Week in review

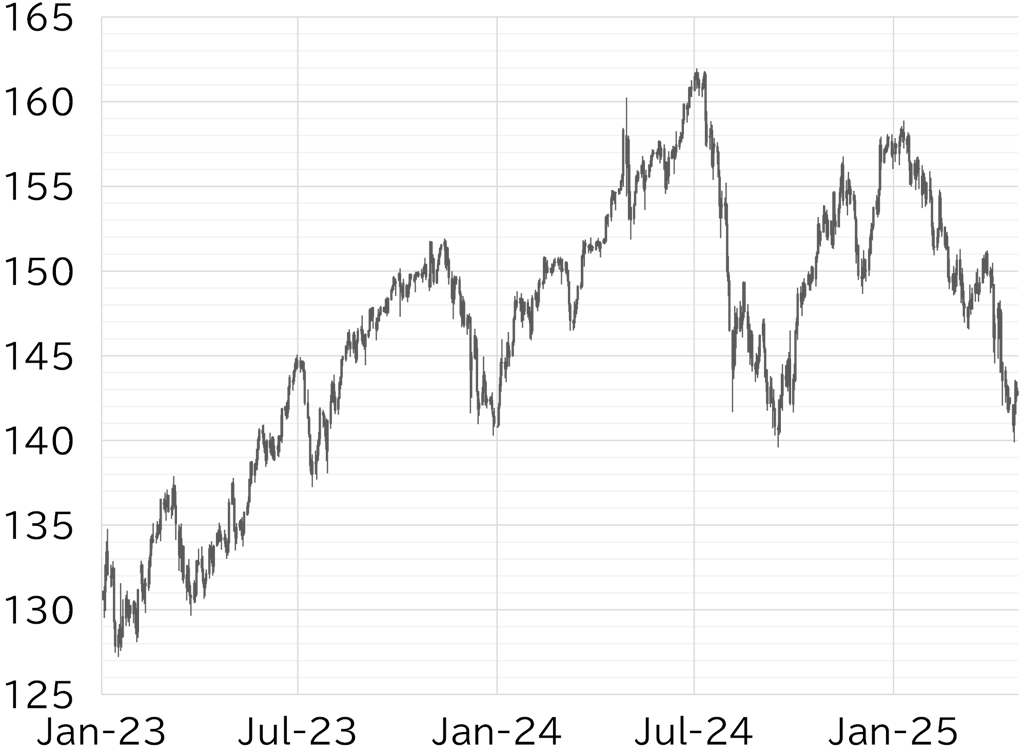

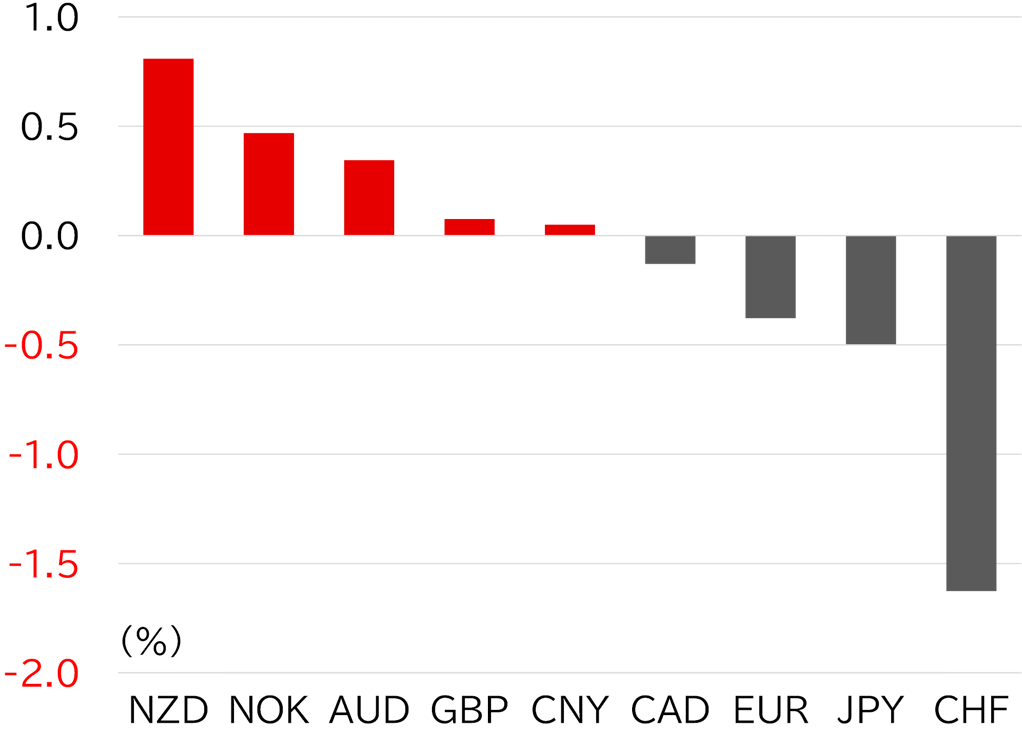

The dollar weakened from the start of the week after senior US officials confirmed that the Trump administration was considering removing Fed Chair Jay Powell. The USD/JPY dropped from above 142 into the 140 range. The decline extended further on 22 April in Tokyo trading after President Trump continued to criticize Powell on social media, with the pair falling to a low of 139.89. The mood shifted in US trading later that day after Treasury Secretary Scott Bessent struck an optimistic tone on trade negotiations with China, prompting a rebound. The USD/JPY rose sharply to below 143.50 in early Tokyo trading on 23 April after President Trump denied reports that he was considering dismissing Powell. The pair then hovered in the 143 range, with upward momentum appearing capped. It rose above 143.50 but remained top-heavy during US hours after Secretary Bessent said no specific target had been set for exchange rates in relation to the US–Japan finance minister talks. The US–Japan finance minister talks on 24 April were closely watched, but Finance Minister Katsunobu Kato made no mention in the press conference of any request from the US side to correct yen weakness, easing expectations of further yen appreciation. The pair recovered back into the 143 range after the press conference and had passed 143.50 at the time of writing following reports that China would ease tariffs on certain US imports (Figure 1). Performance among G10 currencies was mixed this week. The yen, euro, and Swiss franc all weakened, a pattern that likely reflects a rebound in the dollar driven by Powell dismissal concerns being put to rest and hopes for easing US–China tensions (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00 JST on 25 April

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00 JST on 25 April

Source: Bloomberg, MUFG