Key Points

Please click on download PDF above for full report

In our recent Global Market Research annual roadshow in Jakarta, we have had the opportunity to engage with more than 140 local clients. In this IndonesiaPulse report, we consolidate and address the top 3 questions we have received in our client meetings and conference event:

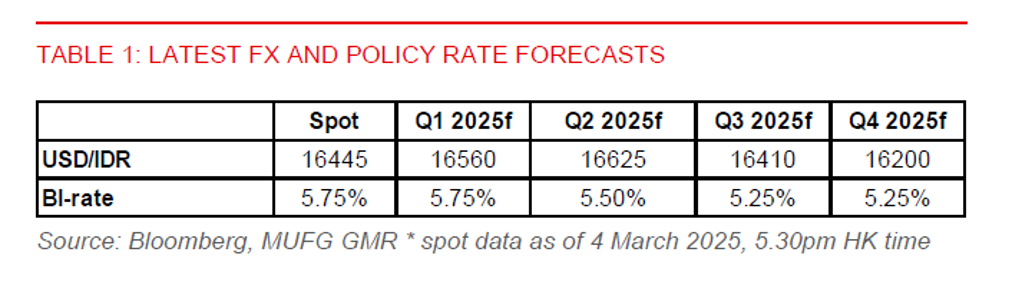

1) The Indonesian rupiah has been negatively impacted by weak global market sentiment, high US interest rates, and a strong US dollar. When can we expect a recovery in the IDR?

2) How will the new regulation on commodity exporters’ foreign proceeds impact the commodity sector and IDR?

3) The middle-income class population in Indonesia has shrunk. Could President Trump’s tariff indirectly affect Indonesia’s consumers and exacerbate the decline in the middle-income class population?

Key takeaways

- Some reprieve for the rupiah may only be possible in H2 2025, in anticipation of sustained US dollar weakness when US economy shows signs of a slowdown and greater clarity about Indonesia’s fiscal outlook later in the year. Both domestic and global uncertainties do not seem to favour a sustained rupiah recovery yet. Market sentiment has weakened, while equity volatility has spiked, as global trade war escalates. US tariffs will likely be larger, sooner, and more pervasive this time around. While the rupiah has gotten some near-term reprieve due to lower US yields and a weaker US dollar, this may prove to be short-lived.

-

We believe the intent of the revised regulation is not to hurt the commodity sector, given the sector’s importance to the Indonesian economy. The government now requires commodity exporters in the mining (excluding those from the oil and gas sector), plantations, forestry, and fisheries sectors, to retain all their foreign export proceeds (DHE SDA) in Indonesia for at least one year, starting on 1 March. Prior to this, natural resource exporters only need to keep 30% of their foreign proceeds onshore for 3 months. Oil and gas exporters will continue to adhere to the previous regulation, i.e. only required to retain 30% of foreign proceeds onshore for 3 months.

-

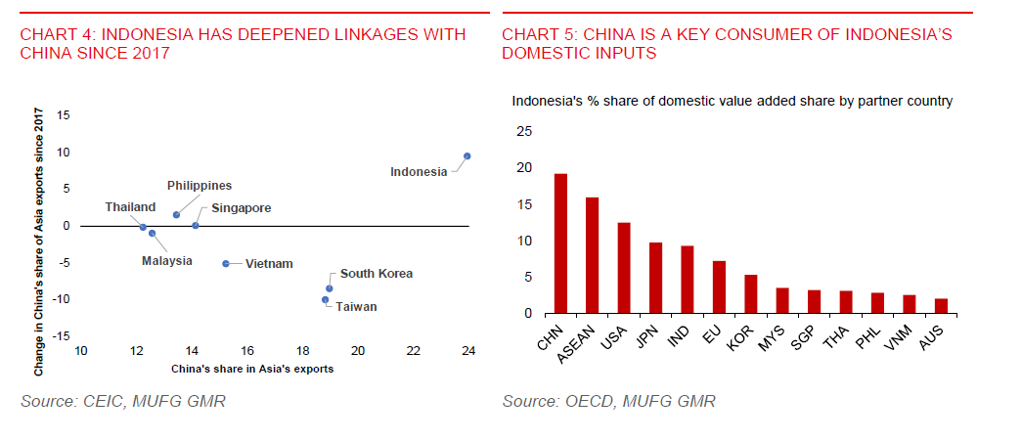

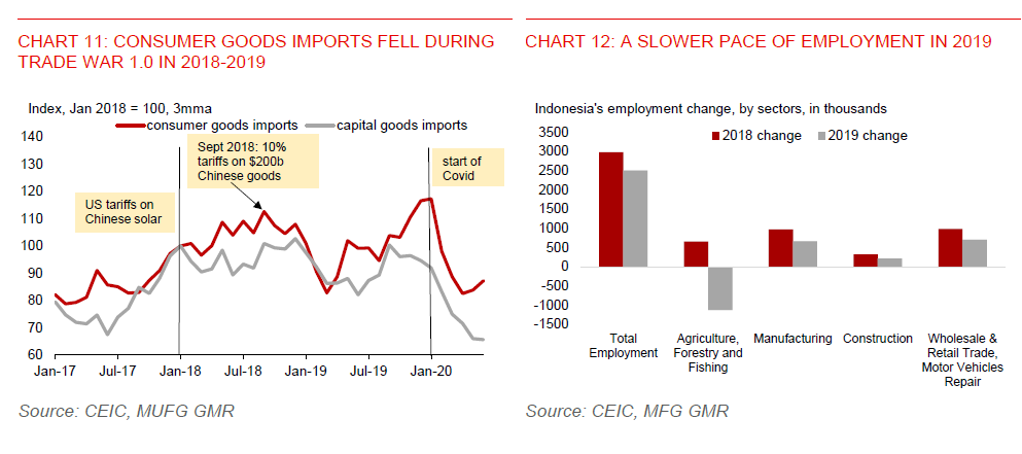

Higher US tariffs on China could lead to negative spillover impact on Indonesian consumers. The potential negative tariff impact could manifest itself in lower Chinese demand for Indonesia’s commodity products. This could in turn put pressure on commodity prices and slow employment in the mining and basic metals sectors. The negative impact might be larger this time around, given Indonesia’s rising export exposure to the Chinese markets in recent years. Notably, the mining sector contributes about one-third of Indonesia’s domestic value added in exports to China, while the basic metals sector contributes about 10%. During the 2018-2019 trade war, Indonesia’s terms of trade fell by about 3%, dampening real incomes.