Week in review

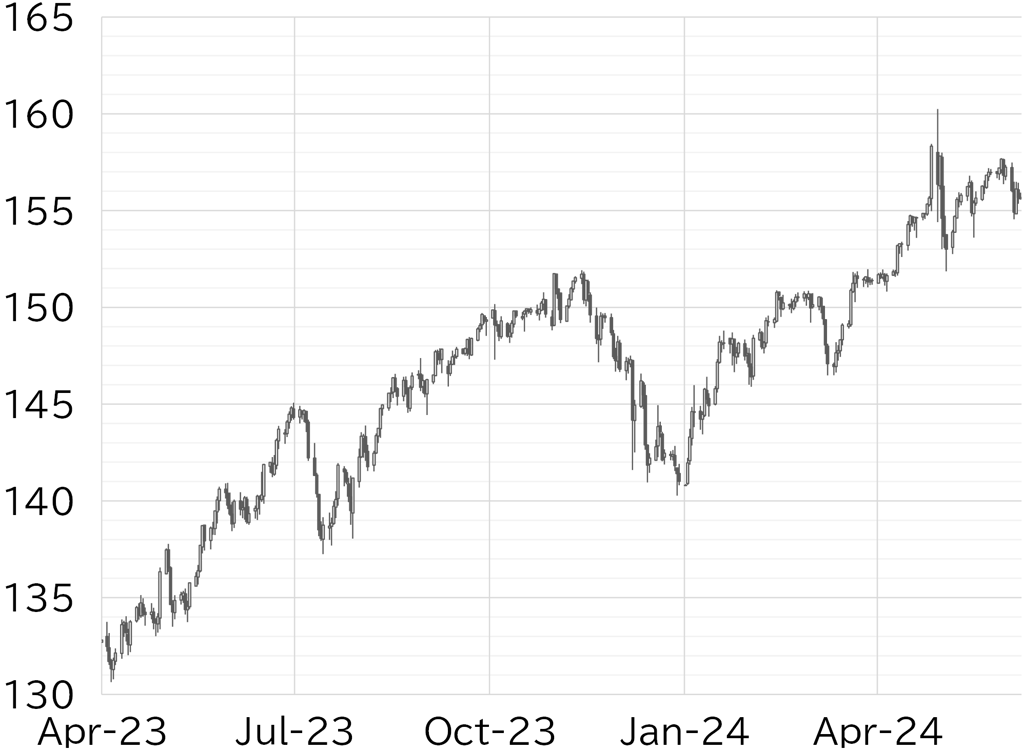

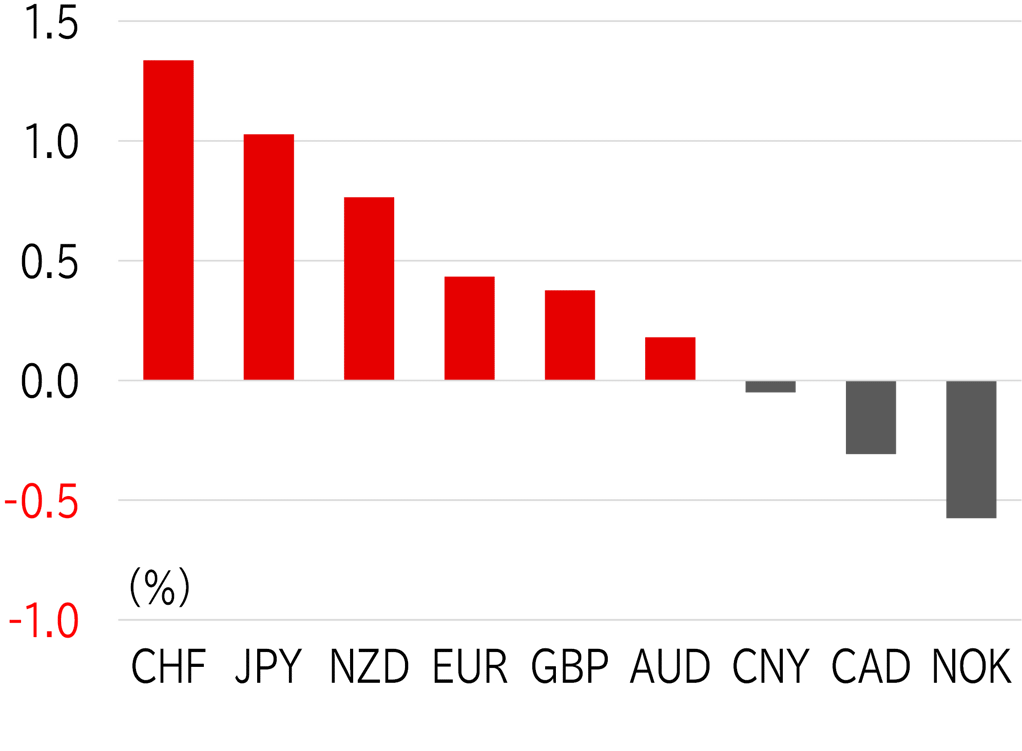

The USD/JPY opened the week at 157.20, then moved lower in European trading hours on Monday 3 June due to a decline in UST yields. The pair fell to the 155 level as dollar selling accelerated after the ISM manufacturing index, announced on the same day in US hours, missed the market's forecast overall. The pair rebounded slightly in the morning of 4 June during the Tokyo session, but yen cross rates led a decline thereafter in the absence of any catalysts and the USD/JPY fell below 155.50, then dipped below 155 after US job openings fell well short of expectations. However, yen selling became dominant during a period of slow trading on the morning of 5 June, and the USD/JPY clawed back the previous day's losses. The USD/JPY recovered to above 156 in European trading hours. The pair rose to around 156.50 after the US ISM non-manufacturing index beat market expectations. On 6 June, the USD/JPY fell back to around 155.50 in the Tokyo session, then recovered to the low 156 level during overseas trading hours. It fell below 156 by the end of the US session, but the downtrend did not gain traction and at the time of writing this report on 7 June the USD/JPY was trading above 155.50 (Figure 1). There were some moves to risk off this week despite the weak dollar environment, as the Mexican Peso and Indian rupee weakened due to elections in those countries during the first half of the week and oil prices declined. It appears that the Swiss franc and the yen were bought on such expectations (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00 JST on 7 June

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00 JST on 7 June

Source: Bloomberg, MUFG