Key Points

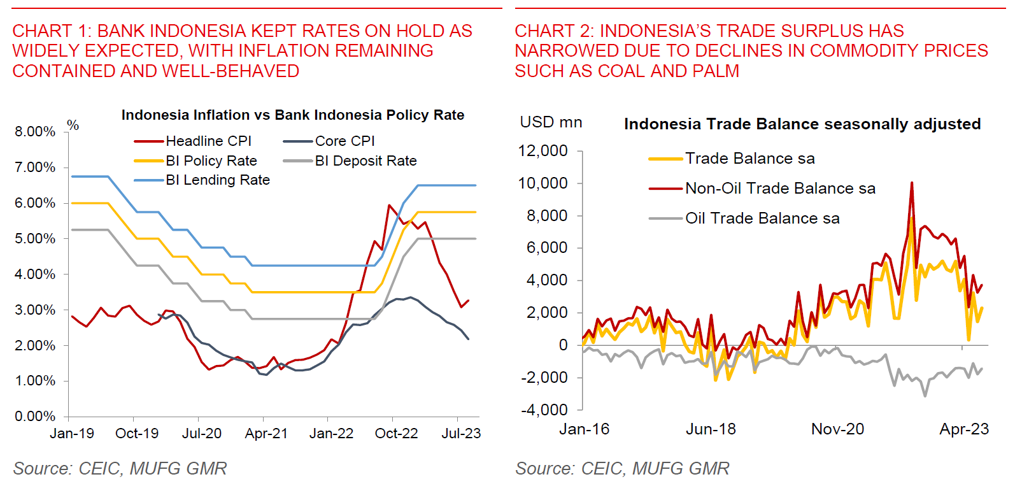

- Bank Indonesia kept its key BI rate on hold at 5.75% as expected. BI is quite sanguine on the inflation trajectory, and as such, also the path forward for the policy rate, notwithstanding uncertainty on the global economy and the US Dollar.

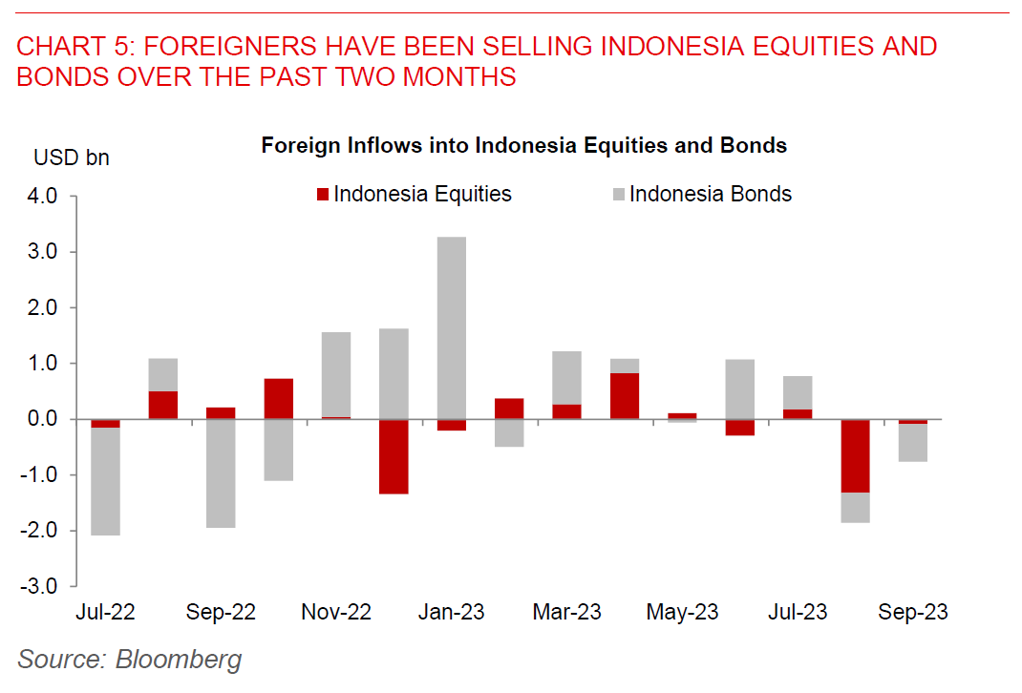

- Governor Perry said that there is “room to review” BI’s interest rate given low inflation, but the room is partly offset by a strong dollar and uncertain global environment. The central bank’s focus is to stabilize the exchange rate, especially as it sees a Fed rate hike in November that could trigger fund outflows.

- BI provided a few updates on new instruments and regulations to encourage FX and capital flows during the press conference and investor presentations.

- First, BI said that banks have placed US$1.3bn in FX export proceeds in Bank Indonesia. This is higher than the US$277mn of FX term deposits placed with the central bank earlier in September. As a reminder, BI requires exporters in the mining, plantation, forestry and fisheries sectors to repatriate 30% of their foreign currency earnings for a minimum period of 3 months, starting from August 2023. There may be more flows to come once the full impact of the regulations kick in.

- Second, BI said that the new SRBI securities have attracted almost $2.5bn in its 1st two auctions by domestic banks. Nonetheless, the impact on foreign capital inflows was likely limited so far, with only US$130mn of transactions in the secondary market, of which 80% are from foreign participants, according to BI.

- We are currently forecasting USDIDR at 15,100 in 4Q2023 and 14,800 in 2Q2024 on the back of a gradually weaker Dollar assumption through 2024.