Week in review

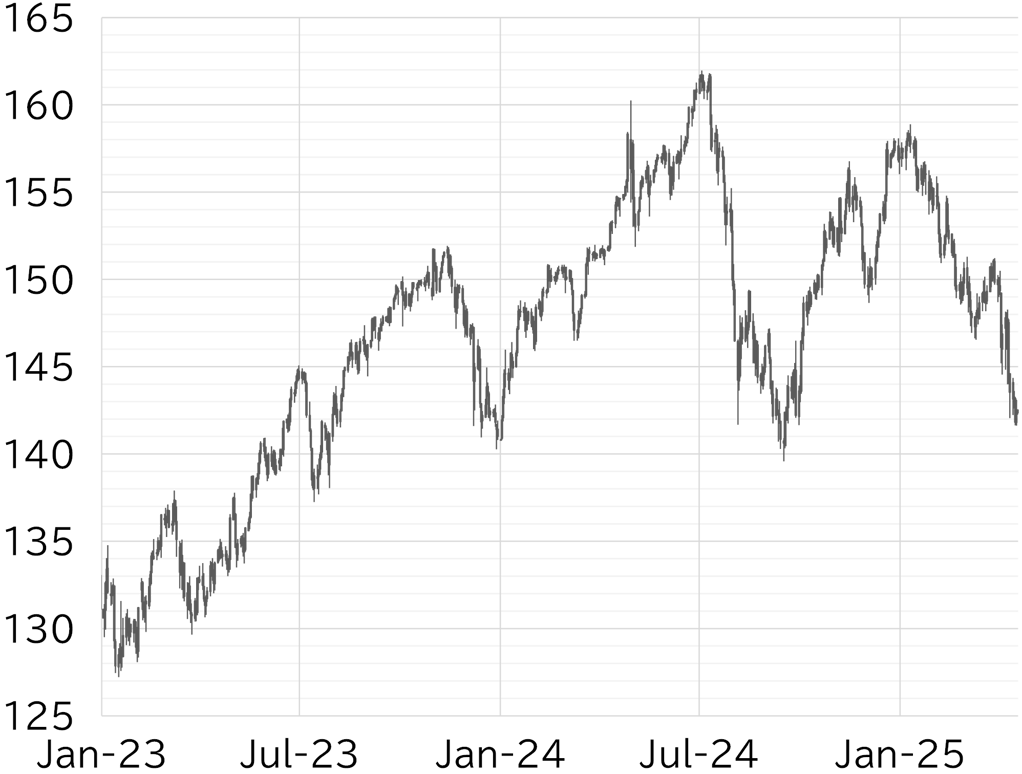

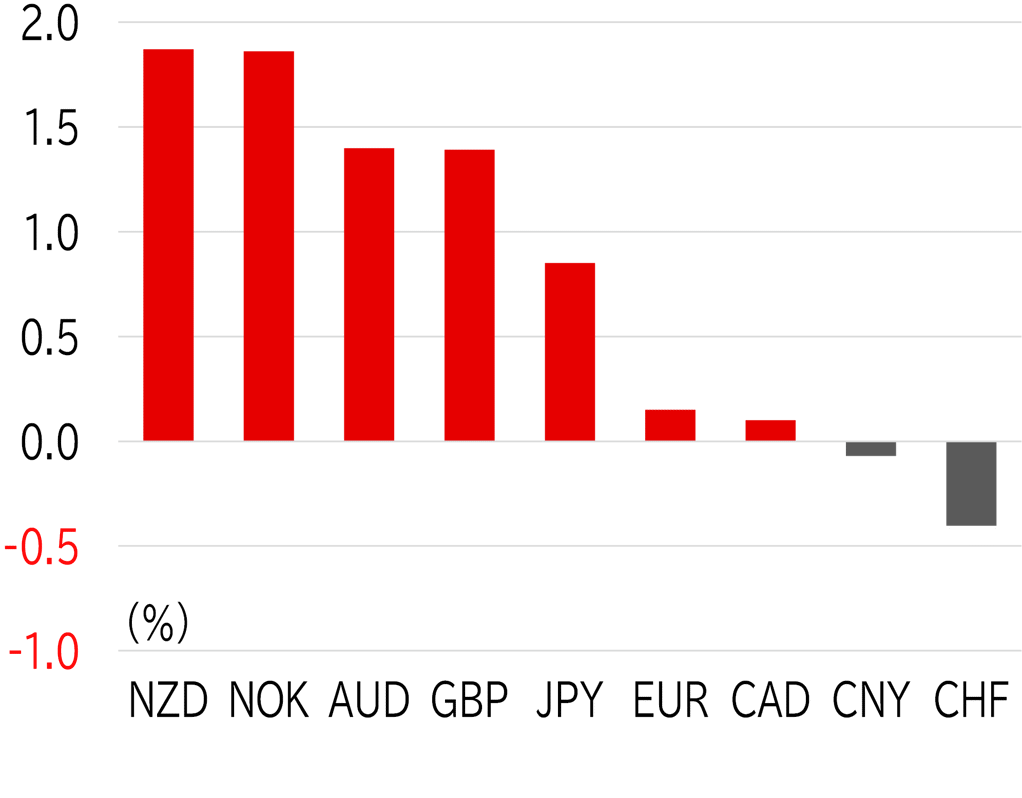

The USD/JPY came under downward pressure early Japan time on 14 April following weekend reports related to US tariff policy. The pair plunged from the 144 range to below 143 and continued to trade with high volatility, mainly above 142.50. Risk sentiment in equities and other markets improved after overseas investors entered the market, which briefly lifted the pair back above 144, but gains were capped. On 15 April, the USD/JPY hovered near 143 without clear direction. On 16 April, the Sankei Shimbun published an interview with BOJ Governor Kazuo Ueda with a headline emphasizing tariff risks, but the USD/JPY fell back into the 142 range from the morning. The pair then rebounded to just below 143 after media reports raised hopes for progress in US-China trade talks. However, risk sentiment turned again after Fed Chair Jay Powell reiterated his focus on inflation and US share prices declined on reports of new export restrictions on semiconductors to China. The USD/JPY dropped to 141.64, its lowest level so far this week. The yen was sold on 17 April after reports that exchange rates had not been raised as a topic during Economic Revitalization Minister Ryosei Akazawa's visit to the US for tariff negotiations, and the USD/JPY rebounded to levels near 143. However, the pair fell back below 142 and remained top-heavy after US President Donald Trump mentioned the possible dismissal of Fed Chair Powell and the Philadelphia Fed Index came in well below market expectations. The USD/JPY was trading below 142.50 at the time of writing on 18 April (Figure 1). Recent dollar weakness against G10 currencies lost steam this week. The Swiss franc also pulled back following sharp gains last week (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 18 April

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 18 April

Source: Bloomberg, MUFG