Key Points

Please click on download PDF above for full report

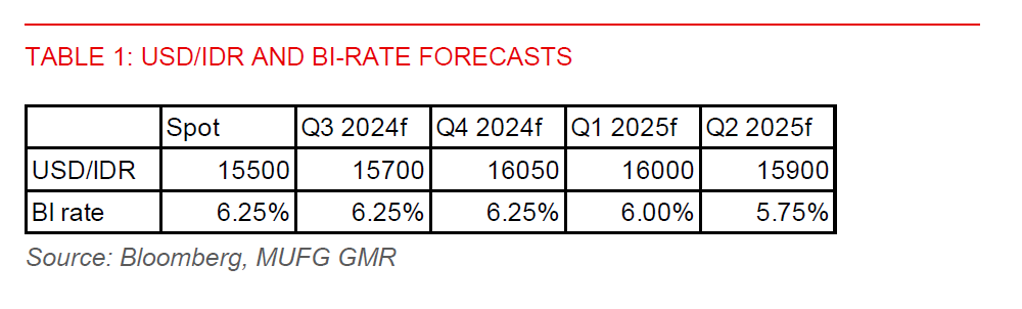

- Bank Indonesia held its benchmark policy rate at 6.25% at today’s policy meeting, in line with our and market expectations. Accordingly, the deposit facility rate and lending facility rate were kept at 5.50% and 7.00%, respectively. We think BI has struck a balanced tone at today’s policy meeting, citing that global development still warrants some vigilance but domestic demand also needs to be supported. This implies that any signs of unexpected weakness in domestic demand will elicit a policy rate cut by BI.

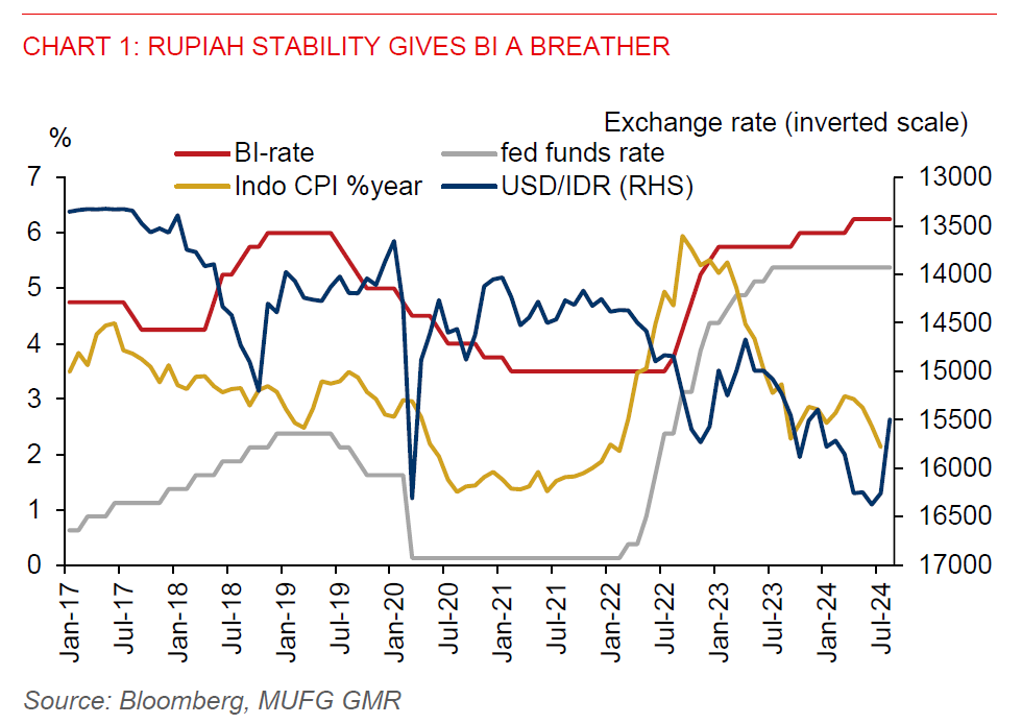

- We think conditions are now in place for BI to lower its policy rate, given resilient economic growth (+5%yoy in Q2), solid loan growth of 12.4%yoy in July, contained inflation (just 2.1%yoy in July), and recent rupiah strength (> 5% gain vs. USD since July). The next policy move will be a cut. But we think BI could still afford to be patient and wait for the Fed to lower rates first before considering cutting so as to avoid unnecessary currency volatility. Moreover, BI governor Perry Warjiyo has signalled that global risks need to be manageable before BI rates can be lowered. Markets will still be watching for how ongoing unrest in the Middle East will continue to unravel, the upcoming US elections in November, and lingering domestic fiscal risks under incoming President Prabowo.

- We think Indonesia’s fiscal deficit cap of 3% GDP is here to stay. It has been an important anchor for fiscal management and maintaining investor confidence in Indonesia’s economy. The new government will not want to jeopardise its ‘BBB’ credit rating too.

- It is good news that the new government will keep to fiscal discipline, easing market concerns of a rapid deterioration of government finances. We still look for fiscal discipline to continue in the next administration. A budget deficit of 2.5% of GDP has been proposed for 2025, though this hinges on strong revenue collection offsetting a large increase in spending. President Jokowi has recently presented the budget proposal for 2025. It will be implemented by incoming President Prabowo, whose team is involved in its formulation. The budget sets revenue at IDR2996.9tn (7% increase from 2024 budget) and spending at IDR3613.1 (about 9% increase from 2024 budget). This results in a deficit of IDR616.2tn, or est. 2.53% of GDP, wider than the 2.3% deficit budgeted for 2024.

- The rupiah has been on a good run since start of H2 2024 against the US dollar on the back of broad US dollar weakness fuelling the appeal of emerging market assets. Indeed, emerging market and Asian currencies have had reprieve against the US dollar. But USDIDR is now looking oversold. Fed rate cuts also do not always guarantee sustained rupiah strength. And global uncertainties and domestic fiscal challenges could still prove to be a drag on the rupiah over the next 6-12 months in our view. We look for USDIDR to stabilise at 15,700-15,900, a higher level than the spot rate at 15,500-level at the time of writing. One thing to note is that the government has planned its 2025 budget around a USDIDR exchange rate of 16,100.