Week in review

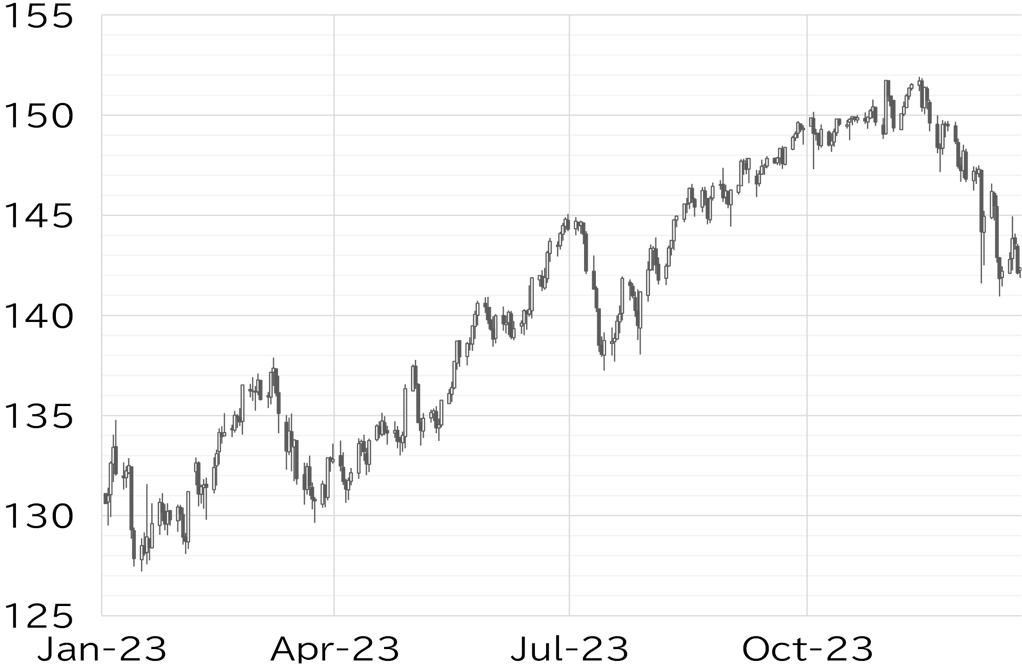

The USD/JPY opened the week at 142.33. It remained directionless at this level for a time on 18 December, but then rose to around 143 due to yen selling following the announcement of a Japanese company's acquisition of a US company in the evening Tokyo time. However, upside was curbed as investors waited on the BOJ's monetary policy meeting. The USD/JPY rose to around 143.50 on the second day of the meeting (19 December) after the BOJ announced that it would keep policy on hold before noon during the Tokyo session. Yen selling dominated after that as Governor Kazuo Ueda made no clear comments hinting at an early end to negative interest rates at his press conference, and the USD/JPY rose to nearly 145 in US trading hours. However, expectations of rate cuts in the US drove dollar selling, and the USD/JPY failed to break past 145 and fell back to around 143.50. Price movement was limited on 20 December as an increasing number of market participants went on break for the Christmas holiday. The USD/JPY fell back to below 142.50 in the Tokyo session on 21 December due to yen buying demand from Japanese investors looking to settle accounts ahead of the New Year holiday. The USD/JPY briefly fell below 142 on 22 December due to hawkish comments in the minutes of the BOJ's October monetary policy meeting. It was trading below 142.50 at the time of writing this report (Figure 1).

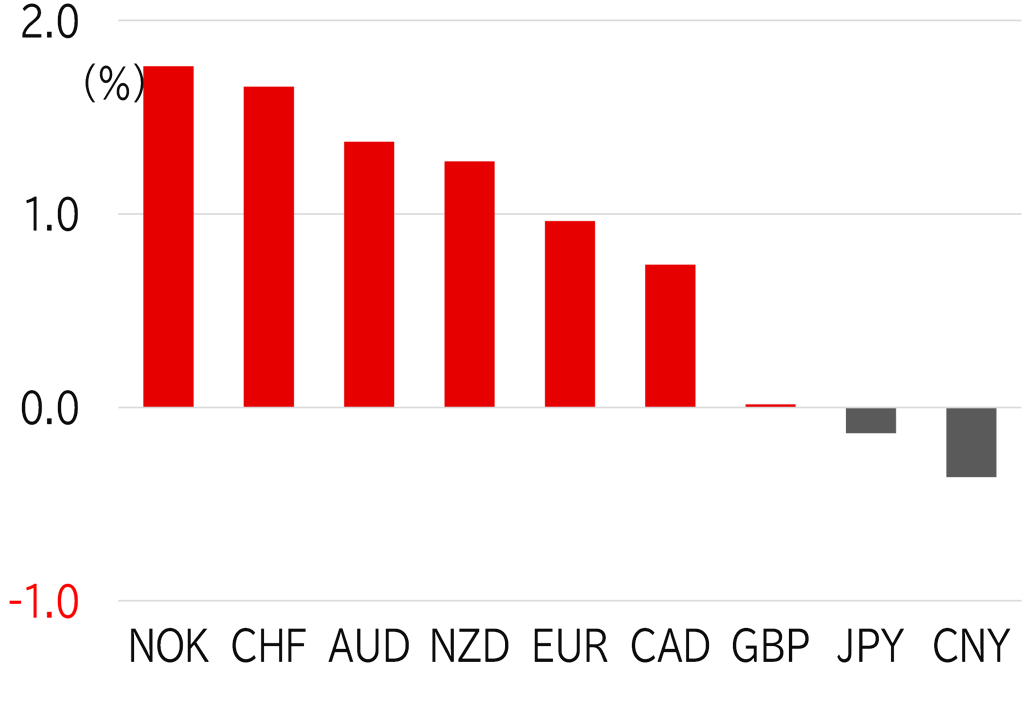

The dollar weakened almost across the board against major currencies this week as well. The yen was notably weak because expectations that the BOJ will end its negative interest rate policy receded (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00am JST on 22 December

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00am JST on 22 December

Source: Bloomberg, MUFG