Key Points

Please click on download PDF above for full report

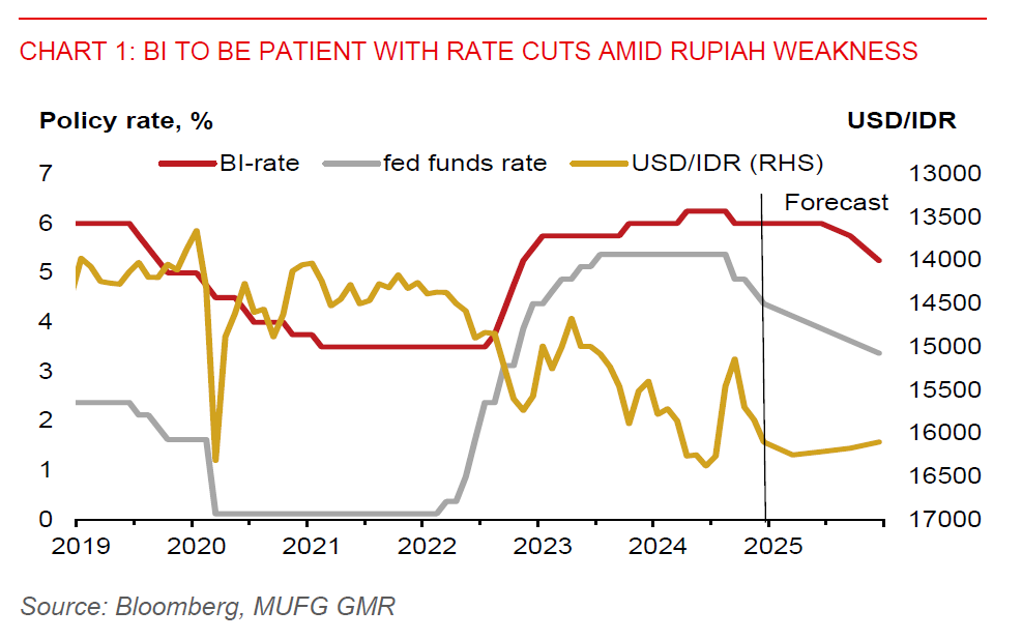

- Bank Indonesia (BI) kept its policy rate at 6.00% during its December 2024 meeting. The deposit facility rate stayed at 5.25% and the lending facility rate at 6.75%. The rate-hold decision shows Bank Indonesia still focused on rupiah stability following recent currency weakness, despite slowing economic growth momentum and a manageable inflation outlook.

- The Indonesian rupiah has weakened past 16,000 against the US dollar. This has partly reflected one-off domestic factor involving a recent raid at Bank Indonesia’s offices by anti-corruption body. This has further hurt market sentiment towards the rupiah as it faces heightened global trade uncertainties. We estimate that the raid has led to markets pricing in 1-1.5% additional risk premium on the Indonesian rupiah for now.

- BI will thus likely remain patient with rate cuts amid rupiah weakness, as it anticipates a challenging external environment ahead. The central bank sees global financial market uncertainty rising, a slower pace of Fed rate cuts, and global growth slowing to 3.1% from 3.2% previously. BI says its exchange rate policy will be focused on rupiah stability and that rupiah weakness has so far been manageable. BI will continue to support the rupiah via FX intervention and issuing rupiah securities (SRBI) at attractive yields to attract foreign inflows.

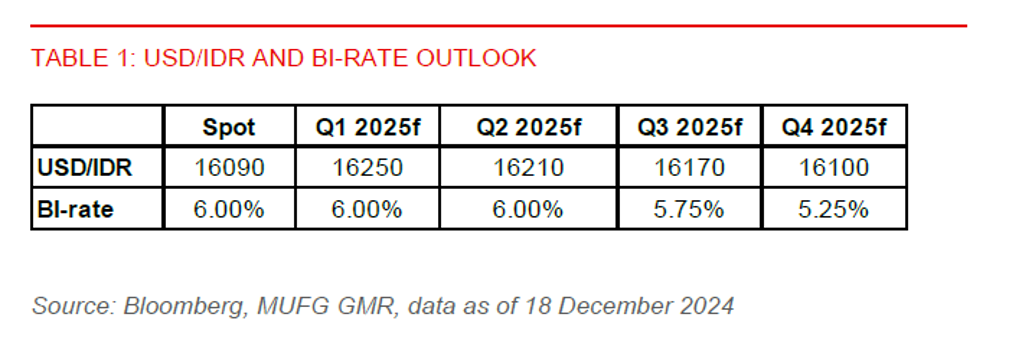

- Nonetheless, we think the policy decision represents a pause rather than an end to BI’s easing cycle. We look for BI to lower the policy rate by 75bps in H2 2025, bringing it to 5.25% by end-2025, though staying above our 4.5% estimate for BI’s neutral rate. Our BI-rate forecast for 2025 is in line with our expectation for the pace of fed funds rate cuts next year. Moreover, BI’s policy restrictiveness has started to act as a drag on growth, which warrants a lower policy rate. Bank credit growth further slowed to 10.8%yoy in November, from a peak of 13.1%yoy in April. The manufacturing PMI has also slipped into contraction since July. In order to sustain credit growth, BI will strengthen macroprudential liquidity measures from January.

- It’s unclear the extent of tariff hikes from Trump, but some form of higher US tariffs is likely. With Indonesia being a more domestic oriented economy, the economic impact from higher US tariffs would be less than that for more export-oriented economies like South Korea, Malaysia, and Singapore. But interestingly, Indonesia’s economy is becoming more connected to the Chinese supply chain. And rupiah tends to be vulnerable amid sustained dollar strength and global uncertainties. We expect Indonesia’s economy will slow to 4.9% in 2025 from 5.1% in 2024. And we maintain our outlook for USD/IDR to rise to 16,250 by Q1 2025 on the back of potential US tariff announcement, before seeing some reprieve in H2 2025 that will allow BI to resume cutting rates.

- Meanwhile, Indonesia has a manageable external debt profile to prevent a currency crisis. Its high debt service ratio is not a major concern. The debt service ratio has notably risen to 22.3% in Q3 2024, above the internationally accepted threshold of 20% according to the World Bank. The increase in debt service burden has partly to do with Bank Indonesia issuing rupiah securities (SRBI) to attract foreign inflows to defend the rupiah. The SRBI is denominated in rupiah, which should help contain external vulnerability.