Week in review

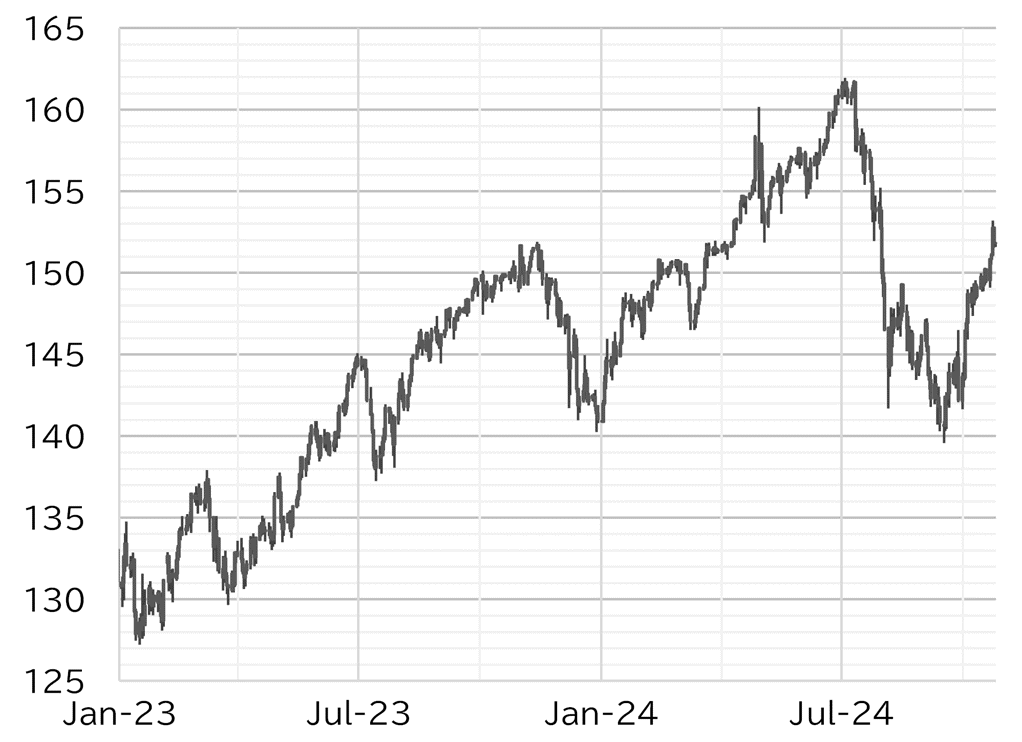

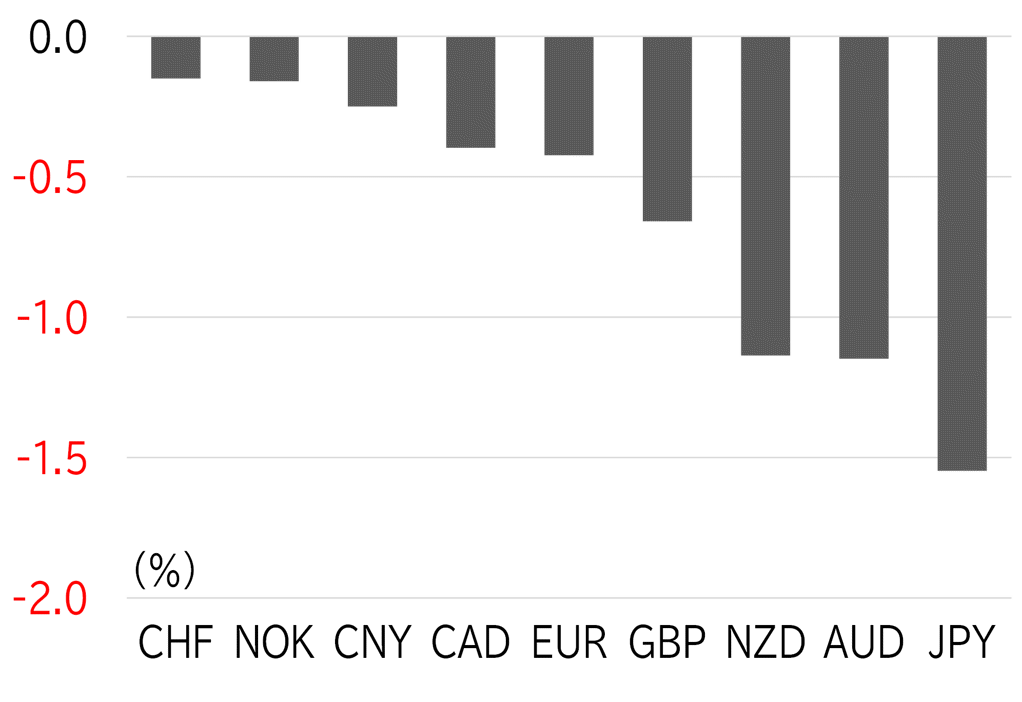

The USD/JPY opened the week at 149.61. The pair fell to the low for the week of 149.09 in the Tokyo session as dollar selling dominated amid a decline in UST yields, then recovered to above 150 in overseas trading hours along with a rise in yields. The USD/JPY rose above 150.50 as expectations of a decline in UST yields receded after several senior Fed officials said a gradual pace of interest rate cuts would be appropriate. Yen buying dominated around the time of the fixing rate announcement on 22 October, but the USD/JPY only fell to around 150.50 before rising above 151 as UST yields rose to the 4.2% level. Dollar buying and yen selling driven by rising UST yields continued on 23 October. The USD/JPY rapidly broke past 152 from the morning in the Tokyo session, then rose to the high for the week of 153.19 after overseas players entered the market. However, the pair did not get established at the 153 level and fell to above 152.50 due to deterioration in US housing data and softening of the US stock market. On 24 October, the dollar was sold due to a decline in UST yields, and verbal intervention from Japanese authorities worked to halt yen selling. The USD/JPY fell back to the upper 151 level after European traders entered the market. The USD/JPY briefly recovered to the low 152 level after US statistics beat market expectations, but quickly lost momentum and fell to above 151.50 along with a further decline in UST yields. On the morning of 25 October, Vice Finance Minister for International Affairs Atsushi Mimura said the government will be increasingly vigilant to currency moves. The yen strengthened slightly in response, but the USD/JPY was trading above 151.50 at the time of writing this report (Figure 1). This week, the dollar strengthened against all major currencies due to the rise in UST yields. The Swiss franc was broadly flat due to risk-off sentiment ahead of major events, and the Norwegian krone was relatively firm as the decline in oil prices halted. Meanwhile, the yen was the worst performer (Figure 2).

FIGURE 1: USD/JPY

Note: Through 10:00 JST on 25 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 10:00 JST on 25 October

Source: Bloomberg, MUFG