Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

CARLOS PEDROSO

Chief Economist

Banco MUFG Brasil S.A.

E: cpedroso@br.mufg.jp

MAURICIO NAKAHODO

Senior Economist

Banco MUFG Brasil S.A.

E: mnakahodo@br.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

April 2024

KEY EVENTS IN THE MONTH AHEAD

1) ECB MEETING A KEY HIGHLIGHT IN APRIL

The US dollar was close to unchanged in March with G10 FX volatility remaining subdued at the low levels that prevailed prior to the global inflation shock hitting the financial markets. The EUR/USD trading range in Q1 was the narrowest since Q3 2021. When looking at OIS pricing for upcoming rate cuts, the ECB cutting in June is now priced with most conviction. In that context, the ECB meeting on 11th April will be a key event this month with guidance on the potential for a rate cut key for EUR performance. We suspect the pricing should be endorsed but there will be an inevitable degree of caution given the near two-month period of time before the June meeting. ECB rhetoric certainly does suggest a building consensus for a rate cut in June – data permitting. The BoC and the RBNZ (& BoJ; see below) are the other G10 central banks meeting this month. The BoC will be in a similar position in terms of guidance ahead of the June meeting although expectations of a BoC rate cut in June are not as high as for the ECB. April is much too soon for any action from the RBNZ but weak data (recession confirmed in GDP data for Q3 & Q4) points to a notable impact from restrictive policy that warrants at least a more dovish communication that sees the RBNZ bringing forward into 2024 a potential rate cut.

2) BOJ MEETING AND WAGE DATA IN FOCUS

Given the significant change in policy announced by the BoJ in March, there will be a high level of focus on the BoJ meeting on 26th April. The BoJ will also provide its updated GDP and inflation forecasts which will likely reveal a higher level of conviction on achieving its price stability goal. Prior to the meeting we will also have the 3rd estimate from Rengo on the outcome of ‘Shunto’ wage negotiations that look set to show an agreed wage increase of over 5.00%. The 2nd estimate came in at 5.25%, down from the first estimate of 5.28%. The 2nd estimate tally a year ago was 3.76%. The third estimate is scheduled to be announced on 4th April. The wage agreement will likely have consequences for the BoJ updated inflation forecasts and forecasts that imply the price stability goal will likely mean Governor Ueda is set to communicate the prospect of additional rate hikes going forward. While Governor Ueda implied that in March he may use the published forecasts as reason to communicate the message more explicitly.

3) CHINA’S RMB FOREIGN EXCHANGE POLICY AND PBOC’S POLICY DIRECTION IN GENERAL

We saw some unclear policy signals recently, from the USD/CNY fixing on 22nd March, to President Xi’s old Speech on China’s monetary tools. The tense reaction from market participates shows the stress in the market towards the Chinese economy and the currency. Having said that, there are signs of improvement in the Chinese economy, so we need to closely monitor economic developments.

