Please download PDF from above for the following currencies.

Australian dollar // New Zealand dollar //Canadian dollar // Norwegian krone // Swedish Krona // Swiss franc // Czech koruna // Hungarian forint //Polish zloty // Romanian leu // Russian rouble // South African rand // Turkish lira // Indian rupee // Indonesian rupiah // Malaysian ringgit // Philippine peso //Singapore dollar // South Korean won // Taiwan dollar // Thai baht // Vietnamese dong // Argentine peso // Brazilian real // Chilean peso // Mexican peso // Crude oil // Saudi riyal // Egyptian pound

Monthly Foreign Exchange Outlook

DEREK HALPENNY

Head of Research, Global Markets EMEA and International Securities

Global Markets Research

Global Markets Division for EMEA

E: derek.halpenny@uk.mufg.jp

LEE HARDMAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for EMEA

E: lee.hardman@uk.mufg.jp

LIN LI

Head of Global Markets Research Asia

Global Markets Research

Global Markets Division for Asia

E: lin_li@hk.mufg.jp

MICHAEL WAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: michael_wan@sg.mufg.jp

LLOYD CHAN

Senior Currency Analyst

Global Markets Research

Global Markets Division for Asia

E: lloyd_chan@sg.mufg.jp

EHSAN KHOMAN

Head of Commodities, ESG and Emerging Markets Research – EMEA

DIFC Branch – Dubai

E: ehsan.khoman@ae.mufg.jp

MUFG Bank, Ltd.

A member of MUFG, a global financial group

August 2024

KEY EVENTS IN THE MONTH AHEAD

1) AUGUST – USUALLY VERY QUIET OR VERY VOLATILE

August brings with it lighter manned trading desks and holiday vacations which tends to mean lower trading volumes and potentially narrower trading ranges. However, if a risk event emerges during this period it can often lead to greater volatility in thinner than usual liquidity. In our pound section we touch briefly on the BoE decision but beyond that we only have the RBA, Riksbank and RBNZ meetings in August. We had previously flagged the risk of an RBA rate hike in August but weaker than expected inflation data likely means the RBA can avoid any additional monetary tightening. Sharp declines in the key inflation rate and ongoing economic weakness makes it a near certainty that the Riksbank will cut its key rate on 20th August. The only debate is whether the cut will be 25bps or 50bps – the OIS market is priced closer to a 50bp cut. We expect a 25bp cut. For the RBNZ in July it shifted its tone and was much more dovish but not to the extent to signal prospects of a cut in August. The data in our view justifies a cut but August may be too soon. We now expect a cut by the following meeting in October, having originally assumed November. If there was volatility in August it could come from geopolitics. Conflict escalation risks in the Middle East have risen after Israel’s attacks in Lebanon and Iran and will be monitored closely.

2) FED’S UPDATE AT JACKSON HOLE

Jackson Hole is always an opportunity for the Fed to provide some updated guidance for market participants ahead of the resumption of post-summer trading in September and can often be used by the Fed to provide more detailed thinking on monetary policy. The 2024 symposium is titled “Reassessing the Effectiveness and Transmission of Monetary Policy” and will take place on 22nd-23rd August. Following the FOMC at the end of July when a September rate cut was put on the table, the symposium will offer Fed officials the opportunity to provide an update with by then another NFP jobs report and CPI print. Assuming there are no nasty upside surprise in those data sets we should certainly expect Fed officials to talk up further the prospects of a September rate cut.

3) FOCUS ON CHINA’S STIMULUS POLICIES

On 31st July, Chinese stock market rallied, with the onshore stock indexes having their best day in almost half year. The CSI index rose 2.1%, and Hang Seng China Enterprises Index increased by 2.4%. Market sentiment was boosted on the day, following a statement from the Politburo meeting earlier. The statement pledged to boost consumption to expand domestic demand, and said it is necessary to further mobilize the enthusiasm of private investment and expand effective investment”. We expect more specific growth enhancing policies to be rolled out. The focus in near term about China is on government stimulus.

