Key Points

Please click on download PDF above for full report

- Bank Indonesia (BI) held its policy rate unchanged at 5.75% today, in line with our and market expectations. Concerns about rupiah stability have likely led to the rate hold. The rupiah has weakened by about 2.1% against the US dollar since the last policy meeting on 19 March. BI expects Indonesia’s GDP growth to slow to below the midpoint of its projection range of 4.70%-5.50% in 2025 amid global trade uncertainties, while reiterating that a strong policy response is warranted. In addition, the central bank also sees global growth slow to 2.9% this year from 3.2% previously.

- We are slightly more pessimistic than the central bank in our outlook for Indonesia’s economy, though. We have revised down our 2025 GDP growth forecast for Indonesia to 4.6% from 4.9% previously. This mainly reflects the much higher announced US tariff rate on China, of 145%, which would have larger negative spillover effect on Indonesia’s economy.

- The downside risk to growth remains significant. Both US and Indonesia have agreed a 60-day window for bilateral trade negotiations. It remains to be seen if Indonesia can secure better trade terms with the US, failing which the full 32% reciprocal tariffs could come into effect in July. President Trump has delayed the full 32% reciprocal tariff on imports from Indonesia for 90 days until 9 July, but he has still applied a 10% baseline tariff in the interim. It appears that the Indonesian government is planning to boost US imports by $19bn to eliminate its trade surplus with the US. And it could do so via raising imports of US energy and agricultural commodities, including LPG, crude oil, wheat, and soybeans.

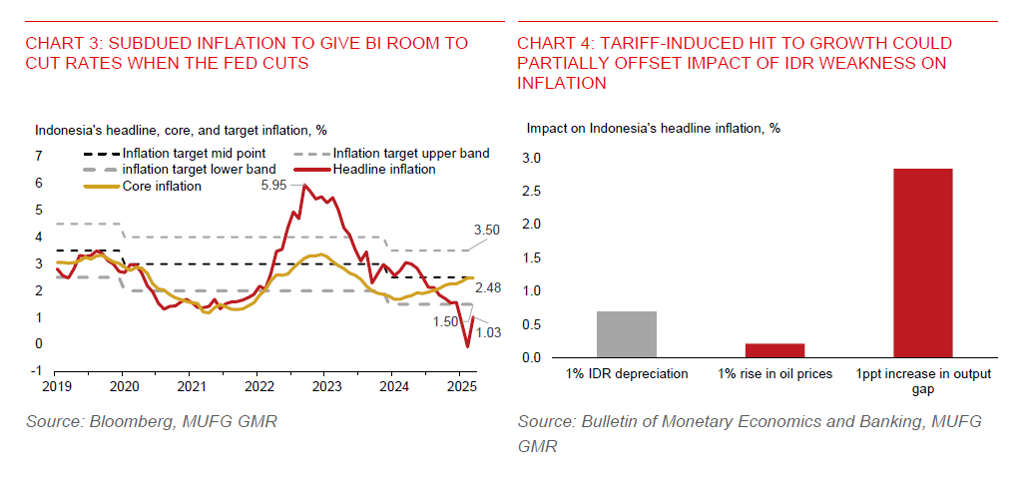

- We maintain our forecast for Bank Indonesia to cut the policy rate by 50bps in the rest of this year, bringing the policy rate to 5.25% by end-2025. This will be consistent with the Fed’s March median dot plot of 2 rate cuts this year and Fed Chair Powell’s cautious stance on rate cuts. The next 25bps BI rate cut could still come this quarter, possibly in June, when the Fed could cut rates. Indeed, to be sure, BI will continue to seek opportunities to cut rates, given monetary policy is restrictive on economic activity, at a time of higher US tariffs. Bank credit growth has slowed further to just 9.2%yoy in March, from 10.3%yoy in February and the April 2024 peak of 13.1%.

- Moreover, inflation has been subdued in Indonesia, which could provide some buffer for the BI to lower rates and tolerate some currency weakness. Core inflation was 2.5%yoy in March, which is still manageable at the midpoint of BI’s inflation target range of 1.5%-3.5%. Meanwhile, headline inflation picked up to 1%yoy in March, from -0.1%yoy in February. While the government’s one-off electricity discount in January-February has ended, headline inflation was partially offset by discounts for economy class airfares during Eid in March. While rupiah weakness could push up imported costs, we anticipate that the tariff-induced hit to domestic and global growth could provide a partial offset keeping Indonesia’s inflation in check. BI expects inflation will remain within its inflation target of 1.5%-3.5% this year.

- We maintain our forecast for USDIDR at 16,625 by end-Q2 for now amid US dollar’s recent weakness. There may still be some modest rupiah weakness over the coming weeks, but sharp depreciation from current levels looks unlikely. Indeed, market sentiment towards the rupiah has appeared to be much weaker than during the Covid shock in March 2020, which could help limit the room for sharp falls. Moreover, BI has been intervening to contain the pace of rupiah depreciation, including in offshore NDF markets. BI has pledged to continue intervening in the FX market to support rupiah stability and keep headline inflation within its target over 2025 and 2026. That said, the risks remain skewed to more IDR downside, especially if the full 32% reciprocal tariffs are applied.