Key Points

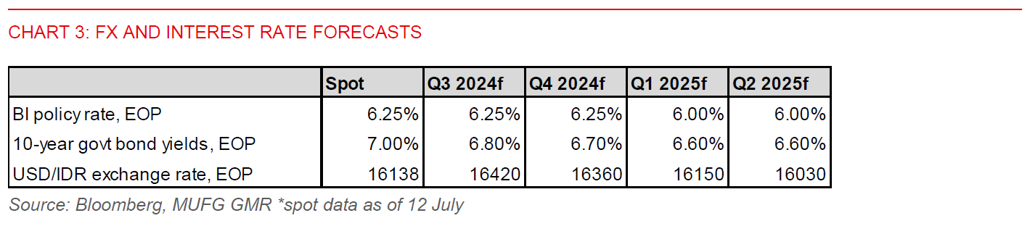

- The Indonesian rupiah has taken a breather after dropping to a 4y low in June. However, it still faces several crosswinds from a patient Fed, ongoing tensions in the Middle East, and its own political leadership transition and accompanying fiscal uncertainty under a new government come October. Our near-term bias for IDR is still skewed to the downside. We forecast USD/IDR to weaken to 16,420 in 3 months before somewhat easing to 16,150 by early 2025.

- Indonesia’s economy has so far been resilient, despite tight monetary policy. Bank credit growth has accelerated, driven by the government’s macroprudential policy and demand from households and corporates. CPI inflation has also been manageable at 2.5%yoy in June, with food inflation easing. However, this has only helped the rupiah at the margin. Given twin deficits in both the current account and fiscal account, we think the rupiah will remain vulnerable to external risks. Markets will remain vigilant of geopolitical shocks impacting the rupiah in the months ahead.

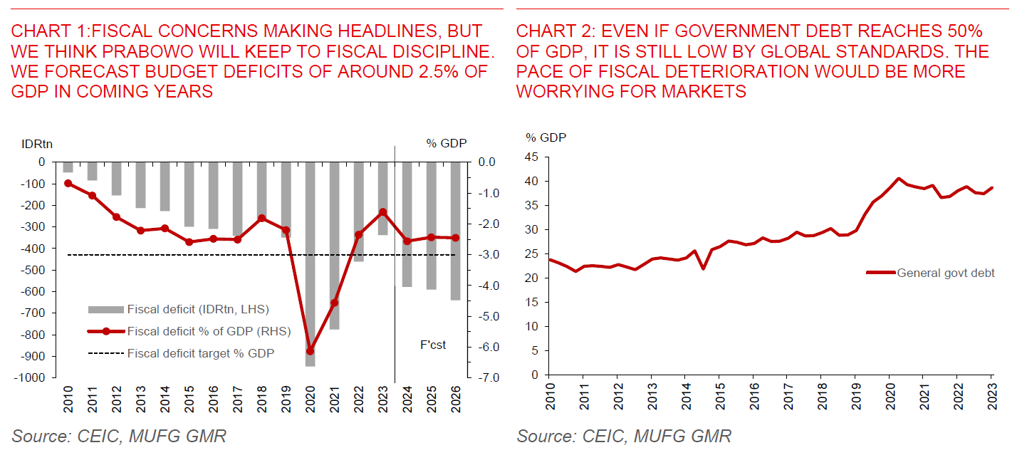

- The rupiah also faces ongoing domestic political headwinds. Markets are uncertain about the cabinet makeup under the incoming government and the fiscal outlook. News headlines suggest Prabowo plans to push up government debt to GDP to 50% over next 5 years. To achieve this, we estimate Indonesia’s fiscal deficit would have to widen to about 5% of GDP, from an average deficit of 2.3% of GDP during the pre-pandemic years of 2015-2019, assuming nominal GDP grows at an average pace of 7.5%-8% over the next five years. It’s the pace of fiscal deterioration that’s worrying markets.

- Fiscal uncertainty will linger on, but our baseline is for Prabowo to keep to fiscal discipline, as it is unlikely for his government to jeopardise the country’s sovereign credit rating, which currently stands at BBB (with a stable outlook) by S&P and Baa2 (with a stable outlook) by Moody’s.

