Week in review

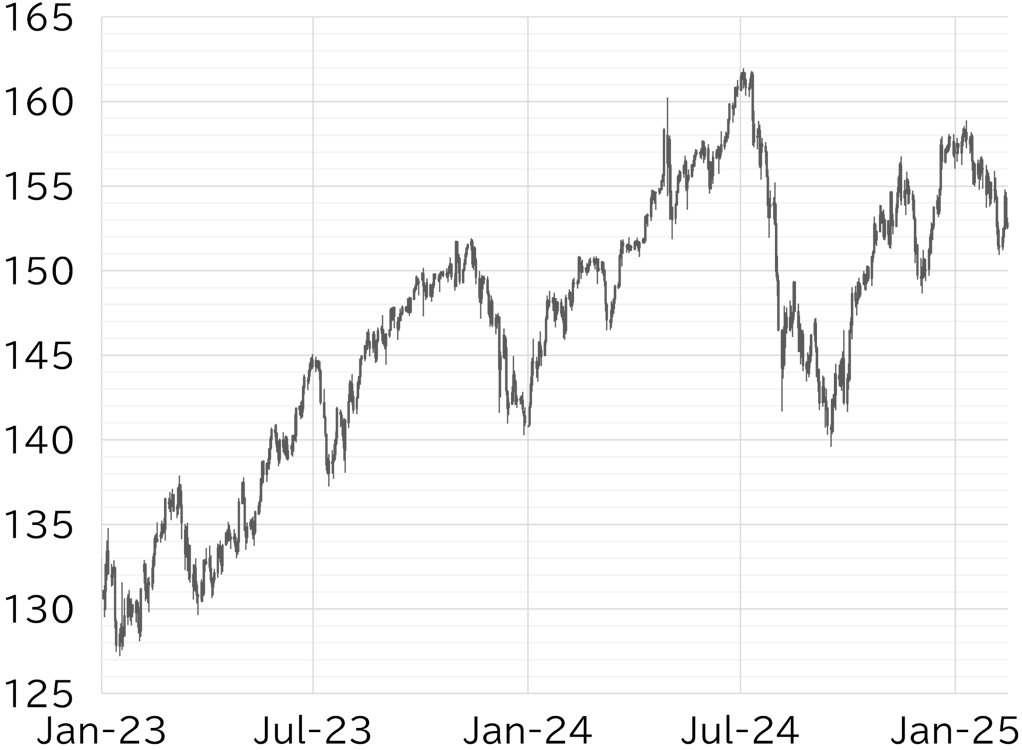

The USD/JPY strengthened in early Tokyo trading on 10 February following the conclusion of the Japan-US summit, recovering to above 152 just before noon. It then hovered around 152 during Asian trading on 11 February, a Japanese market holiday, and edged slightly higher to the low 152 level in European trading hours, but remained broadly flat. When Japanese markets reopened on 12 February, yen selling emerged early in the session, quickly pushing the USD/JPY into the 153 range. The pair briefly stalled around 153.50 before climbing above 154 after the US CPI for January came in above market expectations, broadly boosting the dollar. Reports that US President Donald Trump and Russian President Vladimir Putin had agreed in a phone call to begin peace talks over the Ukraine conflict further supported risk sentiment, which fueled additional yen selling and sent the USD/JPY to the high for the week of 154.80. However, the pair did not test 155 and gradually became top-heavy on 13 February. Selling pressure increased in overseas trading after reports indicated that the Trump administration would delay the implementation of reciprocal tariffs. This dampened US inflation expectations, leading to lower UST yields and pushing the USD/JPY back into the 152 range. The USD/JPY was trading below 152.50 as of the time of writing on 14 February (Figure 1). This week, both the yen and the dollar weakened among G10 currencies. The recovery for European currencies was comparatively strong due in part to expectations regarding the situation in Ukraine (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 14 February

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 14 February

Source: Bloomberg, MUFG