Week in review

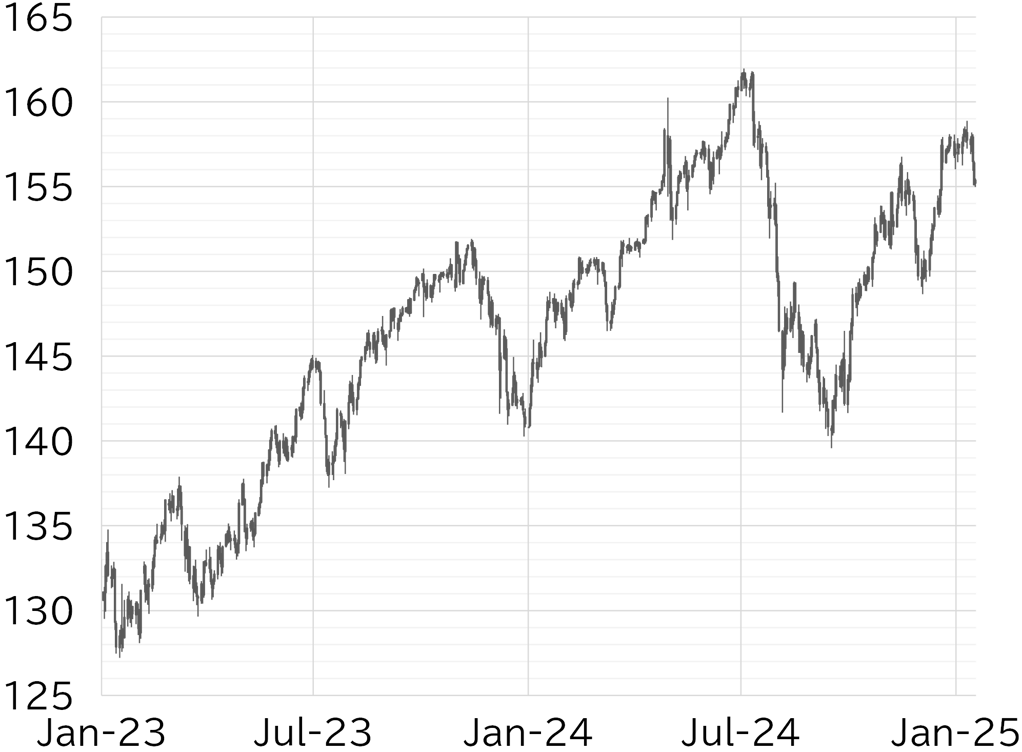

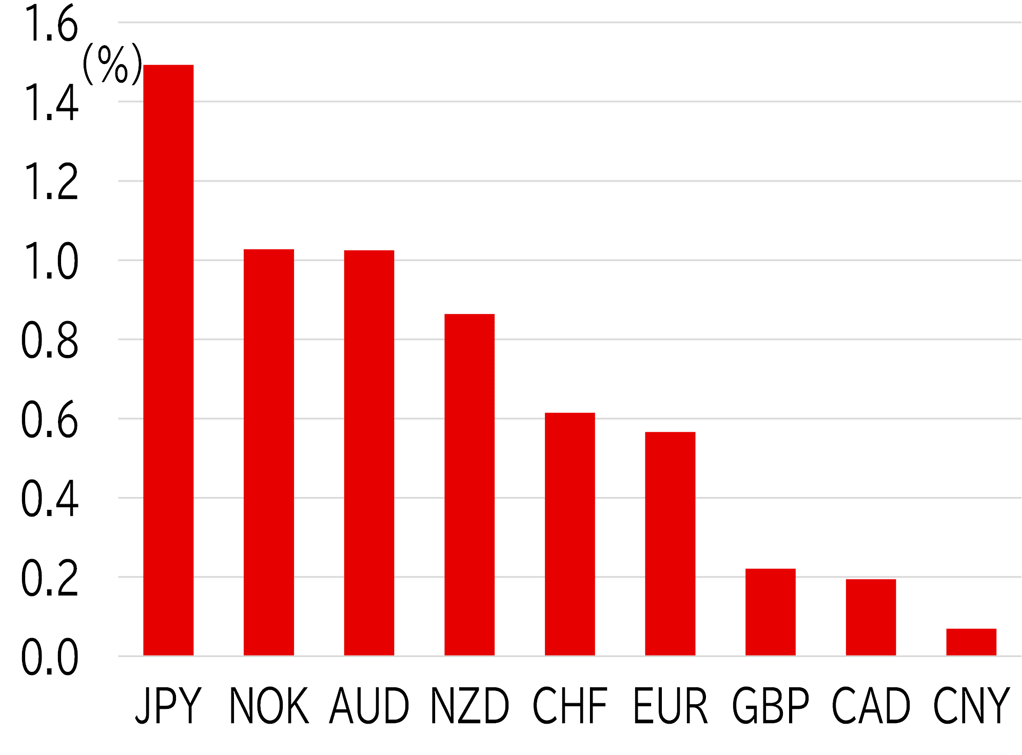

The USD/JPY opened at 157.92 on 13 January, which was a public holiday in Japan. The dollar strengthened even in Asian trading hours at the start of the week, partly because the US payrolls report announced on Friday exceeded market expectations across the board. However, the USD/JPY remained top-heavy with yen cross rates coming under downward pressure, and the pair fell below 157 for a time through US trading hours. The USD/JPY recovered in early trading on 14 January with the return of Japanese investors, but upside was curbed below 157.50 following a speech by BOJ Deputy Governor Ryozo Himino. However, moves to chase downside were limited and the USD/JPY climbed to a high for the week of 158.19 after incoming US president Donald Trump announced plans to create an "External Revenue Service" agency to support his tariff policy. On 15 January, BOJ Governor Kazuo Ueda hinted at a rate hike at next week's monetary policy meeting, echoing earlier remarks by Himino. This triggered yen buying and the USD/JPY fell back to below 157.50. The pair then fell to below 156.50 as the GBP/JPY declined and the dollar weakened after the CPI in both the UK and the US missed market expectations. On 16 January, the USD/JPY fell sharply to below 155.50 after some overseas news agencies, citing insiders, reported that the BOJ was likely to raise rates at its meeting next week. The USD/JPY briefly rebounded to the low 156 range, but the dollar weakened and the pair fell to below 155.50 in US trading hours after Fed Governor Christopher Waller in a media interview said the CPI announced on 15 January supported the possibility of a rate cut in the first half of 2025, including at the March FOMC, and that he did not think Trump's proposed tariffs would have a major impact on inflation. The pair briefly fell below 155 early in the Tokyo session on 17 January. The USD/JPY had recovered slightly and was trading below 155.50 at the time of writing this report (Figure 1). The dollar was weak overall among G10 currencies this week. The sterling was soft after recently hitting a new low, while the yen pulled out well ahead of the pack amid growing expectations of a rate hike next week (Figure 2).

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 17 January

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 17 January

Source: Bloomberg, MUFG