- We expect Bank Indonesia will maintain the policy rate at 6.25% this year to steady the rupiah, while intervening in the FX market where necessary at times of increased volatility. BI rate cut will likely only happen early next year. And the rupiah is likely to get reprieve once US Fed cut rates.

RUPIAH TOOK A BREATHER, BUT HEADWINDS REMAIN

- The Indonesian rupiah has rebounded from a 4-year low of around 16,480 per US dollar. This has mainly been driven by the US dollar falling following recent softness in US economic data. Indeed, US CPI inflation cooled further to 3%yoy in June from 3.3%yoy in May. And on a month-on-month basis, US CPI fell 0.1% after recording zero growth in May. The US ISM services index also unexpectedly fell into contractionary territory in June, while the US unemployment rate rose by 0.1ppt to 4.1%. Meanwhile, nonfarm payrolls slowed to 206k in June, from a downward revised 218k in May (272k before the revision). The average hourly earnings growth in the US also eased to 0.3%mom (+3.9%yoy) in June from 0.4%mom (+4.1%yoy) a month ago. Markets have raised their expectations for a first Fed rate cut to happen in September. Also, markets are now pricing 2.5 rate cuts (-60bps) in the US this year from 2 cuts (-50bps) before the June US CPI data release.

- However, there are still headwinds for the rupiah in the months ahead. We maintain our forecast for USDIDR will rise to 16,420 by end-Q3 before somewhat moderating to 16,360 by end-Q4 in anticipation of the Fed turning dovish. The rupiah still faces crosswind from a patient Fed, US election risk, Middle east tensions, and Indonesia’s political leadership transition.

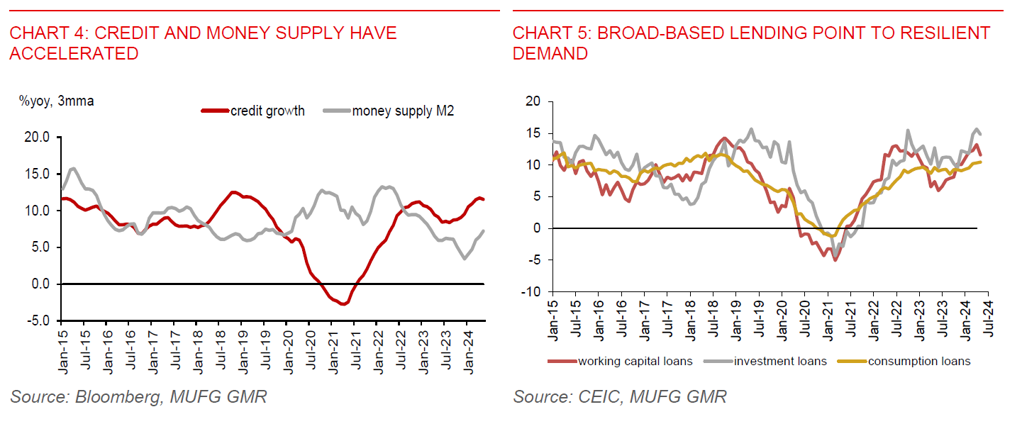

- Indonesia’s economy has so far stayed resilient, withstanding tight monetary conditions, but this has likely only provided support for the rupiah at the margin. Bank credit growth accelerated to 11.5%yoy on a 3mma basis in May, underpinned by the central bank’s macroprudential liquidity incentive policy (Chart 4). The policy consists of IDR268tn worth of incentive, has been in place since October 2023, and is aimed at encouraging local banks to expand loan disbursement to cushion the economy against the impact of tighter domestic monetary conditions.

- Credit demand from corporates and households have also held up, with increases seen across working capital loans, investment loans, and household borrowing (Chart 5). Consumer confidence has been relatively stable, staying above the 5-year pre-pandemic average level, underpinned by a recovery in labour market conditions and improving inflation-adjusted wage growth. However, the covid reopening boost to business sentiment has faded, as it normalises back to pre-pandemic levels.