Forecast rates against the US dollar - End-Q3 2024 to End-Q2 2025

|

Spot close 31.07.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

JPY |

150.46 |

150.00 |

148.00 |

146.00 |

144.00 |

|

EUR |

1.0820 |

1.0900 |

1.1000 |

1.1200 |

1.1200 |

|

GBP |

1.2840 |

1.2980 |

1.3100 |

1.3250 |

1.3180 |

|

CNY |

7.2199 |

7.2400 |

7.1800 |

7.1500 |

7.1000 |

|

AUD |

0.6527 |

0.6500 |

0.6700 |

0.6800 |

0.6900 |

|

NZD |

0.5939 |

0.5900 |

0.6000 |

0.6100 |

0.6200 |

|

CAD |

1.3813 |

1.3700 |

1.3500 |

1.3300 |

1.3200 |

|

NOK |

10.924 |

10.642 |

10.455 |

10.179 |

10.089 |

|

SEK |

10.719 |

10.734 |

10.545 |

10.268 |

10.179 |

|

CHF |

0.8800 |

0.8760 |

0.8730 |

0.8660 |

0.8750 |

|

|

|

|

|

|

|

|

CZK |

23.505 |

23.390 |

23.360 |

22.860 |

22.770 |

|

HUF |

364.27 |

363.30 |

363.60 |

360.70 |

364.30 |

|

PLN |

3.9644 |

3.9170 |

3.9090 |

3.8660 |

3.8930 |

|

RON |

4.5959 |

4.5690 |

4.5550 |

4.5000 |

4.5270 |

|

RUB |

85.769 |

86.980 |

87.560 |

88.240 |

90.610 |

|

ZAR |

18.200 |

18.300 |

18.200 |

18.000 |

17.800 |

|

TRY |

33.101 |

34.000 |

35.500 |

37.000 |

38.000 |

|

|

|

|

|

|

|

|

INR |

83.725 |

83.500 |

83.200 |

82.800 |

83.000 |

|

IDR |

16255 |

16420 |

16360 |

16150 |

16030 |

|

MYR |

4.5885 |

4.5000 |

4.4000 |

4.3700 |

4.3000 |

|

PHP |

58.361 |

58.400 |

58.000 |

57.700 |

57.500 |

|

SGD |

1.3375 |

1.3350 |

1.3200 |

1.3000 |

1.2900 |

|

KRW |

1369.6 |

1375.0 |

1360.0 |

1345.0 |

1325.0 |

|

TWD |

32.804 |

32.800 |

32.400 |

32.000 |

31.700 |

|

THB |

35.572 |

35.700 |

35.300 |

35.000 |

34.700 |

|

VND |

25246 |

25400 |

25500 |

25550 |

25600 |

|

|

|

|

|

|

|

|

ARS |

931.75 |

970.00 |

1030.0 |

1450.0 |

1550.0 |

|

BRL |

5.6466 |

5.7000 |

5.7000 |

5.6000 |

5.4000 |

|

CLP |

941.93 |

960.00 |

950.00 |

930.00 |

890.00 |

|

MXN |

18.609 |

18.500 |

18.500 |

18.200 |

17.800 |

|

|

|||||

|

Brent |

80.54 |

88.00 |

93.00 |

95.00 |

91.00 |

|

NYMEX |

77.12 |

83.00 |

88.00 |

90.00 |

86.00 |

|

SAR |

3.7518 |

3.7500 |

3.7500 |

3.7500 |

3.7500 |

|

EGP |

48.520 |

48.400 |

48.300 |

48.100 |

47.600 |

Notes: All FX rates are expressed as units of currency per US dollar bar EUR, GBP, AUD and NZD which are expressed as dollars per unit of currency. Data source spot close; Bloomberg closing rate as of 4:30pm London time, except VND which is local onshore closing rate.

US dollar

|

Spot close 31.07.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

USD/JPY |

150.46 |

150.00 |

148.00 |

146.00 |

144.00 |

|

EUR/USD |

1.0820 |

1.0900 |

1.1000 |

1.1200 |

1.1200 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

143.00-158.00 |

141.00-156.00 |

139.00-154.00 |

137.00-152.00 |

|

|

EUR/USD |

1.0400-1.1100 |

1.0500-1.1300 |

1.0600-1.1500 |

1.0700-1.1600 |

MARKET UPDATE

In July the US dollar weakened against the euro in terms of London closing rates, from 1.0717 to 1.0820. In addition, the dollar weakened against the yen, from 160.84 to 150.46. The FOMC at its meeting in July left the fed funds rate unchanged in a range of 5.25% to 5.50%. The FOMC continued with its policy of reducing its securities holdings with QT ongoing but at a reduced rate of USD 60bn per month through a reduction in UST bond holdings from USD 60bn to USD 25bn. The pace of reduction in the holdings of MBS remains at USD 35bn per month. In June, the FOMC reduced its median dot profile for 2024 from three rate cuts to just one.

OUTLOOK

The US dollar weakened in July with the DXY index 1.7% lower with yen strength playing a big role in that. The Fed meeting at the end of July provided the FOMC with the opportunity to signal to the market the increased prospect of a rate cut. Fed Chair Powell stated that as long as the “totality” of the data increased the Fed’s confidence in achieving its dual mandate goal then a rate cut was possible at the September meeting. The Fed statement contained new language on the economy that indicated less confidence in the resilience of the labour market. We believe it is the jobs market that will see the greatest change over the coming months that will see the FOMC cut by perhaps more than markets expect. The inflation data in July has helped reinforce the likelihood that the move higher for inflation was more a seasonal issue in Q1 with inflation now more consistently moving toward target. MoM supercore PCE inflation in May and June were the weakest since Nov/Dec of last year. ADP employment in July was weaker than expected and the labour differential index in the consumer confidence data was the weakest since March 2021. ISM employment indices for both manufacturing and services are below the 50.0-level.

While the Fed is now set to commence easing, our FX forecasts remain conservative in showing only moderate US dollar weakness ahead. Nearly three Fed rate cuts are now priced by year end while most other G10 central banks are already or will soon be cutting as well. In addition, global growth concerns remain elevated with data from China confirming ongoing economic weakness. Election uncertainty in the US could also curtail appetite to sell the dollar. While we do not expect a second Trump presidency to play out like the first (initial US dollar surge), immediate action by Trump on tariffs would likely see the dollar strengthen (not our base-case at this point). Still, a Trump victory is not a given any more with Kamala Harris performing considerably better nationally and in swing states than President Biden.

The removal of worst-case political risk scenarios in Europe and the increased risk of a more aggressive Fed before the end of the year, we have tweaked the Q3 and Q4 dollar levels marginally weaker but our 2025 forecasts are unchanged. While a weakening US labour market and rate cuts will weigh on the dollar, global growth uncertainties and US political uncertainties will curtail the scale of dollar selling.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

5.33% |

5.13% |

4.38% |

3.88% |

3.38% |

|

3-Month T-Bill |

5.28% |

4.88% |

4.25% |

3.75% |

3.38% |

|

10-Year Yield |

4.03% |

4.25% |

4.13% |

4.13% |

4.13% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

It’s been one long year since the last Fed hiked but the time has come for cuts. We believe that the Fed is now one step away (where they will further signal cuts are the next move at Jackson hole) from starting the long-awaited easing cycle at the September FOMC meeting. The July FOMC statement was softened to acknowledge that labour markets are cooling and that inflation is only somewhat elevated. They keep emphasizing their dual mandate of full employment and stable prices in both the statement and during chair Powell’s press conference. This to us is further evidence that the pivot to cuts has started because they are not just focused on inflation concerns. The dovish July FOMC meeting was in stark contrast to the hawkish June FOMC meeting results which suggests the dots will get revised back to 2-3 cuts for 2024 in September too. That would imply at least a cut in December. We maintain our view that the consumer-led slowdown is well on its way and that will require multiple rate cuts for the balance of 2024. The first cut will likely be 25bps (unless something were to break in financial markets and/or the banking system), but subsequent cuts can move to a 50bps pace if conditions severely worsen ahead.

