Key Points

Please click on download PDF above for full report

- Bank Negara Malaysia kept its overnight policy rate unchanged at 3.00%, given a resilient domestic demand outlook and manageable inflation. This marks the 11th straight meeting that the central bank has stood pat. Today’s policy decision is also in line with our and market expectations. BNM has largely continued with its neutral tone in the monetary policy statement, despite the US raising tariffs by 20% on imports from China so far this year. The central bank assessed that at the current level of policy rate, it is consistent with their assessment of growth and inflation dynamics.

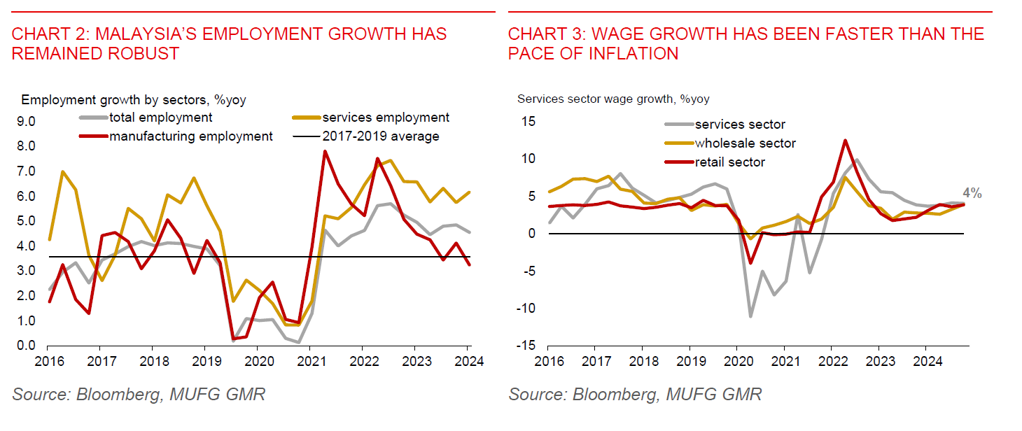

- Policymakers still see economic risks as evenly balanced for now, though. Despite global uncertainties, BNM expects the positive growth momentum seen in 2024 can be sustained this year, anchored by domestic demand. Overall employment grew 4.6%yoy in Q4 2024, higher than the 2017-2019 pre-Covid average of 3.6%yoy. Notably, services employment has been robust, growing 6.2% in Q4, up from 5.7%yoy in Q3, though manufacturing employment growth softened to 3.2%yoy from 4.1%yoy in Q3. In addition to that, wage growth in the services sector was still healthy at 4%yoy, which was faster than the pace of inflation at 1.7%yoy in January.

- The ongoing tech cycle upturn, along with Malaysia’s multi-pronged approach to move up the semiconductor value chain, should also bode well for the sector’s outlook over the medium term. Malaysia has benefitted from higher approved foreign investment in the electrical and electronic sectors since 2021, while the state of Johor is fast becoming the city’s new data centre hub. And notably, semiconductor has been a dominant driver of export performance. In addition to that, local investment has been a bright spot with robust investor participation, especially in the services sector such as information and communications and real estate. In the first 9 months of 2024, local approved investments jumped 48.2%yoy to MYR143.4bn.

- However, BNM remains cognizant of the increasing downside risk to economic growth, which could stem from a slowdown in major trading partners due to higher US tariffs. While Malaysia is likely less exposed to Trump’s reciprocal tariff hikes, the country’s trade openness still makes it vulnerable to escalating global trade frictions. In its policy statement, the central bank has said that the outlook for global growth, inflation, and trade is subject to considerable uncertainties due to tariffs. Also, comparing the policy statement in March with that in January, the central bank has replaced the phrase “heightened risk of trade” with “significant uncertainties surrounding trade policies”.

- Meanwhile, BNM expects headline inflation will remain manageable, adding that the impact on inflation from an upward revision to minimum wage and public servant salaries will be limited. We also think the government’s plan to rationalise RON95 fuel subsidies around mid-2025 will not be a major inflation problem. We estimate that a more targeted RON95 fuel subsidy policy would add only 0.5ppt to headline inflation in H2, which could push inflation above 2.5%, but still manageable. Moreover, global commodity prices have been declining, which will provide a partial offset. We look for Malaysia’s inflation to average 2.4% in 2025, from 1.8% in 2024.

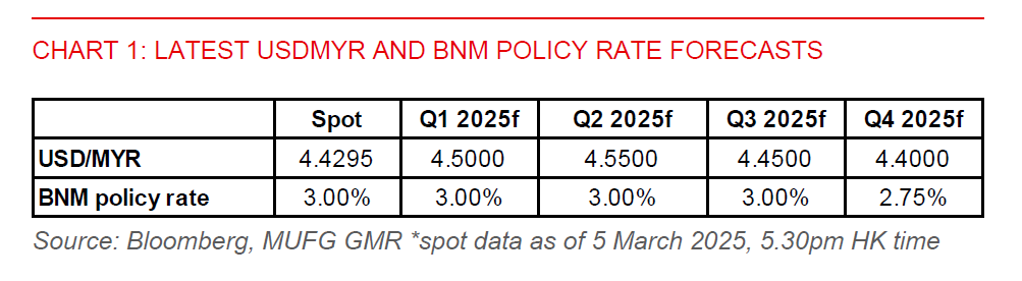

- In terms of our USDMYR outlook, we maintain our forecast for it to rise to 4.5500 level by Q2, in anticipation of more US tariff actions in April and greater financial market volatility. A key risk will stem from Trump’s threat to impose 25% tariff on semiconductors, which could hurt Malaysia’s manufacturing and export outlook. Should there be a significantly large negative economic shock, the BNM would likely cut the policy rate, which could put more pressure on the ringgit. But for now, we look for BNM to keep its policy rate at 3.00% for most part of this year, before possibly easing once by 25bps to 2.75% in Q4 on the back of potentially lower fed funds rate by then.