Key Points

Please click on download PDF above for full report

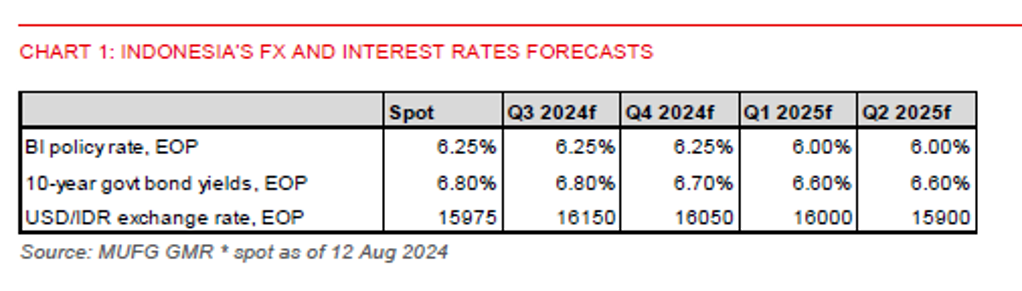

- We have lowered our USDIDR forecast to 16150 in Q3 (from 16420 previously) and 16050 in Q4 (from 16360 previously) to reflect recent easing depreciatory pressure. The rupiah has gotten near-term reprieve, partly resulting from market expectations for a faster pace of US rate cuts this year following weaker than expected US nonfarm payroll data. The rupiah has strengthened past the key psychological level of 16000 to settle at around the 15900-level against the US dollar. But we stay cautious about the rupiah outlook given a highly volatile market environment, where market expectations about US rate cuts could still shift, depending on forthcoming inflation data. Key downside risks could stem from potential escalation of Middle East tensions, which would pose an upside risk to oil prices, and impact of US election uncertainty on markets.

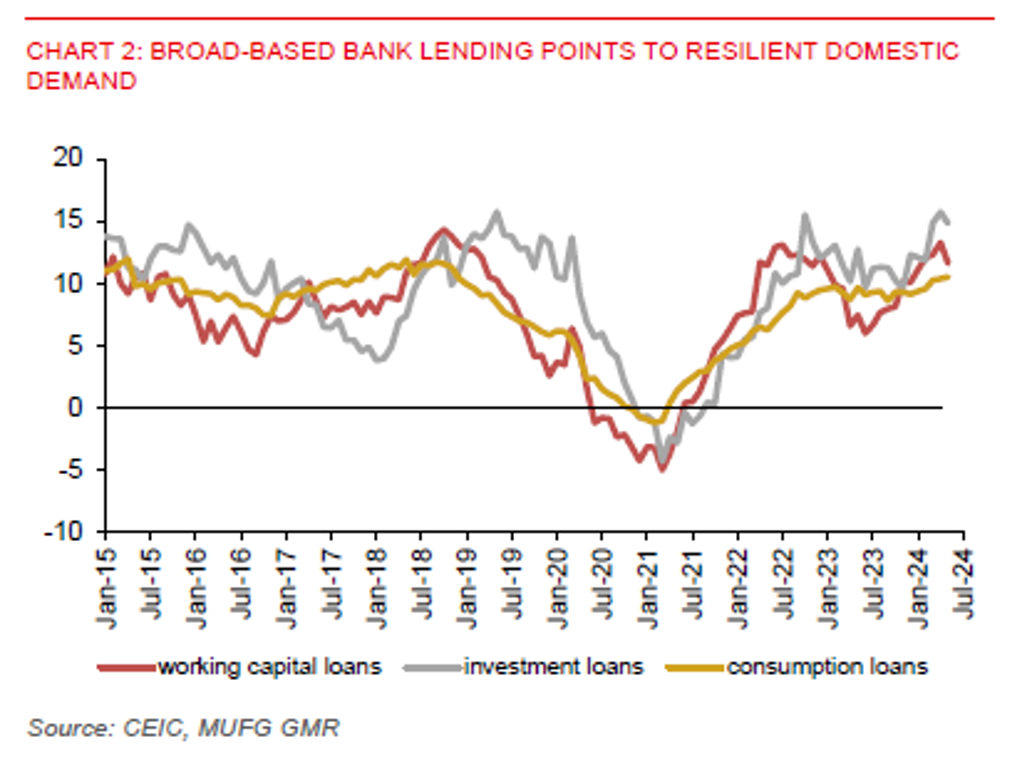

- Meanwhile, Indonesia’s economic resilience continues, with GDP growing 5.05%yoy in Q2, only slightly slower than the 5.11%yoy pace in Q1. Growth has been dragged down by an end to election spending in Q1, offset by firms resuming their investment plans after election uncertainty has passed. Net exports also made modest positive contribution to growth. A solid pace of credit growth in Q2 and still high consumer confidence point to domestic demand resilience largely continuing in H2.

- With Indonesia’s current account in deficits amid weak commodity prices, rupiah depreciation will likely persist from a medium to longer term perspective. However, Bank Indonesia’s commitment to stabilise the rupiah through market intervention should help to prevent any sharp and excessive depreciation of the currency, barring an unexpected shock to markets. We expect Bank Indonesia will keep its policy rate at 6.25% this year to anchor the rupiah, with the central bank remaining cautious about rising global risks. Market concerns about rapid fiscal deterioration under incoming President Prabowo has also eased, after he has given assurance to markets that the new government will keep the fiscal deficit within the constitutional limits of 3% of GDP.

Solid credit growth reflects resilient domestic demand