(George Goncalves)

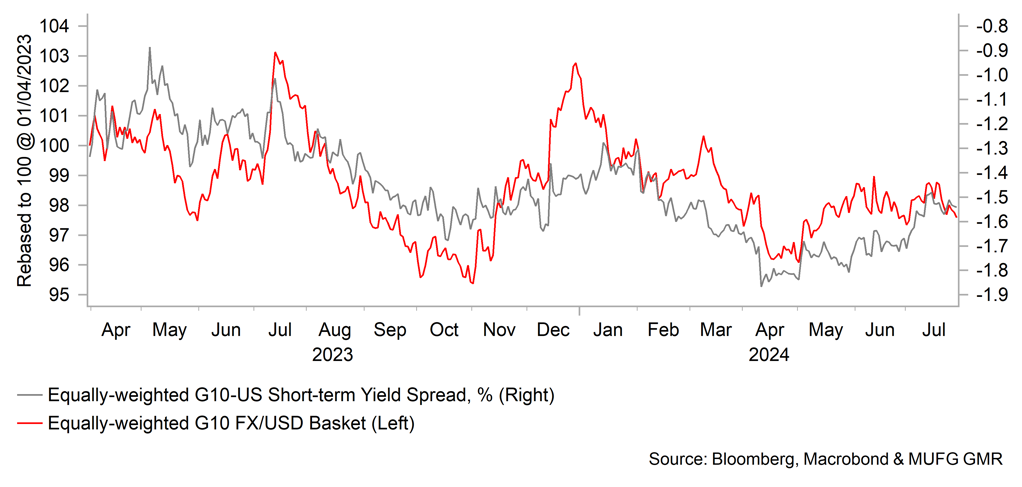

USD PERFORMANCE VS. SHORT-TERM YIELD SPREADS

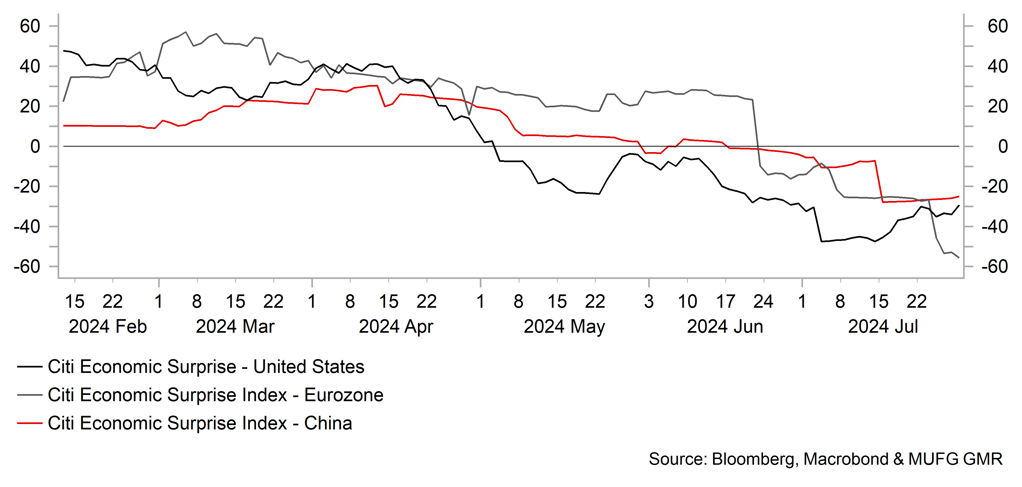

ECONOMIC SURPRISE INDICES FOR CHINA, EURO-ZONE & US

Japanese yen

|

Spot close 31.07.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

USD/JPY |

150.46 |

150.00 |

148.00 |

146.00 |

144.00 |

|

EUR/JPY |

162.80 |

163.50 |

162.80 |

163.50 |

161.30 |

|

Range |

Range |

Range |

Range |

||

|

USD/JPY |

143.00-158.00 |

141.00-156.00 |

139.00-154.00 |

137.00-152.00 |

|

|

EUR/JPY |

155.00-170.00 |

154.00-169.00 |

153.00-168.00 |

152.00-167.00 |

MARKET UPDATE

In July the yen strengthened substantially versus the US dollar in terms of London closing rates from 160.84 to 150.46. In addition, the yen strengthened notably versus the euro, from 172.37 to 162.80. The BoJ, at its meeting in July announced some changes to its policy stance. As roughly expected, the BoJ announced it was cutting the JGB monthly purchase rate by JPY 400bn per quarter, which is estimated to see purchases fall to around JPY 2.9trn by Q1 2026. In addition, the BoJ raised the interest rate paid on excess reserves (the Complimentary Deposit Facility) by 15bps to 0.25%, which will lift the unsecured overnight call rate close to that level.