Forecast rates against the US dollar - End-Q2 to End-Q1 2025

|

Spot close 28.03.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

JPY |

151.31 |

145.00 |

142.00 |

140.00 |

138.00 |

|

EUR |

1.0802 |

1.0900 |

1.1200 |

1.1200 |

1.1400 |

|

GBP |

1.2639 |

1.2750 |

1.3020 |

1.2950 |

1.3100 |

|

CNY |

7.2255 |

7.1500 |

7.0000 |

6.9000 |

6.8000 |

|

AUD |

0.6524 |

0.6650 |

0.6900 |

0.7000 |

0.6900 |

|

NZD |

0.5983 |

0.6200 |

0.6300 |

0.6400 |

0.6400 |

|

CAD |

1.3535 |

1.3500 |

1.3200 |

1.3000 |

1.3200 |

|

NOK |

10.840 |

10.642 |

10.268 |

10.089 |

9.8250 |

|

SEK |

10.685 |

10.642 |

10.268 |

10.1790 |

9.8250 |

|

CHF |

0.9007 |

0.9080 |

0.9020 |

0.8930 |

0.8950 |

|

|

|

|

|

|

|

|

CZK |

23.397 |

23.390 |

22.950 |

22.860 |

22.370 |

|

HUF |

364.66 |

362.40 |

357.10 |

361.60 |

359.60 |

|

PLN |

3.9855 |

3.9450 |

3.8840 |

3.8840 |

3.8600 |

|

RON |

4.5991 |

4.5690 |

4.4730 |

4.5000 |

4.4390 |

|

RUB |

92.311 |

93.220 |

92.980 |

94.880 |

96.900 |

|

ZAR |

18.943 |

19.400 |

19.300 |

19.100 |

19.200 |

|

TRY |

32.313 |

35.000 |

37.750 |

40.250 |

42.000 |

|

|

|

|

|

|

|

|

INR |

83.400 |

83.000 |

82.500 |

82.000 |

81.500 |

|

IDR |

15853 |

15850 |

15680 |

15500 |

15400 |

|

MYR |

4.7320 |

4.7300 |

4.6600 |

4.6000 |

4.5700 |

|

PHP |

56.310 |

56.000 |

55.700 |

55.300 |

55.000 |

|

SGD |

1.3494 |

1.3400 |

1.3300 |

1.3200 |

1.3000 |

|

KRW |

1345.9 |

1320.0 |

1295.0 |

1275.0 |

1265.0 |

|

TWD |

31.985 |

31.600 |

31.300 |

31.150 |

31.050 |

|

THB |

36.426 |

36.000 |

35.500 |

34.800 |

34.500 |

|

VND |

24781 |

24800 |

24800 |

24800 |

24800 |

|

|

|

|

|

|

|

|

ARS |

857.54 |

915.00 |

1000.00 |

1600.0 |

1700.0 |

|

BRL |

5.0023 |

4.9200 |

4.9300 |

4.9500 |

4.9500 |

|

CLP |

981.60 |

975.00 |

980.00 |

980.00 |

980.00 |

|

MXN |

16.628 |

17.300 |

17.400 |

17.500 |

17.600 |

|

|

|||||

|

Brent |

87.31 |

86.00 |

88.00 |

91.00 |

95.00 |

|

NYMEX |

82.62 |

81.00 |

83.00 |

86.00 |

90.00 |

|

SAR |

3.7505 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

47.322 |

46.000 |

45.000 |

45.500 |

45.800 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 28.03.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

USD/JPY |

151.31 |

145.00 |

142.00 |

140.00 |

138.00 |

|

EUR/USD |

1.0802 |

1.0900 |

1.1200 |

1.1200 |

1.1400 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

139.00-155.00 |

136.00-152.00 |

134.00-150.00 |

132.00-148.00 |

|

|

EUR/USD |

1.0400-1.1300 |

1.0600-1.1500 |

1.0800-1.1700 |

1.0900-1.1900 |

MARKET UPDATE

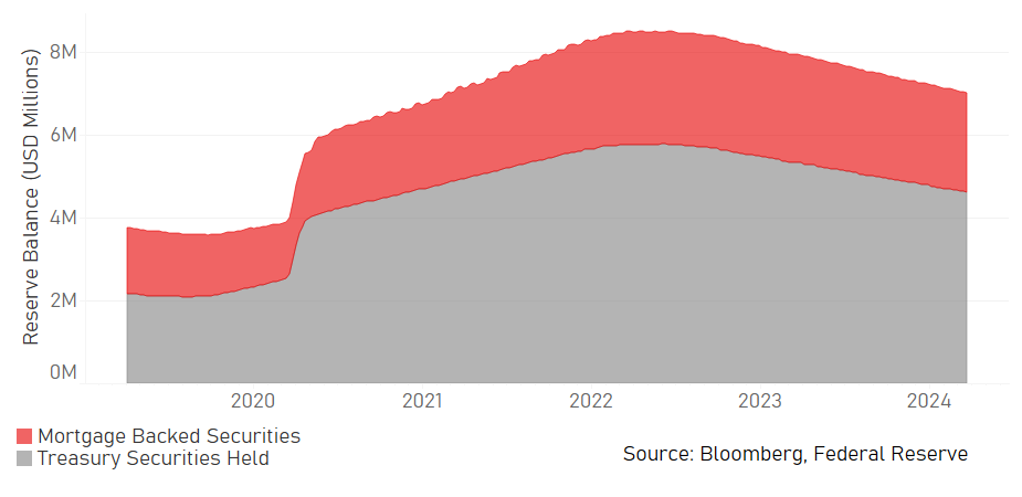

In March the US dollar strengthened very modestly against the euro in terms of London closing rates, from 1.0808 to 1.0802. The dollar strengthened more clearly versus the yen, from 149.82 to 151.31. The FOMC at its meeting in March held the fed funds rate at a range of 5.25% to 5.50%. The FOMC continued with its policy of reducing its securities holdings with QT ongoing at a pace of USD 95bn worth of UST bonds (USD 60bn) and MBS (USD 35bn) of balance sheet reduction each month, although the pace of QT looks set to be tapered, with a formal updated guidance possibly delivered at the next meeting in May.

OUTLOOK

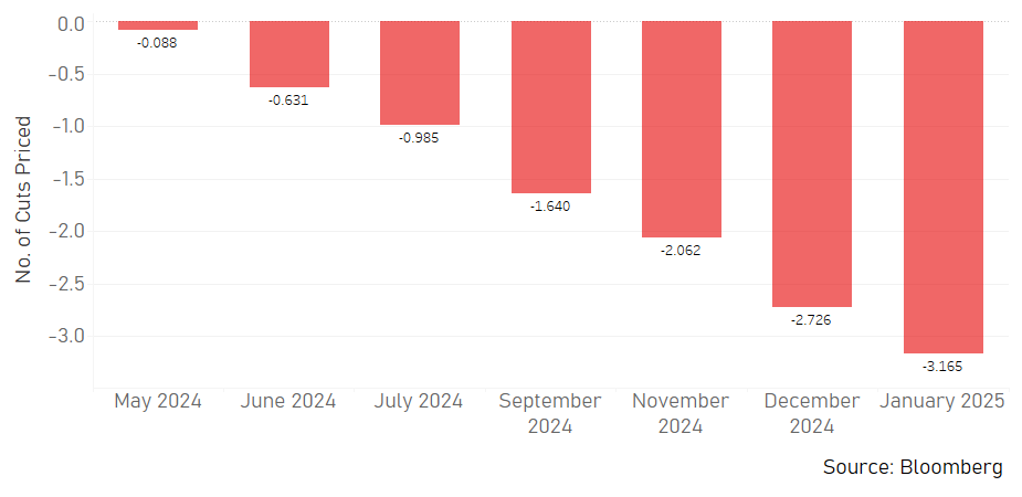

The US dollar had another month of trading in a narrow range and closed March close to unchanged with low FX volatility reflecting the lack of expected divergence across the major economies. At the end of March five of the G10 central banks were priced at around 20bps or more of easing at the June meeting while the cumulative total of monetary easing in 2024 is within 20bps (80bps to 100bps) amongst the same five central banks. The pricing for the US commencing cuts in June looks accurate to us but we suspect the Fed will ultimately cut by 125bps, so more than currently priced and part of our reasoning for clearer USD depreciation in H2. Our take of the FOMC press conference is that Powell communicated in a way consistent with a central bank wanting to commence easing. The Fed SEP forecasts showed an increase in GDP forecast for this year (2.1% vs 1.4%) and increased in core PCE (2.6% vs 2.4%) but maintained the median dot profile of three rate cuts this year. That guidance we believe helped temper dollar strength in March.

