Week in review

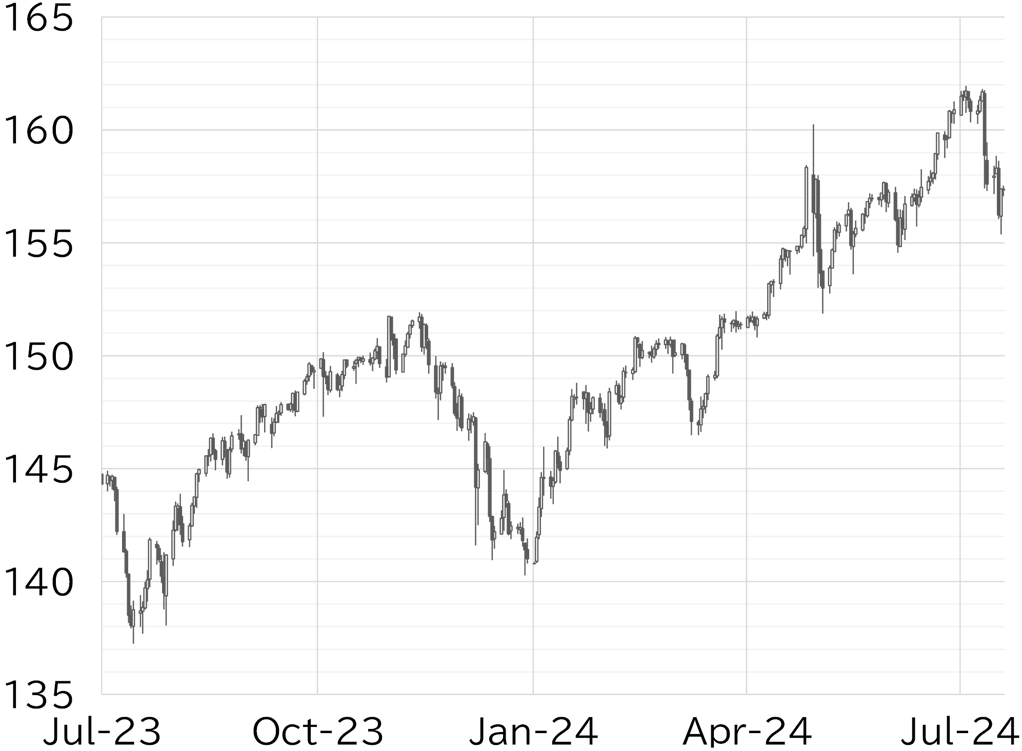

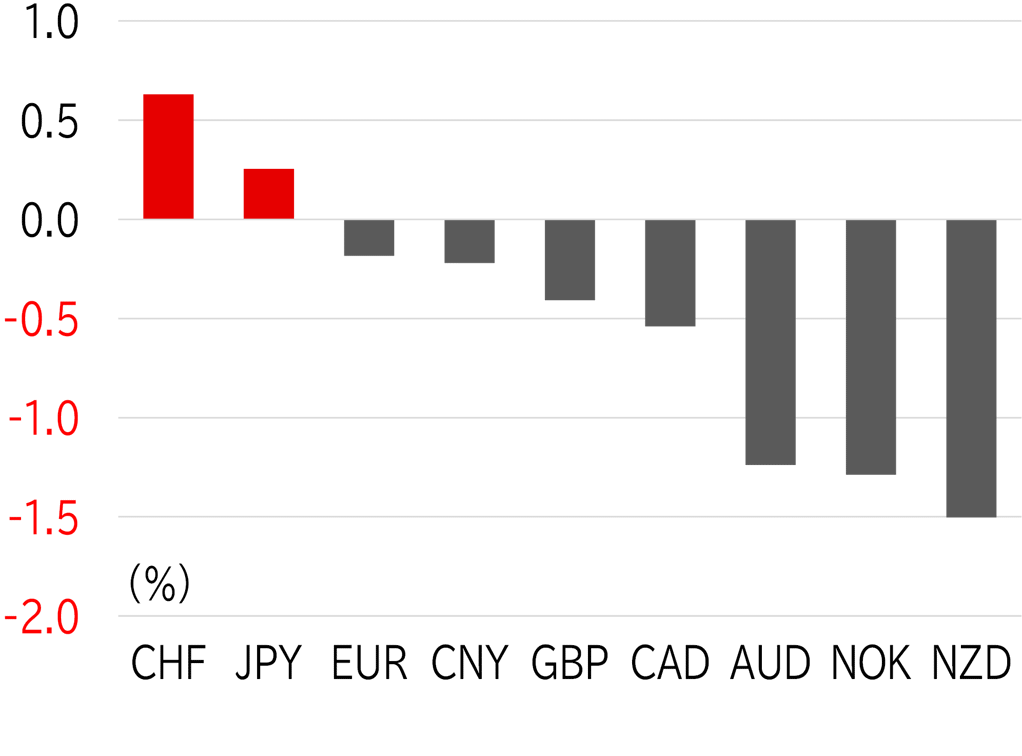

The USD/JPY opened the week at 158.23, moving around 158 without a sense of direction during the Japanese public holiday on 15 July. The pair fell briefly to below 157.50 in US trading hours after Fed Chair Jay Powell said he was more confident about the slowdown in inflation following last week's CPI report, but then quickly recovered. Strength in Japanese stocks on 16 July encouraged yen selling and the USD/JPY rose to above 158.50, but upside was curbed before reaching 159. The pair hovered around 158.50 at the start of trading on 17 July but fell sharply in the evening Tokyo time after Digital Transformation Minister Taro Kono said in an interview that the BOJ should raise rates to lift the yen. In addition, former US President Donald Trump said in an interview that the dollar was too strong against the yen and yuan. As a result, the dollar weakened, and the USD/JPY fell to below 156.50. The decline stopped briefly at that level, then resumed on the morning of 18 July with a fall to the 155 level. The USD/JPY rose back to around 156.50 on the same day around the time of the fixing rate announcement, then rose further to around 157.50 in US trading hours after the Philadelphia Fed index beat market expectations, resulting in a rise in UST yields and a stronger dollar. It was trading in the low 157 level at the time of writing this report on 19 July (Figure 1). The strongest performers this week were the Swiss franc, followed by the yen, and then the dollar, showing a typical risk-off pattern (Figure 2). US share prices were soft in particular, and the VIX fear index also rose.

FIGURE 1: USD/JPY

Note: Through 11:00am JST on 19 July

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00am JST on 19 July

Source: Bloomberg, MUFG