Week in review

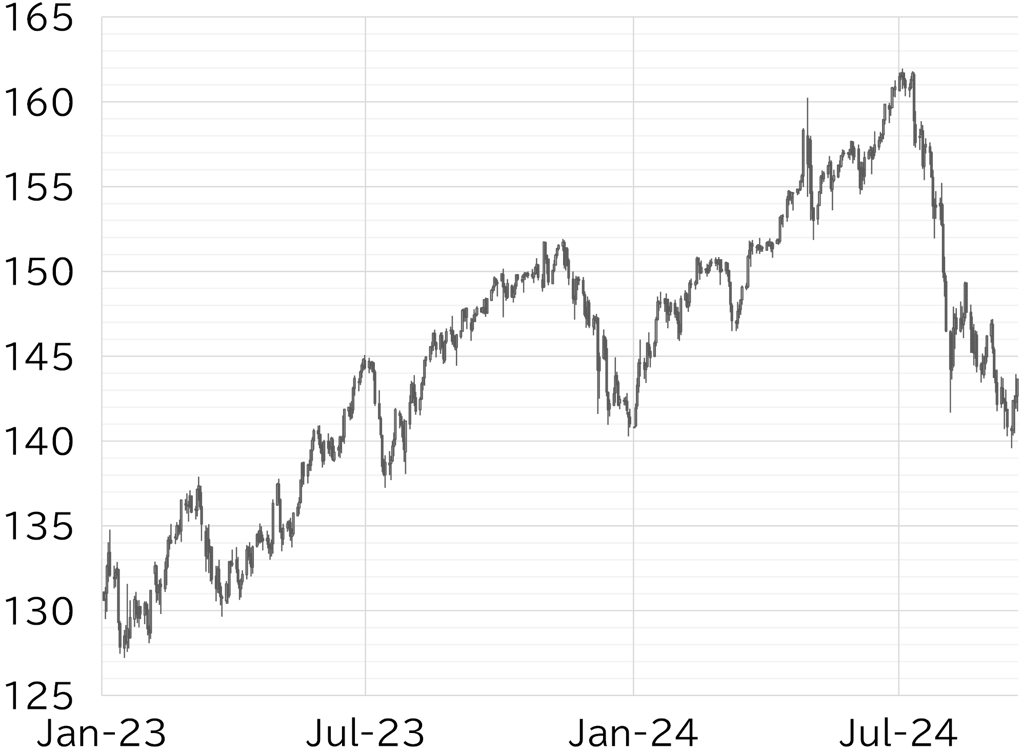

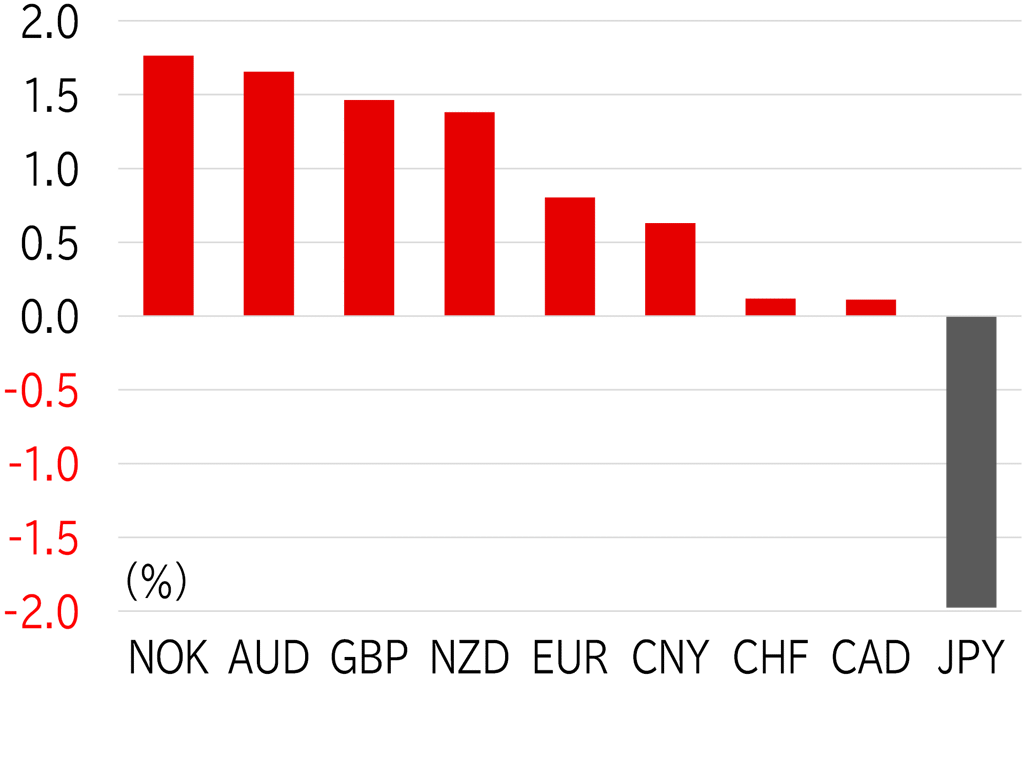

The USD/JPY opened the week at 140.80. The pair fell to the low for the week of 139.68 in the absence of any special events through Asian trading hours on 16 September, which was a public holiday in Japan. This was the first time below 140 since July 2023, but the pair did not get entrenched at this level and soon bounced back, rising beyond 140.50 after the NY Fed Empire State Manufacturing Index unexpectedly improved. Japanese investors returned to the market on 17 September, and the USD/JPY remained deadlocked at this level through Tokyo and European trading hours ahead of the FOMC meeting. However, the dollar strengthened and the USD/JPY rose from above 141 to around 142.50 in US trading hours following the release of stronger-than-expected US retail sales data. The USD/JPY lost its sense of direction again on 18 September, but then fell swiftly to around 140.50 after the FOMC announced a 50bp rate cut. However, it rebounded sharply to above 142.50 as the dollar strengthened across-the-board in response to the Fed's dot plot pointing to a slowdown in the pace of rate cuts going forward and Fed Chair Jay Powell seeming to rein in expectations for rate cuts in his post-meeting press conference. The USD/JPY rose to 143.95 on 19 September as dollar buying and yen selling dominated from the morning in the Tokyo session, before falling back to around 142 in volatile trading. The USD/JPY traded around 142.50 in the Tokyo session on 20 September, but the yen weakened during BOJ Governor Kazuo Ueda's press conference following the Bank's monetary policy meeting, and the pair had risen to around 143.50 at the time of writing this report (Figure 1). The dollar and the yen weakened among G10 currencies this week. The Australian dollar and Norwegian krone, which are commodity currencies, were relatively strong due to a recovery in oil prices (Figure 2).

FIGURE 1: USD/JPY

Note: Through 17:00 JST on 20 September

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

NNote: Through 17:00 JST on 20 September

Source: Bloomberg, MUFG