Key Points

Please click on download PDF above for full report

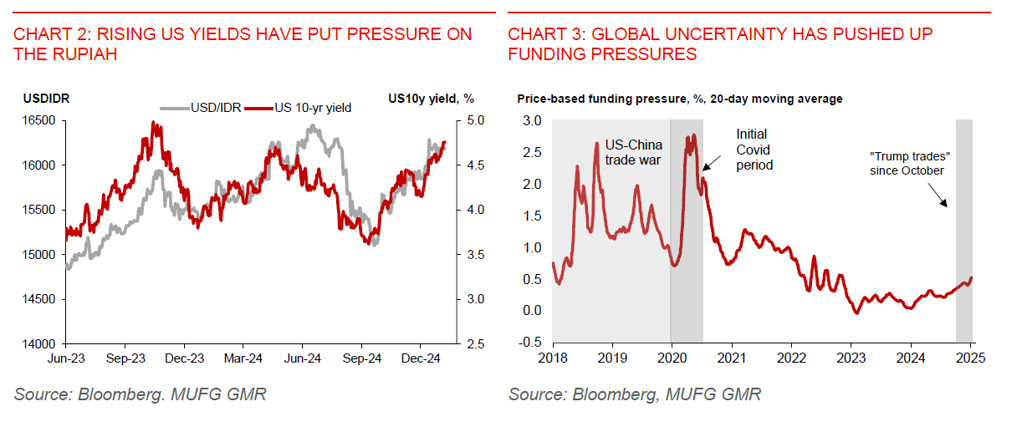

- “Trump trades” have hurt the outlook of Indonesia’s financial markets, with the country’s benchmark equity index falling more than 5% since Trump’s election victory, Indonesia’s sovereign bond yields rising above 7%, and USDIDR rising above the 16,000 level again. FX funding pressures have also increased amid rising global uncertainties.

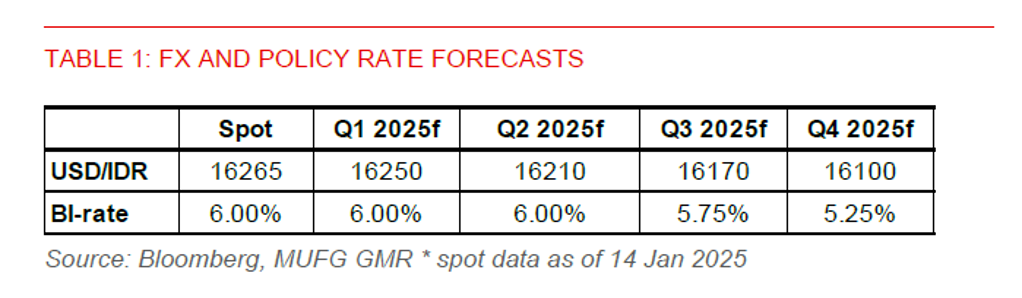

- Markets have priced in some US tariff risks. We still expect the rupiah to remain on the backfoot for now with no catalyst for sustained gains, given elevated US yields, a strong US dollar, and global trade uncertainty. In addition to unfavourable global developments, we also see several key themes in 2025 that could undercut the rupiah’s appeal, including slower domestic growth and fiscal challenges. We maintain our outlook for USDIDR to end Q1 2025 at 16,250 before getting modest reprieve in subsequent quarters on potential lower fed funds rate.

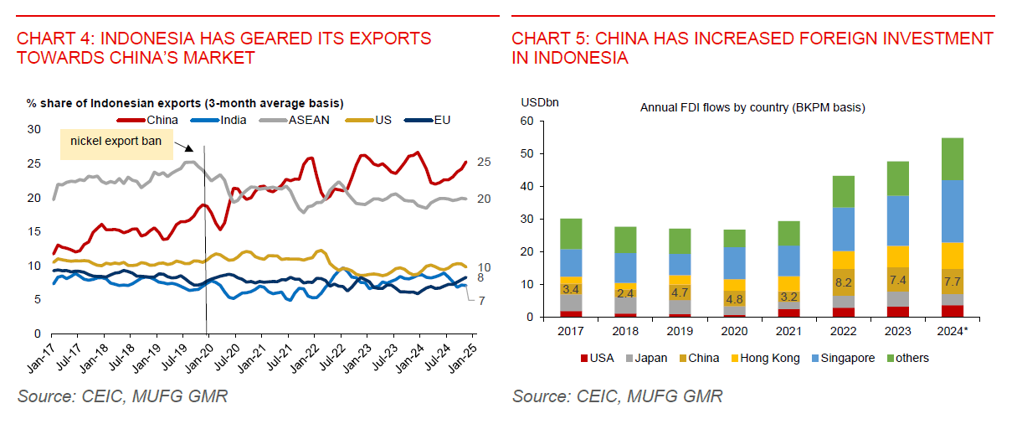

- Theme 1: Trump’s tariff to slow growth to 4.9%. With Indonesia’s exports becoming more orientated to China’s market, it is vulnerable to negative spillovers from US tariff hikes on China. We forecast Indonesia’s growth will slow to 4.9%, mainly via lower exports and fixed investment. In particular, the commodity sector will be negatively impacted, given its close links to China’s demand and commodity prices.

- Theme 2: Greater fiscal challenge in 2025, but Prabowo could stay prudent. Fiscal deficit will likely widen to 2.5% of GDP in 2025, from 2.3% in 2024. President Prabowo has kept the value added tax broadly unchanged at 11%, causing IDR72 trillion of lost fiscal revenues. There’s not much fiscal headroom for capital expenditure, interest payment is taking up more of the budget amid elevated US rates, while government debt maturity amount will be higher over next 3 years. But we still expect the government to keep the budget deficit below the 3% of GDP cap, with Finance Minister Sri Mulyani providing a steady hand in fiscal management. It’s also unlikely for the government to jeopardize the country’s sovereign rating.

- Theme 3: BI Governor Perry Warjiyo will show resolve in defending IDR. The central bank has signalled that it is in the market to slow the pace of rupiah depreciation. With BI prioritizing rupiah stability, we expect policy rate to stay at 6.00% in H1 2025, while rupiah securities (SRBI) will still be issued at attractive yields to support foreign inflows and FX reserves. The government has notably joined in the act, requiring commodity exporters to keep part of their foreign earnings onshore for at least 1 year, up from 3 months currently.