Key Points

Please click on download PDF above for full report.

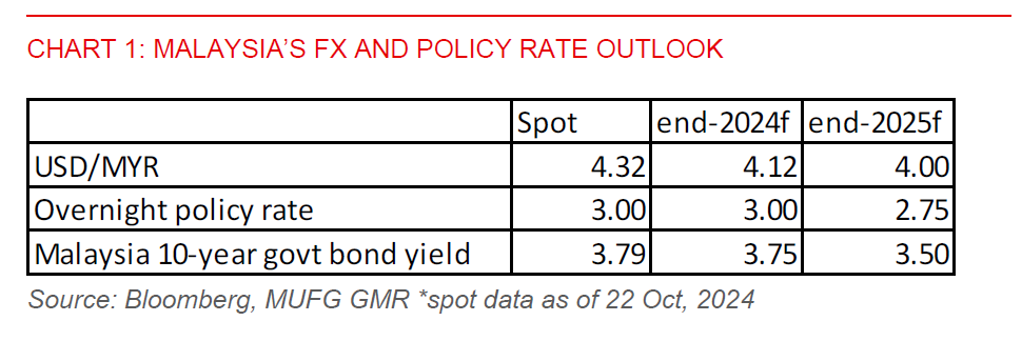

- Despite recent weakness amid global uncertainties, we hold a positive outlook on Malaysia’s ringgit-denominated government bonds, given the government’s commitment to fiscal consolidation in 2025 and manageable inflation. This, along with our anticipation for more Fed rate cuts next year, should provide tailwinds for the ringgit too. We forecast Malaysia’s 10-year government bond yield to fall to 3.50% by end-2025 (from 3.79% currently) and the ringgit to appreciate to MYR4.00/USD by end-2025 (from 4.32 at the time of writing).

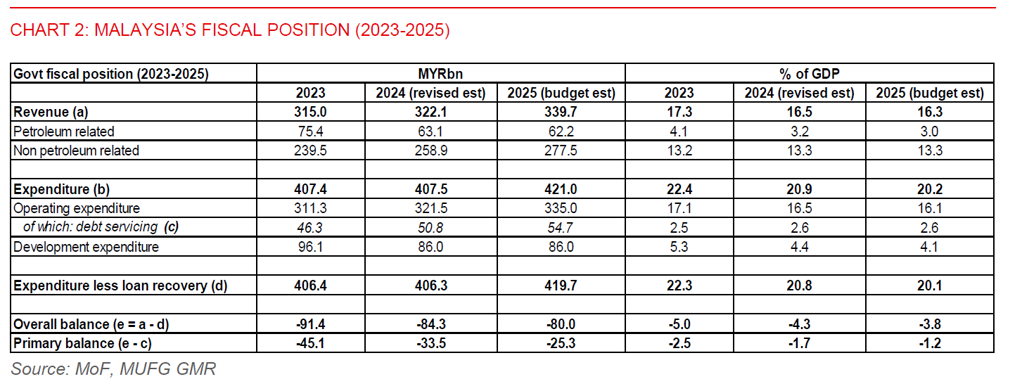

- Prime Minister Anwar recently delivered the budget for 2025, which shows that the government plans to run a narrower fiscal deficit of 3.8% of GDP next year, from an estimated 4.3% in 2024. This will help keep public debt levels in check and rebuild the fiscal buffer to cope with future economic shock. The fiscal tightening would pose some drag on growth, but a stronger outlook for domestic demand could provide a partial offset.

- A key fiscal measure is to remove RON95 fuel subsidies from mid-2025 for the top 15% of consumers, which include wealthy individuals, foreign nationals, and businesses. This could help save the government MYR8bn, narrowing the fiscal deficit by 0.4% of GDP. But this will also add about 0.5ppt to headline inflation. Still, inflation will likely remain manageable. And with the Fed likely cutting rates into 2025, there may be room for BNM to cut the overnight policy rate once by 25bps next year.

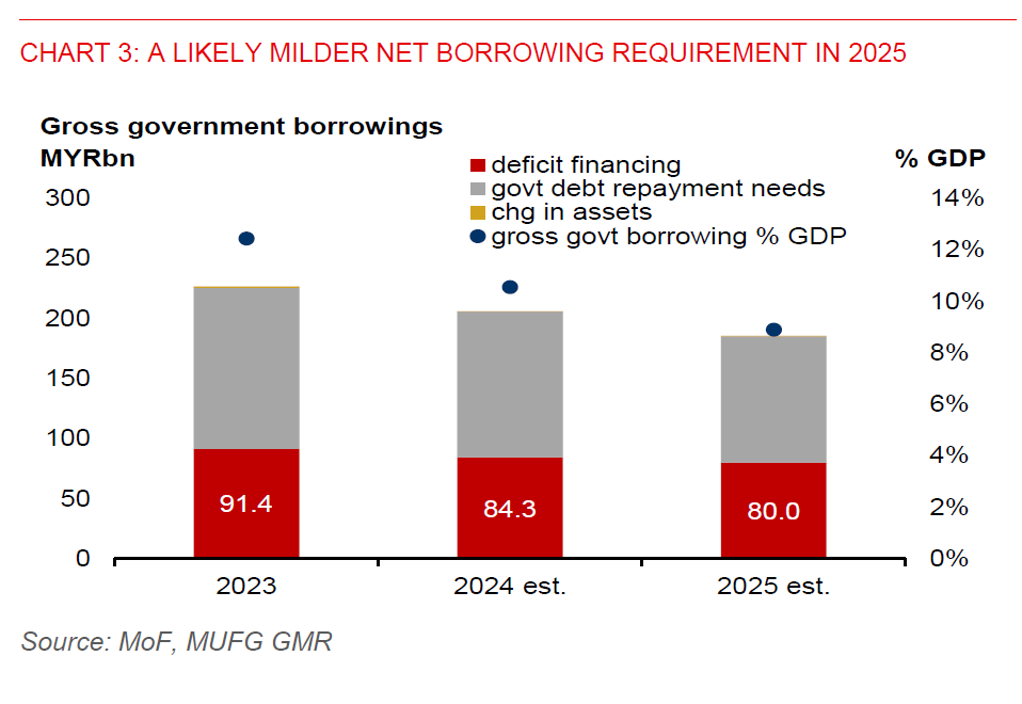

- Based on Budget 2025, fiscal deficit financing is set to narrow to MYR80bn in 2025, from MYR84.3bn in 2024. This, along with a reduction in government debt repayment needs, suggest smaller borrowing requirements next year. We expect gross government borrowings will fall to 9% of GDP (MYR185.4bn) in 2025, from 10.6% (MYR206bn) in 2024 and 12.4% (MYR226.6bn) in 2023, which should help constrain bond supply. Measures to widen the tax base will also be crucial for fiscal consolidation efforts, given Malaysia’s relatively low tax ratio of 12.6%.