The guidance to cut rates three times suggests to us that the FOMC sees downside risks to the forecasts and hence wishes to act to counter those risks. The consumer side of the economy looks to be slowing. Nominal retail sales are 2.7% lower in Q1 to date versus Q4 in annualised terms and other data points to strains increasing. The delinquency rate on credit card debt has hit 4%, the highest since the GFC with interest rates charged at a record high. While a relatively small portion of the economy it’s an indication that the excess covid savings support is no longer a supportive factor. SMEs in the US also look to be under increased strain. Credit availability is restrictive according to NFIB data while the NFIB Hiring Plan Index has declined to levels not seen since the pandemic suggesting weakening labour demand ahead. As the economy shows clearer signs of weakening over the coming months, we expect rate cut expectations to increase and prompt further US dollar weakness going forward.

The US dollar is set to break out of the recent narrow trading range, with a move to the downside as the Fed starts to cut rates. The scale of dollar depreciation will also be dependent on global economic conditions. Only marginal improvement in global growth is expected and hence only moderate USD weakness is expected.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

5.33% |

5.13% |

4.63% |

4.13% |

3.63% |

|

3-Month T-Bill |

5.37% |

5.00% |

4.50% |

4.00% |

3.50% |

|

10-Year Yield |

4.31% |

4.13% |

3.75% |

4.00% |

3.75% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

With the 1st quarter in the books for 2024, we take a look back at how rates markets have performed relative to our original and slightly revised forecasts from the last monthly. In hindsight, we should have just kept our rates path unchanged from our initial 2024 outlook (excluding the Fed Funds rate – which we’ll get to in a moment). Granted, our last update took up forecasts by 25-38bps, we now lower our rate path by 13-25bps for certain quarters to reflect where Q1 levels are ending and how such a starting point compares to our macro and Fed expectations. Speaking of, post the dovish March FOMC meeting, where the Fed kept 3 cuts as a minimum for 2024 (as we expected), we officially shifted back our first cut to June. We believe that the QT adjustment will take place at the May FOMC opening the door for the first cut to likely take place in June. Now, as we have been saying for the last few updates, if the Fed isn’t ready by then, we will just push back the start of the easing cycle one meeting at a time. We continue to see risks over the horizon but the Fed might want to actually see a catalyst surface before cutting. So its June or July or bust.

(George Goncalves)

FED’S HOLDINGS OF TREASURY SECURITIES AND MBS

NUMBER OF FED CUTS (25BPS) PRICED

Japanese yen

|

Spot close 28.03.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

USD/JPY |

151.31 |

145.00 |

142.00 |

140.00 |

138.00 |

|

EUR/JPY |

163.45 |

158.10 |

159.00 |

156.80 |

157.30 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

139.00-155.00 |

136.00-152.00 |

134.00-150.00 |

132.00-148.00 |

|

|

EUR/JPY |

151.00-167.00 |

150.00-166.00 |

149.00-165.00 |

147.00-164.00 |

MARKET UPDATE

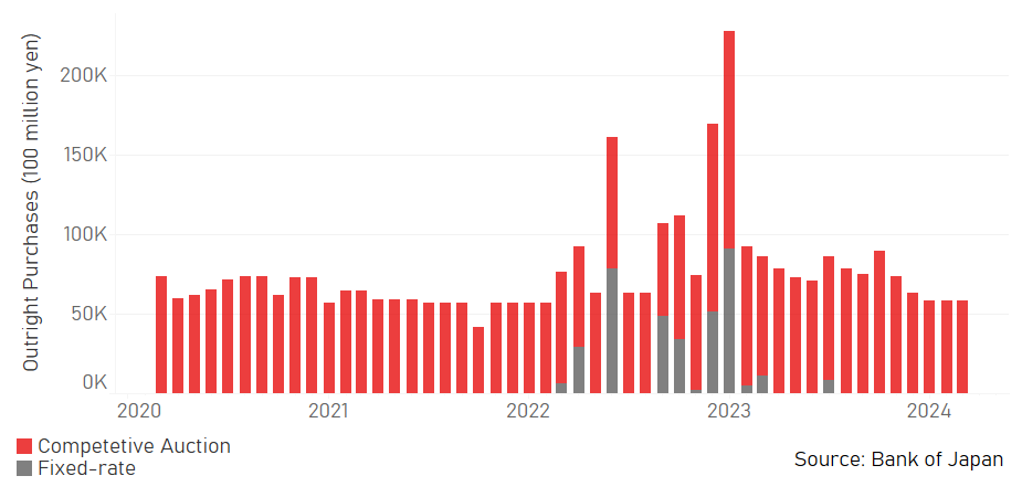

In March the yen weakened versus the US dollar in terms of London closing rates from 149.82 to 151.31. In addition, the yen weakened versus the euro, from 161.93 to 163.45. The BoJ at its meeting in March announced a host of policy changes which effectively amounted to the termination of the QQE/NIRP policy framework adopted in 2013 (QQE) and enhanced in 2016 (NIRP). The BoJ scrapped the tiered interest rates paid on reserves and will now pay 0.10% on excess reserves with the aim of guiding the overnight call money rate to between 0.00%-0.10%. YCC was scrapped but the BoJ will purchase around JPY 6trn per month while ETF and REIT purchases were ended and CP and corporate bond purchases will be slowed with these purchases to end in about a year. The o/n call money rate closed at 0.07%.

