Week in review

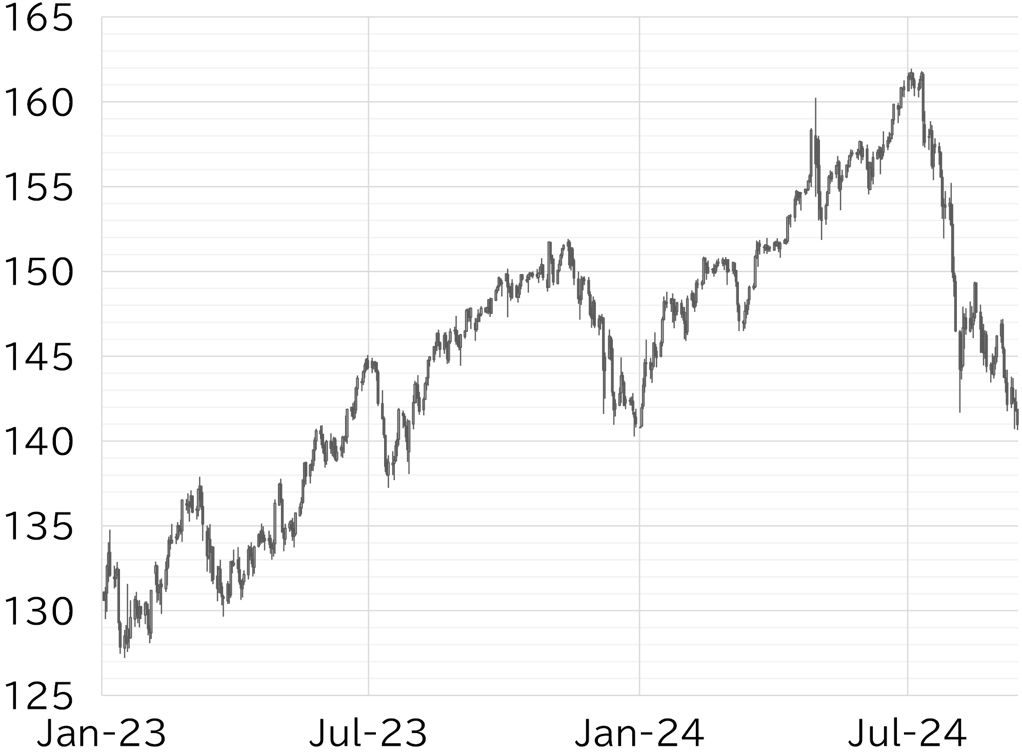

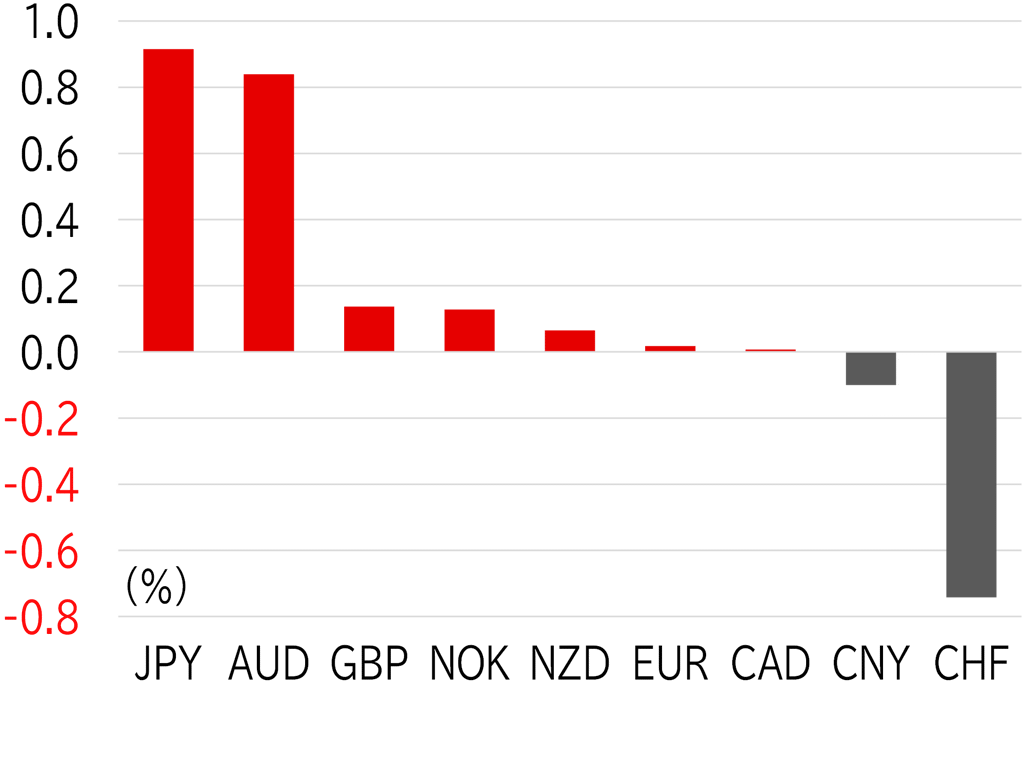

The USD/JPY opened the week at 142.48. It rose to a high for the week of 143.80 on 9 September, supported by higher UST yields and a rise in the Nikkei 225 in the afternoon session. The pair became top-heavy and fell back below 143 after the rise in UST yields stopped. A similar pattern played out on 10 September, with the USD/JPY rising past 143.50 through European trading hours before falling back in US time. The yen strengthened amid a fall in oil prices and the USD/JPY fell to around 142.50. On 11 September, the dollar weakened across the board in the morning during the Tokyo session after Vice President Kamala Harris beat Donald Trump in the televised US presidential debate. The USD/JPY fell to 140.71, below the 5 August low of 141.68. The US CPI released on the same day exceeded market expectations, and the USD/JPY bounced back to around 142.50. The USD/JPY rose to around 143 on 12 September. However, it was unable to advance past this level and faced increased downward pressure after the US PPI and new jobless claims announced in US trading hours came in weaker than the market had expected. In addition, the WSJ reported that the Fed could cut rates by 50bp at next week's FOMC meeting, resulting in the dollar weakening across the board, and the USD/JPY fell below 141 again through 13 September. The USD/JPY had fallen to a low for the week of 140.65 at the time of writing this report (Figure 1). The dollar was weak among G10 currencies this week, with the yen and Australian dollar the strongest performers (Figure 2). The RBA's caution about cutting rates may have made the Australian dollar relatively preferred since the Fed is poised to cut rates.

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 13 September

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 13 September

Source: Bloomberg, MUFG