Key Points

Please click on download PDF above for full report

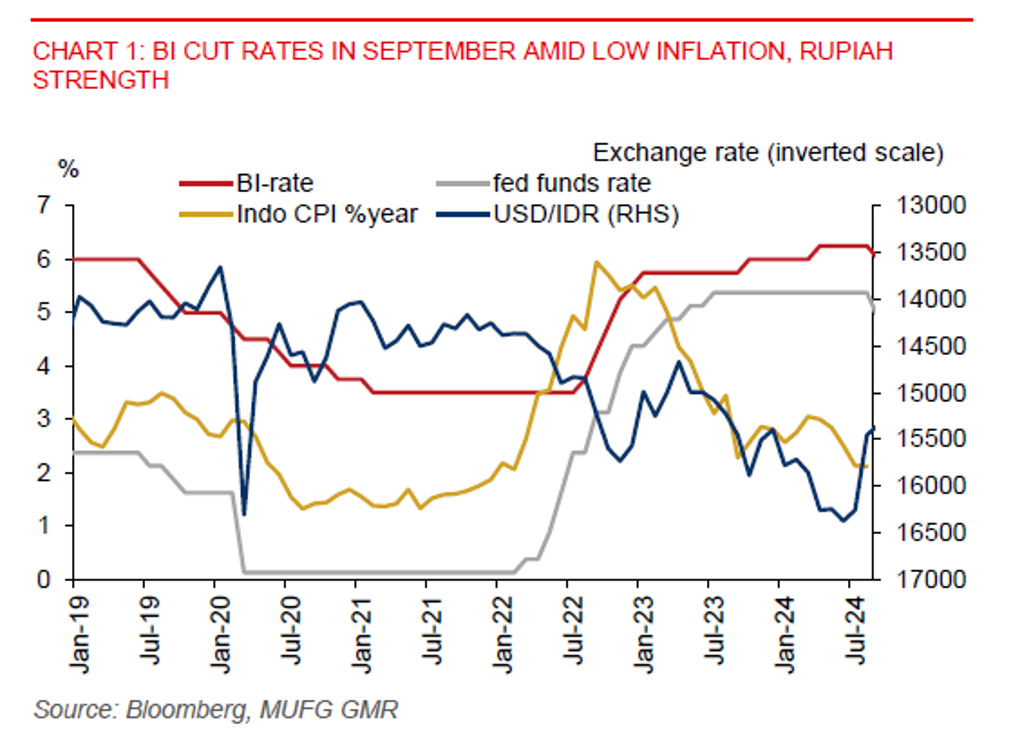

- Bank Indonesia cut its benchmark policy rate by 25bps to 6.00% in September. The deposit facility rate and lending facility rate were also lowered to 5.25% and 6.75%, respectively.

- BI says the rate cut is in line with low inflation in the country. The central bank also thinks monetary policy uncertainty is easing in advanced economies, while anticipating faster and bigger fed funds rate cuts than previously expected. BI has also said that it will continue to watch for further headroom for rate cuts, signalling further policy easing.

- Conditions have fallen into place for BI to lower its policy rate, though the timing of the start of interest rate cut is earlier than we had expected. CPI inflation was 2.1%yoy in August, unchanged from July and within BI’s 1.5%-3.5% target. Inflation will likely remain contained given falling global food and commodity prices. The IDR has also appreciated from a mid-2024 low of 16,478 per US dollar, erasing year-to-date losses and keeping imported inflation in check. In addition, Indonesia recorded a larger trade surplus of US$2.9bn in August vs. US$472mn in July.

- Investor sentiment has improved, with easing global market uncertainty leading to foreign capital inflows strengthening the IDR. BI sees clearer US rate cut path ahead will spur more foreign capital inflows. The Jakarta Composite Index (JCI) is up by more than 7% year-to-date to record-highs of more than 7,800. Net foreign equity inflows were US$1.6bn in September, the second largest net inflow since April 2022. The largest net foreign equity inflow was US$1.8bn in August. Meanwhile, Indonesia’s 10-year government bond yield has declined to below 6.6%, from 7.2% in mid-2024.

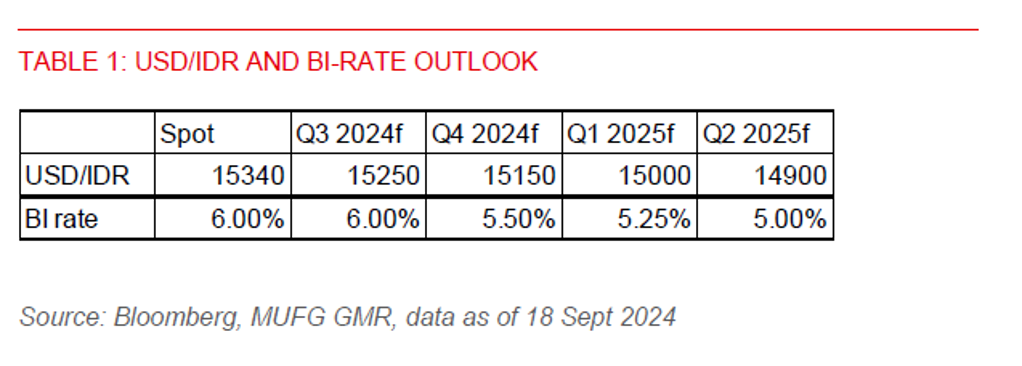

- The terminal BI-rate is possibly around 4.50%. We look for BI to lower the policy rate by 75bps to 5.50% this year, implying another 50bps in rest of this year, followed by another 100bps back to neutral rate of 4.50% in 2025 to sustain economic growth momentum. Reflecting the potential for rapid easing pressures from US rates, lower oil prices, and BI’s FX policy support, we have revised down our short-term USDIDR forecasts to 15250 in Q324, 15150 in Q424, 15000 in Q125, and 14900 in Q225. Moreover, a renewed strengthening of Indonesia’s FX reserves will also help support the IDR. That said, downside risks to IDR will stem from US elections on 5 Nov, Indonesia’s local elections on 27 Nov, and geopolitical tensions.