OUTLOOK

The yen weakened further in March despite the BoJ finally deciding to alter the policy stance. The measures above were largely as expected and the failure of Governor Ueda to more strongly indicate the prospect of additional rate hikes resulted in renewed yen selling as investors concluded that the event risk had passed and a still very substantial divergence in policy between Japan and the rest of the world would continue. While the guidance may not have been as strong as market participants expected, certain comments do still suggest more hikes to come. Governor Ueda cited signs of stronger inflation and FX moves that impacted the inflation outlook as possible triggers for additional hikes. The OIS market implies 20bps of additional hikes are priced by year-end. We now expect the next rate hike to come in July, which is only partially priced and if delivered the likelihood is that the market will then expect more suggesting the curve is under-priced. Governor Ueda stated that wage data was key in the decision to hike in March and the Rengo 2nd estimate revealed an agreed increase of 5.25%. That’s considerably stronger than a year ago (3.58%) and will help support growth and inflation.

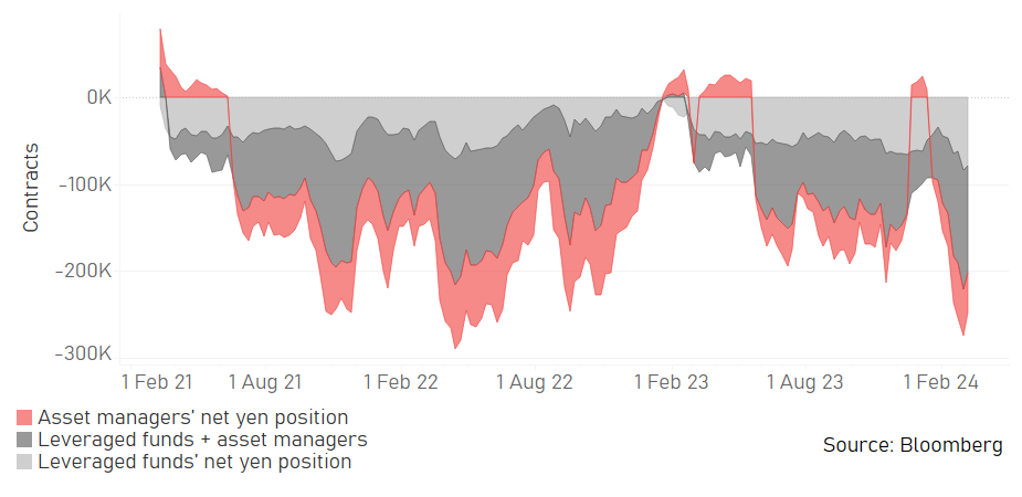

The passing of a key event risk – the BoJ rate hike – has encouraged investors to re-establish yen short positions given the carry attractiveness remains very high given the environment of very low FX volatility. But there are likely other factors at play encouraging yen weakness. The NISA expansion at the start of the year is resulting in greater investments in foreign equities – evident in Jan/Feb data – that are likely still weighing on the yen. The outperformance of Japan equities has also prompted increased yen selling hedging as foreign investor holdings of Japan equities expands further. The strong equity performance in Japan may also be leading to a general pick-up in risk appetite that means greater tolerance amongst Japanese investors for taking increased FX risk.

A strong message threatening intervention toward the end of March implies limited scope for further weakness and the BoJ hike with more to come coupled with Fed rate cuts commencing in June will see USD/JPY start to turn lower.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

-0.10% |

0.10% |

0.25% |

0.25% |

0.50% |

|

3-Month Bill |

-0.05% |

0.10% |

0.30% |

0.30% |

0.60% |

|

10-Year Yield |

0.74% |

0.80% |

1.00% |

1.10% |

1.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

Remarkably, the 10-year JGB yield ended March close to unchanged, increasing by just 2bps to close at 0.73%. Similar to above, the cautious communication from Governor Ueda resulted in a ‘buy-the-rumour / sell-the-fact’ type reaction in the JGB market – the 10-year yield increased 9bps ahead of the meeting and then nearly fully retraced the move. This may well be a reflection of Life Insurance companies buying with Lifers plans previously indicating a strategy of buying JGBs at higher levels after a BoJ policy change. Still, our sense is that the financial market response reflects the probable under-estimation by investors of the importance of the BoJ’s move. The ‘Shunto’ wage negotiations are resulting in much higher than expected wage increases that will help to support inflation later in the year, reinforced by the depreciation of the yen so far this year – import prices are now drifting higher. We now expect a second rate hike in July of 15bps and that will likely lead to expectations of further hikes to come that will help see the 10-year yield drift higher through to year-end.

