Week in review

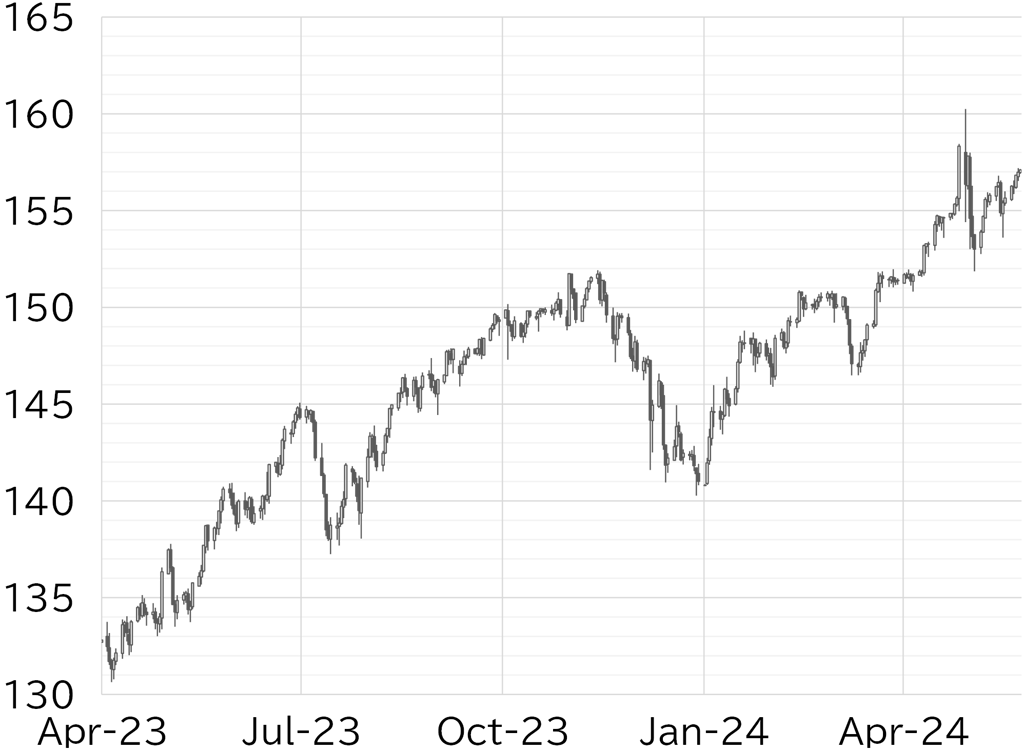

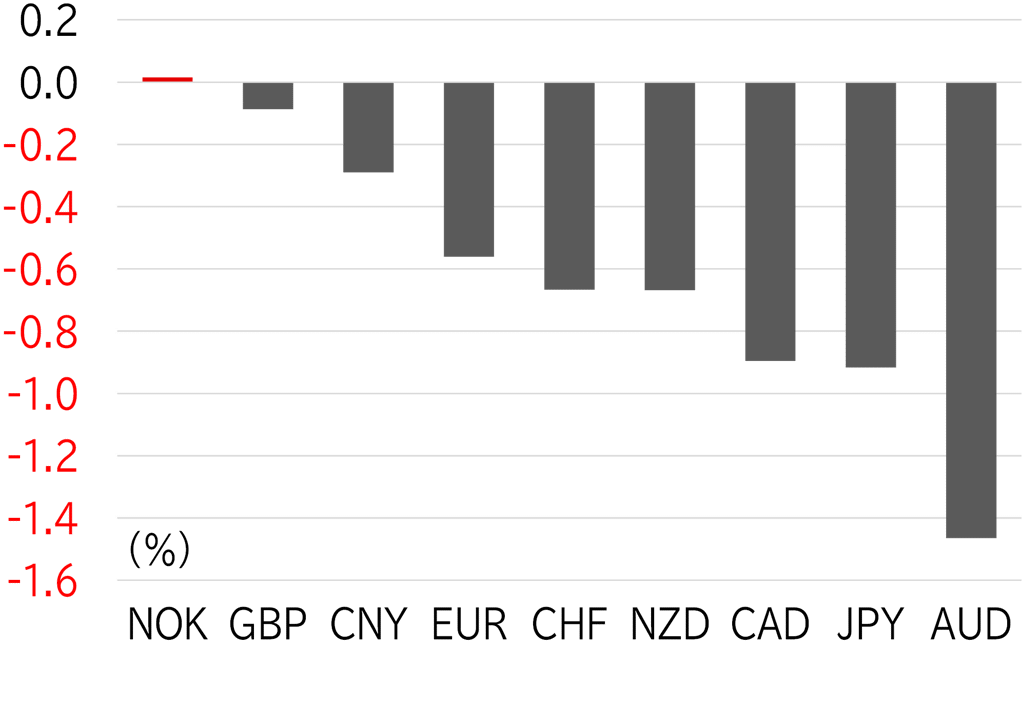

The USD/JPY opened the week at 155.79. The pair became top-heavy at the 155 level on Monday 20 May, partly due to expectations of a rise in long-term JGB yields but rose above 156 after Atlanta Fed President Raphael Bostic said the Fed might have to consider an interest rate hike. Hawkish comments from other senior Fed officials worked to drive the USD/JPY up to around 156.50 through Tokyo trading hours on 21 May. However, the pair temporarily fell back to the upper 155 level as comments from Fed Governor Christopher Waller were not as hawkish as had been expected. Nevertheless, the pair continued to inch higher from the morning of 22 May, rising to around 156.50. The USD/JPY then moved even higher as the dollar strengthened across the board following the announcement of the minutes of the FOMC meeting held on 30 April – 1 May. The pair treaded water just before 157 on 23 May, but then rose sharply to the low 157 level following an unexpectedly strong US PMI reading, with the Composite PMI Output Index rising to the highest level since April 2022. The USD/JPY has recovered from a fall over the long holidays to reach new highs, and at the time of writing this report on 24 May, it is becoming top-heavy amid concerns of intervention by the Japanese authorities (Figure 1). The dollar strengthened almost across the board this week, while the sterling was relatively strong due to concerns about the risk of inflation. Meanwhile, commodity currencies such as the Canadian dollar and the Australian dollar were weak due in part to a softening in crude oil prices (Figure 2).

FIGURE 1: USD/JPY

Note: Through 12:00pm JST on 24 May

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00pm JST on 24 May

Source: Bloomberg, MUFG