OUTLOOK

The yen strengthened substantially in July for a number of reasons but the final leg of strength at month-end was triggered by the BoJ policy announcements. The slowdown in the monthly purchase rate of JGBs was expected and is estimated to result in around a 7-8% drop in BoJ JGB holdings – in monetary terms by a little over JPY 40trn. We believe the pace of reduction, which was decided upon after consultations with market participants, will not result in any disruptive functioning in the JGB market. The rate decision (which MUFG expected) was more of a surprise for the market and was only partially priced. This was accompanied by the updated Economic and Prices Outlook report with only limited changes in forecasts. But it was the guidance that really helped drive the yen stronger. The BoJ now has an explicit bias to tighten as laid out in the statement and is conditioned on incoming economic data merely endorsing current BoJ forecasts. Following this we have added an additional rate hike by the BoJ into the forecast horizon.

In addition to the prospects of a more hawkish BoJ ahead, the yen is set to benefit from the start of Fed easing – which we continue to expect to start in September. The drop in USD/JPY in July was consistent with the US-JP spread moving in favour of Japan but 75% of the shift in the spread was down to falling US yields and 25% due to the rise in Japan yields. The MoF also confirmed at the end of July that it had intervened to buy yen again in July, totalling JPY 5.5trn. Governor Ueda after the BoJ meeting stated that FX was now a more important variable being looked at which suggests to us we may now have had a shift that will see the BoJ and the MoF more aligned in policy actions. The BoJ cited upside risks related to import prices that could imply a greater willingness to act if the yen weakened and threatened the inflation goal. We have also seen a strengthening once again of the correlation between risk (VIX) and the yen with the USD/JPY / VIX correlation negative for eight consecutive days for the first time in two years. With US yields falling, there is an increased prospect of the yen’s safe-haven characteristic returning.

There have been false dawns for a yen recovery before but the scale of the move in July, the drop in US yields and hawkish BoJ rate hike, the prospects for a sustained turn lower for USD/JPY have never been this compelling since the bull-run began.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

0.25% |

0.25% |

0.50% |

0.75% |

0.75% |

|

3-Month Bill |

0.15% |

0.30% |

60.00% |

0.80% |

0.80% |

|

10-Year Yield |

1.06% |

1.15% |

1.30% |

1.50% |

1.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year JGB yield closed July around unchanged at 1.06% but yields had been lower until the BoJ policy announcement resulted in a final-day jump in yields. The key for JGBs was the plan to reduce purchases. The pace of monthly purchases being reduced by JPY 400bn was in line with expectations and indeed was decided upon after consultation with market participants. This pace will result in JGB holdings on the BoJ’s balance sheet falling by a little over JPY 40trn by Q1 2026 from the current level of JPY 585bn. All else equal, this will result in some upward pressure on yields. But of course other factors will not be equal and global demand for bonds and global yields will be key. We now assume the policy rate will rise to 0.75% by Q1 2025 and the additional rate hike we have added mean our 10-year JGB forecasts have been tweaked higher too. But the changes in the 10-year yield forecasts are modest as the moves are likely to take place in circumstances of yields moving modestly lower in the other major developed economies as monetary easing unfolds in all of the other G10 countries.

