Week in review

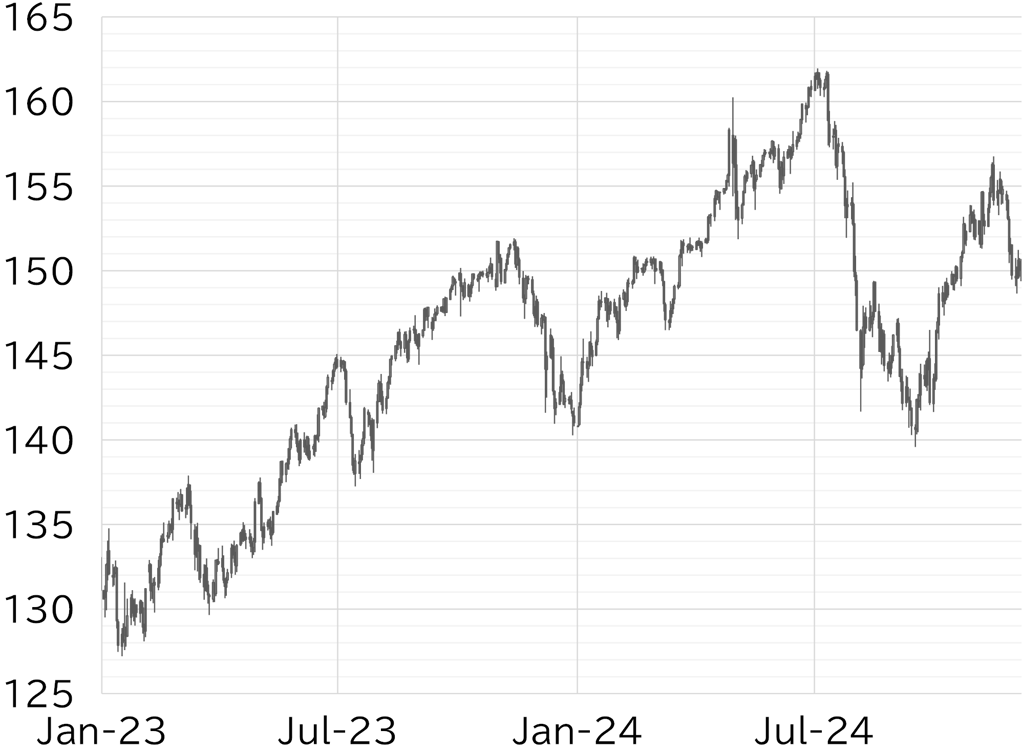

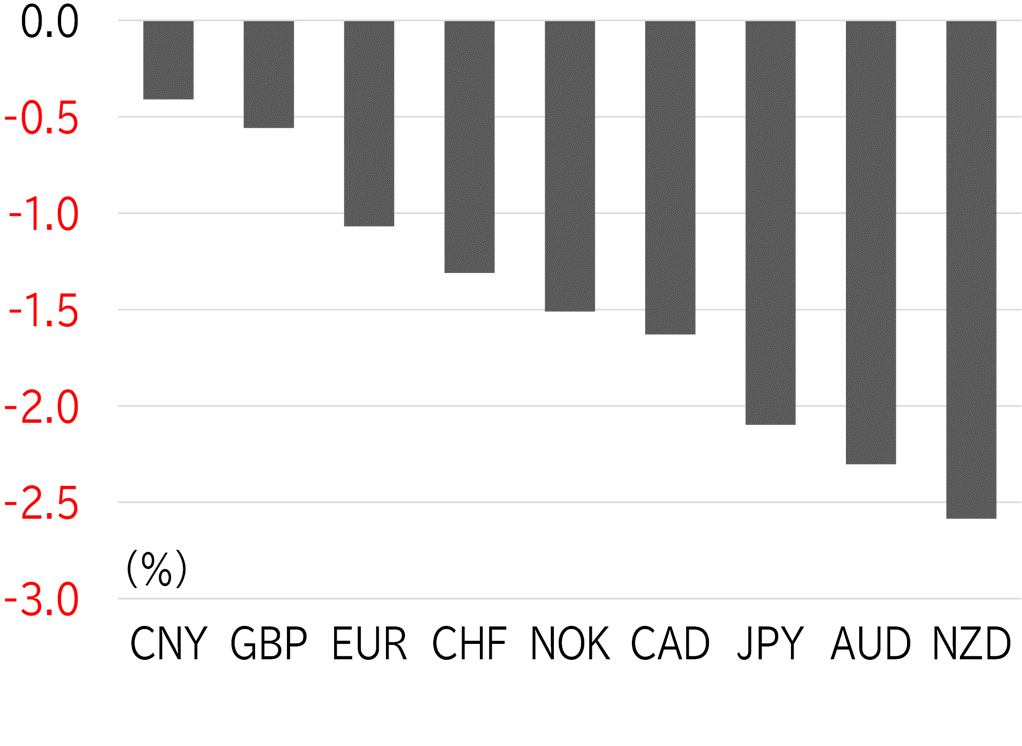

The USD/JPY opened the week at 149.89, rising to around 150 on Monday 9 December. Yen selling picked up after Prime Minister Shigeru Ishiba said Japan has not yet escaped deflation and China announced an aggressive fiscal and monetary policy stance, and the USD/JPY advanced to below 151.50 in US trading hours as the dollar strengthened along with a rise in UST yields. The pair rose to below 152.50 on 10 December as the dollar was bought in the absence of any notably news after European investors entered the market and as reports of a Japanese financial institution buying a US peer triggered yen selling. The USD/JPY fell back to below 151.50 on 11 December along with a fall in share prices and a decline in yen cross rates following news that Chinese authorities had approved a weaker yuan. However, yen selling gained momentum after Bloomberg reported that the BOJ could postpone a rate cut at its upcoming monetary policy meeting, and the USD/JPY swiftly rose to above 152.50. The pair fell back to around 152 as UST yields declined and upside was checked after the US CPI for November came in broadly in line with expectations. The USD/JPY subsequently tested 152 several times, but was bottom-firm and remained strong through to the close on 12 December along with a further rise in UST yields. The pair had recovered to above 153 at the time of writing this report on 13 December (Figure 1). The dollar was strong overall among G10 currencies this week. European currencies were reasonably strong, while the AUD, which is sometimes seen as a proxy for the CNY, was weak (Figure 2).

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 13 December

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 13 December

Source: Bloomberg, MUFG