Week in review

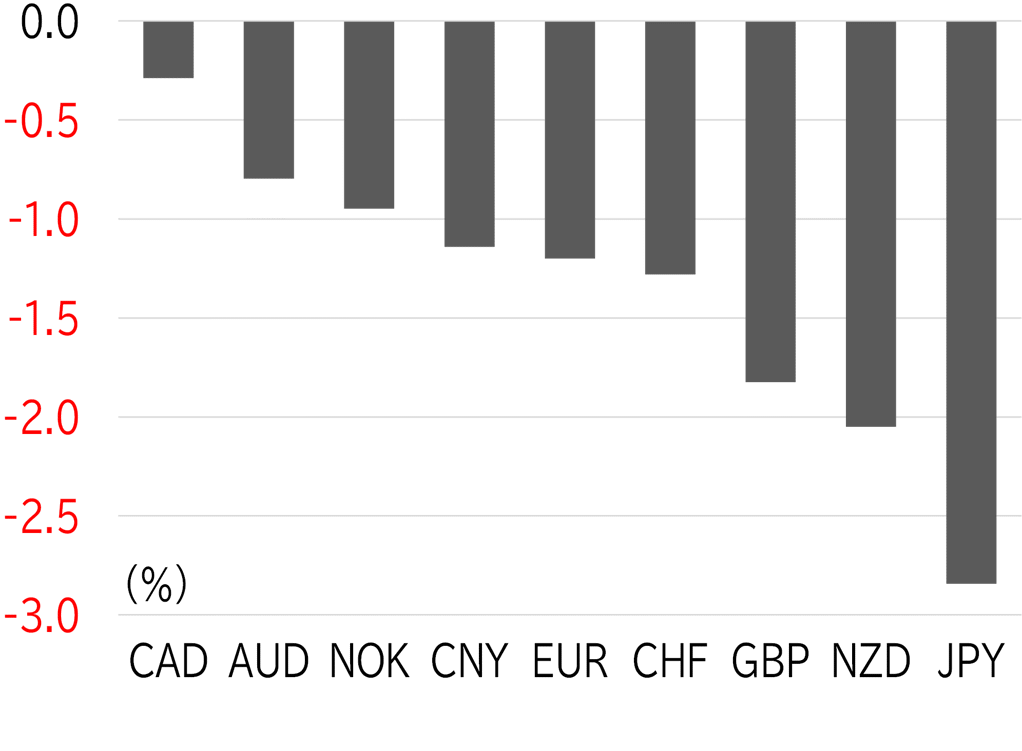

The USD/JPY opened the week at 142.81. The pair fell to 141.65 on Monday 30 September along with a decline in the Nikkei 225 Average but rose back to above 143 after European investors entered the market. In US trading hours, the USD/JPY rose to almost 144 after Fed Chair Jay Powell made hawkish comments, such as that the Fed was not in a hurry to cut rates. The summary of opinions of the September BOJ monetary policy meeting, announced on the morning of 1 October in Tokyo trading hours, contained details in line with comments made by BOJ Governor Kazuo Ueda during his press conference about carefully considering rate hikes while watching the direction of the US and other overseas economies, and this also worked to weaken the yen. The USD/JPY rose to around 144.50, but then fell back due to growing tensions in the Middle East. The pair dipped below 143 after the ISM Manufacturing Index missed the market's forecast. However, the USD/JPY stayed below 143 only briefly, and rose steadily higher on 2 October in the Tokyo session. Yen selling picked up steam and the USD/JPY rose above 144.50 due to Prime Minister Shigeru Ishiba's downbeat comments about rate hikes following his meeting with Governor Ueda on the evening of the 2nd. In addition, the ADP employment report released in US trading hours beat the market's forecast, driving the USD/JPY up to around 146.50. Yen selling dominated on 3 October, supported by strength in the Nikkei 225 Average, and the USD/JPY rose to its high for the week of 147.25. The pair then became top-heavy after dovish BOJ policy board member Asahi Noguchi came out in favor of rate hikes and PM Ishiba and other cabinet members tried to undo the damage. In US trading hours, the USD/JPY rose back to the low 147 level after the ISM Non-Manufacturing Index greatly beat the market's forecast, but the pair remained top-heavy. The USD/JPY had fallen to around 146.50 at the time of writing this report on 4 October (Figure 1). This week, the dollar was strong across the board. Commodity currencies were relatively strong, partly because growing tensions in the Middle East drove up oil prices (Figure 2).

FIGURE 1: USD/JPY

Note: Through 13:00 JST on 4 October

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 13:00 JST on 4 October

Source: Bloomberg, MUFG