USD/JPY SHORT-TERM VALUATION MODEL ESTIMATE

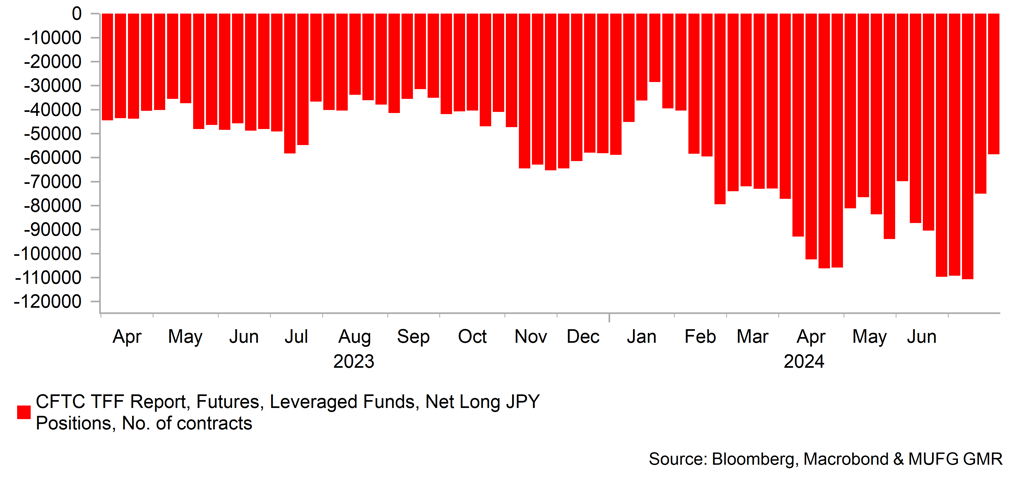

SHORT JPY POSITIONS HELD BY LEVERAGED FUNDS

Euro

|

Spot close 31.07.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

EUR/USD |

1.0820 |

1.0900 |

1.1000 |

1.1200 |

1.1200 |

|

EUR/JPY |

162.80 |

163.50 |

162.80 |

163.50 |

161.30 |

|

Range |

Range |

Range |

Range |

||

|

EUR/USD |

1.0400-1.1100 |

1.0500-1.1300 |

1.0600-1.1500 |

1.0700-1.1600 |

|

|

EUR/JPY |

155.00-170.00 |

154.00-169.00 |

153.00-168.00 |

152.00-167.00 |

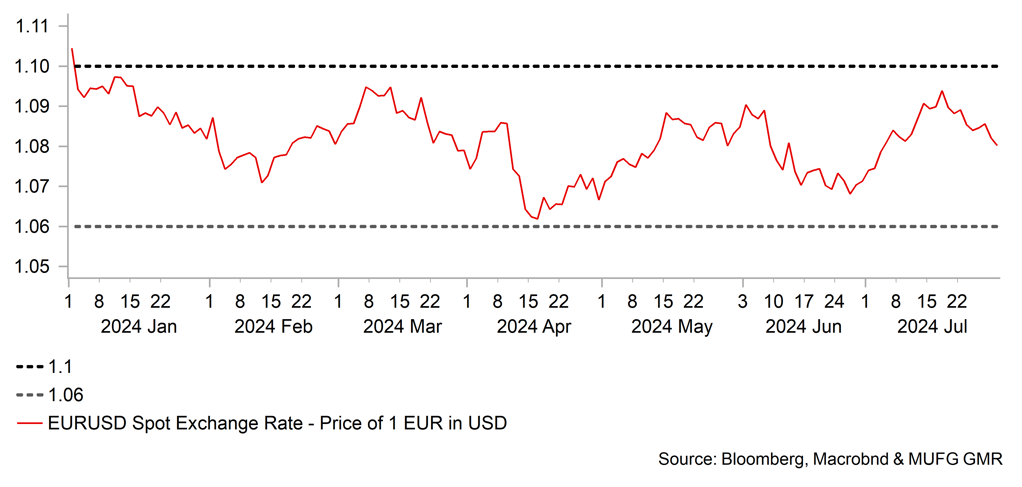

MARKET UPDATE

In July the euro strengthened versus the US dollar in terms of London closing rates, moving from 1.0717 to 1.0820. At its meeting in July, the ECB held the key policy rate by at 3.75%, after cutting by 25bps in June, the first cut after 450bps of rate hikes through to September last year. The ECB is running down APP securities and commenced PEPP run-off in July with an estimated EUR 380bn of securities rolling off the balance sheet from both programs combined in 2024.

OUTLOOK

The euro advanced in the first half of July both versus the US dollar and on a trade-weighted basis as well with the political risks related to the second round French parliamentary elections receding. The strategy of centre and left parties aligning to tactically vote against Marine Le Pen’s RN was successful and after doing well in the first round, RN failed to gain an outright majority in the new parliament. While that has been viewed as a positive, the final outcome of a hung parliament is hardly positive either and raises the risk of further delays in resolving France’s public deficit problems.

The EUR EER-42 index gained notably in response to the easing political risks – advancing by 1.2% to a high on 18th July, but then receded with investors’ concerns over the outlook for the euro-zone economy increasing. The advance PMI readings were weaker than expected and other business surveys (ZEW & Sentix) also turned lower. We are not surprised by this rally in EUR petering out and remain unconvinced that conditions are in place for a more sustainable larger rally. While the euro-zone economy is now recovering, the degree of monetary restraint will continue to limit the scale of economic recovery from here. Increased global growth concerns evident by continued weak China growth and declining commodity prices will also act to contain the scale of economic recovery.

At the meeting in July ECB President Lagarde was cautious on providing guidance, maintaining a meeting-by-meeting approach but we still expect the ECB to cut the key policy rate twice further this year, in September and December. Lagarde stated at the meeting that the September decision was “wide open” but the mixed growth outlook, global uncertainties and some early signs of moderating wage growth should be enough to strengthen confidence in achieving the price stability goal that allows for a September cut. The Indeed Wage Tracker did pick up from 3.4% in May to 4.0% in June but this is a level still consistent with a moderation in wage growth.

With the worst case scenario in the French election avoided, we see greater support for EUR/USD and maintain our view of a gradual appreciation through to Q2 2025. However, the US election outcome could create volatility and while we do not expect Trump II to be the same as Trump I we could see a temporary bout of dollar strength. Overall though the path higher for EUR/USD should remain intact.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

3.75% |

3.50% |

3.25% |

3.00% |

2.75% |

|

3-Month Bill |

3.60% |

3.45% |

3.15% |

2.90% |

2.70% |

|

10-Year Yield |

2.30% |

2.40% |

2.30% |

2.20% |

2.20% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year bund yield initially jumped in July reflecting the reduced political risks following the second round parliamentary election results in France. But the bounce didn’t last and overall in July, the German bund yield fell 20bps to close at 2.30%. As cited above, some of the euro-zone data disappointed – certainly the more leading type sentiment data worsened somewhat which was viewed more important than the GDP data, which generally was a little better than expected for Q2 (EZ GDP 0.3% in Q2 vs 0.2% expected). But the global backdrop was also conducive to declining yields. Equity markets corrected lower and US Treasury bond yields declined as inflation risks recede. Given we expect two more ECB rate cuts and given the inflation data over the coming months should be consistent with easing concerns over upside risks, 10-year Bund yields should decline further. However, those declines will likely be modest if as we assume the US economy manages a soft landing and the global growth outlook does not deteriorate. Still, global growth levels are unlikely to be inflationary and the 10% drop in commodity prices (Bloomberg Index) since May is indicative of diminishing global inflation risks.

