Week in review

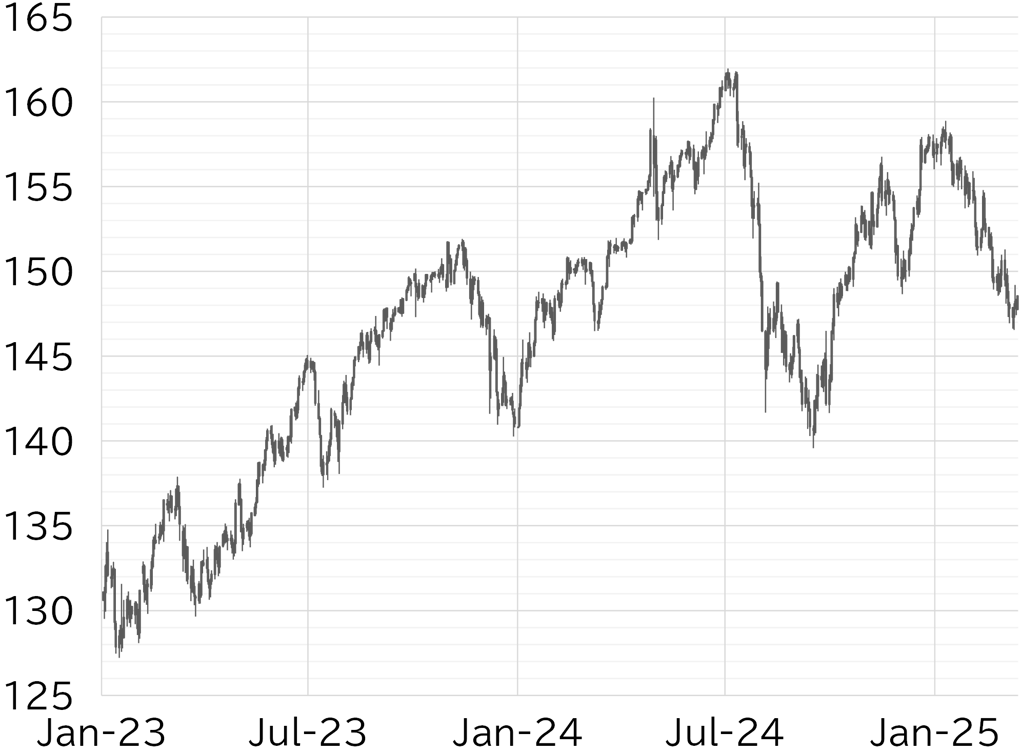

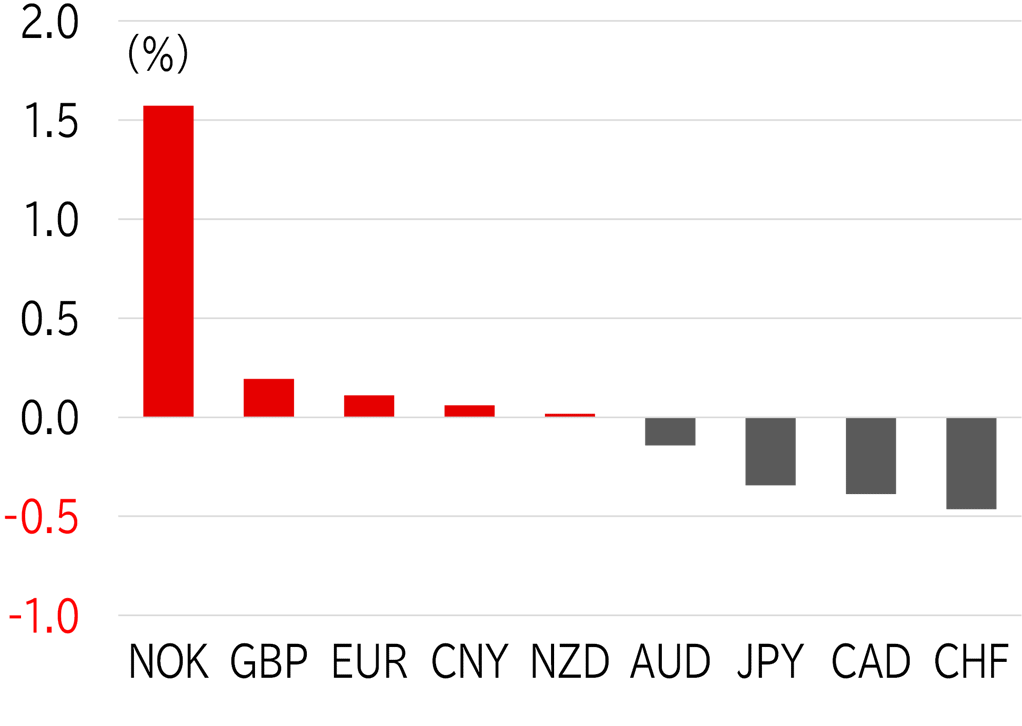

The USD/JPY opened the week at 147.57. The pair fell to the upper 146 level in US trading hours on 10 March as markets turned risk off with share prices falling in Japan, Europe, and the US. The decline continued in early Tokyo trading on 11 March, with the USD/JPY falling to a low for the week of 146.55 amid a sharp decline in the Nikkei 255. However, in European hours, expectations for German fiscal expansion lifted European share prices, driving a broad euro rally that also supported the USD/JPY through cross-yen demand. The pair climbed toward 148 in US trading but briefly fell back to the 147 range after reports that President Donald Trump had ordered additional tariffs on steel and aluminum imports from Canada. Expectations for a ceasefire in Ukraine helped stabilize risk sentiment, limiting further declines. The USD/JPY became top-heavy around 148 in the Tokyo session on 12 March, but gained support as continued gains in European share prices lifted US and European yields. The February US CPI missed market expectations, but this boosted Fed rate cut expectations, supporting US share prices and easing risk aversion, which helped the pair climb to 149.20. However, the USD/JPY became top-heavy and fell back to below 148.50 as the rise in UST yields was not sustained. The pair fell to the upper 147 level on 13 March after BOJ Governor Kazuo Ueda's Diet testimony was interpreted as supportive of further rate hikes. The February US PPI release showed strength in components that feed into the Fed's preferred PCE deflator, which prompted UST yields to rise and lifted the USD/JPY back to the lower 148 range. However, the pair fell to around 147.50 due to increased risk aversion following President Trump's comments on further tariff hikes against the EU. On 14 March, early Tokyo trading saw some short-covering, and the USD/JPY was trading below 148.50 at the time of writing (Figure 1). G10 currency markets saw a pause in recent dollar weakness this week, with strength in European currencies, including the sterling and the euro, while the yen remained in the middle of the pack (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 14 March

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 14 March

Source: Bloomberg, MUFG