Week in review

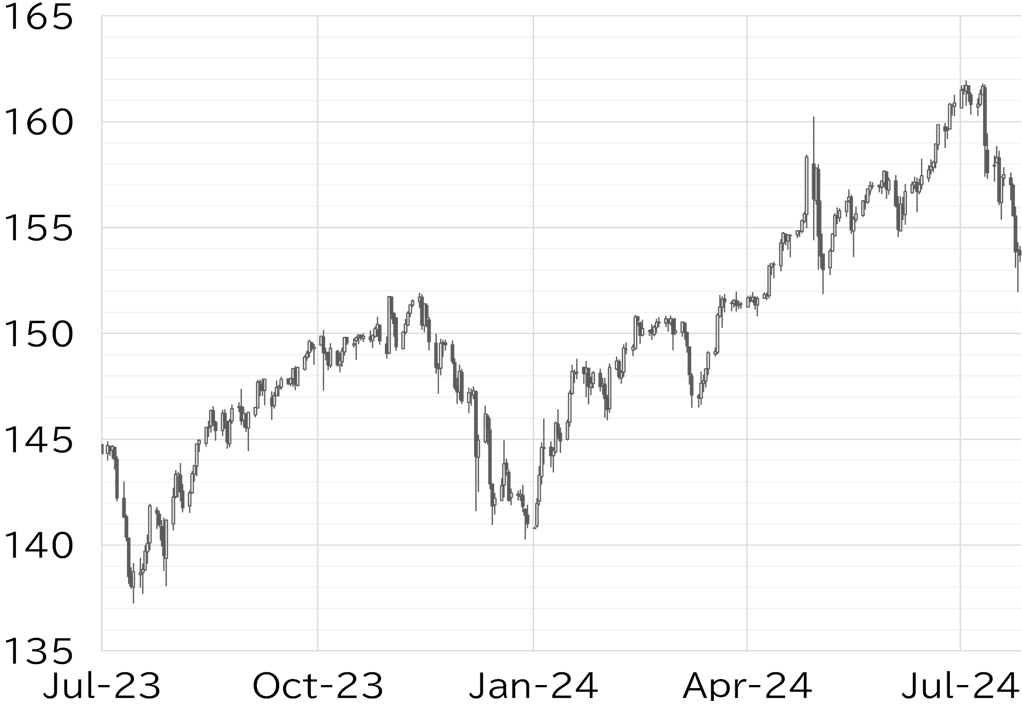

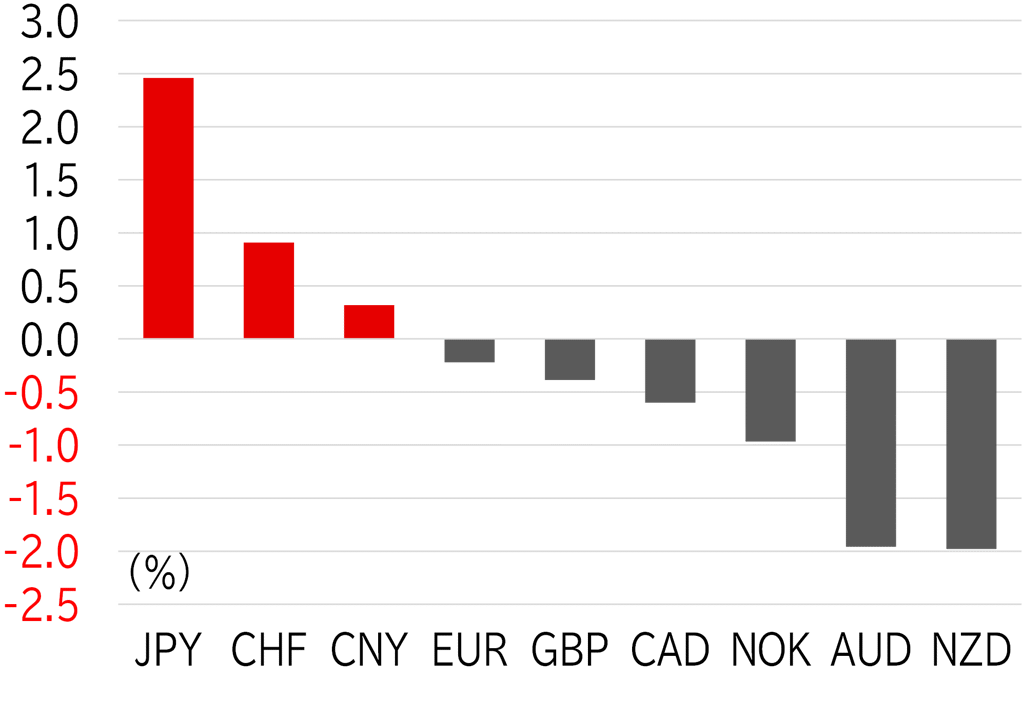

The USD/JPY opened the week at 157.41. It rose slightly to a high for the week of 157.61 around the time of the fixing rate announcement on 22 July amid a lack of any notable catalysts. The People's Bank of China cut several key interest rates, which resulted in a decline in the yuan and the Australian dollar, but yen buying pushed the USD/JPY down to below 156.50. The pair briefly recovered to above 157, but yen buying strengthened from the morning on 23 July following comments by LDP Secretary-General Toshimitsu Motegi's that basically urged the BOJ to raise rates. Yen buying continued amid a fall in oil prices and other risk off moves and the USD/JPY fell to the 155 level. The trend continued on 24 July, with the USD/JPY falling intermittently to below 155 in the Tokyo session and then below 154 in US trading hours. Yen buying also dominated during the Tokyo session on 25 July, with downward pressure around the time of the fixing rate announcement pushing the USD/JPY below 153. The USD/JPY briefly broke below 152 after European investors came online, falling to 151.95 for the first time since 3 May. However, the pair rallied quickly after US real GDP growth in 2Q exceeded market expectations, surging back to the low 154 level. The USD/JPY was top-heavy at this level and was trading above 153.50 from the morning of 26 July (Figure 1). The strongest performers this week were the yen, followed by the Swiss franc, and then the dollar, showing a typical risk-off pattern as last week (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 26 July

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 26 July

Source: Bloomberg, MUFG