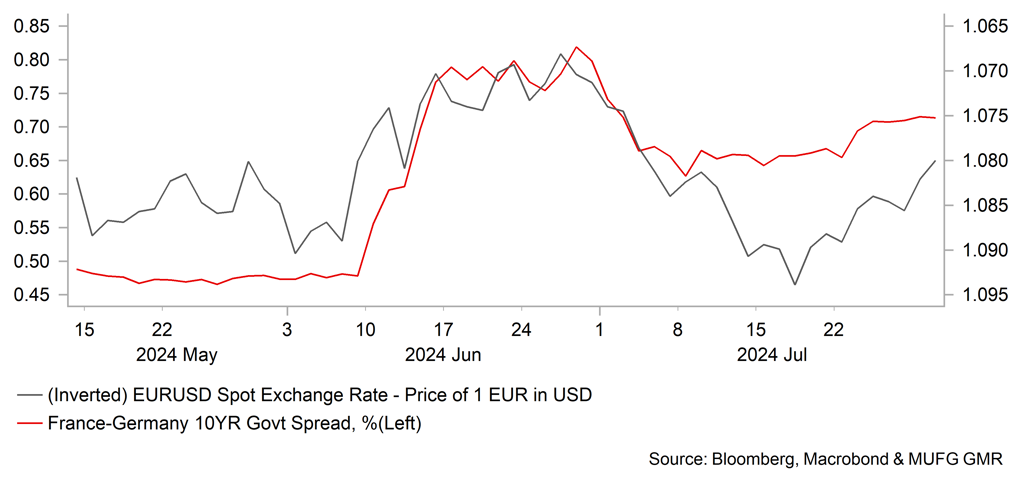

EUR/USD VS. 10-YEAR YIELD SPREAD BETWEEN FRENCH & GERMAN BONDS

EUR/USD PERFORMANCE SO FAR THIS YEAR

Pound Sterling

|

Spot close 31.07.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

EUR/GBP |

0.8427 |

0.8400 |

0.8400 |

0.8450 |

0.8500 |

|

GBP/USD |

1.2840 |

1.2980 |

1.3100 |

1.3250 |

1.3180 |

|

GBP/JPY |

193.19 |

194.60 |

193.80 |

193.50 |

189.70 |

|

Range |

Range |

Range |

Range |

||

|

GBP/USD |

1.2400-1.3200 |

1.2500-1.3400 |

1.2600-1.3600 |

1.2700-1.3700 |

MARKET UPDATE

In July the pound strengthened against the US dollar in terms of London closing rates from 1.2642 to 1.2840. In addition, the pound strengthened against the euro, from 0.8477 to 0.8427. The MPC did not meet in July and hence the key policy rate was unchanged at 5.25%, following 14 consecutive rate increases through to August last year before commencing a pause from September.

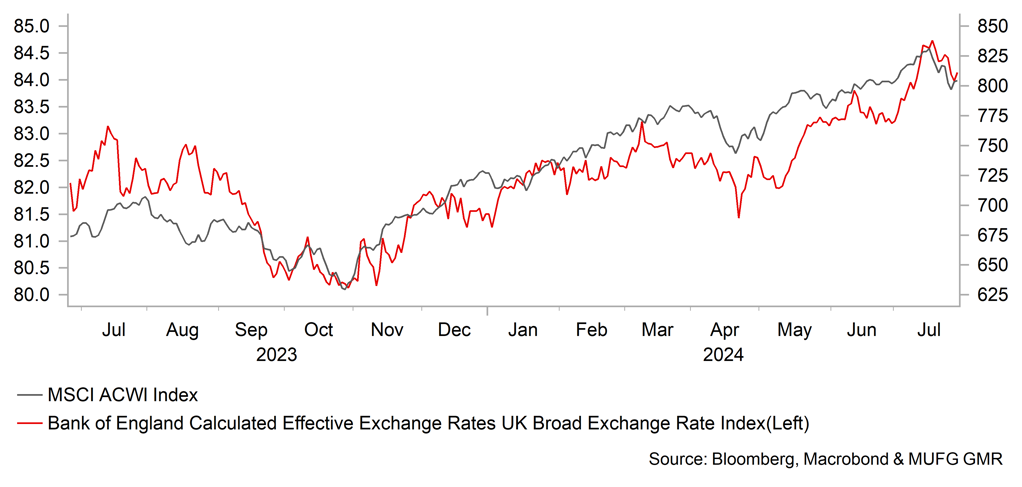

OUTLOOK

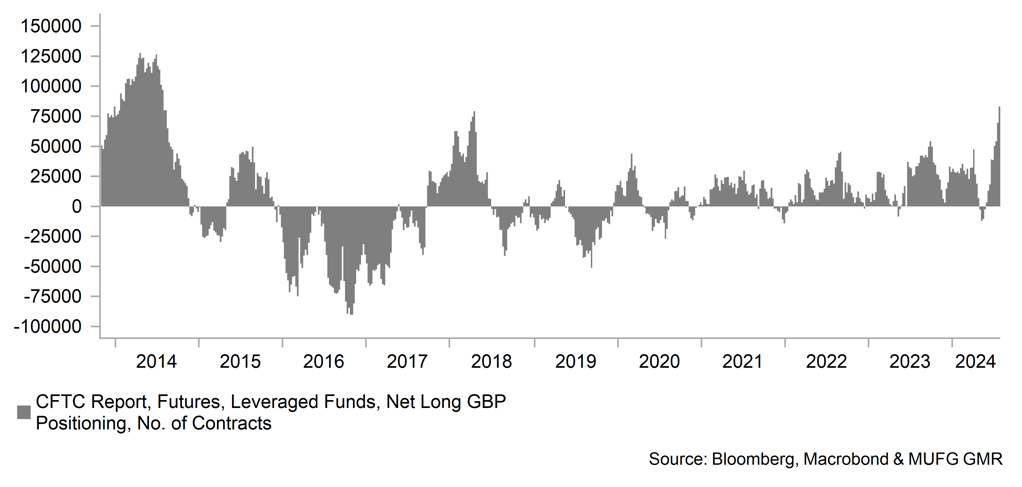

The pound advanced in July helped by a combination of an improving political outlook and better economic conditions. We argued here last month that a big majority for the Labour Party in the general election on 4th July would raise expectations of a period of political stability – something the UK has lacked since the Brexit referendum back in 2016. That’s exactly what we got with Labour winning 411 seats, a gain of 209 seats for a working majority of 172 seats. The pound is the top performing G10 currency on a year-to-date basis and the political backdrop is part of that performance. The macro backdrop is also playing a role. It is becoming increasingly clear that the reversion of CPI back to target is helping lift both corporate and household sentiment and consumer spending is being helped by the improvement in incomes in real terms. However, the Labour Party’s first steps taken have been to highlight the poor fiscal position and to flag the likelihood of tax increases being announced in Chancellor Reeves first budget on 30th October. A capital gains tax increase, the removal of some tax reliefs on pensions and possibly inheritance tax increases are the main areas of potential given the commitment not to raise income tax, national insurance and VAT. Spending cuts have also been announced so these could act to constrain some of this growth pick-up.

