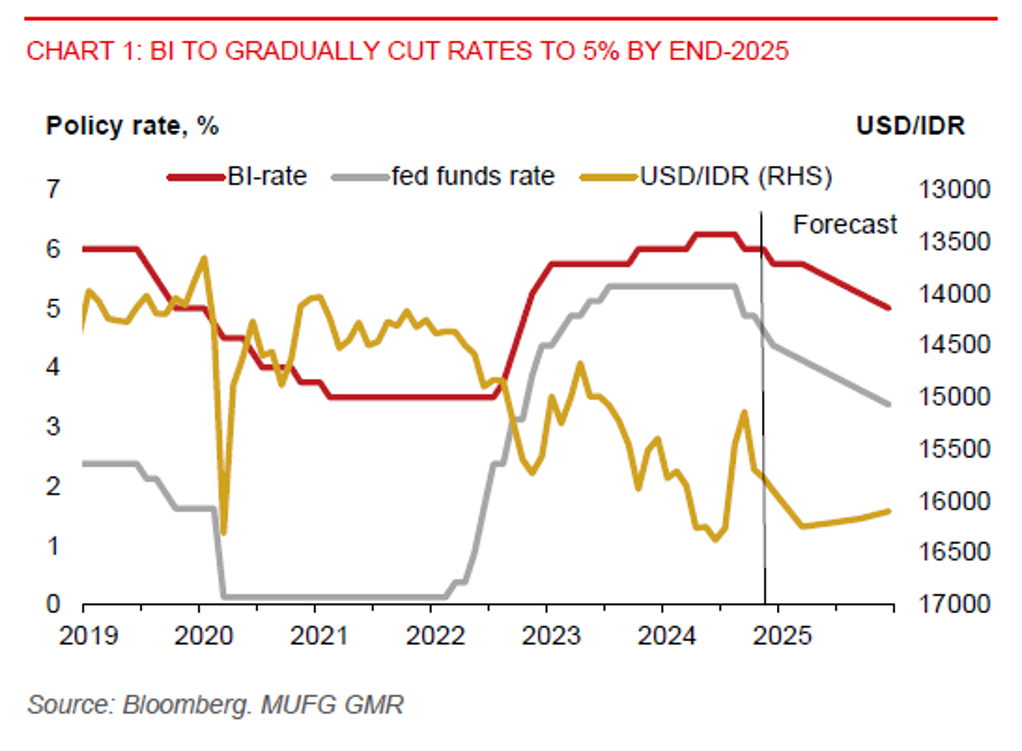

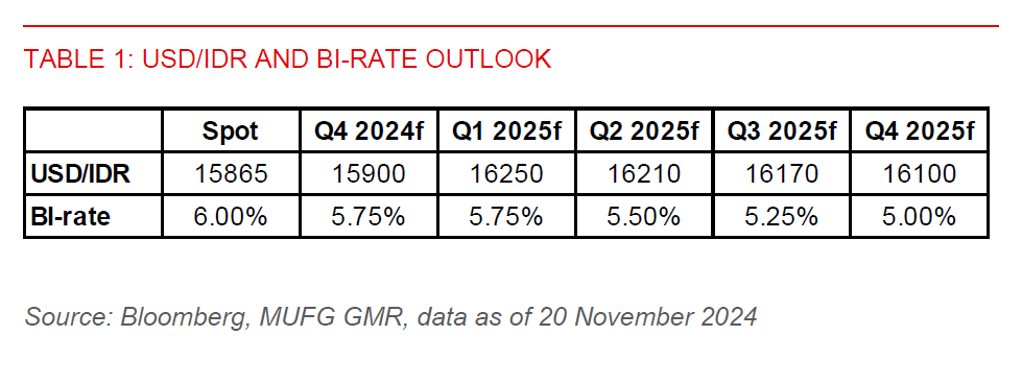

- In line with our and market expectation, Bank Indonesia (BI) kept the benchmark policy rate unchanged at 6.00% in November for the second straight month, after cutting it by 25bps in September. This was despite the Federal Reserve cutting the policy rate by another 25bps this month, as well as emerging signs of softening economic growth and falling inflation in Indonesia. Recent renewed weakness in the rupiah, where USD/IDR is nearing the 16,000-level following Donald Trump’s election win, has likely led BI to take a more cautious approach to policy easing.

- We still look for BI to cut the policy rate again by 25bps to 5.75% in December. This is largely predicated on our anticipation for the Fed to lower its policy rate by another 25bps in December, USD/IDR to stabilize at around 15,900, and no oil supply shock from ongoing geopolitical tensions in the Middle East.

- To begin with, Indonesia’s policy rate is quite restrictive relative to pre-Covid levels, suggesting there’s ample scope for policy rates to go lower from here. What’s more, Indonesia’s economic growth is starting to show some signs of weakness, while inflation is contained (1.7%yoy in October, below the midpoint of the 1.5%-3.5% inflation target band). GDP growth slowed to 4.95%yoy in Q3, from 5.05% in Q2. Our estimates of Indonesia’s seasonally adjusted GDP show growth slowing sequentially to 0.9%qoq in Q3, from 1.4%qoq in Q2. The main drag was from a slower pace of growth in household consumption and domestic investment. High frequency indicators also point to further weakness ahead. The manufacturing PMI slipped into contractionary territory in Q3, suggesting further production weakness ahead. Bank loan growth also softened to 10.9%yoy in October, from a peak of 13.1%yoy growth in April.

- Trump’s potential tariff hikes (60% tariff on all Chinese imports and 10% on other countries) would hurt the outlook for Indonesia’s economy and currency, though less so compared to the larger negative impact this would have on more export-oriented economies like Singapore and Malaysia. We estimate Trump’s proposed tariff could still cut Indonesia’s GDP growth by 0.5ppts. Its rising export exposure to China (23.9% of total exports vs. 14.2% in 2019) is a headwind. Indonesia’s economy has also become more integrated with China’s supply chain. A more integrated supply chain with China means lower demand for Chinese goods will have a greater impact on Indonesian exporters that supply Chinese producers. Industries most likely affected include iron and steel, nickel, palm oil, coal, rubber, and electrical machinery.

- The pace of BI rate cuts in 2025, however, will likely be slower than we had earlier expected. We now look for just 75bps cut to 5.00% by end-2025, compared to our earlier projection for BI-rate to return to our estimated neutral level of 4.50%. BI now sees more limited fed funds rate cut, while its key focus will remain on maintaining rupiah stability. Donald Trump’s proposed tariff hikes, if implemented fully, could have inflationary consequences for the US economy, slowing the pace of Fed rate cuts. Markets have pared back their US rate cut expectations to just 75bps through 2025, down from about 120bps before the US election result.

- Meanwhile, market sentiment towards Indonesia has soured on Trump’s victory. Net foreign equity outflows were US$261mn in the week ending 15 November, marking the fourth straight weeks of outflows. Also, net foreign bond outflows were US$116mn, continuing for the fourth straight week. We expect the rupiah will stay vulnerable in a sustained period of USD strength and global uncertainties. We see USD/IDR ending the year at 15,900 before rising to 16,250 by Q1 2025 on the back of potential US tariff announcement. After a likely December rate cut in our view, the next BI rate cut may only happen in Q2, when a likely lower fed funds rate by then could provide more space for BI to cut rates while still keeping the rupiah stable.