Key Points

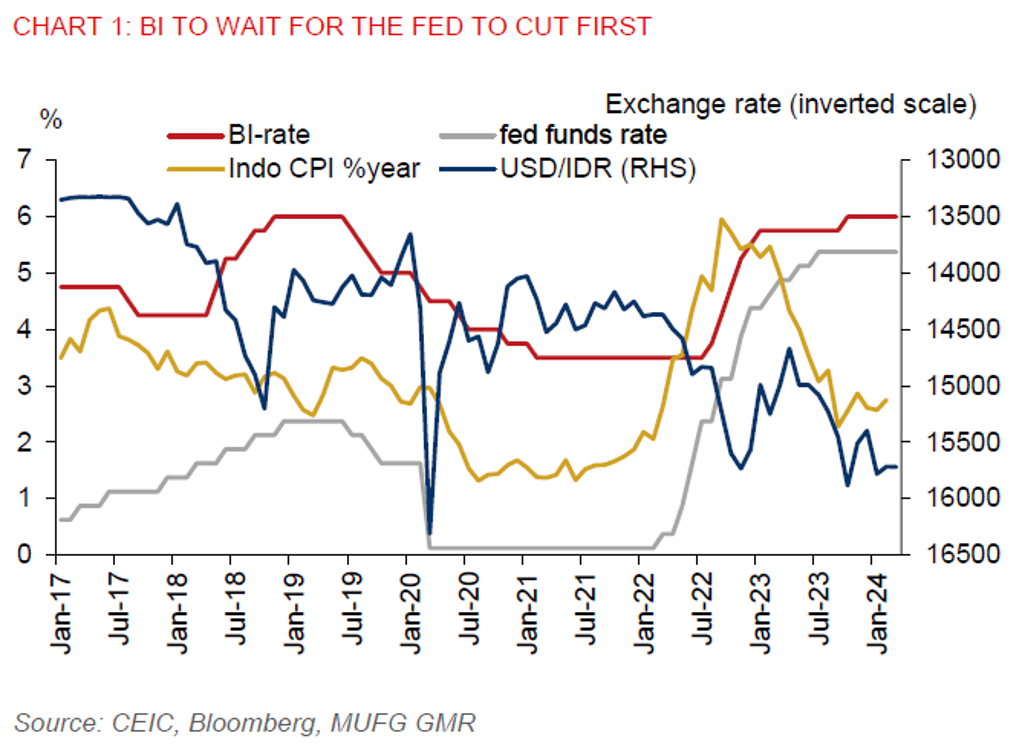

- As we had expected, Bank Indonesia (BI) held its policy rate unchanged at 6% for the fifth straight meeting in March as it seeks to maintain rupiah stability and keep inflation within its 2024 target range of 1.5%-3.5%.

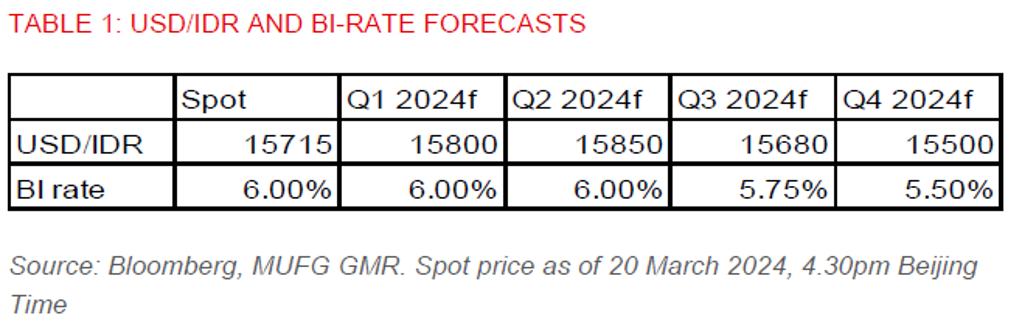

- Indonesia’s economy will likely remain on a steady footing this year and inflation to stay within BI’s target, leaving the stability of the exchange rate as the key factor in determining the timing and pace of BI rate cuts. We look for BI to cut its policy rate only after the US Fed loosens its monetary policy to avoid unnecessary rupiah volatility. For now, we see the BI lowering its policy rate by 50bps to 5.50% in H2 2024.

- Our 2024 outlook for Indonesia’s economy remains positive. We look for GDP to grow 5.1% this year, unchanged from the pace in 2023. Election uncertainty has eased, and we think Indonesia should be able to continue to rely on its domestic demand to support growth of 5.1% this year. Consumer confidence remains high, labour market conditions are still solid, while corporates have boosted borrowings for investment purposes. Bank Indonesia expects credit growth in the range of 10%-12% this year. Meanwhile, exports have been weak, but there are signs of improvement. There’s no change to BI’s outlook for growth this year. The central bank continues to expect GDP growth of 4.7%-5.5%.

- Inflation will likely continue to pick up in the coming months, but we think this will be temporary. We expect inflation will remain within BI’s target of 1.5%-3.5% this year. Indeed, core inflation and administered prices were stable at 1.7%yoy. Monetary policy conditions remain tight, while authorities continue to ensure adequate food supply via the National Movement for Food Inflation Control (GNPIP). The inflation pickup in February (2.75%yoy, from 2.57%yoy in January) was mainly due to a seasonal spike in food prices (such as rice, chillies, eggs, poultry, and cooking oil). Food prices could rise further in the coming months amid the Ramadan season and Idul Fitri holidays There’s no change to BI’s outlook for inflation to remain within its target range this year.

- We see no catalyst yet for sustained gain in the Indonesian rupiah versus the US dollar in the near term. Our 3-month USD/IDR forecast stays at 15,850. The IDR can no longer count on the current account, which is in deficit. Meanwhile, in the latest FOMC meeting, there is no change in the US Fed’s outlook for 3 rate cuts in 2024.