ASSET MANAGERS AND LEVERAGED FUNDS POSITIONING

BOJ’S MONTHLY PURCHASES OF JGBS

Euro

|

Spot close 28.03.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

EUR/USD |

1.0802 |

1.0900 |

1.1200 |

1.1200 |

1.1400 |

|

EUR/JPY |

163.45 |

158.10 |

159.00 |

156.80 |

157.30 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0400-1.1300 |

1.0600-1.1500 |

1.0800-1.1700 |

1.0900-1.1900 |

|

|

EUR/JPY |

151.00-167.00 |

150.00-166.00 |

149.00-165.00 |

147.00-164.00 |

MARKET UPDATE

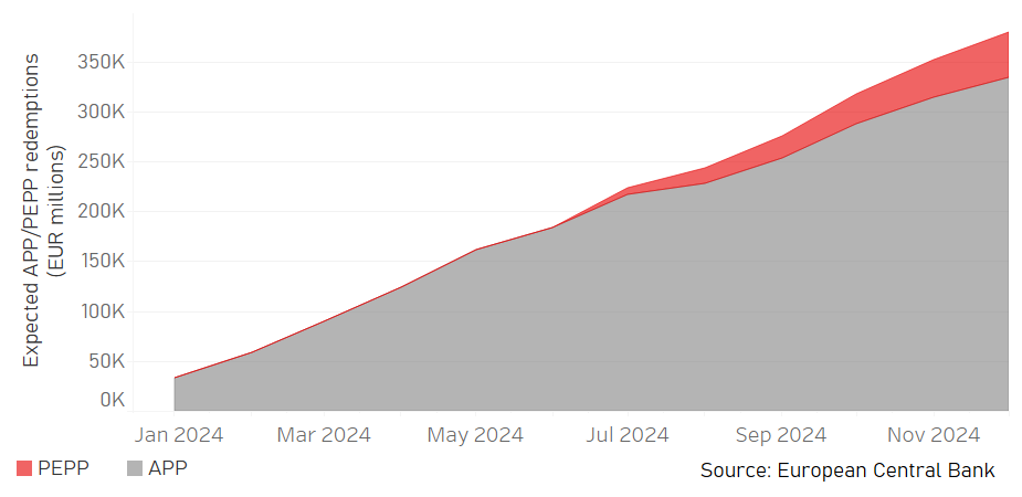

In March the euro weakened very modestly versus the US dollar in terms of London closing rates, moving from 1.0808 to 1.0802. The ECB at its meeting in March held the key policy rate at 4.00%, following 450bps of rate hikes through to September last year. The ECB is running down APP securities and will commence PEPP run-off in H2 with an estimated EUR 380bn of securities rolling off the balance sheet from both programs combined in 2024.

OUTLOOK

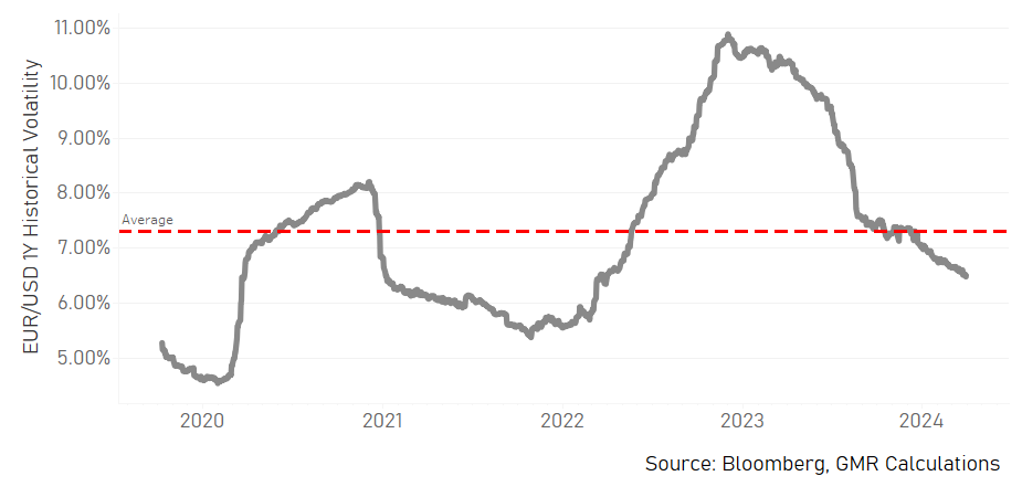

The trading range in EUR/USD remains very narrow and 3-month implied volatility remains at levels not seen since early 2022. The move was modest again in March with EUR/USD declining only very marginally. Most of this decline came close to month-end with uncertainty building over whether the Fed will cut as much as priced. We see some scope to EUR downside over the short-term given the greater probability of the ECB cutting rates in June and the ECB therefore likely in a stronger position to communicate this message to the market at the April meeting. There is a risk therefore of greater uncertainty over the rate cut outlook in the US relative to the euro-zone. That bias is reflected in the 2-year EU/US swap spread that has now drifted to the widest US spread over the euro-zone since December 2022 when EUR/USD was trading at lower levels. The spread move partly reflects continued weak data in Europe as well. The German retail sales data slumped by 1.9% MoM in February and the Kiel Institute lowered its projection for GDP in 2024 to just 0.1% (vs 1.3% prev). However, we remain optimistic that growth can recover modestly as the year unfolds and see consumer spending picking up. It’s worth noting that the IFO Retail business climate showed a marked improvement with the index jumping from -18.1 in February to -7.3 in March.

