Week in review

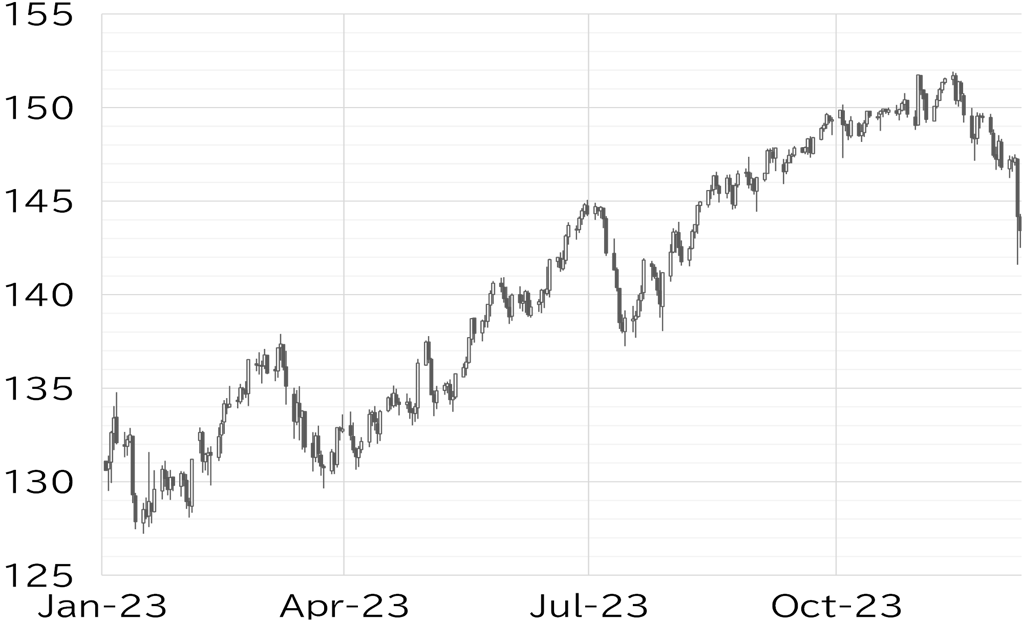

The USD/JPY opened the week at 146.37. It fell to 146.24 due to dollar selling from the morning of 4 December during the Tokyo session, continuing the trend from last Friday. It recovered to above 147 in the European session, rebounding around the time of the first market announcement, but became top-heavy at below 147.50. It remained directionless at around this level on 5 December. In US trading hours, UST yields declined further after the job openings and labor turnover survey for October missed market expectations, but the reaction in the USD/JPY was limited. On 6 December, BOJ Deputy Governor Ryozo Himino talked about the possibility of an exit from large-scale monetary easing. The USD/JPY temporarily fell to the 146 level from the end of the Tokyo session when European investors entered the market, partly because some of his remarks were viewed positively, but ultimately continued to trade around the low 147 level. Then, amid a softening of the USD/JPY in the Tokyo session on the morning of 7 December, BOJ Governor Kazuo Ueda commented that monetary policy would become even more “challenging” from year-end through 2024. Coming on the heels of Deputy Governor Himino's remarks the previous day, this worked to spark expectations that the BOJ would normalize policy at an early date, driving the USD/JPY lower. In the afternoon, the USD/JPY fell to below 145.50 when European investors entered the market, partly due to media reports of Governor Ueda's visit to Prime Minister Fumio Kishida's office to discuss his policy stance. It seemed the USD/JPY would settle at this level, but during US trading hours, an IMF spokesperson said that the BOJ should raise its policy rate, which further accelerated yen buying, and the USD/JPY plummeted to 141.60. It quickly rebounded to the 143 level, then recovered to above 144 early on the morning of 8 December. However, the USD/JPY remained top-heavy and had fallen to below 143.50 at the time of writing this report (Figure 1).

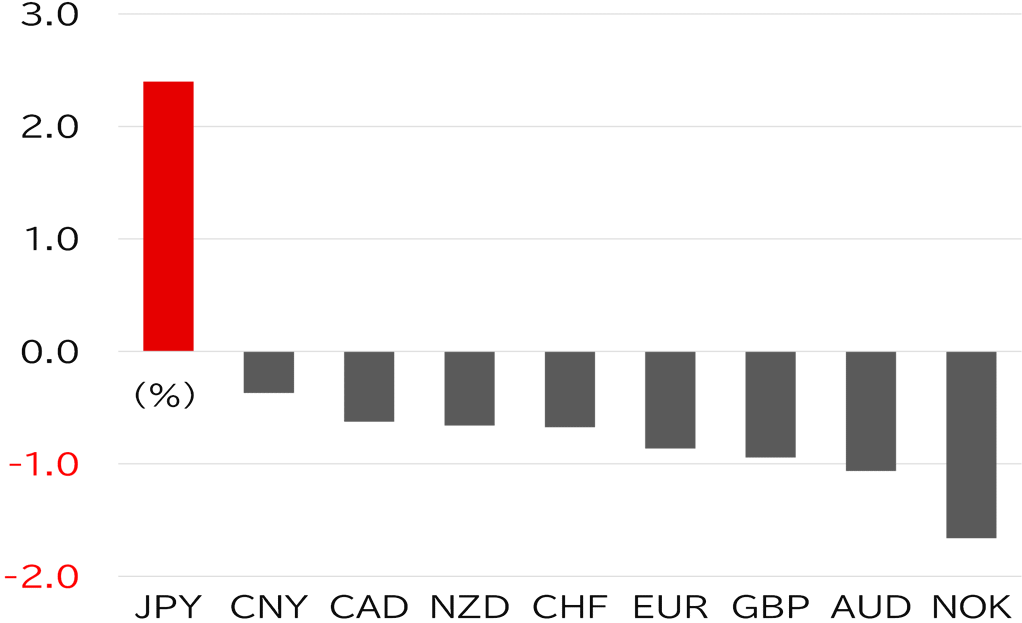

The yen was the only currency that strengthened this week, while all other major currencies softened against the dollar. Both the USD/JPY and cross yen rates declined overall. The euro was particularly weak due to heightened expectations of an early rate cut (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00am JST on 8 December

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00am JST on 8 December

Source: Bloomberg, MUFG