Week in review

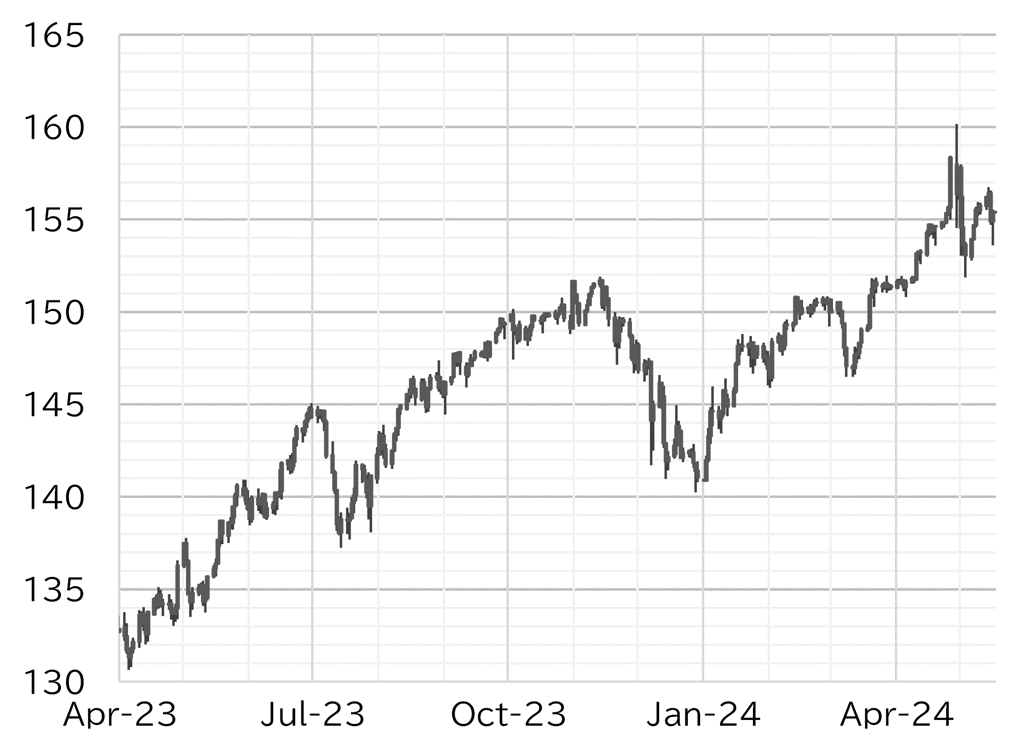

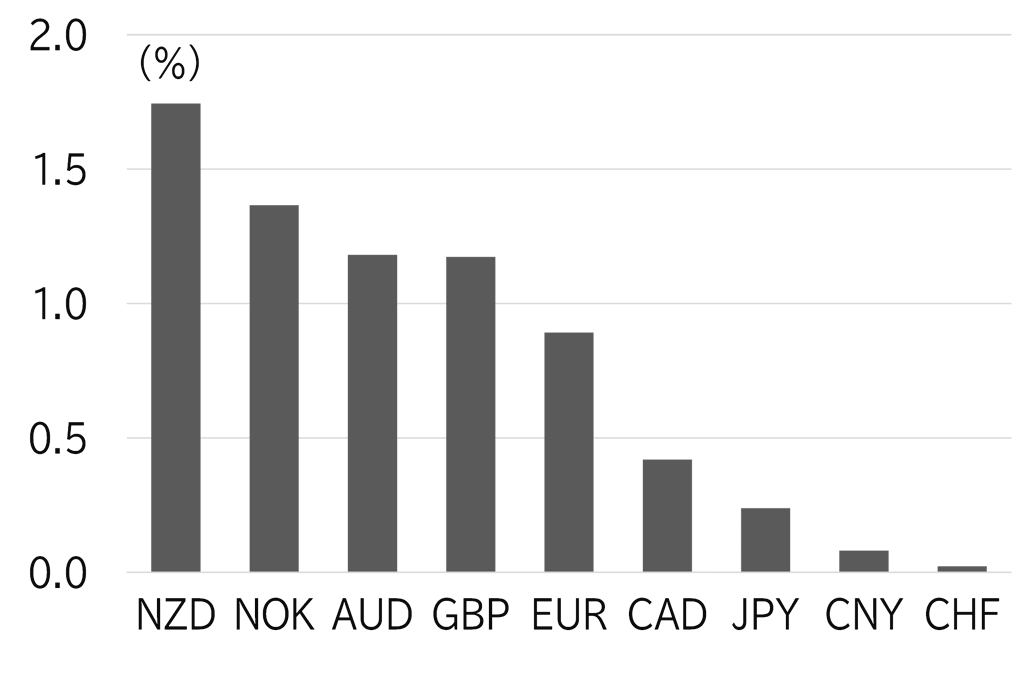

The USD/JPY opened the week at 155.85. JGB yields rose, mainly in the long-term sector, after the BOJ announced it would reduce purchases of 5-10y JGBs in its open market operations. The USD/JPY fell to around 155.50 but yen buying was not sustained, and the pair rose to the low 156 level as the NY Fed's data on consumer inflation expectations came in higher than the market had forecast. The USD/JPY rose to the high for the week of 156.80 on 14 May after growth in the PPI for April announced in US trading hours beat the market's forecast on a MoM basis, but 157 did not come into sight. In a speech on 14 May, Fed Chair Jay Powell said it was unlikely that the next move the Fed makes would be a rate hike, that it would take longer than expected to bring inflation down, and that the Fed will need to be patient and maintain rates at current levels for now. The speech did little to move the USD/JPY since it was basically in line with his comments at the press conference following the recent FOMC meeting. After that, the market remained in wait-and-see mode ahead of the April CPI report. On 15 May, the closely watched US CPI report showed a slowdown in both YoY and MoM growth, and slower growth in the supercore inflation reading, which measures services inflation excluding housing. US retail sales for April announced at the same time also missed the market's forecast. As a result, UST yields declined and the dollar softened. The USD/JPY fell to 155, bounced back above 155.50, and was then pushed down to below 155. The pair softened from the morning on 16 May and fell below 154 as the previous day's dollar selling continued, hitting the low for the week of 153.60 before gradually rising. Several US economic indicators showed a downturn in sentiment this week, but strong growth in the import price index for April beat the market's forecast, which worked to drive up UST yields and supported a rise in the USD/JPY to the155 level. The pair was trading below 155.50 at the time of writing this report (Figure 1). The dollar softened against all major currencies this week due to a decline in UST yields. The Swiss franc was relatively weak amid a shift to risk on and a rise in US share prices (Figure 2).

FIGURE 1: USD/JPY

Note: Through 9:00am JST on 17 May

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 9:00am JST on 17 May

Source: Bloomberg, MUFG