Key Points

Please click on download PDF above for full report

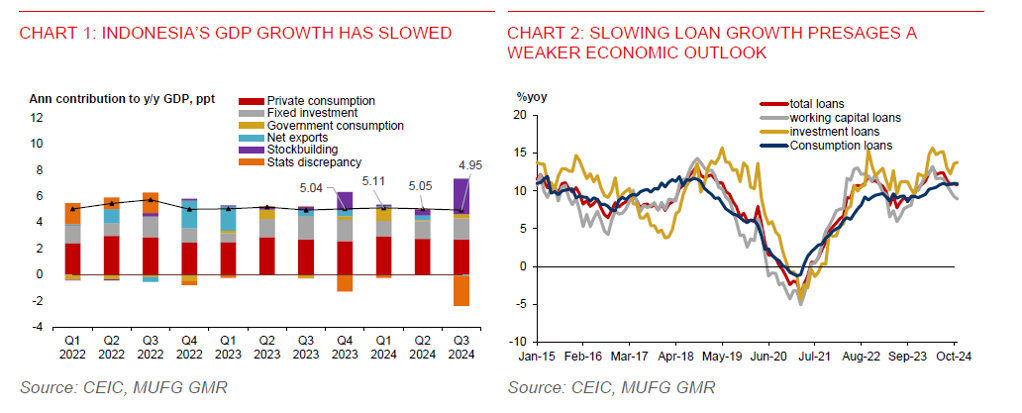

- Bank Indonesia (BI) cut its policy rate by 25bps to 5.75%, surprising Bloomberg consensus for a rate hold. The need to support economic growth has been cited as a reason for the rate cut decision today. BI now sees GDP growth in 2025 to be weaker than the midpoint of its projected range of 4.70%-5.50%, i.e. below 5.1%. Today’s rate decision also shows that policymakers are grappling with duelling objectives of the need to support growth on one hand while stabilising the rupiah on the other hand.

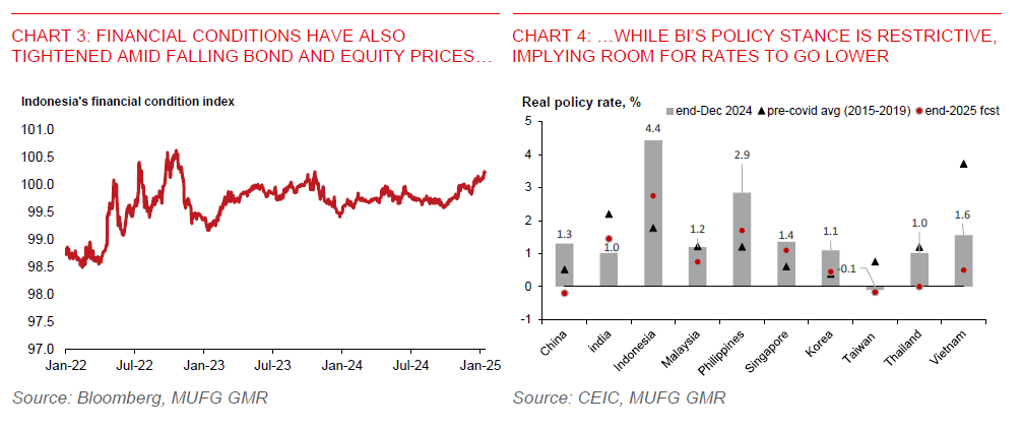

- Given rising global uncertainties, we think it’ll be hard to estimate the exact timing of BI rate cuts going forward, as BI’s priorities could seemingly shift between supporting economic growth and the rupiah. Moreover, it’s unclear the extent of US tariff hikes. However, what’s clear is that there will still be room for BI to continue easing policy, given currently tight financial conditions, domestic growth slows, and the Fed likely to continue lowering rates this year. We maintain our outlook for BI policy rate to end this year at 5.25%.

- BI’s policy restrictiveness has started to act as a drag on growth, which indeed warrants a lower policy rate. Bank credit growth further slowed to 10.8%yoy in November, from a peak of 13.1%yoy in April. The manufacturing PMI has also slipped into contraction since July. In order to sustain credit growth, BI will look to strengthen macroprudential liquidity measures from this month. We maintain our forecast for GDP growth to slow to 4.9% in 2025, from an estimated 5% in 2024.

- Inflation is unlikely to be a major concern, given weak commodity prices and softening domestic growth that will keep core inflation in check. Headline inflation was 1.6%yoy in December, at the lower end of BI’s inflation target range. During his press conference, BI Governor Perry Warjiyo has sounded confident that inflation will stay within the 1.5%-3.5% target this year.

- We see significant downside risk to our rupiah forecast, currently at 16,250 against US dollar in Q1 2025, following the surprise BI rate cut. Moreover, Indonesia’s long-term yield spread versus the US does not seem to be large enough to compensate for risk premia. Having said that, BI will likely continue to be in the market to support the rupiah. A pickup in Indonesia’s gross reserves to US$155bn has also enhanced BI’s ability to perform direct FX spot intervention. In addition, a step-up in monetary operations around SRBI (Bank Indonesia’s rupiah securities), which has seen a decline in net issuances since November, will thus be needed to help keep the rupiah in check.