The market is now close to 100% priced for a 25bp ECB rate cut in June – a stronger conviction than most other central banks expected to cut in June. Inflation continues to come down quickly but the ECB has indicated wage growth as being key to instilling confidence in the achievement of the price stability goal. While we expect cuts to commence in June, communications from the ECB have led us to reduce the overall extent of rate cuts to 100bps, implying scope for skipping a meeting. July is the most obvious given the evidence of achieving price stability should be clearer later in the year and by then we expect the Fed to be more active also. That scenario we believe will help limit the downside for EUR/USD. The end of negative rates in the euro-zone has also resulted in the end of substantial net bond outflows.

There continues to be a lack of conviction over short-term EUR/USD direction although the rates spread points to EUR downside risks initially. However, we doubt that will be sustained and assuming weaker US data starts to emerge soon and assuming domestic demand conditions in Europe improve modestly, we see scope for a gradual drift higher as the Fed ultimately has scope to ease more than the ECB

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

4.00% |

3.75% |

3.50% |

3.25% |

3.00% |

|

3-Month Bill |

3.87% |

3.60% |

3.35% |

3.05% |

2.80% |

|

10-Year Yield |

2.30% |

2.20% |

1.90% |

2.00% |

1.80% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield declined in March, by 11bps to close at 2.30%. Developments in March have not changed the outlook for longer-term yields going forward. We maintain that over the forecast horizon the 10-year yield will drift lower as the ECB cuts the key policy rate by 100bps. The continued progress made on achieving the price stability goal should see the 10-year yield drift toward a long-term equilibrium level for the policy rate – a range of between 2.00% and 2.50%. If the ECB does cut by 100bps, we would expect further cuts to be priced further into 2025 – currently the H2 2025 1mth ESTR futures contract are priced close to the 2.50% and if those cuts are realised in circumstances of a soft landing in Europe and in the US, then the 10-year yield may not be too much below that level. So in 2025 when we could be nearer the end of the easing cycle, the 10-year yield could be drifting higher. A soft landing remains our broad assumption for the US economy and such a scenario will help support longer-term yields later in 2025. Lower inflation and slowing wage growth will help instil confidence of the price stability goal but supply issues will be another factor helping support longer-term yields.

APP AND PEPP REDEMPTIONS (ESTIMATED)

EUR/USD 1Y HISTORICAL VOLATILITY

Pound Sterling

|

Spot close 28.03.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

EUR/GBP |

0.8547 |

0.8550 |

0.8600 |

0.8650 |

0.8700 |

|

GBP/USD |

1.2639 |

1.2750 |

1.3020 |

1.2950 |

1.3100 |

|

GBP/JPY |

191.24 |

184.90 |

184.90 |

181.30 |

180.80 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2200-1.3200 |

1.2400-1.3400 |

1.2500-1.3500 |

1.2600-1.3700 |

MARKET UPDATE

In March the pound strengthened very modestly against the US dollar in terms of London closing rates from 1.2634 to 1.2639. In addition, the pound strengthened very marginally against the euro, from 0.8555 to 0.8547. The MPC at its meeting in March left the key policy rate unchanged at 5.25%, following 14 consecutive rate increases through to August before commencing a pause from September.

OUTLOOK

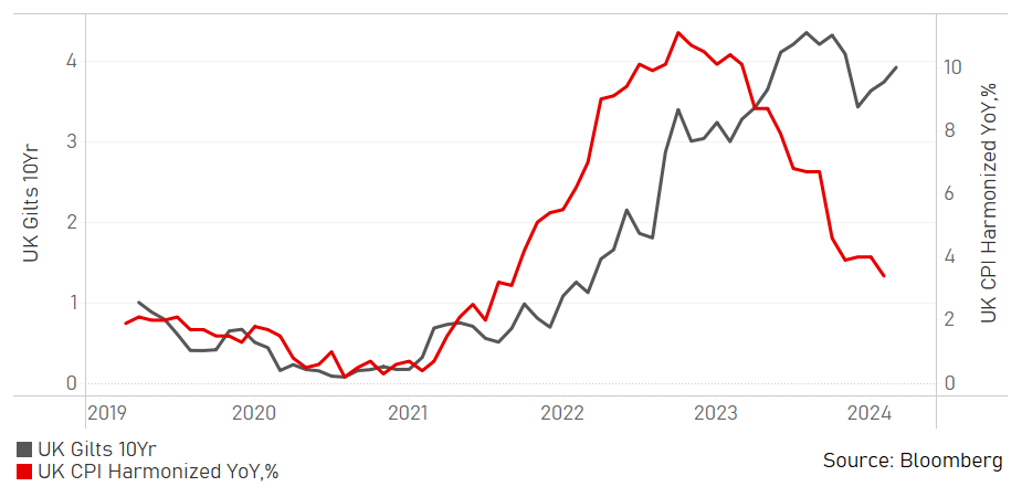

The pound was close to unchanged in March with FX volatility remaining very low in part due to the ongoing expectations of a synchronised policy easing across many of the major central banks. That synchronised easing includes the Bank of England and the MPC meeting in March brought the BoE into line with many other central banks in potentially commencing its easing in June. There was a clear shift in tone from the BoE with increased confidence over inflation moving back to target and Governor Bailey’s message was that rate cuts are now “in play”. The inflation outlook remains positive for the UK given the much faster than expected decline in annual headline inflation, which has now dropped to 3.4%. The annual rate is set to fall below target in April data released in May and the BoE is now less confident of the view of inflation then picking back up in 2H. We maintain our view that the BoE will cut by a total of 100bps in 2024, but have brought forward the starting point to June following the communications from Governor Bailey in March.

