Key Points

Please click on download PDF above for full report

- Bank Indonesia (BI) held its policy rate unchanged at 5.75% today, given the rupiah has underperformed regional currencies while Indonesia’s stock market has been in turmoil. Notably, the Jakarta Composite Index (JCI) fell by 7% at one point on 18 March, triggering a temporary 30-minutes trading halt, before paring back some losses. The sharp equity decline could possibly be due to rumours about veteran Finance Minister Sri Mulyani resigning. She has since dispelled resignation rumours by saying that she will stay on as finance chief, while emphasizing that the country’s budget deficit for 2025 will stay at 2.5% of GDP, within the constitutional limit of 3%.

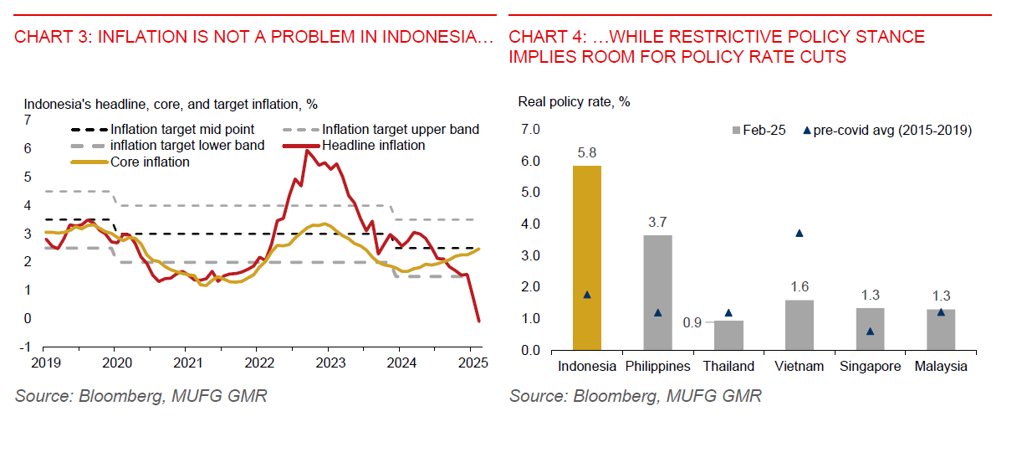

- BI still sees Indonesia’s GDP growth at 4.70%-5.50% this year, despite global uncertainties. However, the bank has mentioned that persistent global uncertainty requires a strong policy response. To be sure, the central bank is still looking for opportunities to cut the policy rate this year, given Indonesia’s inflation adjusted policy rate has been quite elevated. This implies that BI’s monetary policy stance is currently restrictive, which will be a drag on domestic economic activity, at a time when tariff headwinds are mounting. Bank credit growth has slowed steadily to 10.3%yoy in February, from 13.1%yoy in April 2024. We maintain our outlook for Bank Indonesia to cut the policy rate by 50bps in the rest of this year, bringing the policy rate to 5.25% by end-2025. The next 25bps rate cut could possibly come as early as Q2.

- Despite being an export-oriented economy, Indonesia won’t be totally immune to higher US tariffs on imports from China or global trade disruption. The US reciprocal tariff plan is set to be announced or implemented on 2 April, along with possibly an additional 25% sectoral tariffs on autos, semiconductors, and pharmaceuticals. Canadian authorities were being told by US officials that tariffs will be virtually certain on 2 April.

- Meanwhile, inflation is not a problem for Indonesia. Core inflation was 2.5%yoy in February, up from 2.4%yoy in January, but still manageable at the midpoint of BI’s inflation target range of 1.5%-3.5%. Headline inflation was -0.1%yoy in February, but that’s mainly due to one-off electricity discount provided by the authorities. BI expects inflation will remain within its inflation target this year.

- In terms of our USDIDR forecast, we maintain our outlook for USDIDR to rise to 16,625 in Q2, in anticipation of larger and more pervasive US tariff actions in April. The rupiah is likely to weaken further to help absorb the potential negative impact of US tariffs. It will also be difficult for BI to raise the policy rate to defend the rupiah, at a time when domestic economic growth is facing challenges from both global and domestic policy uncertainties.