Week in review

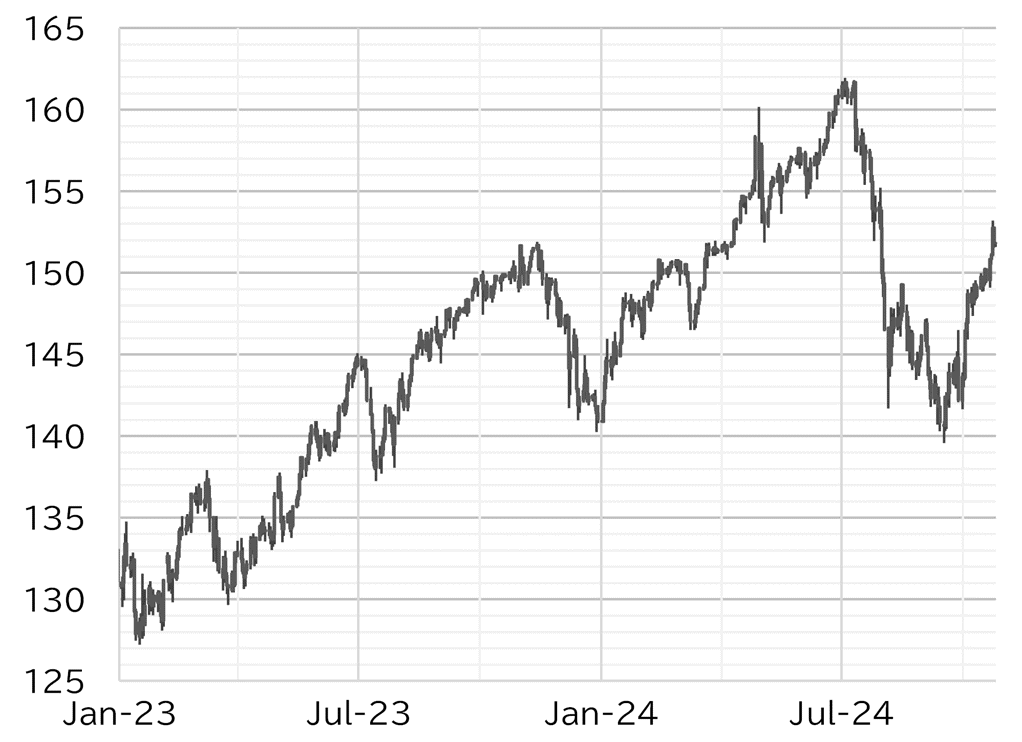

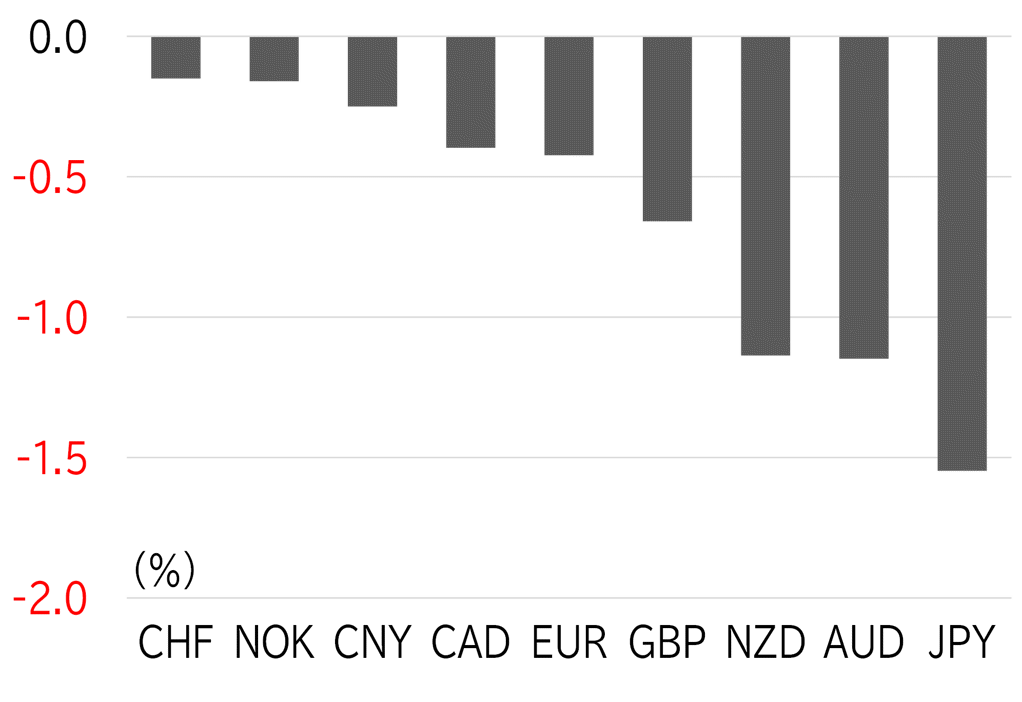

The USD/JPY opened the week at 152.21. The dollar softened on 4 November, which was a public holiday in Japan, due to moves to unwind the Trump trade following reports over the weekend that US presidential candidate Kamala Harris had taken the lead in Iowa. The USD/JPY temporarily fell below 152 but then moved little as the market waited on the results of the election on 5 November. The pair faced downward pressure again through the morning of 6 November in the Tokyo session and fell below 151.50, but the dollar strengthened as the prospect of a Trump victory came into view with voting closing in Eastern US states and the USD/JPY rose to 154 by around noon. The pair pulled back to below 153.50, but then climbed to a high for the week of 154.71 on the morning of 7 October in Tokyo trading hours, with the dollar strengthening across the board as some media outlets called the race for Trump after he won the key battleground state of Pennsylvania. However, the USD/JPY then became top-heavy as the rise in UST yields lost momentum. The dollar weakened across the board in US trading hours and the USD/JPY fell below 153. The FOMC moved to cut rates by 25bp as had been widely expected, and Fed Chair Jay Powell said the outcome of the election will have no effect on the Fed's outlook or monetary policy stance in the near term. The market's reaction was muted in the absence of an anticipated dovish tilt by the Fed, and the USD/JPY was trading around 152.50 at the time of writing this report on 8 November (Figure 1). In the end, the dollar, yen, and euro were soft among G10 currencies this week (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00 JST on 8 November

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00 JST on 8 November

Source: Bloomberg, MUFG