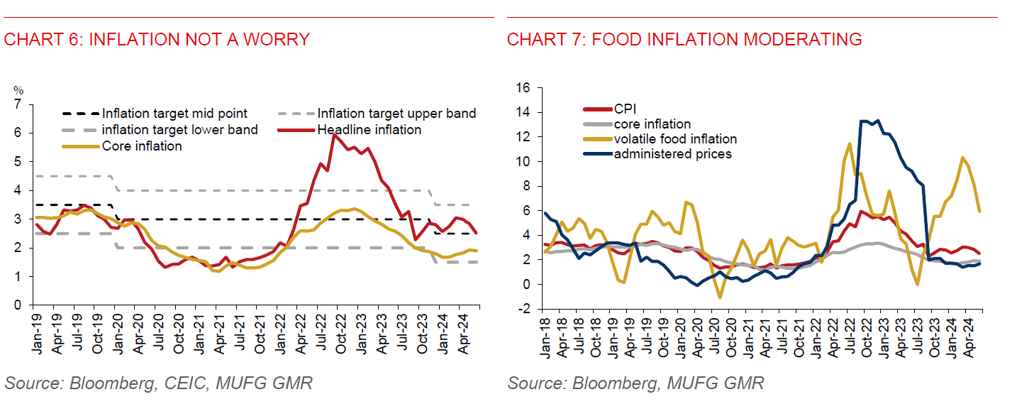

- Indonesia’s CPI inflation has continued to make progress. Headline inflation slowed further to 2.5%yoy in June, marking the slowest pace of increase since March 2022 and remaining within Bank Indonesia’s 1.5%-3.5% target range (new range starting this year) (Chart 6). Core inflation (ex-volatile food and energy) was relatively stable at 1.9%yoy, food price inflation eased to 6.0%yoy from a peak of 10.3% in March, while administered price inflation were subdued at 1.7%yoy (Chart 7). Looking ahead, we expect core inflation will increase but remain contained, administered prices continuing to keep a lid on price pressures, while falling global food prices and higher food supply following the harvesting season should help moderate domestic food prices. We look for Indonesia’s inflation to average around 3% in 2024. The upside risks to inflation stem from geopolitical tensions in the Middle East, which could help lift commodity prices and further increase shipping costs.

RUPIAH STILL VULNERABLE TO GLOBAL PRESSURES

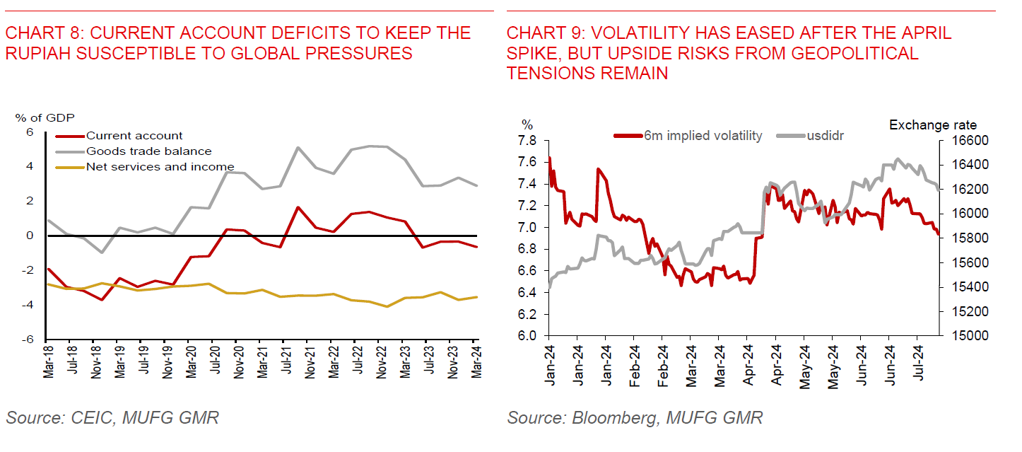

- Despite Indonesia’s macroeconomic resilience and manageable inflation, the rupiah will stay vulnerable to external pressures, given its twin deficits. The current account balance was in deficit of 0.6% of GDP in Q1 2024, widening from 0.3% of GDP in Q4 2023. We estimate the current account balance will remain in deficit of around 0.5% of GDP in Q2, notwithstanding the modest improvement in export growth (Chart 8). Exports were up by 2.3%yoy in April-May, partly driven by favourable base effects, while imports were down by 0.9%yoy over the same period. Meanwhile, the implied volatility in USDIDR has moderated following the spike in April. But given election risks in the US and lingering geopolitical tensions in the Middle East, rupiah volatility could see a renewed pickup in the months ahead, with markets likely to remain vigilant of geopolitical shocks (Chart 9).

