Week in review

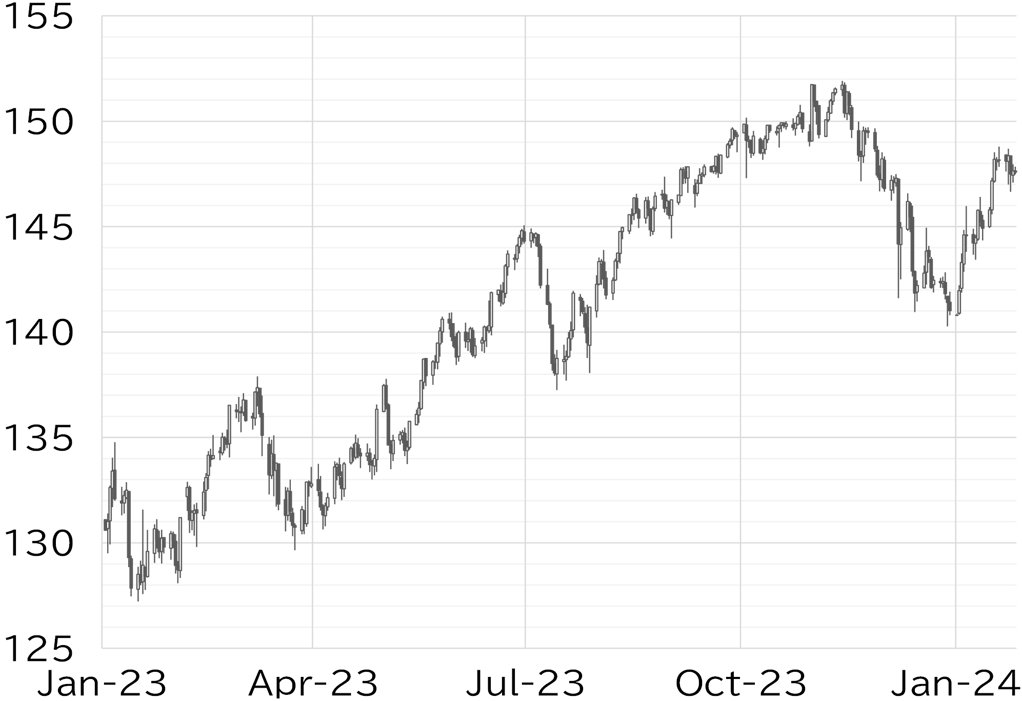

The USD/JPY opened the week at 148.12. The pair traded around 148 driven by the direction of UST yields at the start of the week. At around noon Tokyo time on 23 January, the BOJ announced that it had left policy unchanged at the monetary policy meeting. This pushed the USD/JPY up to around 148.50, but the pair became top heavy as the details of the Outlook Report came to light. Yen buying gathered pace during BOJ Governor Kazuo Ueda's press conference, and the USD/JPY dipped below 147. It rebounded following the press conference and rose to 148.70 and in US trading hours. The USD/JPY moved gradually lower from the morning of 24 January amid dollar selling and yen buying. A decline in the EUR/JPY on weak European economic data weighed on the USD/JPY, and UST yields also fell. As a result, the USD/JPY fell to 146.65 in US trading hours. However, it rebounded to above 147 following the release of unexpectedly strong US PMI data. UST yields rose following a lackluster 5y UST auction, and the USD/JPY rose to around 147.50. It hovered around this level on 25 January, losing a sense of direction. The USD/JPY fell to below 147.50 in US trading hours but had yet to show a clear direction through to the time of writing this report on 26 January (Figure 1).

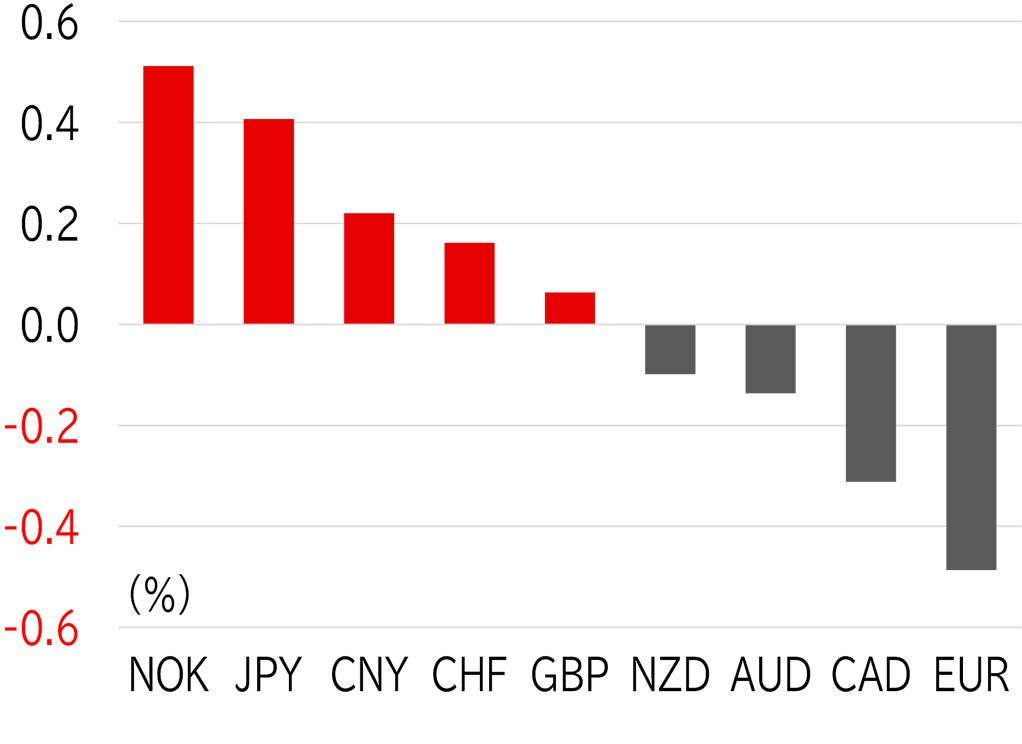

This week, the yen was the best performer among G10 currencies with the dollar sitting in the middle of the pack. The euro softened following ECB President Christine Lagarde's post ECB meeting press conference (Figure 2).

FIGURE 1: USD/JPY

Note: Through 11:00am JST on 26 January

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 11:00am JST on 26 January

Source: Bloomberg, MUFG