Key Points

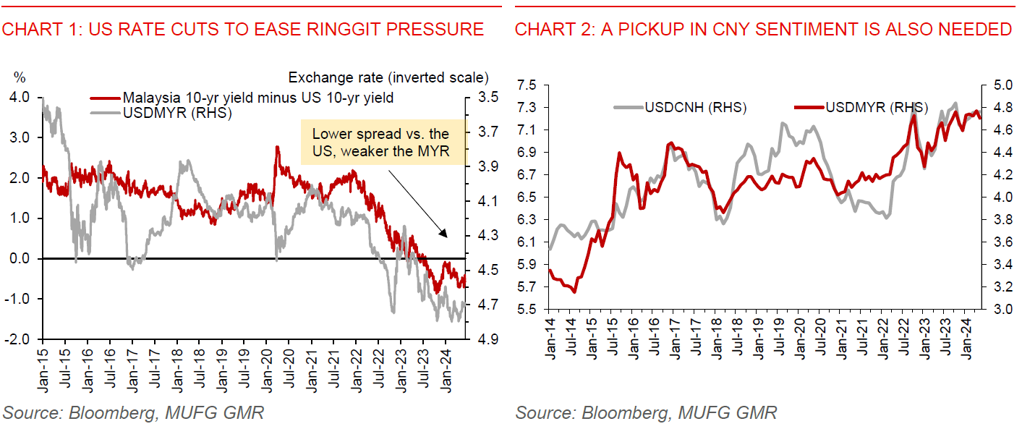

- The diesel subsidy rationalisation move on 10 June will help marginally improve government finance (+0.2% of GDP), while having only limited impact on inflation (+0.1ppt). The impact on consumers will also be softened by the government’s offset measures. In terms of FX impact, we think this policy has not moved the needle on our short-term outlook for the Malaysian ringgit. We maintain our forecast for the ringgit to remain weak at around 4.75 against the US dollar in the next 3 months. Ringgit reprieve will likely only come when the US Fed lowers interest rates and sentiment towards CNY improves.

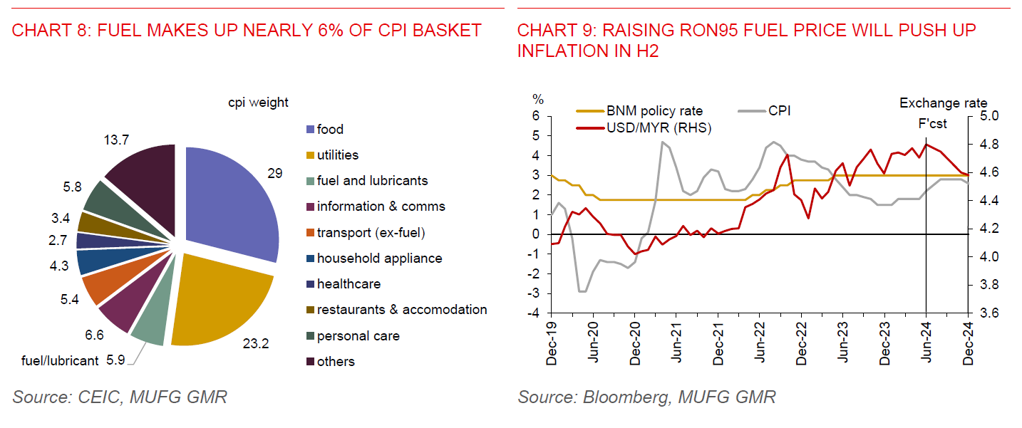

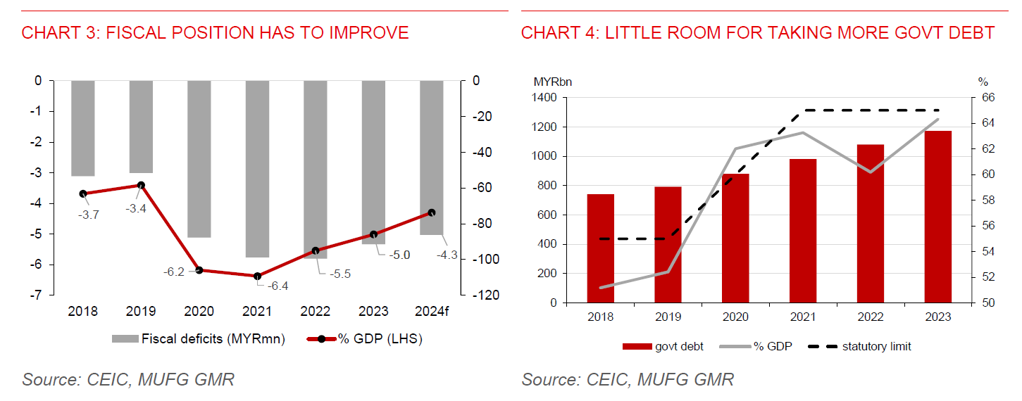

- With government debt nearing its statutory threshold of 65% of GDP, there is hardly any room left for taking on more debt (Chart 4). The government will have to raise rationalise fuel subsidies and pay down its debt, or further raise the statutory limit. Raising RON95 fuel price will have a bigger inflation impact, given its relatively larger weight in the CPI basket. Every 10% increase in RON95 fuel price will add 0.6ppt to inflation. It will also likely be necessary to lift the price of RON95 fuel if the government wants to narrow its fiscal deficit to 4.3% of GDP this year as planned, from 5% of GDP deficit in 2023 (Chart 3).

