Week in review

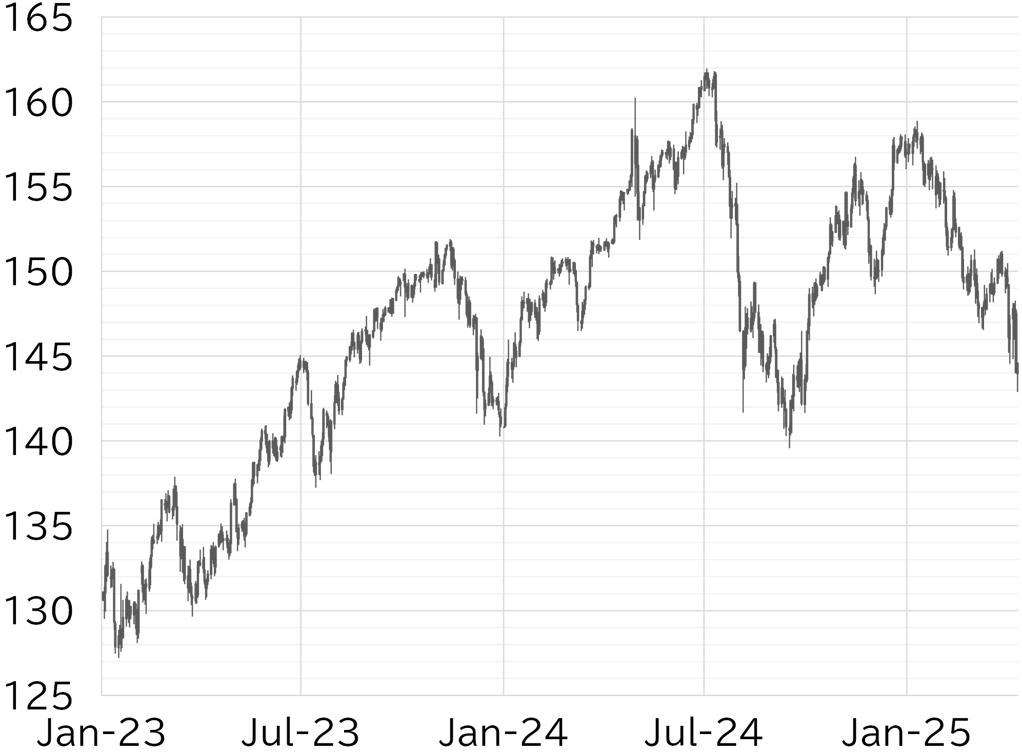

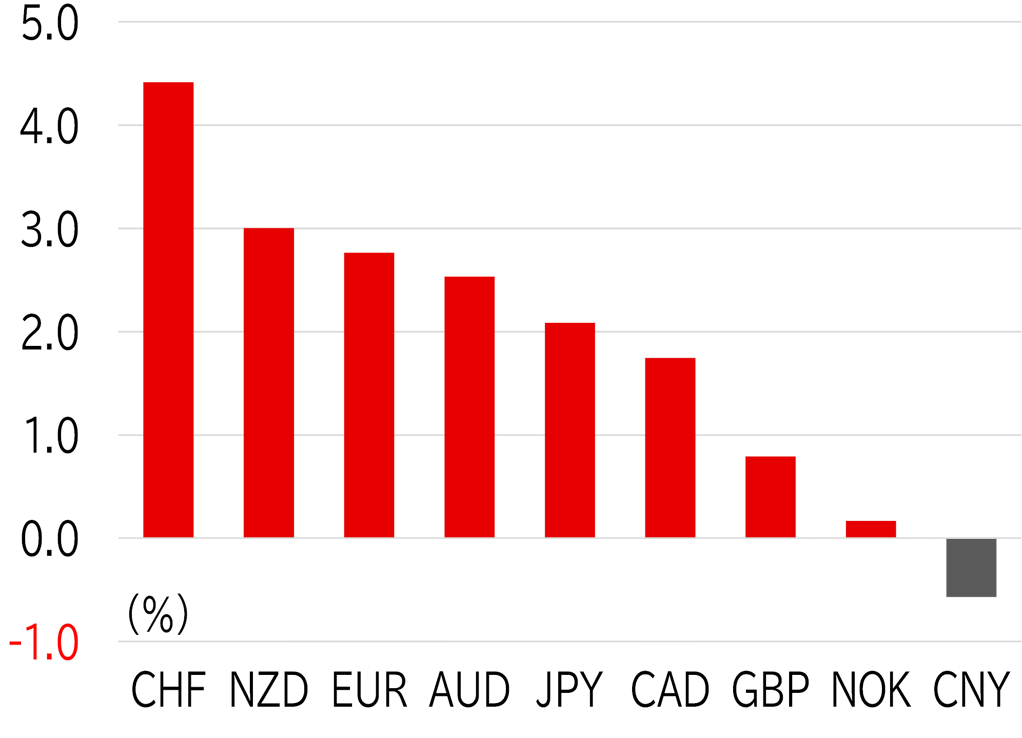

The USD/JPY came under downward pressure early Japan time on 7 April following weekend reports on tariff policy, falling into the 144 range. The pair then rebounded toward the 9:00am Tokyo open, and by late morning had climbed to just below 147 in volatile trading. The pair fell again after foreign investors entered the market, but later surged to around 148 following reports that the US government was considering suspending the "reciprocal tariffs." The pair struggled to break higher from there, and on 8 April began drifting lower. Risk sentiment worsened after reports that the US would raise tariffs on China, pushing the USD/JPY below 146. The downtrend continued on 9 April, and the pair extended losses below 145 as broader US selling pressure emerged after a sharp rise in UST yields. The announcement of retaliatory tariffs by China and comments by Treasury Secretary Scott Bessent that a strong yen is normal sent the pair below 144. The USD/JPY then rebounded sharply to below 148.50 after President Trump announced a 90-day suspension of the "reciprocal tariffs." Even so, the rally proved short-lived after the US announced that total tariffs on China would rise to 125%. On 10 April, the pair resumed its downtrend, gradually falling throughout the day despite a lack of new developments. The USD/JPY dropped to exactly 144 in US time after a media report said tariffs on China would rise to 145%. The dollar continued to weaken from early morning on 11 April and had briefly fallen to the upper 142 level by the time of writing (Figure 1). The dollar continued to weaken across-the-board against G10 currencies this week. The Swiss franc led gains as a safe-haven currency, while the yen lagged behind the euro, Australian dollar, and others (Figure 2).

FIGURE 1: USD/JPY

Note: Through 15:00 JST on 11 April

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 15:00 JST on 11 April

Source: Bloomberg, MUFG