Week in review

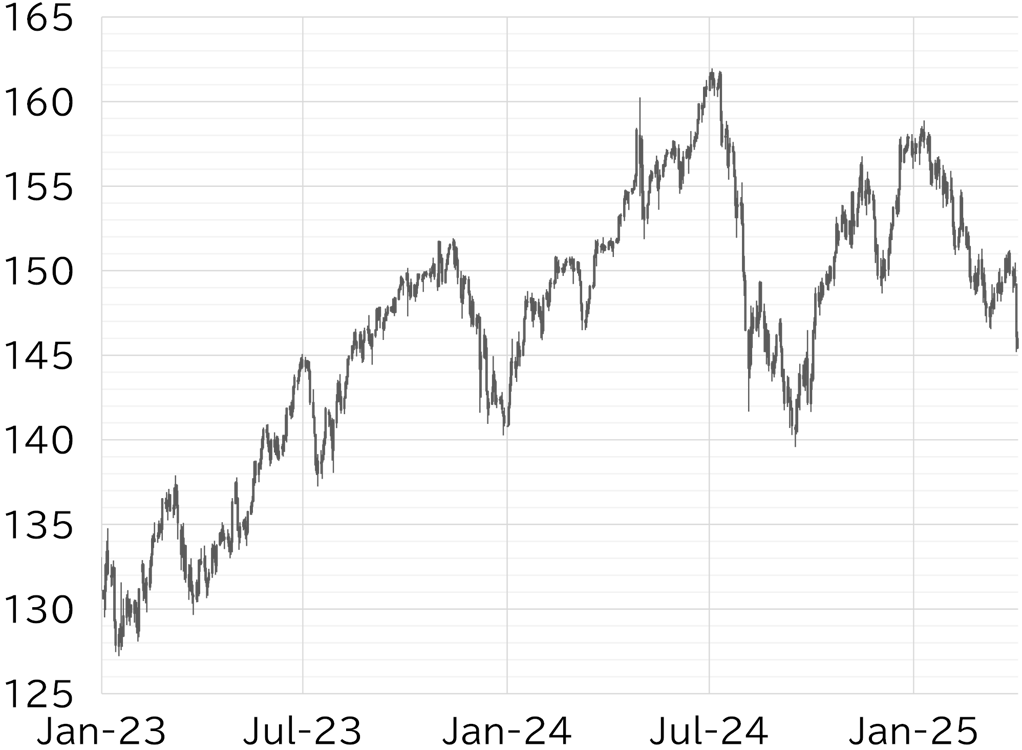

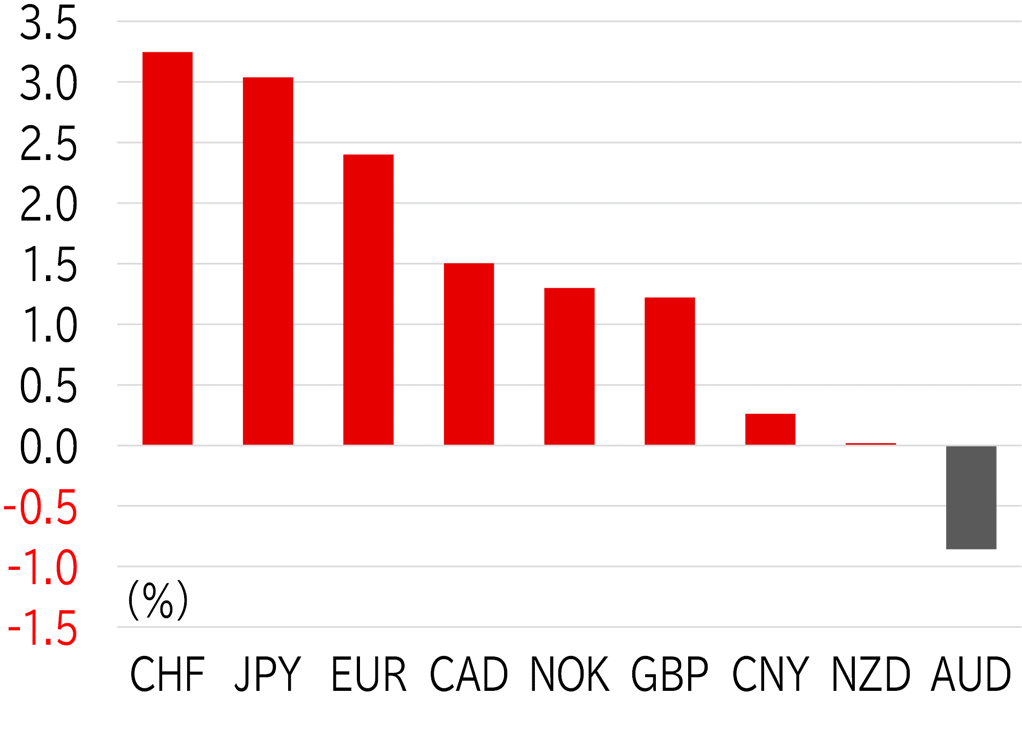

The USD/JPY opened the week at 149.63. The pair slipped below 149 on 31 March after a sharp decline in the Nikkei 225 triggered risk-off yen buying. Concerns over US–Russia relations and a rise in oil prices helped lift the dollar later in the session, pushing the pair back above 150. However, the recovery stalled quickly, and the pair moved lower on 1 April as upward momentum faded from the Tokyo open. Weaker-than-expected ISM manufacturing and JOLTS job openings data released during US trading hours pushed the USD/JPY down below 149. The pair gradually recovered to levels around 150 after markets turned cautious ahead of the US government's tariff announcement scheduled for 2 April. However, the USD/JPY dropped sharply after US President Donald Trump unveiled a new base tariff of 10% and reciprocal tariffs by country early on 3 April Japan time. The initial reaction saw both dollar and yen strength, but the dollar soon weakened across the board, and the USD/JPY remained on a downward trajectory. The pair dropped below 147 toward the end of Tokyo trading and extended losses after overseas markets opened. A downside surprise in the US ISM non-manufacturing index released during US trading hours pushed the pair down to a low of 145.19. The pair has since rebounded slightly, but was still trading top-heavy around 145.50 at the time of writing on 4 April (Figure 1). The dollar weakened across the board among G10 currencies this week. The yen and Swiss franc outperformed, consistent with a classic risk-off environment (Figure 2).

FIGURE 1: USD/JPY

Note: As at 14:00 JST on 4 April

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: As at 14:00 JST on 4 April

Source: Bloomberg, MUFG