Week in review

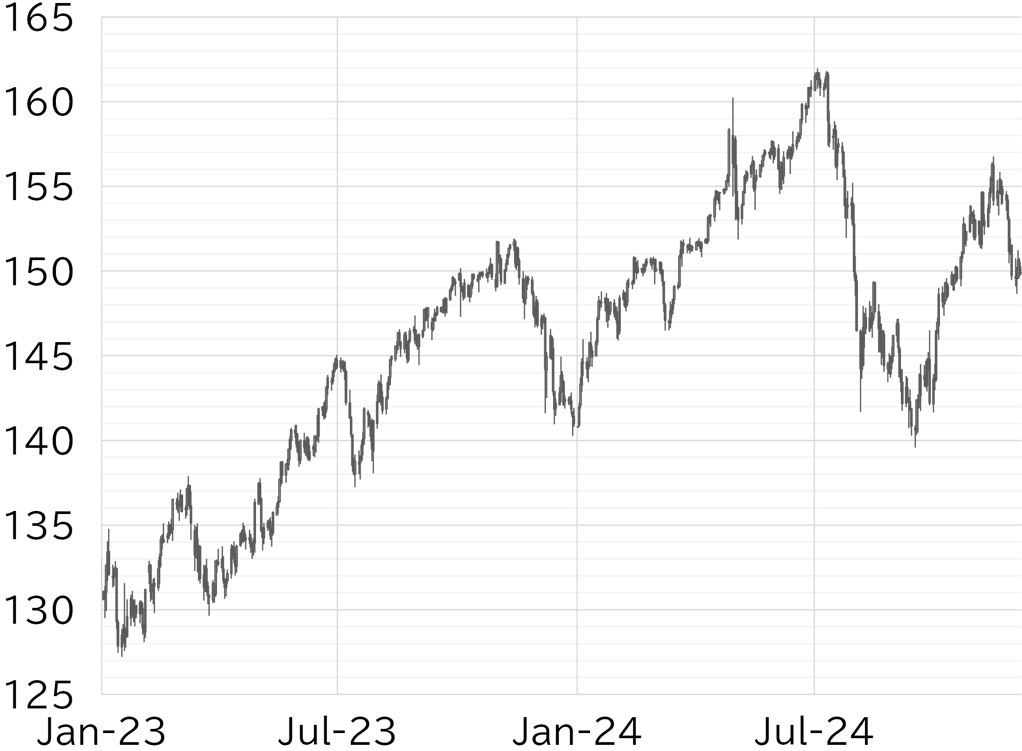

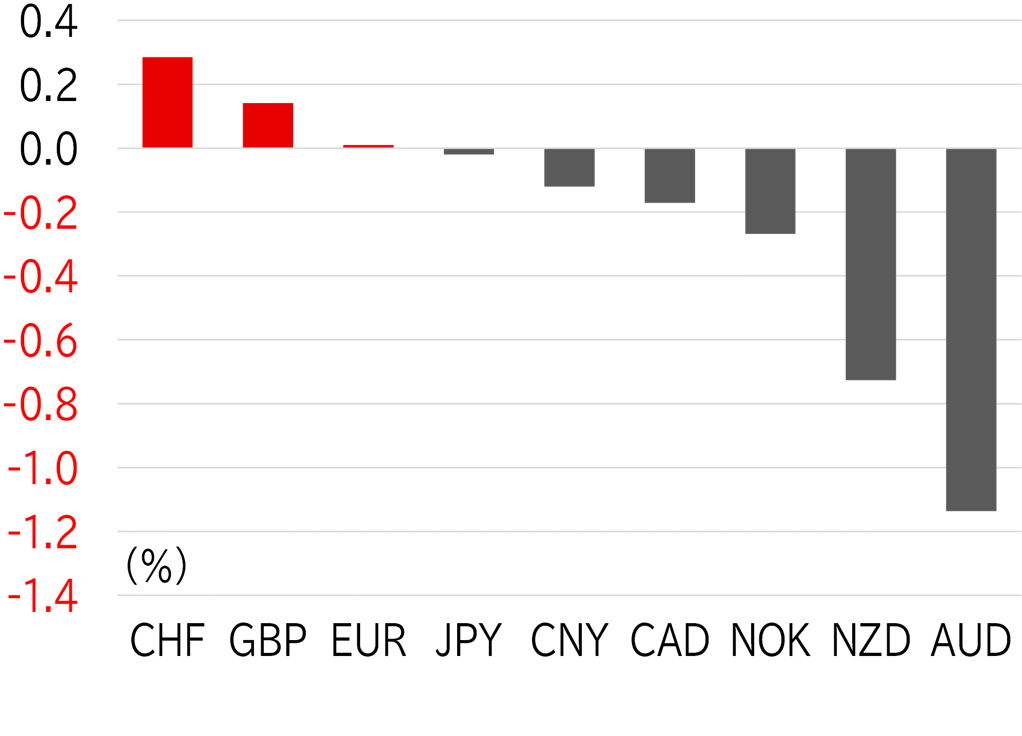

The USD/JPY opened the week at 149.86. The pair rose to around 150.50 on Monday 2 December as yen buying following the Nikkei Shimbun's interview with BOJ Governor Kazuo Ueda over the weekend was not sustained. However, upside was curbed by downward pressure on the euro and other cross yen rates due in part to political turmoil in France, and the USD/JPY fell below 149.50. The market was probably also conscious of Fed Governor Christopher Waller's comment that he is leaning toward a rate cut in December. The USD/JPY rebounded to below 150.50 on 3 December early in the Tokyo session, but the pair became top-heavy after overseas investors entered the market. The USD/JPY fell to around 148.50 in US trading hours as the yen strengthened across the board after the president of South Korea suddenly declared martial law. However, the decline stopped after job openings in the US job openings and labor turnover survey (JOLTs) exceeded market expectations, and yen buying unwound early on 4 December as martial law was lifted in South Korea. The USD/JPY then rose to below 150.50 driven by yen selling following reports by domestic and overseas media outlets speculating that the BOJ would postpone a rate hike in December. The pair was pushed down to around 150 as the dollar softened due to an unexpectedly weak ISM non-manufacturing index, but recovered back to around 150.50 after Fed Chair Jay Powell said the US economy is in very good shape and that he saw room to proceed cautiously with rate cuts. The USD/JPY traded below 150.50 early in the Tokyo session on 5 December, but fell to above 149.50 after BOJ policy board member Toyoaki Nakamura in an afternoon press conference appeared hawkish by indicating he was open to an interest rate hike in December. However, the USD/JPY remained bottom-firm at this level on 6 December, trading around 150 ahead of the US payrolls report (Figure 1). Among G10 currencies this week, European currencies were fairly strong, while the Australian dollar was notably weak following soft GDP data (Figure 2).

FIGURE 1: USD/JPY

Note: Through 12:00 JST on 6 December

Source: EBS, Refinitiv, MUFG

FIGURE 2: MAJOR CURRENCIES' RATE OF CHANGE VS USD THIS WEEK

Note: Through 12:00 JST on 6 December

Source: Bloomberg, MUFG