DOMESTIC POLITICAL RISKS, FISCAL UNCERTAINTY WILL DOMINATE MARKET SENTIMENT

- The rupiah will remain vulnerable to domestic political headwinds, with the political leadership transition to a new President coming up in about 3 months’ time. Prabowo will be inaugurated on 20 October. Discussions among a coalition of political parties are underway to determine the cabinet makeup. But it remains unclear who will likely succeed finance minister Sri Mulyani, who has been credited by foreign investors for her prudent management of public finance. She has kept Indonesia’s budget deficit within the limit of 3% of GDP, apart from the Covid years in 2020-2021 (Chart 1).

- In addition, fiscal uncertainty under Prabowo’s government has also weighed on the rupiah. A recent headline news stating that Prabowo will raise the government debt to GDP ratio to 50% of GDP, from roughly 39% in 2023, has rattled markets and led to an attendant sell-off in the rupiah (Chart 2). Bank Indonesia in its policy statement has also acknowledged that market perception of fiscal risks has been a factor for the rupiah decline in June. However, Prabowo has since clarified that he will stick to fiscal discipline, keeping the budget deficit below 3% of GDP. This has somewhat eased market concerns, with the rupiah rebounding from its recent low of 16,480 per US dollar.

- Increased fiscal concerns by investors have arisen during the election campaign earlier this year, when Prabowo has pledged to expand fiscal spending to fund his populist programmes, including to provide free school lunches (which his team has recently estimated to cost IDR71tn in 2025 or about 0.3% of GDP) and to raise civil servant wages. Assuming nominal GDP grows at an average pace of 7.5%-8% over the next five years, we estimate Indonesia’s fiscal deficit would have to widen to about 5% of GDP to push up the government debt to GDP ratio to 50% by end-2029., from an average deficit of 2.3% of GDP during the pre-pandemic years of 2015-2019. This would imply Prabowo’s government scrapping the 3% fiscal deficit cap that’s currently in place. It’s the pace of deterioration in the fiscal balance that’s more worrying for markets, not the actual level of government debt to GDP ratio. Indeed, even if the government debt to GDP ratio reaches 50%, this is still low by international standards. Our bias for the rupiah is skewed to the downside.

- Government debt maturity amount will be much higher over the next 3 years, though most debt are denominated in rupiah (Charts 10 and 11). This will help ease some concerns about the impact of rupiah weakness on the government’s debt repayment ability and the country’s external resilience.

- The 2025 budget is currently set at 2.29%-2.82% of GDP. It is a wider deficit target range to give the incoming government some flexibility to implement its fiscal policy. But it is not all about ramping up spending, as Prabowo also plans to increase state revenues to fund the rise in spending. The target government debt to GDP ratio was at 37.82%-38.71% of GDP in 2025, which is an improvement from 39% in end-2023. However, given that fiscal revenues are largely determined by commodity prices, and with the latter falling, this will be a constraint to the extent of increase in fiscal revenues, and hence the extent of increase in fiscal spending.