- Over the medium term, our outlook for the ringgit remains positive, partly in anticipation of an eventual decline in the US policy rate and partly as the diesel subsidy rationalisation marks the start of fiscal consolidation. Fiscal risk has been a concern, following large Covid-induced outlay and a substantial rise in fuel subsidies brought about by the surge in crude oil prices during 2022 (Charts 5 and 6). Notably, diesel subsidies rose to MYR14.3bn in 2023, from just MYR1.4bn in 2019.

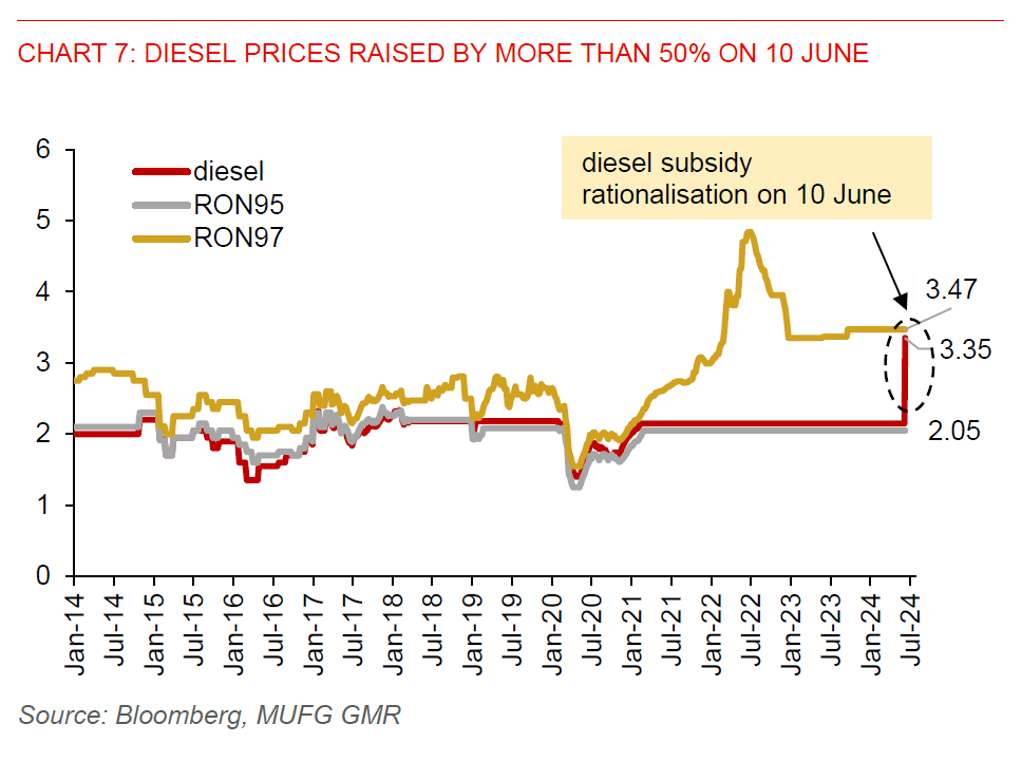

- On June 10, the government raised the retail price of diesel by MYR1.20/litre (+55.8%) to MYR3.35/litre, which is the average market price seen in May based on the Automatic Pricing Mechanism (Chart 7). Based on the government’s estimate, this move will save MYR4bn of spending, implying a narrowing of the fiscal deficit by about 0.2% of GDP. The impact on inflation will likely be limited, though, at just +0.1ppt, given diesel’s negligible share in the CPI basket.

- Meanwhile, we believe the impact on consumers will be offset by the government’s supportive measures. These measures include widening the scope of subsidised diesel to 23 eligible types of commercial vehicles, up from 9 types previously, distributing monthly cash assistance to eligible individuals worth MYR200 per month (known as Budi Mandani cash assistance), and continuing the diesel subsidy especially for the low-income group (including fishermen and farmers).

- While the diesel subsidy reform is a positive step, more subsidy cuts will likely be needed to narrow the fiscal deficit to 4.3% of GDP as planned for this year. The government has planned to cut the subsidy by MYR11.5bn, based on its 2024 budget. The measures that have been taken so far – raising diesel prices (MYR4bn/year) and lifting subsidies for chicken and eggs (MYR3.8bn/year) in November 2023 - add up to only about MYR7.8bn of potential fiscal savings per year. This leaves another MYR3.7bn of subsidy cut that is required.

- We expect the government will rationalise RON95 fuel subsidies this year. In a scenario where the government lifts RON95 fuel prices at the start of H2, we estimate prices will have to be raised by 35sen to MYR2.40/litre, or about 17% higher than the subsidized price of MYR2.05/litre. This would add about 1ppt to headline inflation, given fuel accounts for about 5.9% of the CPI basket (Chart 8). This, along with inflation that averaged just 1.7% in the first four months of this year, has led us to forecast headline inflation to average 2.3% in 2024 (Chart 9). But we are cognizant that this inflation outlook could understate the extent of indirect second round price effects. Given the upside risk to inflation, we think BNM is in for a prolonged rate pause at 3%. A slower pace of rationalising RON95 fuel price also means that prices will have to be raised by much more to achieve the remaining MYR3.7bn of required cuts.