The BoE likely took these announced measures into account when it announced its MPC decision at the very start of August with a split decision to the cut the policy rate by 25bps to 5.00%. The decision was “finely balanced” for some of those who voted to cut and there was no clear guidance from the MPC over future easing. The BoE in its Monetary Policy Report raised its GDP growth forecast for 2024 to 1.25%, which reflects the stronger growth since the start of this year but is still above market consensus. We expected the August cut and are maintaining our view of one further cut this year – most likely at the next MPR meeting in November. Caution is set to prevail given the very close vote to cut in August.

The decision of the BoE to cut in August was not fully priced but equally is not a big surprise and hence we see little reason for us to alter our view that the pound can strengthen further versus the US dollar. The Fed, ECB and most G10 central banks will be cutting through the remainder of the year and indeed the caution in the communication from the BoE at the August meeting points to risks of less easing from the BoE than elsewhere. Political stability will also make for a welcome change and help provide further GBP support.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Policy Rate |

5.25% |

5.00% |

4.75% |

4.50% |

4.25% |

|

3-Month Bill |

5.15% |

4.95% |

4.70% |

4.40% |

4.20% |

|

10-Year Yield |

3.97% |

4.10% |

3.90% |

3.80% |

3.80% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

The 10-year Gilt yield declined by 20bps to close at 3.97%, and the lowest close since March. The BoE cut rates at the start of August but given the 10-year Gilt yield has declined by 40bps over June and July we see less scope for further declines ahead. However, the move in yields is more than we were assuming in our last FX Outlook publication and hence we have adjusted modestly lower our levels going forward. Our updated levels still imply scope for yields to rebound modestly and we see the very close decision to cut, the limited guidance on future cuts and the BoE’s view of upside inflation risks as reason to see some retracement of the decline in yields from June and July. Nonetheless, we acknowledge the risk to this view is that yields are lower. If actual inflation in the coming months moves higher but by less than expected, the BoE cold be in a position to turn more dovish and possibly cut twice more this year. Furthermore, global growth conditions could deteriorate more than expected, and with the Fed cutting more actively, the BoE could have the scope to cut more. We will also be watching closely the UK labour market and wages which have been a factor keeping domestic inflation pressures higher.

SHIFT TO MORE RISK-OFF TRADING WEIGHS ON GBP

LONG GBP POSITIONS HELD BY LEVERAGED FUNDS

Chinese renminbi

|

Spot close 31.07.24 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

USD/CNY |

7.2199 |

7.2400 |

7.1800 |

7.1500 |

7.1000 |

|

USD/HKD |

7.8116 |

7.8000 |

7.7900 |

7.7800 |

7.7700 |

|

Range |

Range |

Range |

Range |

||

|

USD/CNY |

7.0000-7.3300 |

6.9500-7.3200 |

6.9000-7.3100 |

6.8500-7.3000 |

|

|

USD/HKD |

7.7700-7.8400 |

7.7600-7.8300 |

7.7500-7.8200 |

7.7400-7.8100 |

MARKET UPDATE

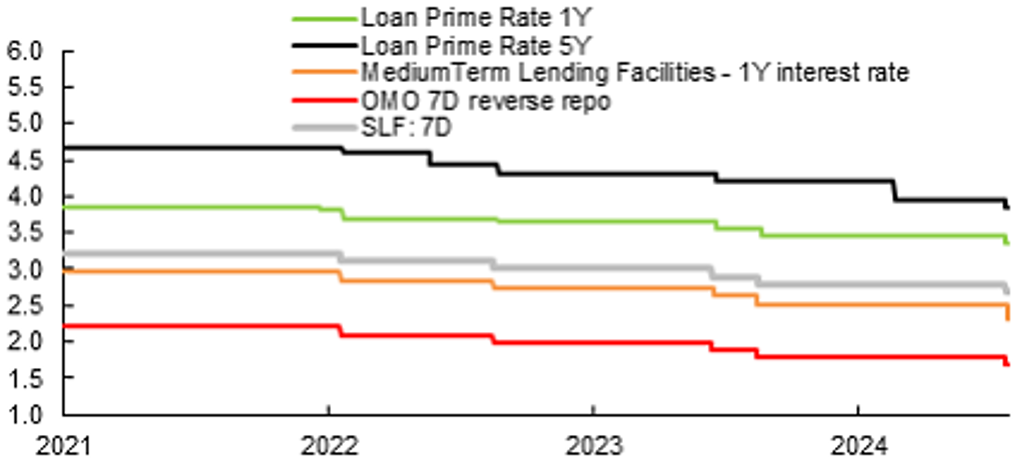

In July, USD/CNY decreased from 7.2670 to 7.2199. The PBoC lowered various policy rates across the month, with the 7D reverse repo rate lowered down by 10bps to 1.70%, both 1Y LPR and 5Y LPR rates lowered by 10bps to 3.35% and 3.85% respectively on 22nd July, meanwhile, the 1Y MLF was cut by 20bps to 2.30% on 25th July.

