Week in review

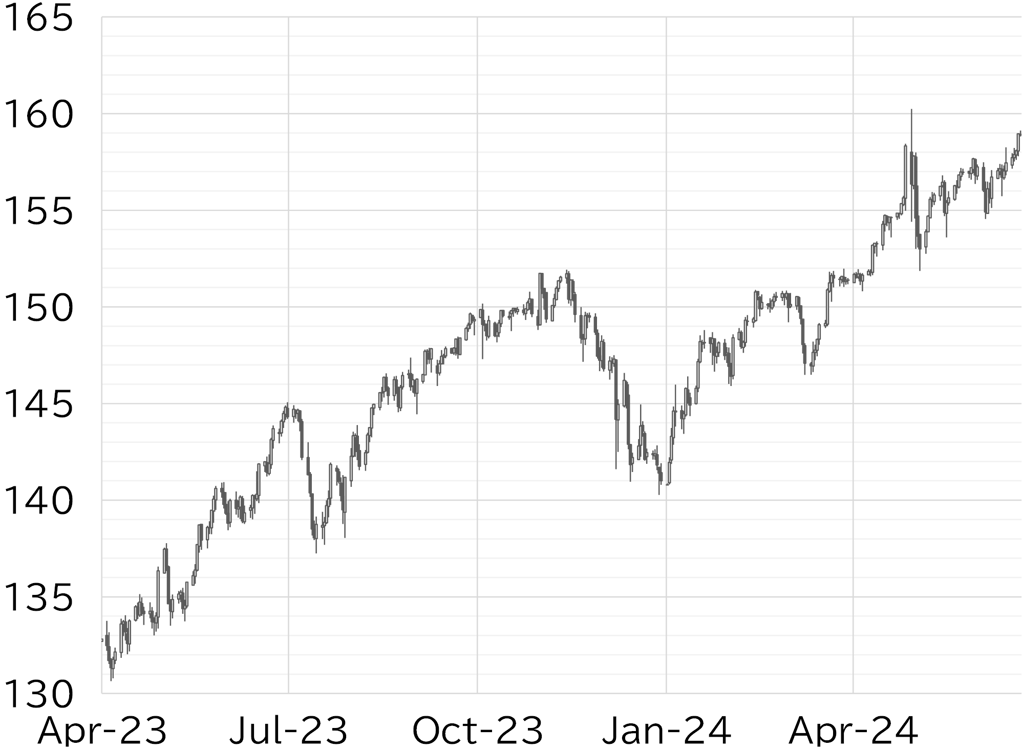

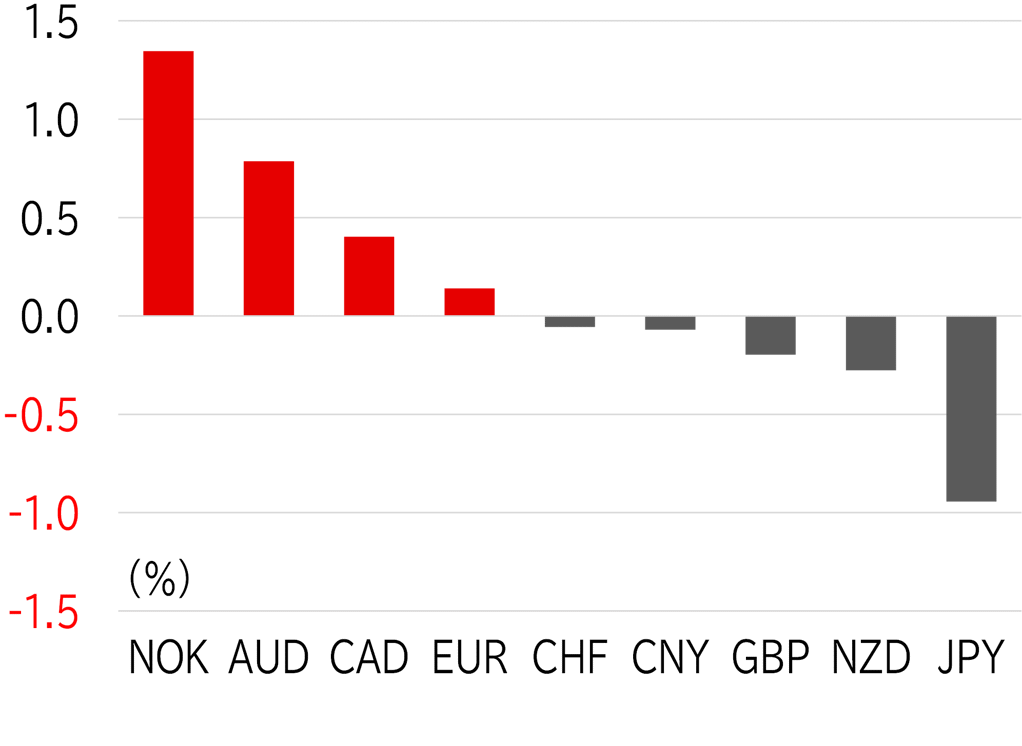

The USD/JPY opened the week at 157.52. It traded around 157.50 in the Tokyo session on 17 June amid a lack of any notable news, then fell below 157.50 in European trading hours as yen selling picked up steam due to concerns about the political situation in France following the EU elections. However, a subsequent rise in UST yields drove dollar strength putting upside pressure on the USD/JPY, which rebounded to nearly 158. On 18 June, the yen strengthened slightly in the morning due to BOJ Governor Kazuo Ueda's parliamentary hearing, but the USD/JPY rose above 158 in the afternoon as a hawkish shift by the RBA drove Australian dollar buying. The USD/JPY fell to around 157.50 after US retail sales for May came in below the market's forecast. It remained bottom-firm at that level, then gradually rose back to above 158 on 19 June which was a holiday in the US. On 20 June, the USD/JPY climbed gradually in the Tokyo session due in part to calendar factors. In European trading hours, the Swiss National Bank unexpectedly cut rates, sparking dollar strength and a rise in the USD/JPY. In US trading hours, Minneapolis Fed President Neel Kashkari suggested it would take one to two years to achieve the inflation target, resulting in a sharp rise in UST yields and a stronger dollar. The USD/JPY rose intermittently to nearly 159. On 21 June, it rose past 159 in the morning for the first time since 29 April. It was trading above 158.50 at the time of writing this report (Figure 1). Commodity currencies were strong this week due to a continued rise in oil prices, with the dollar in the middle of the pack. The yen was the worst performer (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 21 June

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 21 June

Source: Bloomberg, MUFG