Week in review

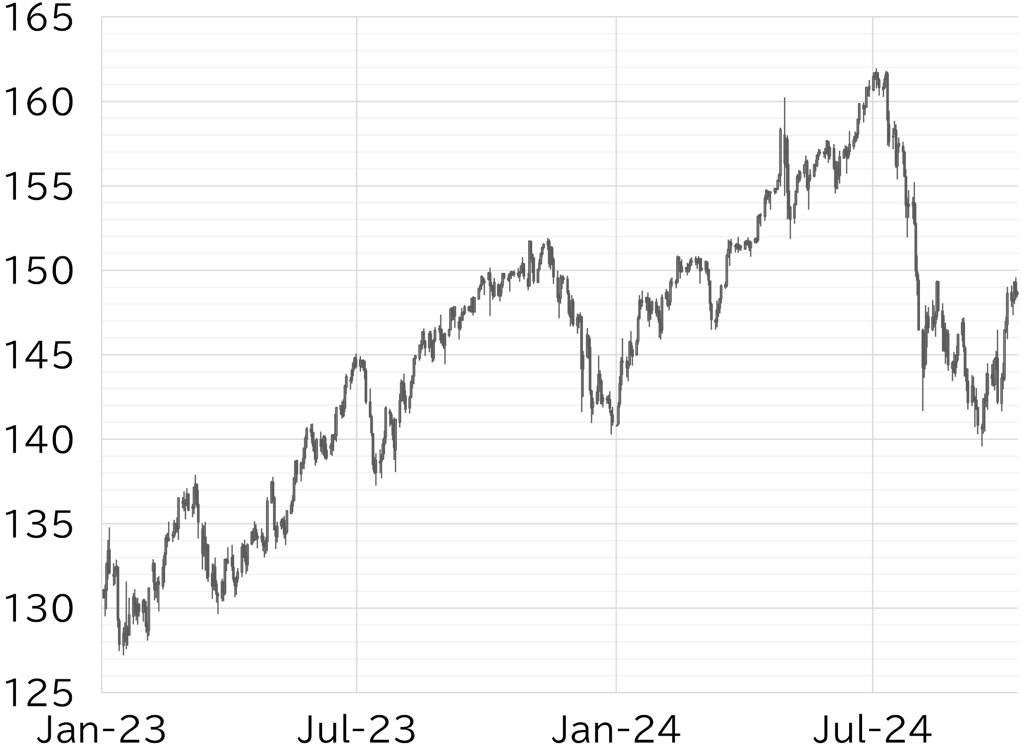

The USD/JPY opened the week at 148.78. The pair tested 149 early in the Tokyo session on 7 October due to dollar strength following the US payrolls report announced on 4 October, but gradually fell back in the wake of comments by Vice Finance Minister for International Affairs Atsushi Mimura. The USD/JPY declined to its low for the week of 147.35 on 8 October, then recovered amid dollar strength. The pair rose above 149 in US trading hours on 9 October amid FF futures factoring in rate hikes being postponed at the November FOMC, long-term UST yields becoming established above 4%, and dollar strength on awareness of growing tensions in the Middle East. The USD/JPY rose to around 149.50 for the first time since early August during the Tokyo session on 10 October. However, on that evening, BOJ Deputy Governor Ryozo Himino's comment that "The Bank will adjust the degree of monetary accommodation if it has greater confidence that the outlook for the economy and prices will be realized" worked to hold down upside. In US trading hours, the CPI for September beat the market's forecast, sending the USD/JPY to 149.58, but new jobless claims worsened more than expected and the pair fell back to 148.28 in choppy trading. The USD/JPY then moved around 148.50, in part due to a decline in UST yields (Figure 1).

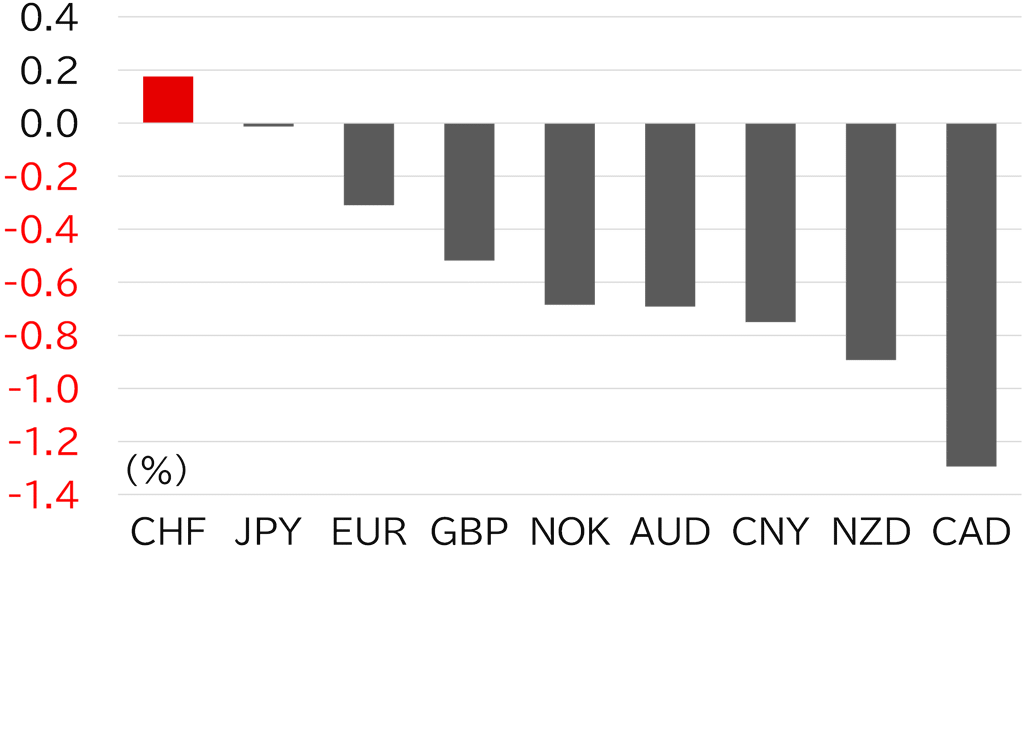

The USD/JPY did not relinquish the three-yen gain following last week's comments by Prime Minister Shigeru Ishiba, but the yen avoided weakening further. Growing tensions in the Middle East supported buying of the USD, Swiss franc, and the yen in moves to risk off (Figure 2). The USD/JPY has therefore yet to climb back to the 150 level.

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 11 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 11 October

Source: Bloomberg, MUFG