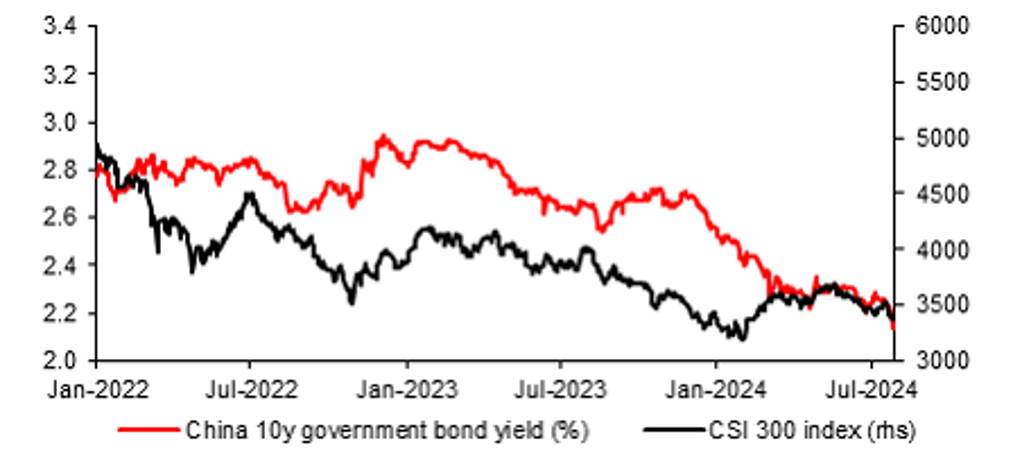

OUTLOOK

The third plenum and politburo meeting did not lift investor’s sentiment on China’s economy and the currency. China’s stock market price, measured by the CSI 300 index, was once down by nearly 5.0% after the conclusion of the third plenum. Amid the decline of stock market, the release of Q2 and July macroeconomic data also pressed down on CNY. Despite these factors, CNY managed a 0.5% appreciation against the USD in July, largely due to the US dollar’s weakness (the DXY index declined by 1.7% during the month, driven by growing expectations for Fed rate cuts starting in September), and a technical reason of reducing the short position of CNY- carry trades. USD/CNY fixing increased in July from 7.1256 at end of June to 7.1346 on 31st July. USD/CNY recently traded 1% above the fixing level, compared to almost 2% at the start of July.

Looking ahead, two factors, movements of US dollar, and the Chinese government’s policy initiatives, likely are the main drivers for USD/CNY’s movements. China’s economic fundamentals are unlikely to change soon, and remain a drag on market sentiment. The slower-than-expected 4.7%yoy economic growth in Q2, combined with weak June data, indicated that the Chinese economy faces various challenges (ChinaPulse: Q2’s 4.7%yoy growth shows the need for government to step up policy support). Recent data requires the government to step up policy support for achieving a 5%yoy annual growth target for 2024, and market remains hopeful for additional policy stimulus. On 31st July, the Chinese stock market rallied, with the onshore stock indexes having their best day in almost half year. The CSI index rose 2.1%, and Hang Seng China Enterprises Index increased by 2.4%. Market sentiment was boosted on the day, following a statement from the Politburo meeting. The statement pledged to boost consumption to expand domestic demand, and said the focus of economic policies must shift more to benefiting people's livelihood and promoting consumption, and “it is necessary to further mobilize the enthusiasm of private investment and expand effective investment”. We expect more specific growth enhancing policies to be rolled out. The PBOC’s policy rate cut right after the conclusion of the third plenary signaled government agencies have started working on their own measures to implement the guidelines outlined in the resolution of the third plenum. Having said that, still there are uncertainties on how fast and how big the stimulus could be in near term. On the monetary policy front, we expect another 10bps cut for 7D reverse repo rate in Q4 to further ease monetary conditions.

INTEREST RATE OUTLOOK

|

Interest Rate Close |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

|

|

Loan Prime Rate 1Y |

3.35% |

3.35% |

3.25% |

3.15% |

3.15% |

|

MLF 1Y |

2.30% |

2.30% |

2.15% |

2.00% |

2.00% |

|

7-Day Repo Rate |

1.70% |

1.70% |

1.60% |

1.50% |

1.50% |

|

10-Year Yield |

2.15% |

2.20% |

2.30% |

2.35% |

2.50% |

* Interest rate assumptions incorporated into MUFG foreign exchange forecasts.

Chinese government bond yields further declined to a decade low of 2.15%. The inbalances between supply and demand was the main reason behind the rising bonds prices. On the demand side, the unexpected interest rate cut in July changed the market's cautious attitude and increased allocation demand for bonds, also banks' "deposit relocation" and the weakening of market’s risk appetite, stimulated the bond demand of non-bank institutions as well. In the near term, supply still unlikely catches up with the strong demand, and this will keep the yield of long term bond low. But recent PBOC’s new policy of selling debt holdings to cool bond rally would limit the room for a further decline of bonds yields. To see a reversal of bonds yields, the key is fiscal policy. More proactive fiscal policy could help boost real domestic demand, and eventually help improve market’s risk appetite. Having said that, should fiscal policy fail to work as hoped, the market will bet that the recent policy rate cut was only the beginning, and more monetary easing will need to be delivered, which would push yields even lower.

10-YEAR GOVERNMENT BOND YIELD, AND CSI 300 INDEX

Source: CEIC, MUFG GMR

WE EXPECT ANOTHER 10BPS CUT FOR 7D REVERSE REPO RATE IN Q4

Source: CEIC, MUFG GMR