Week in review

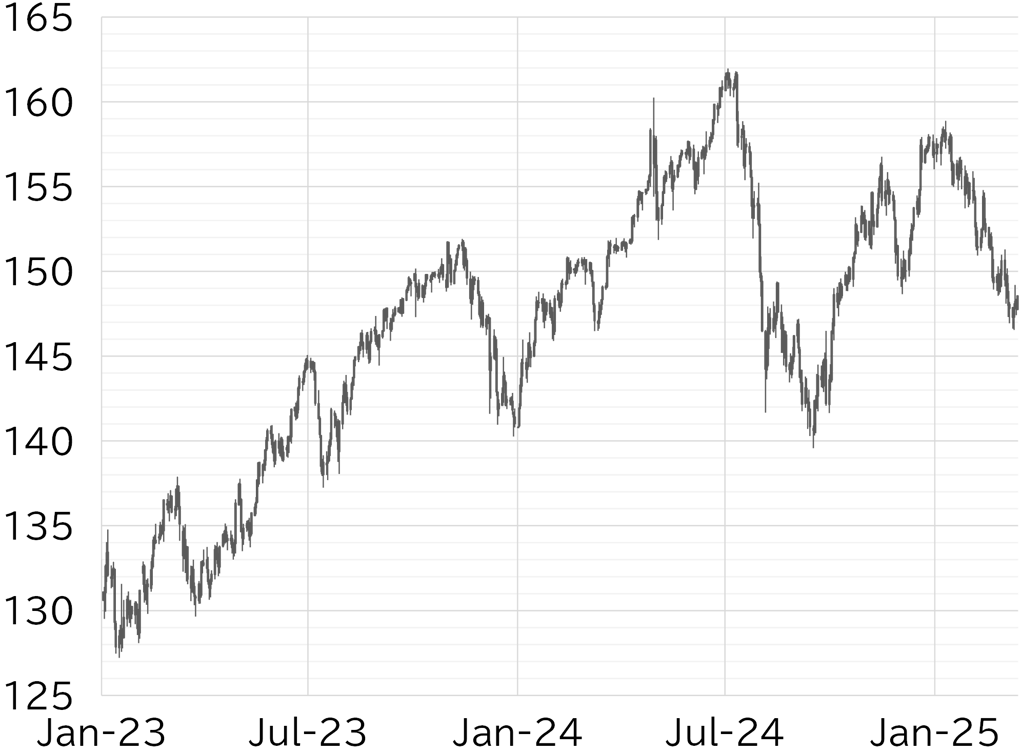

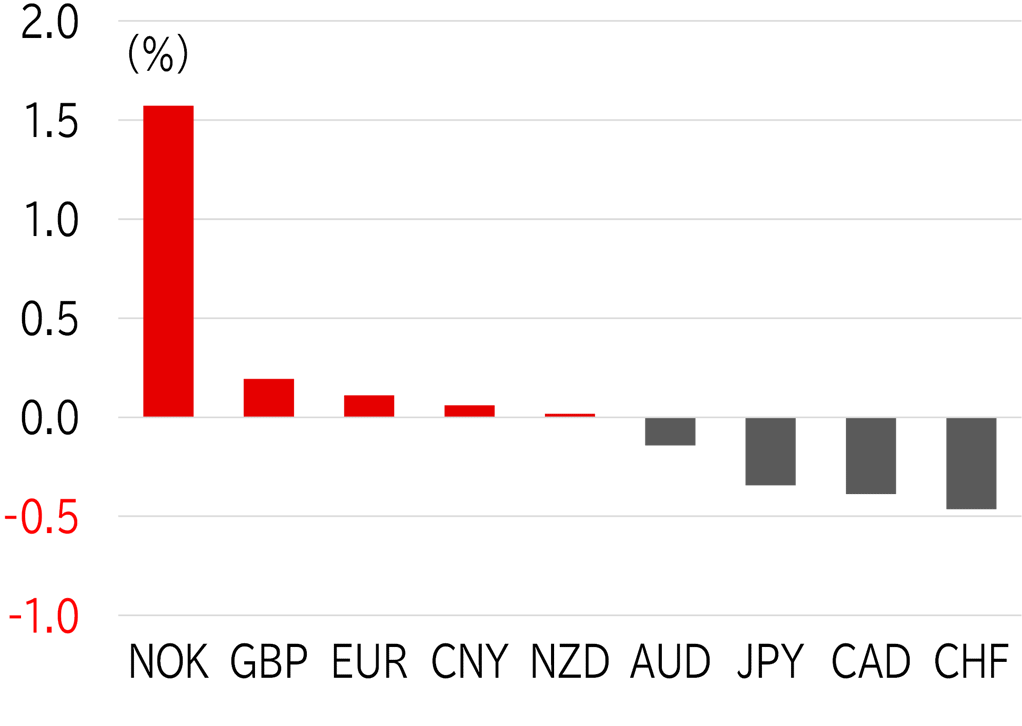

The USD/JPY opened the week at 148.58. The pair firmed toward the end of the session on 17 March due to expectations that progress would be made toward ending the war in Ukraine after US President Donald Trump announced plans for a call with Russian President Vladimir Putin, and because US retail sales data were not as weak as feared. The USD/JPY rose to nearly 150 on 18 March, supported by firm movement in the Nikkei 225 and Asian share prices overall. However, the pair became top-heavy without settling above 150 because the meeting between Trump and Putin failed to achieve anything meaningful and due to renewed tensions in the Middle East. Yen selling picked up on the second day of the BOJ and FOMC meetings on 19 March ahead of BOJ Governor Kazuo Ueda's press conference, which investors expected to be dovish. However, Ueda's remarks leaned slightly hawkish if anything. Around the same time, political instability in Turkey sparked risk-off sentiment, triggering broad-based selling of cross-yen pairs and pushing the USD/JPY below 149.50. The pair rebounded toward 150 ahead of the FOMC meeting as concerns about Turkey receded, but fell sharply to below 148.50 as the dollar was sold after the Fed decided to slow the pace of balance sheet reduction and Fed Chair Jay Powell suggested in his post-meeting press conference that recent inflation pressures were likely transitory. Trading was muted on 20 March due to the Japanese public holiday, although the USD/JPY gradually recovered. The pair firmed again as Tokyo markets reopened on 20 March, and was trading below 149.50 at the time of writing (Figure 1). G10 currencies were mixed this week, with all moves against the dollar staying within a ±1% range (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 21 March

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 21 March

Source: Bloomberg, MUFG