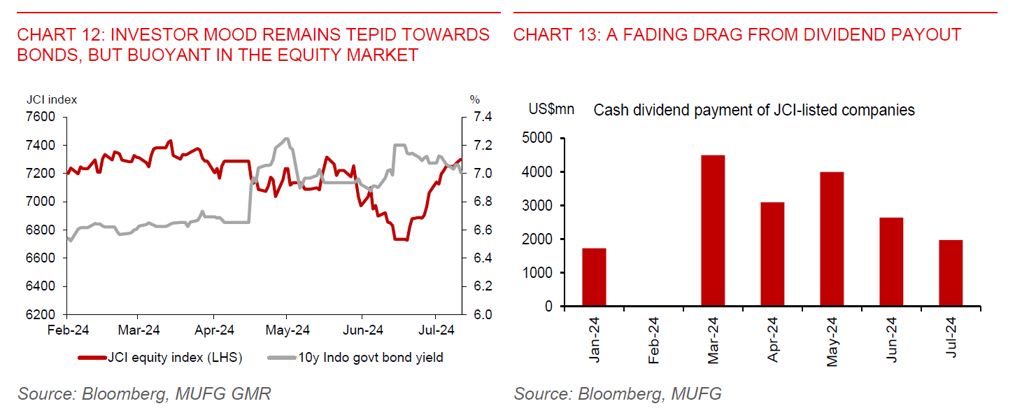

- Investor sentiment appears to be mixed, reflecting concerns about widening fiscal deficits, yet staying optimistic about growth prospects (Chart 12). While Indonesia’s 10y government bond yields have eased to 7% from a mid-June peak of 7.20%, it is still about 50bps higher than end-2023. This reflects tepid investor sentiment amid ongoing political transition risks and investor concerns of increased fiscal risks under a Prabowo government. But the Jakarta composite index has rebounded sharply towards its year-to-date high of around 7450 after falling to a low of 6726 on 19 June, likely reflecting investor optimism about Indonesia’s growth prospects and a fading drag from the huge dividend payout seen over the May-June period (Chart 13).

BI IS DOING WHAT IT COULD TO STEADY THE BOAT

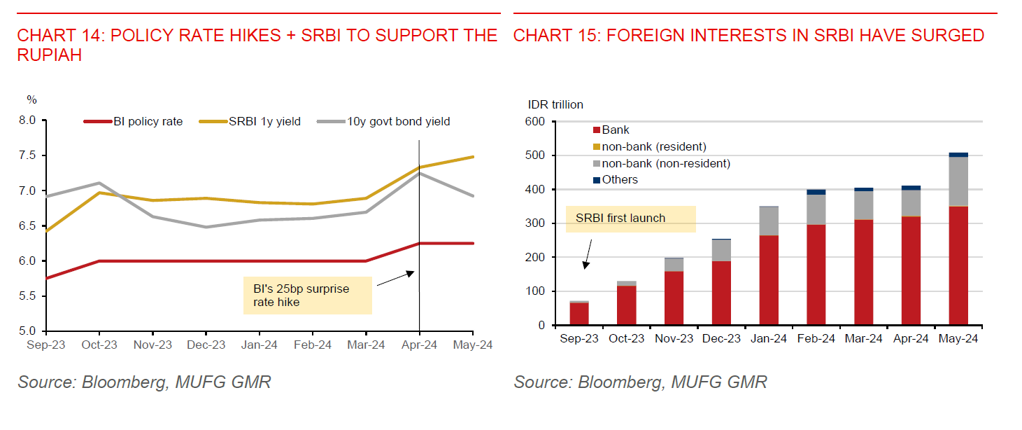

- Bank Indonesia (BI) has reacted swiftly to stem rupiah weakness using a range of instruments, which should support the rupiah at the margin. BI has raised the policy rate by 25bps in October 2023 and April 2024 in response to sharp down moves in the rupiah, intervened directly in the FX market, while issuing rupiah securities (SRBI) at attractive yields of more than 7% to stem outflows and attract foreign inflows (Chart 14). Notably, foreign participation in SRBI has increased markedly since inception in September 2023 (Chart 15). The share of foreign holding has surged to 28.1% in May, up from 18.3% in April.

- With growth staying resilient, coupled with manageable inflation, this leaves BI with exchange rate as a key consideration for future rate path. We expect BI will keep its policy rate unchanged at 6.25% this year, with rupiah stability a clear priority, with rate cuts likely only happening in early 2025.

- Despite FX intervention by BI, foreign reserves unexpectedly rose to a 3-month high of $140.2bn in June, covering about 6.3 months of imports. This has been underpinned by tax and services receipts, government foreign loan withdrawals, and improving exports.