Week in review

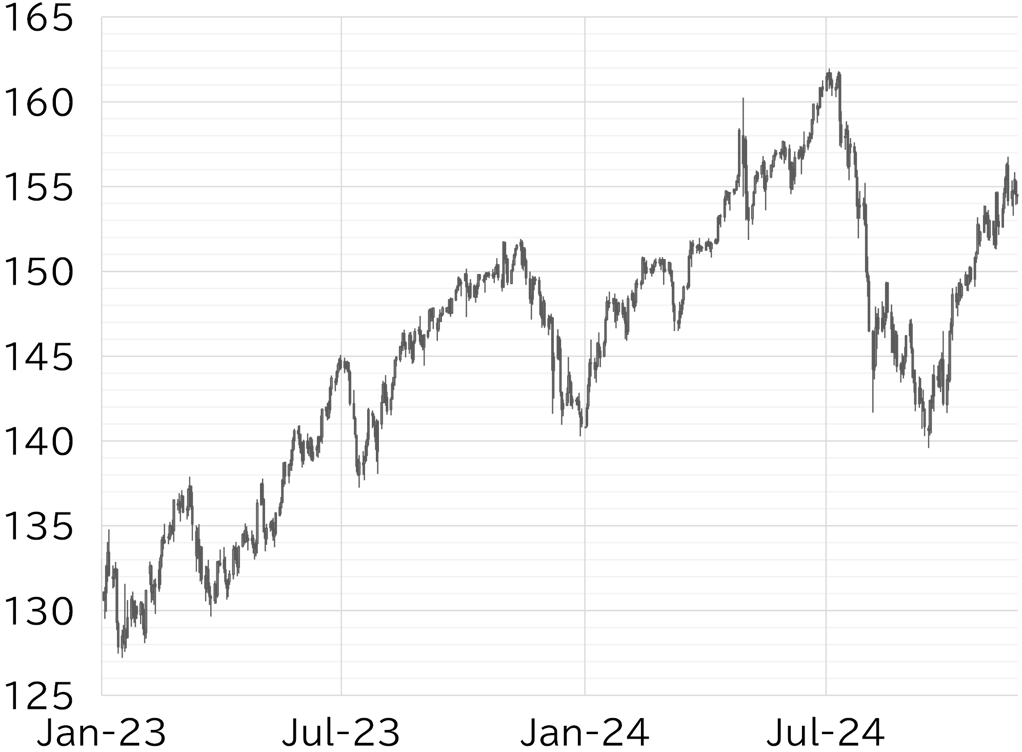

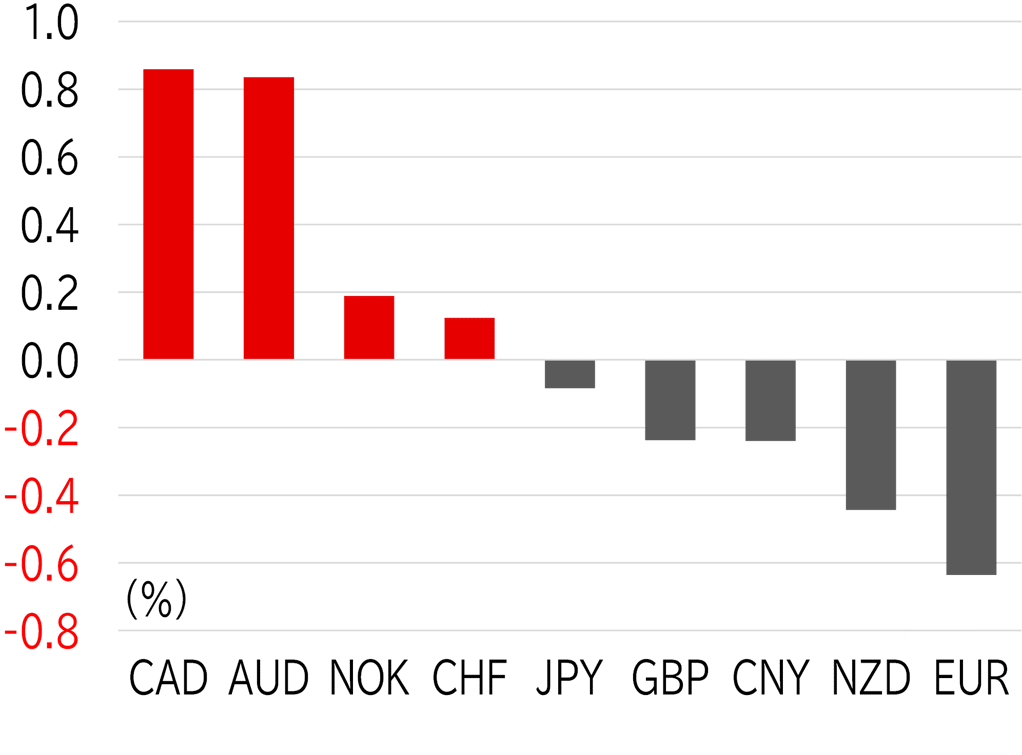

The USD/JPY opened the week at 154.67. The pair fluctuated by over one yen following a speech by BOJ Governor Kazuo Ueda during the Tokyo session on the morning of 18 November, then rose to the low 155 level through US trading hours. The USD/JPY fell sharply on 19 November due to reports that Russia had lowered its standards for the use of nuclear weapons, reaching a low for the week of 153.28. The pair recovered on the same day, then bounced back to above 155 during the Tokyo session on 20 November in the absence of any particular news, before hitting a high of 155.86 early in US trading hours. However, it became top-heavy at just under 156 and moved lower through 21 November. In the afternoon (Tokyo time) of the same day, the USD/JPY adjusted to around 154.50 following the release of an article in which New York Fed President John Williams discussed the need to curb inflation and eventually lower interest rates, which coincided with the headline from Governor Ueda's press conference. The pair dropped further during European trading hours after reports surfaced that Russia had launched a new type of missile at Ukraine. The USD/JPY briefly rebounded before falling below the 154 mark during US trading hours. However, it did not fall far below 154 and subsequently traded in a narrow range below 154.50. On 22 November, during the Tokyo session, it briefly touched below 154 before settling back in the low 154 range at the time of writing this report. Additionally, news that president-elect Donald Trump plans to nominate former Fed Governor Kevin Warsh as Treasury Secretary and potentially appoint him as the next Fed Chair after Jay Powell had little impact on the USD/JPY. (Figure 1). Among G10 currencies this week, commodity currencies such as the Canadian dollar, Australian dollar, and Norwegian krone showed strength, followed by the Swiss franc, the dollar, and the yen (Figure 2). Overall, we think these moves were largely driven by the evolving situation in Ukraine.

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 22 November

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 22 November

Source: Bloomberg, MUFG