Week in review

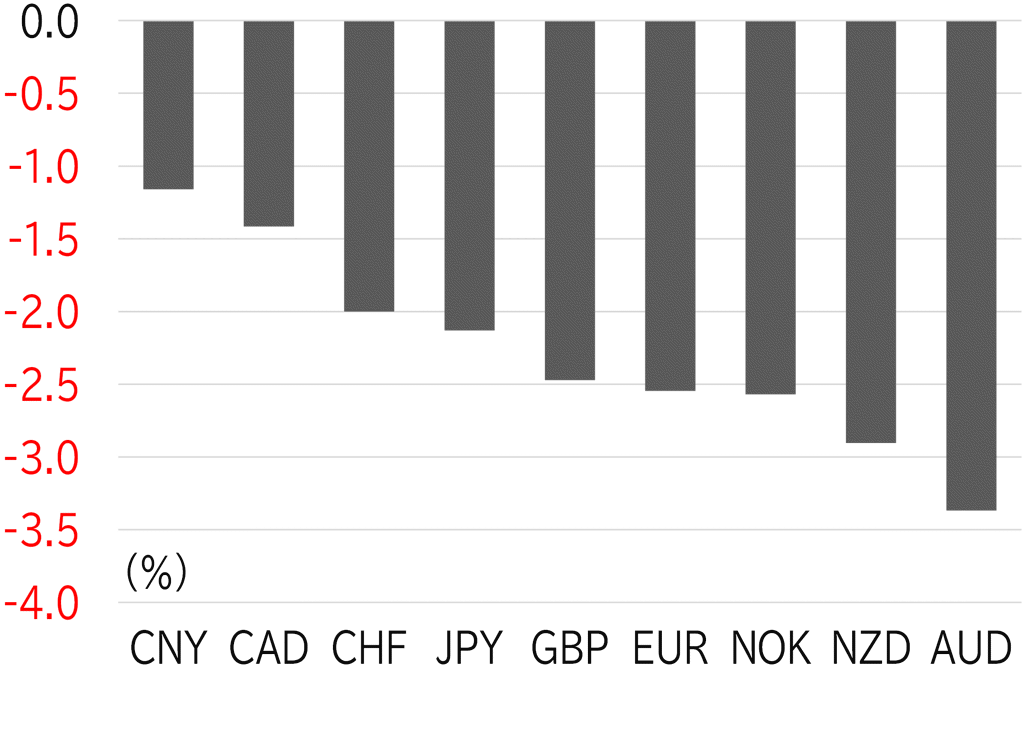

The USD/JPY opened the week at 152.96. It rose to above 153 then tested 154 amid a lack of catalysts on Monday 11 November, which was a market holiday in the US. The pair adjusted to the 153 level as risk sentiment increased slightly after president-elect Donald Trump announced nominations for cabinet members who hold hardline positions on China. However, the USD/JPY rose back toward 155 as the dollar strengthened across the board amid a continued rise in UST yields. The pair hit 155 during European trading hours on 13 November, then fell back to below 154.50 after the US CPI for October came in generally in line with the market's forecast. It subsequently rebounded on concerns of an acceleration in inflation, recovering to above 155 and then rising to around 155.50 amid a rise in UST yields and dollar strength. The USD/JPY rose to above 156 around noon in the Tokyo session on 14 November, then moved around 156 through overseas trading hours. The pair became established above 156 after Fed Chair Jay Powell gave a speech around the close of trading in the US during which he said the Fed did not need to hurry to lower rates. It rose on the morning of 15 November as yen selling dominated, reaching 156.76 around the time of the fixing rate announcement. The USD/JPY was trading below 156.50 at the time of writing this report (Figure 1). This week, the dollar strengthened across the board. Among G10 currencies, the Swiss franc and the yen were the strongest performers as the market was somewhat risk off (Figure 2).

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 15 November

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 15 November

Source: Bloomberg, MUFG