Week in review

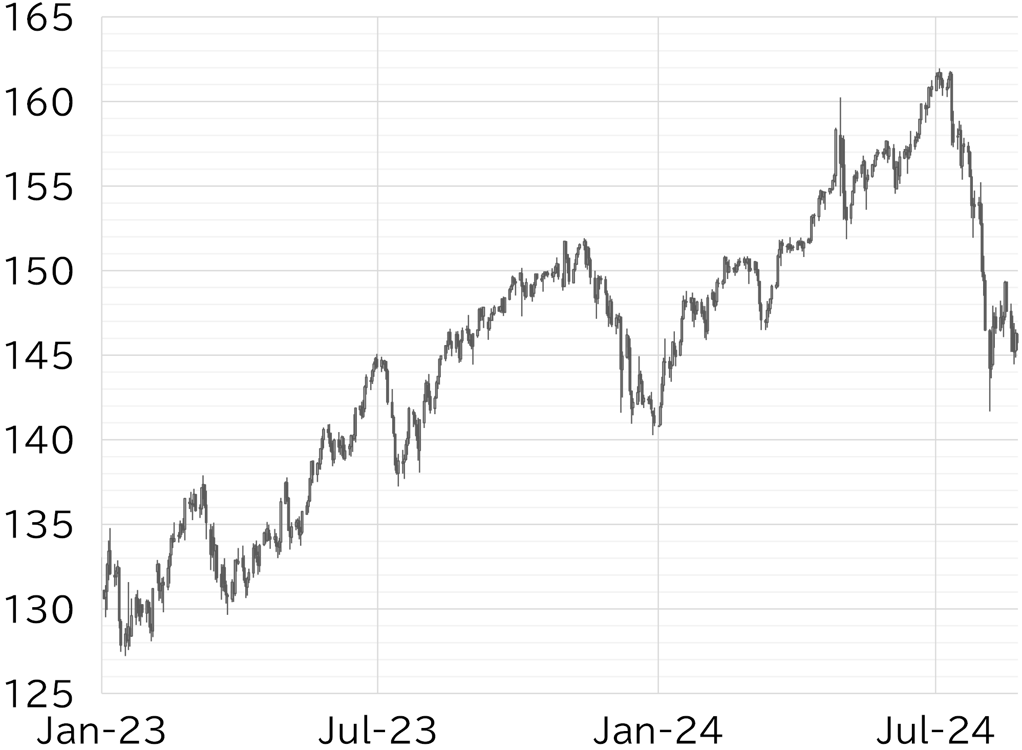

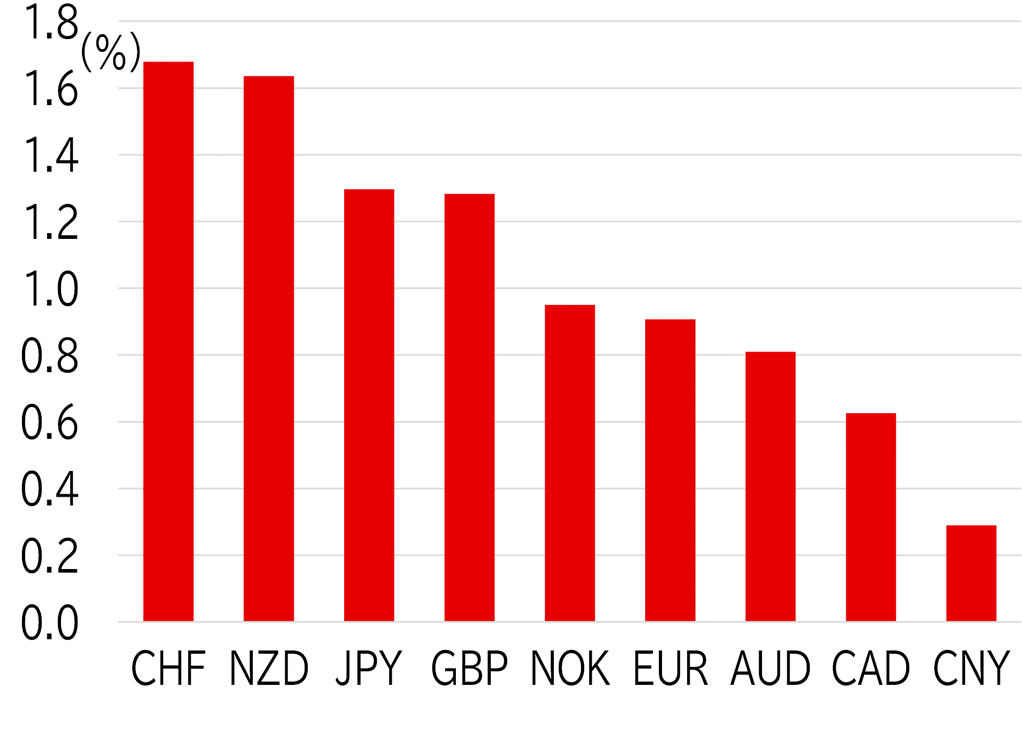

The USD/JPY opened the week at 147.91. Yen buying dominated from the morning in the Tokyo session on Monday 19 August, with the USD/JPY falling to below 145.50 following reports that US payrolls would likely be revised down sharply for the year and news of a plan to acquire a Japanese company. The decline stopped temporarily at that level, and the pair rebounded amid firmness in European and US stocks, rising back to the low 147 level at the end of the Tokyo session on 20 August. However, the dollar continued to weaken ahead of numerous events in the second half of the week, and the USD/JPY briefly fell below 145 early in the morning on 21 August. The USD/JPY rebounded to the low 146 level in European trading hours and briefly pushed beyond 146.50 in US trading hours, but the dollar weakened across the board after US payrolls were revised down by 818,000. The minutes of the July FOMC meeting were also more dovish than expected, and as a result the USD/JPY fell to 144.46 – the lowest point for the week as of writing this report. The pair then rebounded to the low 145 level as the slide in UST yields also stopped. The USD/JPY remained directionless at this level during the Tokyo session on 22 August. Yen cross rates strengthened during European trading hours on the back of firm PMIs in various countries, and the USD/JPY also recovered to above 146. The pair then rose to about 146.50 as the US PMI beat market forecasts. The USD/JPY was weakening at the time of writing this report on 23 August. The pair fell below 145.50 as yen buying pressure increased after BOJ Governor Kazuo Ueda told the lower house financial affairs committee that the Bank intended to proceed with normalization of monetary policy (Figure 1). Among G10 currencies this week, the dollar was soft across the board, and commodity currencies weakened somewhat due in part to a fall in oil prices (Figure 2).

FIGURE 1: USD/JPY

Note: Through 14:00 JST on 23 August

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 14:00 JST on 23 August

Source: Bloomberg, MUFG