Week in review

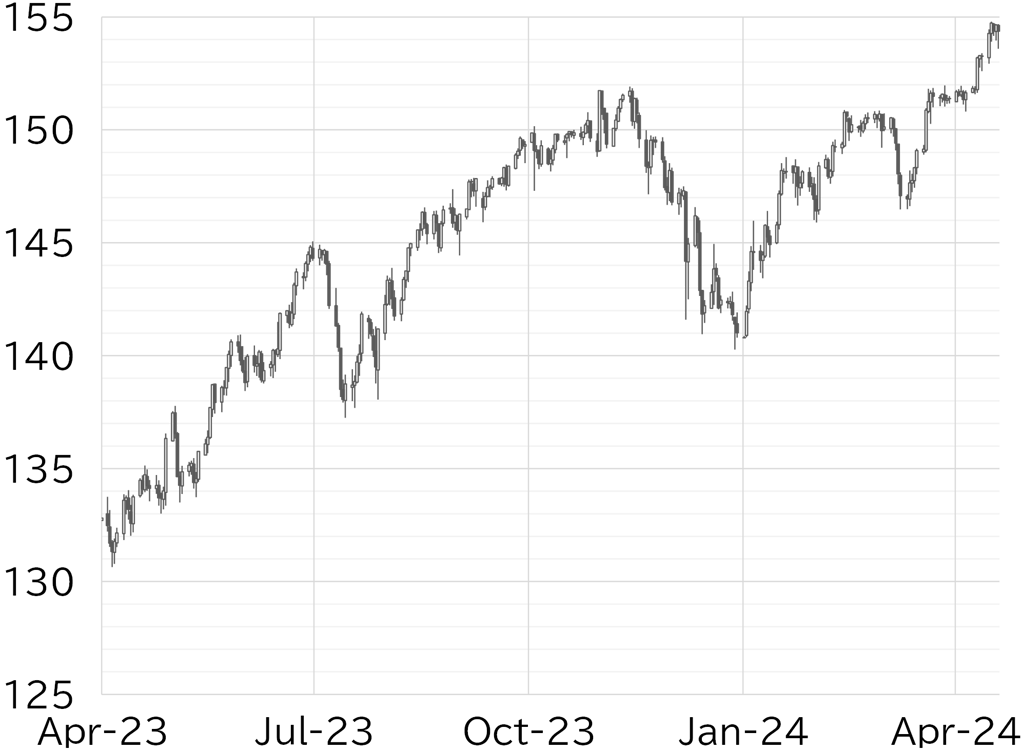

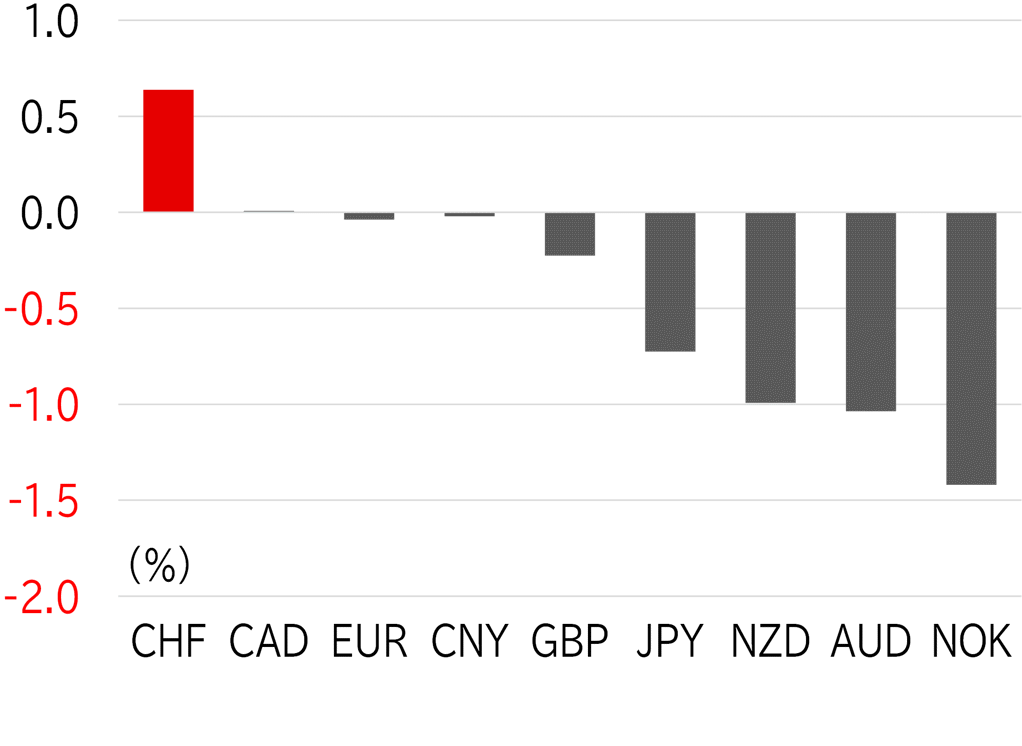

The USD/JPY opened the week at 153.30. It rose gradually on 15 April from the morning in Tokyo trading hours, then shot up to around 154.50 as the dollar strengthened across the board after US retail sales announced in US hours beat the market's forecast. On 16 April, Fed Vice Chair Philip Jefferson suggested the Fed would keep the policy rate on hold, sending the USD/JPY to its high for the week of 154.79, but the pair fell back below 154 following warnings of intervention by Japanese authorities. However, the USD/JPY quickly recovered, rising beyond 154.50 after Fed Chair Jay Powell also hinted that the Fed would delay a rate hike. It became top-heavy on 17 April as the market moved risk off, with a fall in share prices, bonds, and currencies in emerging countries and elsewhere amid a rise in UST yields and dollar strength. The USD/JPY fell below 154.50 in US trading hours following a trilateral meeting of finance ministers from the US, Japan, and Korea. The pair slipped further on 18 April, briefly falling below 154 after Vice Finance Minister for International Affairs Masato Kanda announced in the morning that the G7 had confirmed its commitment on foreign exchange policy based on Japan's stance. However, in US trading hours, NY Fed President John Williams' comment that a rate hike was possible acted to strengthen the dollar, pushing the USD/JPY above 154.50. It remained at this level on 19 April but fell steeply following reports of explosions in Iran and temporarily fell to around 153.50. However, the move to risk off faded amid conflicting information about the incident, and the USD/JPY recovered to the low 154 level (Figure 1). At the time of writing this report, the dollar was strong among G10 currencies, but the Swiss franc was stronger (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 19 April

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 19 April

Source: Bloomberg, MUFG