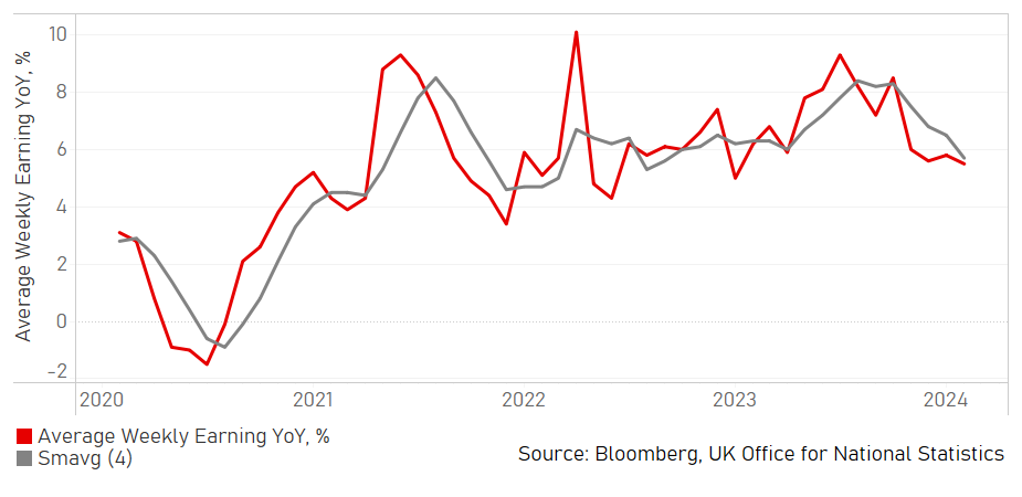

The concern within the MPC remains indicators of “inflation persistence” – elements of services inflation that tend to be driven more by wage growth. However, the latest wage data to January certainly shows signs of notable slowing. The 3mth average wage to January increased just 1.6% on an annualised basis versus the previous three months while other data suggests further slowdown ahead. The REC/KPMG jobs survey in March revealed the vacancy index fell well below the 50-level, to 46.9 from 49.4 underlining weakening labour demand. Permanent hiring fell sharply. The UK will in April implement a near 10% increase in the minimum wage which will help support demand at the low-income end of the scale and with inflation falling sharply, we see scope for some moderate improvement in domestic demand conditions, helped by consumer spending. The Services PMI indicates better growth as does the stronger than expected retail sales data over January and February combined.

We expect the pound to strengthen gradually versus the US dollar as the US economy slows more notably in the second half of the year and the UK begins to show some signs of moderate pick-up fuelled by the sharp drop in inflation that has been a catalyst for little or no growth over the last 18mths. We are broadly neutral on the pound versus the euro although show some moderate upside in EUR/GBP with scope for expectations of the BoE easing more substantially over the easing cycle relative to the ECB which could become more of a factor influencing FX toward the end of the year when 2025 policy expectations will be more influential.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Policy Rate |

5.25% |

5.00% |

4.75% |

4.50% |

4.25% |

|

3-Month Bill |

5.29% |

4.95% |

4.65% |

4.35% |

4.05% |

|

10-Year Yield |

3.93% |

3.80% |

3.50% |

3.60% |

3.40% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield fell in March, by 19bps to close at 3.93% - a more substantial drop compared to bond markets in other key countries. The catalyst was the more explicit guidance from the BoE on the potential for a sooner than previously expected rate cut. Based on the guidance from BoE Governor Bailey, in particular in interviews following the MPC meeting in March, we have moved forward the time of the first rate cut from August to June. There was also plenty of evidence to suggest better inflation prospects ahead. While the inflation data released in March did still show “inflation persistence” in the services sector, the signs of slowing wage growth should result in that persistence subsiding going forward. We are maintaining the quantum of cuts for the year at 100bps but would expect the market to be positioned for further cuts in 2025 which should help driver longer-term yields lower. Assuming we see signs of easing inflation persistence and the BoE cuts rates as we expect, by 100bps, and with the market expecting more cuts in 2025 (to return policy to neutral), further declines in the 10-year yield are likely. We have lowered our forecasts as a result.

UK GILTS 10Y VS. UK CPI YOY, %

AVERAGE WEEKLY EARNINGS YOY, % VS. SMAVG (4M)

Chinese renminbi

|

Spot close 28.03.24 |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

USD/CNY |

7.2255 |

7.1500 |

7.0000 |

6.9000 |

6.8000 |

|

USD/HKD |

7.8260 |

7.8100 |

7.8000 |

7.7900 |

7.7900 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.0000-7.3000 |

6.9000-7.2000 |

6.8000-7.1000 |

6.7000-7.0000 |

|

|

USD/HKD |

7.7800-7.8500 |

7.7800-7.8500 |

7.7600-7.8300 |

7.7600-7.8300 |

MARKET UPDATE

In March, USD/CNY increased from 7.1886 to 7.2255. The PBOC kept the 1-year MLF stable at 2.50% on 15th March and held its both 1-year LPR rate and 5-year LPR rate unchanged at 3.45% and 3.95% respectively on 20th March. The deputy governor of the PBoC said recently that there was still room for cutting banks' reserve requirement ratio (RRR) and that China's monetary policy has ample room to ease.

