Week in review

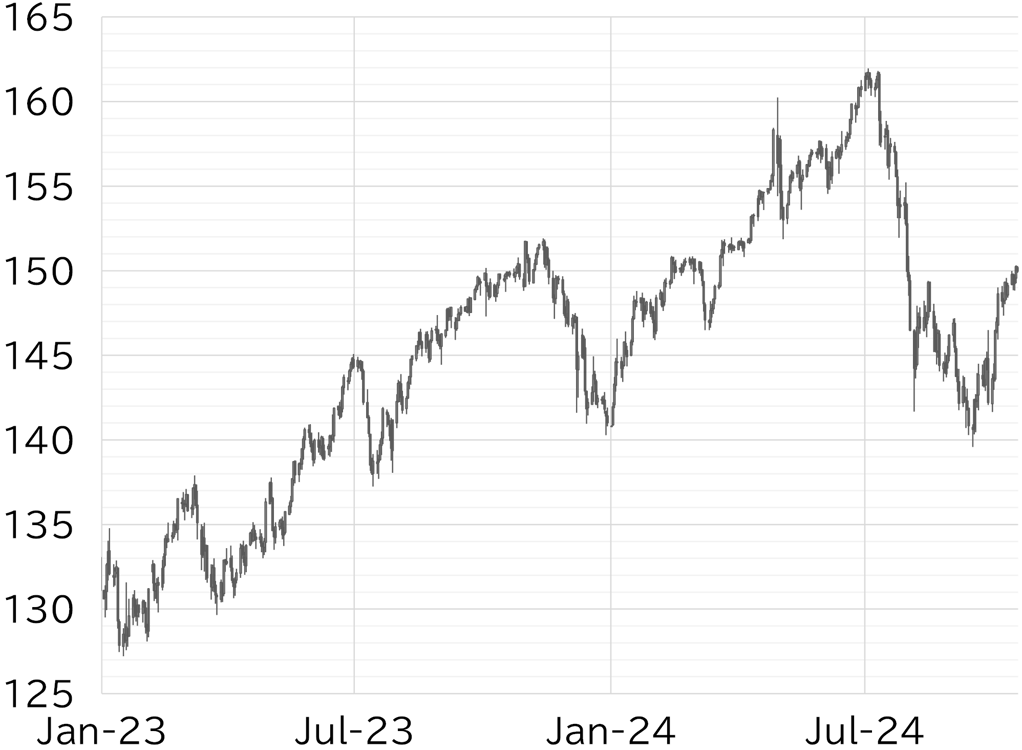

The USD/JPY opened the week at 149.32. It was directionless in Asian trading hours on 14 October, which was a public holiday in Japan, but rose to 149.98 as the dollar strengthened from European trading hours on news that Trump was gaining the lead in the US presidential election race. The USD/JPY became top-heavy from the morning in the Tokyo session on 15 October as Japanese investors returned to the market and the pair fell back below 149.00. However, the downward movement lacked strength, and the pair soon recovered to above 149.00. The USD/JPY fell to a low of 148.83 on 16 October in response to comments from BOJ board member Seiji Adachi in the morning Tokyo time, but yen buying was not sustained. The pair remained static above 149.00 on 17 October, then rose above 150.00 on 18 October (US time) as the dollar strengthened after US retail sales for September exceeded market expectations. Housing-related data was also strong, and the USD/JPY rose to a high for the week of 150.32. The pair fell back below 150.00 on 18 October following warnings about currency moves by Vice Finance Minister for International Affairs Atsushi Mimura in the morning during the Tokyo session (Figure 1).

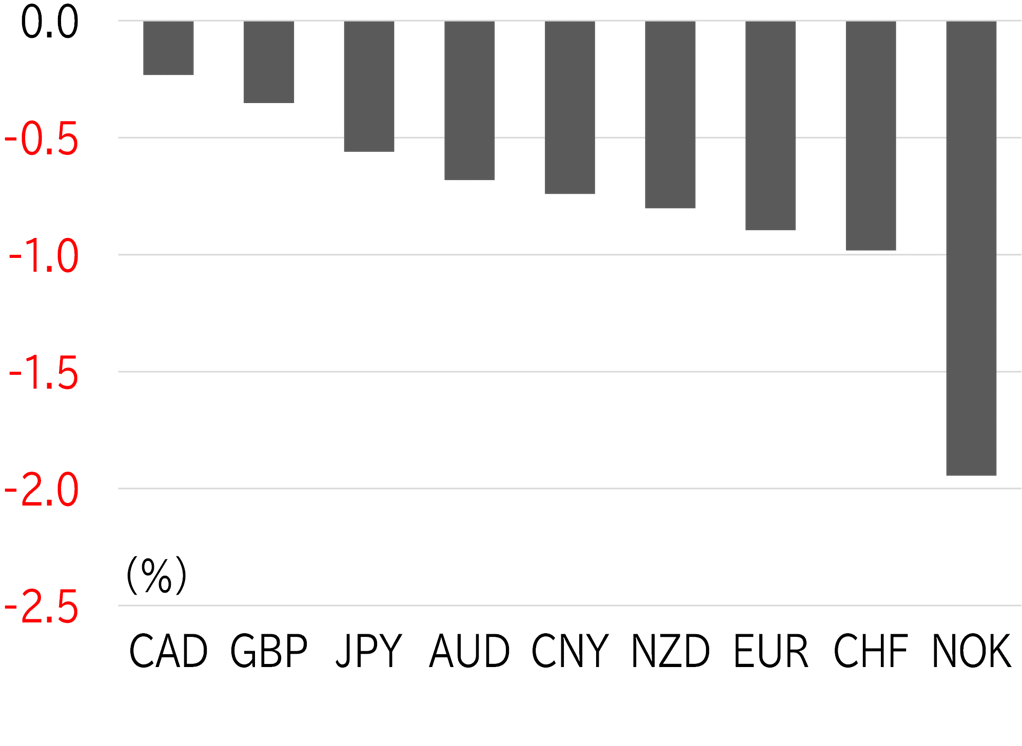

This week, the dollar strengthened across the board. The yen sat in the middle of the pack among G10 currencies in the absence of any notable movers. The Swiss franc lost ground as risk-off sentiment receded. Meanwhile, the Norwegian krone weakened as oil prices softened, but the Canadian dollar, which is also a commodity currency, was relatively strong (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 18 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 18 October

Source: Bloomberg, MUFG