OUTLOOK

It was surprising that the FX market reacted so sensitively to a quite minimal change of the USD/CNY fixing on 22nd March, but the volatile 0.4% depreciation of CNY against the dollar during that day did also reflect various pressures on CNY. Amid the unfavorable external pressures including a strong US dollar caused by a more hawkish tone of the Fed, a surprise rate cut by the SNB and a less hawkish BOE, and a new bill in US Congress trying to limit US mutual funds to invest in some of China stock products, CNY also faces a persistent weak economic performance and news about China’s protracted property downturn is eroding the balance sheets of the country’s big banks, as indicated by a rising property bad loan ratio.

After the USD/CNY daily fixing was set at 7.1004 by PBOC on Friday 22nd March, fixings in the following days retreated back below the 7.1000-level, and maintained at levels similar to those prior to the “incident”. In the offshore market, USD/CNH declined from the peak value of 7.2800 on 22nd March to 7.2504 on 28th March, but onshore USD/CNY remained at about 7.2260, near the peak on 22nd March.

CNY is in fact quite strong, in effective exchange rate terms, despite CNY weakness against the dollar. Although in theory, a more flexible CNY FX could be more helpful in balancing an economy at certain times, through stimulating external demand for China exports. The constraint for PBOC now is that given current intense negative sentiment on China’s economy and assets, potential large depreciation of CNY could result from more flexible USD/CNY and create pressure for capital flight and financial instability. As a result we still expect the PBOC to act to stabilize USD/CNY.

We still expect CNY to strengthen against the dollar in the medium term. There were positive signs for China’s economy in some of China’s January and February key macro indicators. FAI YoY growth improved to 4.2%yoy in Jan-Feb, up from 2023’s 3.0%yoy; IP YoY growth improved to 7%yoy in Jan-Feb, up from December’s 6.8%yoy. Growth was stronger than expected. Additionally, industrial profits growth jumped to 10.2%yoy in Jan-Feb, up from 2023’s -2.3%yoy. Recent policies were taking effect, slowing though. The 6ppts stronger growth of general equipment FAI in Jan-Feb reflected the impact of policy push for equipment replacement. Further gradual transmission from policy to real actions would support a modest strengthening of CNY against the dollar in 2H of 2024.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

|

|

Loan Prime Rate 1Y |

3.45% |

3.35% |

3.25% |

3.25% |

3.25% |

|

MLF 1Y |

2.50% |

2.40% |

2.20% |

2.20% |

2.20% |

|

7-Day Repo Rate |

1.80% |

1.70% |

1.60% |

1.60% |

1.60% |

|

10-Year Yield |

2.29% |

2.40% |

2.47% |

2.55% |

2.60% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

We witnessed a five-month rally of Chinese government bonds, with 10-year yields declining to 2.3% from 2.7% in October 2023. At this juncture, we think that the price rally of China bonds is likely to pause and even reverse slightly. With a relatively more stable USD/CNY outlook, and potential sentiment shift, the demand for government bonds likely goes a bit weaker. With our expectations of further gradual improvement of the economy, a shift toward riskier assets is expected, and will reduce some of safe-haven demand for government bonds. The incoming supply of RMB1 trillion ultra-long government bonds would also bring some upward pressure on yields. Renewed focus on President Xi’s previous comments on the nation’s monetary tools stirred up much focus of markets on 28th March. The main goals may be more on enriching PBOC’s toolbox of monetary policies and for the purpose of better conduct of liquidity management, rather than an approach of QE. Additionally, we still think that the room for further policy rate cuts is limited. Net, we expect a 20bps cut on LPR rate, and slightly more 30bps cut on 1-year MLF. We expect China’s 10-year government bond yield to edge up to 2.55% by end-2024.

SOME REPAIRMENT IN INDUSTRIAL PROFITS GROWTH IN JAN & FEB

Source: CEIC, MUFG GMR

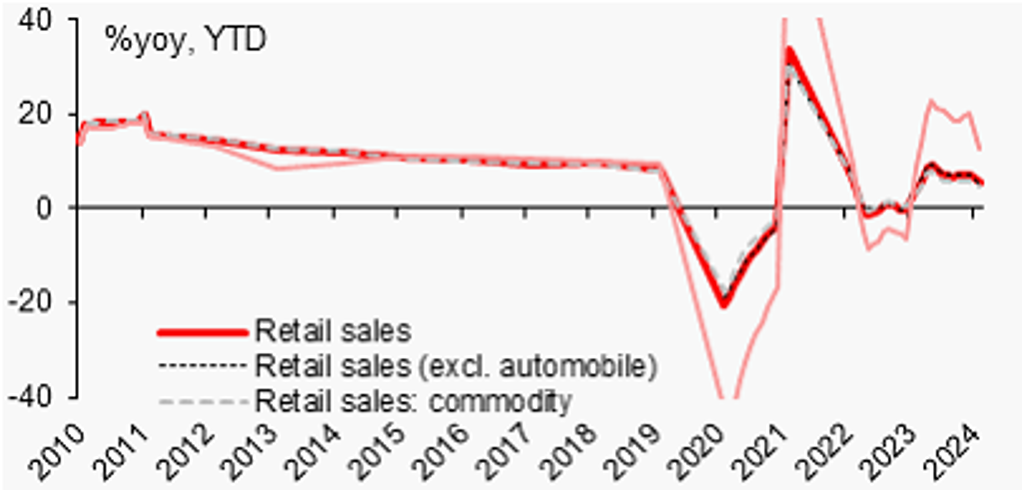

BROAD-BASED GROWTH SLOWDOWN ACROSS RETAIL SALES

Source: CEIC, MUFG GMR